dszc

A receding oil price has been material in lowering inflationary expectations. As much as business productivity and transactions are based on information technology are significant to economic progress. It is increasingly clear that most of the real world depends on hydrocarbons. Agriculture prices are leveraged to Diesel, add logistics and trucking, as well as jet fuel to flying costs and there you have almost every corner of the real economy affected by the cost of energy. I am sure I’ve left things out but where you need something to move, and also generate electricity, high fuel costs make almost everything priced higher. So now, we’ve been very lucky that the price of oil has come down though not so much for Nat Gas. Ask yourself why that is, you could say it was evil speculators that bid up the price and have beaten a cowardly retreat. Speculation provides liquidity when it comes to commodity prices. Sometimes they irrationally bid up the price of a commodity, but it’s not sustainable. Just ask the Hunt brothers. So what pressed down prices? Raising interest rates is of course the means by which the Fed can throttle back demand.

There are two domestic reasons why Oil has come down and one international as well

In any event, what is the answer? There are two domestic factors, the first and not surprisingly there is demand destruction. The price of gasoline ripped higher, and it shocked the public, so they responded by driving less. The second is the draining of the SPR, the Strategic Petroleum Reserve, by the tune of 1 million barrels per day. The SPR was created for natural disasters (like hurricanes) or wartime emergencies. However, this was a man-made disaster so perhaps it qualifies. I won’t go into the policy blunders that made the raiding of the SPR a political imperative. I will say that the draining of the SPR will be halted by October. China is also going to ramp up its consumption of oil and NatGas, likely a lot of coal as well. So in anticipation of less supply and more consumption, WTI will have to go back up.

You don’t easily see it in the price as yet

The WTI price that we follow is based on the futures. There is a cash price, but it tends to trend with what is going on in the future and vice versa. In any case, the WTI futures are what moves the market and that is what we care about here. Right now, September Future is the month. In other words, in August we trade September, after all, it is called the Futures for a reason. You will see the September and October future trading together. I noticed something interesting in the last 7 days of trading: the price differential has narrowed dramatically. Unless my boomer’s eyes have failed me, I saw for like 3 seconds on Thursday the October price was higher by a few pennies before it reversed back. Still, the price difference has narrowed dramatically, we are talking like 30 cents difference. I suspect that as we draw near to the end of this month the October Futures will rise higher than the front month, signaling a new direction for Oil. That is why the price difference between the two has been narrowing.

Why are we stopping the use of the SPR in October? That’s easy

The polite reason is that the oil reserve can’t be drained forever. Also as we get to the bottom of the tank so to speak the quality of the Oil could be an issue. The other obvious reason is that the midterm election is at the beginning of November so there is less imperative to keep prices down. Once that happens the SPR will need to be topped back up, so that will pressure the price as well, even if they don’t start right away. Another item that kept speculation on oil at bay was the prospect of a deal with Iran. However, the attempted assassination of Salman Rushdie has put a damper on talks. It didn’t help when Iran expressed their opinion that Rushdie deserved to die, but they had nothing to do with it. If that weren’t enough Iran has sent assassins teams to the US to go after dissidents that speak against the regime as recently as a few weeks ago. Russia is the only incremental source of Oil since Aramco and all the emirates have 500,000 additional barrels at most. India and China are the only likely customers of Russian oil, but they will be pressured to do with less. With the price of NatGas so high, oil will likely be burned in Europe and elsewhere instead. That will add even more pressure on the price. The developed world is calling for docking Russian Oil at a steep discount to lower Russian revenue that can be used to fund the war effort against Ukraine. This could backfire and Russia could in turn withhold its oil altogether.

