sanfel

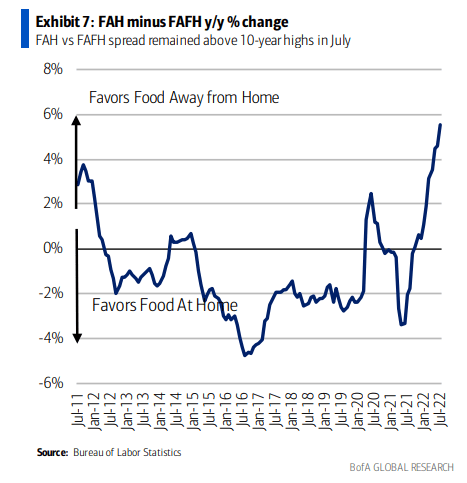

It’s a fascinating time right now in the restaurant industry. While labor costs for low-wage workers soar and food prices climb at staggering rates, there’s a very bullish relative price trend happening. A key metric all restauranteurs monitor is the FAH/FAFH spread. That is: the food at home vs food away from home cost difference.

High grocery bills compared to a typical restaurant check are more favorable for eating establishments in more than a decade, according to Bank of America Global Research. One major company reports earnings this week that will shed more light on the state of the consumer and dining out.

FAH-FAFH Spread Extremely Bullish For Restaurants

BofA Global Research

According to BofA Global Research, Brinker International (NYSE:EAT) comprises two brands – casual diner Chili’s Grill & Bar and polished casual chain Maggiano’s Little Italy. Chili’s domestic system is about 12x the size of Maggiano’s when measured by sales ($3.4 billion vs $273 million in FY21) and drives Brinker’s results. The North American Full-Service segment (including bar & grill and steak) is the largest among full-service markets, but also the most consolidated.

The Texas-based $1.4 billion market cap Hotels, Restaurants & Leisure industry company within the Consumer Discretionary sector trades at a low 9.7 price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. EAT features a significant 11.6% short interest, so traders should be mindful of a possible squeeze following its Q4 earnings report later this week. The firm stopped paying a dividend in March 2020, so it’s possible, though speculative, that it could reinstate a payout in the coming quarters given solid free cash flow.

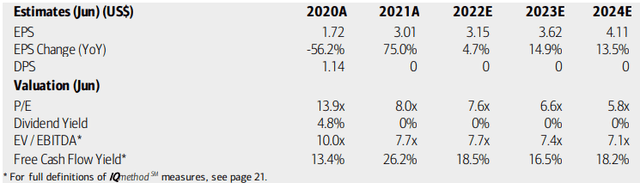

On the valuation front, Brinker looks attractive. Along with its single-digit trailing P/E, analysts at BofA see significant earnings upside through 2024. After tepid growth this year – negative on an inflation-adjusted basis – a real earnings boom is expected in 2023 and 2024. Under that assumption, the company is downright cheap. Moreover, EAT’s EV/EBITDA multiple is low while free cash flow is extremely impressive.

Brinker Earnings, Valuation, Free Cash Flow Forecasts

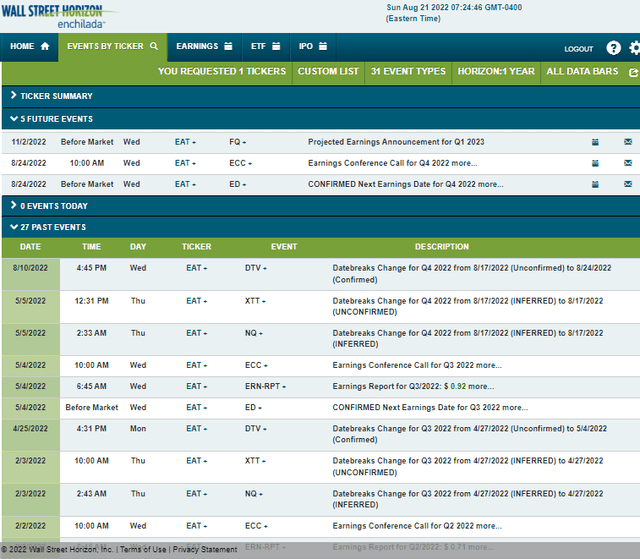

Brinker has a Q4 confirmed earnings date this Wednesday BMO, according to Wall Street Horizon. A conference call takes place at 10:00 am ET and you can listen live here. The corporate event calendar is light until the firm’s Q1 reporting date, projected to take place on Wednesday, November 2, BMO.

EAT Corporate Event Calendar: Earnings On Tap

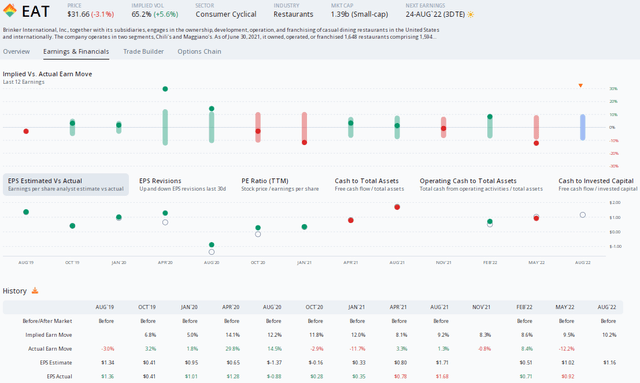

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show an EPS estimate of $1.12 – a significant drop from the same quarter a year ago. The company’s Q3 profits per share were positive on a year-on-year basis, though.

Traders anticipate a big 10.2% implied stock price move following the Wednesday morning earnings release, using the nearest-expiring at-the-money straddle options pricing. ORATS also reports a bearish statistic – there have been three analyst downgrades of the stock since its May report.

Brinker Earnings Preview: Lower YoY EPS Seen, But Stock Price Expected

The Technical Take

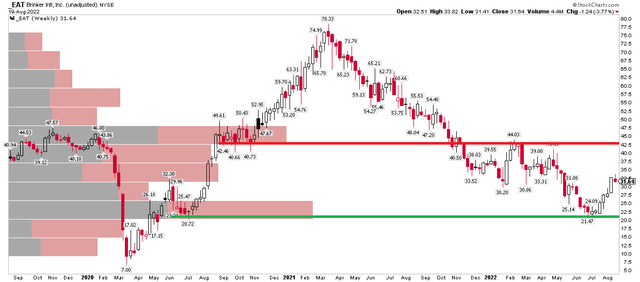

EAT is stuck in an uncomfortable range as it waits for some excitement. Much like waiting on your dinner to come out from the back kitchen. I see support at the June low just below $22 while resistance is apparent in the low to mid-$40s range – the stock’s Q1 and Q2 highs. Traders are well-served waiting for a bullish breakout or a bearish breakdown.

I also included on the chart the ‘volume-by-price’ indicator. It further justifies those support and resistance levels. Notice how the weekly chart illustrates a high volume of shares traded in the low $20s and the mid-$40s. That’s a big memory bank and, per technical analysis, is key demand and supply, respectively.

EAT: Stuck Between Support & Resistance

The Bottom Line

I like Brinker from a fundamental valuation perspective here. Technically, it’s a buy in the low $20s and bulls should take profits in the low $40s. Both value investors and technical swing traders should consider being long if we see a breakout above the mid-$40s. A big implied move post-earnings is expected on Wednesday – and don’t forget about that high short interest ratio.

Be the first to comment