ismagilov

Investment Thesis: I do not see upside for the stock at this time on the basis of an expensive price to free cash flow ratio, as well as lower potential demand across the Annuity segment going forward.

In a previous article back in May, I made the argument that Brighthouse Financial (NASDAQ:BHF) could see upside based on significant growth in cash flow relative to long-term debt – but inflation and its effect on net investment income could also be of potential concern to investors going forward.

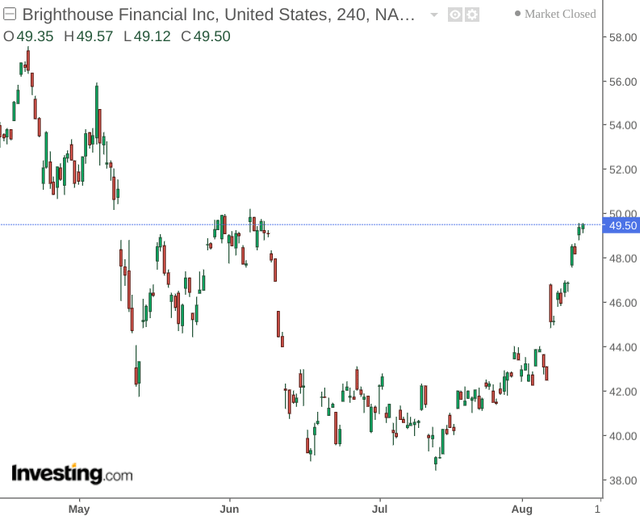

Since my last article, the stock is down marginally by just under 5%:

The purpose of this article is to evaluate the company’s performance on the basis of the most recent earnings results – as well as determine whether the recent rebound we have seen since last month can continue from here.

Performance

When looking at the company’s balance sheet, we can see that the company’s cash relative to long-term debt has continued to improve, with the cash to long-term debt ratio up significantly on that of last year.

| June 2021 | March 2022 | June 2022 | |

| Cash and cash equivalents | 4882 | 4101 | 5071 |

| Long-term debt | 3436 | 3157 | 3157 |

| Cash to long-term debt ratio | 1.42 | 1.30 | 1.61 |

Source: Figures sourced from Brighthouse Financial Second Quarter 2022 Results. Cash to long-term debt ratio calculated by author.

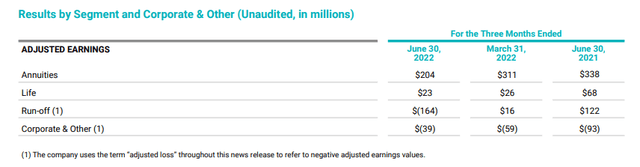

With that being said, we can also see that earnings across the company’s Annuities and Life segments are down significantly from that of last year:

Brighthouse Financial Second Quarter 2022 Results

The company cites macroeconomic headwinds as being a significant reason for the drop in earnings. It is a possibility that in light of a higher cost of living – customers are increasingly reconsidering their insurance policy costs – with a view to either switching or discarding such policies.

Moreover, while I recently argued that life insurance could see significant growth post-pandemic as customers become more aware of mortality risk – we can see that annuities accounted for the bulk of the company’s earnings in the most recent quarter.

In an inflationary environment – fixed annuities can put retirees at a disadvantage in the sense that rates cannot rise with inflation and thus erodes the purchasing power of such an annuity.

In this regard, we could see less demand for fixed index annuity sales going forward – and customers are increasingly likely to compare providers for the best deal – so as to ensure the highest potential rate of return on their investment.

While sales of annuities still rose by 8% compared to Q2 2021 – I take the view that this segment could potentially come under pressure going forward.

Valuation and Looking Forward

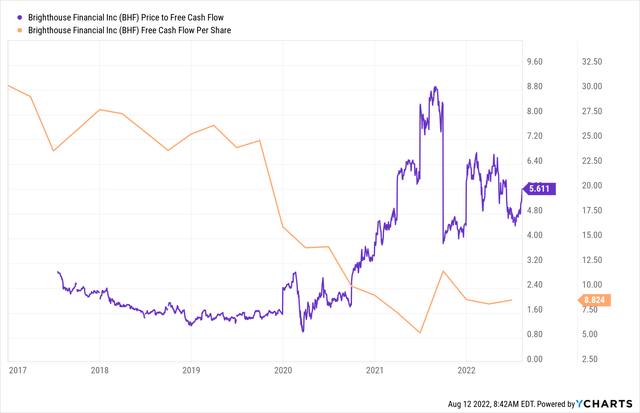

From a valuation standpoint, while Brighthouse Financial has been bolstering a greater level of cash reserves relative to long-term debt, we can conversely see that the company is expensive on a price to free cash flow basis – with this metric trading at significantly higher levels relative to 2020 while free cash flow per share itself has declined significantly over the past five years:

In this regard, I do not see a case for upside on this basis.

Going forward, I expect that inflation might continue to create significant headwinds for the business. With fixed index annuities subject to lower real returns in an inflationary environment – investors are likely to seek alternative options. While this is less likely to be a risk across existing annuities given the potential costs of withdrawal – we could see less uptake across this segment in an inflationary environment – which in turn could lead to lower sales growth.

Conclusion

To conclude, while Brighthouse Financial has continued to bolster its cash reserves relative to its long-term debt, I do not see a case for upside in the stock at this time. The annuity segment could come under pressure in an inflationary environment, and the company is increasingly expensive on a price to free cash flow basis.

Be the first to comment