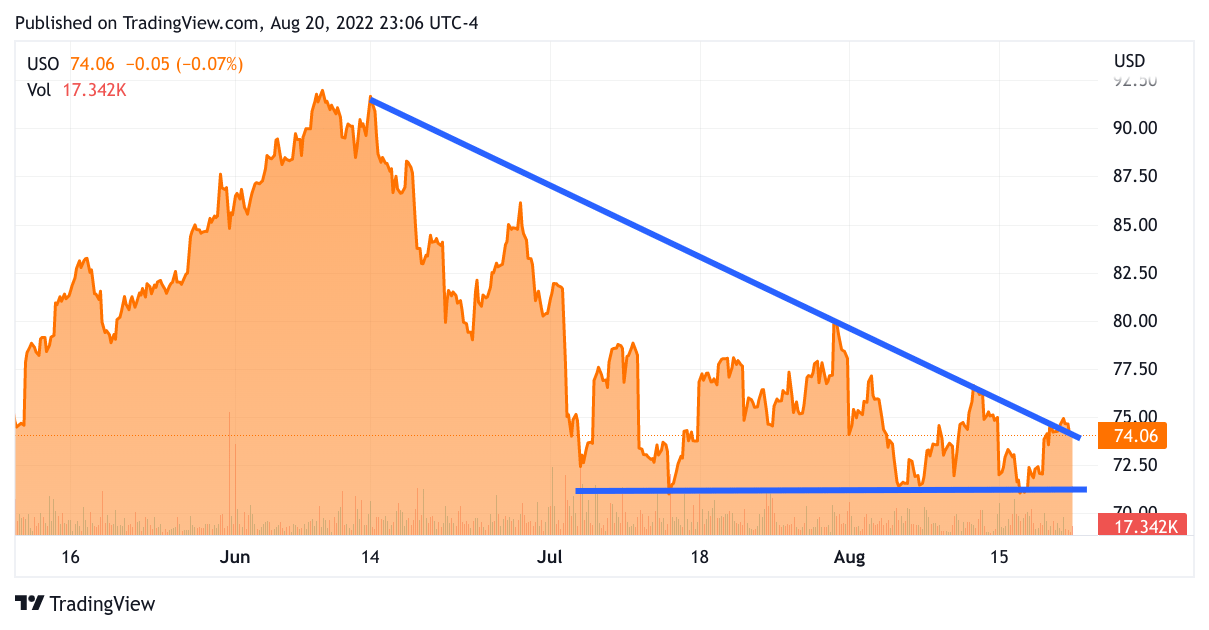

Let’s look at the chart and see what it says. On the surface, it seems that Oil has been doing nothing but retreat. Perhaps the chart has something else to say. For WTI I will use the USO ETF. USO seeks to follow the spot price of light sweet crude aka WTI. As I was saying, spot is slightly different than the futures, but if you read the description of how they run the USO ETF they do use derivatives based in part on the futures. Anyway, here is the 3-month chart.

TradingView

The lower horizontal line is showing a very slight upslope, however, let’s even say it’s flat. If oil was crashing, you’d be seeing lower lows. Also, you can hardly see it but the upper line is marking out the lower highs. Toward the endpoint of the pennant, the last peak is breaking above the down-trend. That tells me we could be looking at a nascent rally. Let’s zoom in to the 1-month chart.

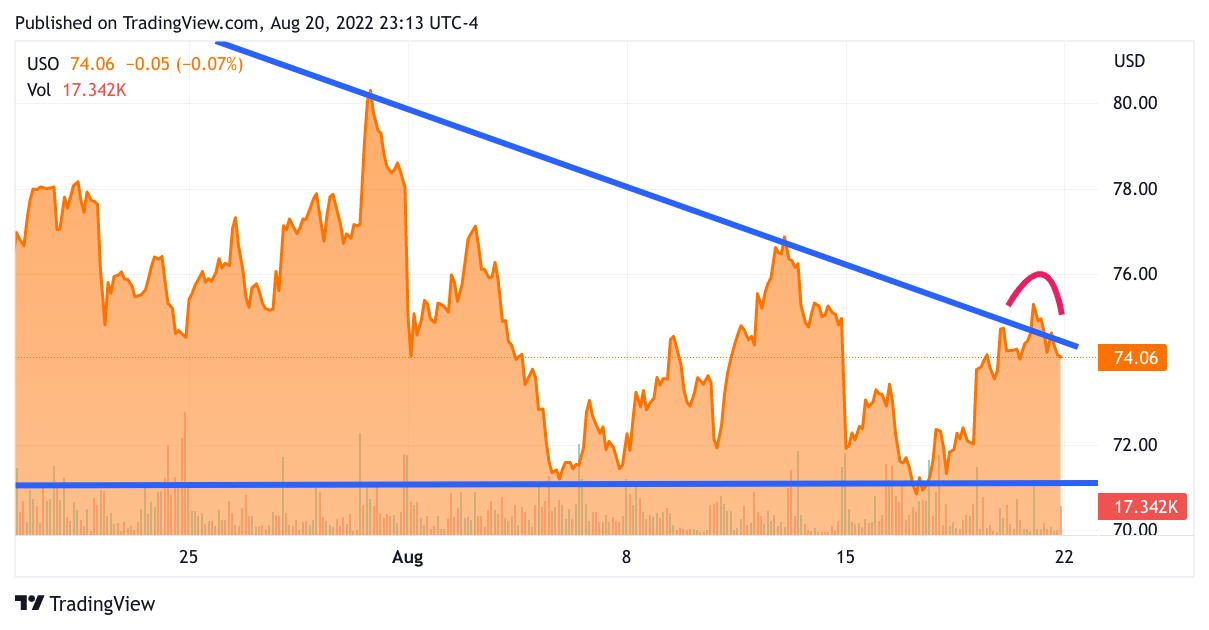

TradingView

It may seem too imperceptible to count, but it is there. We will have to see the behavior of oil this week. I think the notion that the oil coming from the SPR will halt, is going to start influencing the market. I suspect that Oil will eventually reach toward the recent highs, perhaps not to 120 per barrel but certainly in the triple digits as soon as the beginning of September. I am not claiming that we’ll see 100 this week but WTI will start to firm up starting now. There are so many other factors, like shutting down refineries in the fall to switch to winter gasoline formulation, and the hurricane season is not over. The November election is coming up, and the Iran deal is likely not going to be attempted if it drags on any further. That will impact the market, as speculators might be emboldened to start bidding up WTI. The situation with the Russian oil supply will come to a head at the end of the year and as that looms the futures will take that into account as well.

If these charts seem to fall short of convincing let me quote the IEA for you “Among the short positions, the largest declines have been in the producer and merchant category and the swap dealer category. Producers and merchants, also known as commercial traders, predominantly engaged in production, processing, and handling crude oil, and they use financial markets to manage financial risks associated with those activities.” This means that the entities most in the know, who are following their own data as well as those in their supply chain, that understand the price action best are holding back on the short side. How about this nugget; Baker Hughes’ (BKR) rig count for last week was down 6 rigs. That is not encouraging for those wishing that the price of oil keeps falling. Also, according to the American Petroleum Institute as of August 18, there was a drop in July year over year oil supply.

This is not the majority view, plenty of oil experts are out with predictions of a fall in crude to the 60s and 70s. One of the major predictions is that the Permian basin will continue to increase output and help lower prices. It would require that there be no fallout of the EU putting a total ban on Russian crude by year-end as well. I will take the other side of that bet. Let’s leave aside the Baker Hughes data of the rig count already falling since that could be an anomaly. Let me just say that the frackers have been showing remarkable restraint in growing production. Still, analysts are predicting that the US will reach its old production high of 13 million barrels a day by year-end. To that, I say, hogwash! I’m not declaring that I believe that level cannot be achieved, and even exceeded if producers want to. I would say that any oil analyst making such an assertion just hasn’t been listening to the earnings conference calls of the E&P players. They are reiterating once again that they are all about returning sweet dinero to the shareholders. They are creating new production growth only slightly higher to replace the oil produced from the year-over-year quarter. The incremental production growth is coming from non-public outfits, some funded by private equity and others from the debt market. I would suggest that debt is becoming too dear for an out-of-control production spike. Oil companies of course don’t want to see a big spike in oil prices, because that will kill demand, but I bet they prefer to see oil at $60.

So let’s say I have you convinced, what to do

Well, as you know, I write this analysis to figure things out for myself. Hopefully, you find this interesting and entertaining. This week has a lot going on, and Oil may not be the most obvious concern for the market at this moment. Yet, it doesn’t make it any less important of development, in fact, I have been saying that oil is the key to this market in the next several weeks. There is a chance of a witches brew of difficult data coming our way next month, here are a few;

-

First is obviously the cost of energy going up

-

September sees another raise of .75% (even .50% is not great)

-

The next piece is that all these raises finally really begin to bite; layoffs begin to spread to Main street and medium-sized businesses.

-

Ag prices begin to rise back with the cost of Diesel

The sell-off ends when October Fed goes for .50% or even 25% with the warning that there’ll be no pivot. That when the raises stop the terminal rate will not be lowered for the foreseeable future. The market responds by rallying hard because they assume the Fed is bluffing.

So September is going to be scary, What’s more, September could arrive in the last few weeks of August.

I will start preparing while it is still not obvious to reallocate funds to Oil. In fact, I started to do so on Friday based on the price action of the Futures alone. I am going to hedge strongly starting this week. It will be my usual venue for SPXS, SQQQ, and UVXY. I will also use options to short the SPXL, TQQQ, and the SVXY. Furthermore, this week has its causes for volatility, namely the Jackson Hole Conference where Jay Powell can get really hawkish. First up is Tuesday with building permits and new home sales Wednesday is all the durable goods numbers and EIA weekly Oil supply Thursday is PCE prices, 2nd Q GDP, and Jobless claims Friday is Core PCE, and of course, Powell speaks at Jackson Hole. Monday Might see a bit of a bounce in the morning. I will use that to trim my portfolio and start re-hedging. The numbers for inflation have been positive, and since these numbers will be lagging there is a very good chance that the market will be buoyed by them. The counterweight to that optimism will likely be the fear that Powell will put the hammer down on Friday. I may choose to close my hedges and perhaps go long if the market really tanks from Friday’s hammering. I expect WTI to be firm this week but not to the extent it will influence the market just yet. Perhaps we’ll see it at 92 to 94? As August comes to a close the market will see WTI continue to strengthen. By strengthening I don’t mean the price will necessarily break above 93-94-95, What it will do is not fall below 90 as it has been doing with every attempt at advancing for the past month+. By Labor Day maybe it accelerates then. It’s not too early to start strategizing about what to do for September. When I said act now, does not mean I am about to act hastily, I am going to be deliberate, and check my logic against every new piece of data I can find. To me, that is “acting”, just as much as setting up some multi-leg derivative or another way of addressing what I believe is coming. Aside from Oil going up, we could have good news of lower prices being reported and that may delay a precipitous fall in stocks. I intend to take advantage of any rally by adding hedges.

My Trades

Last week I accelerated trading stocks for cash. That meant that I decided to retreat from some positions that I started last week, I closed Akamai (AKAM), and CSX Corporation (CSX). I think I let my inherent optimism get in the way of my judgment. I think they are both good stocks, and perhaps CSX or another railroad should be in my long-term investment account, not in trading. Added to Haleon (HLN) they confirmed that they will be instituting a dividend as I predicted, albeit starting small. Also, Barron’s wrote a bullish article and I always like to scoop Barron’s and have them confirm my moves. I continued to hold and add to Axcelis (ACLS) however slowly, KLA Corp. (KLAC), I trimmed the costly shares at a good price only to buy back more at a lower price. I cut Oracle (ORCL) from the trading account but still have them in my Long-Term portfolio. I sold out my Taiwan Semi (TSM) after the second delegation of congressmen came and China had less of a reaction than Pelosi. I made a decent profit and banked most of it to cash. Wolfspeed (WOLF) I only managed to add a few more shares, in my trading account, and will likely sell it on Monday since it leaped so strong from earnings. I do hold it in my LT account as well. I added two additional biotech names Ginkgo Bioworks (DNA) and Seattle Genetics (SGEN). I liked DNA news flow and earnings reports. For SGEN they lost an arbitration with a Japanese Pharma company and got hammered. I picked it up, not only because it is still in play with a possible acquisition by Merck (MRK), but also because it has approved drugs and revenue. If they have drawn the interest of MRK that is good enough for me. I am already nicely in the black, I may trim it a bit this week. I started new positions in Twilio (TWLO), Zoom (ZM), and PayPal (PYPL). I have been in these names before at much higher prices so I feel that they finally have all of the fast money squeezed out of them. Also, for me, starting a new position means that they are pitifully small. Even if the big dive comes early, they won’t hurt me. I may just add to them. Finally, I closed all my short side bets on Friday including my short on Lemonade (LMND) via Puts.

Ok, that is a lot of activity for someone who is about to don “Sackcloth and Ashes” and join the “Prophets of Doom” that I normally deride. In my defense, I thought the summer rally still had legs, and perhaps it still does. Also, I expect October to turn out better than I expected since I think this retrenchment should be contained in September. Also, as I have mentioned multiple times, the underlying impulse of this market is to move higher. We will see if that continues into next month. Many of these positions are already profitable so I may just cut them and hold the cash. It isn’t my intention to be a fast money trader it just seems to be working that way, as I decide that building cash is the better part of valor.

Be the first to comment