dk_photos

Earnings of Bridgewater Bancshares, Inc. (NASDAQ:BWB) will most probably surge on the back of strong loan growth. Further, earnings will benefit from a rise in interest rates in the latter part of 2023. Overall, I’m expecting Bridgewater Bancshares to report earnings of $1.73 per share for 2022, up 13% year-over-year. For 2023, I’m expecting earnings to grow by a further 13% to $1.95 per share. Compared to my last report on Bridgewater Bancshares, I haven’t changed my earnings estimates much. Next year’s target price suggests a high upside from the current market price. Therefore, I’m upgrading Bridgewater Bancshares to a buy rating.

Internal and External Factors to Sustain Loan Growth

Bridgewater Bancshares’ loan growth slowed to 4.8% in the third quarter from a whopping 8.0% in the second quarter of this year. Going forward, loan growth will likely slide further because of the high interest-rate environment and its negative impact on credit demand. Further, the management is looking to be more selective on loan pricing to support the margin, as mentioned in the earnings presentation.

However, the loan growth is unlikely to dip too low. The management appeared optimistic about loan growth in the presentation. The management expects loan growth to moderate in the mid-teens range. According to the management, loan pipelines and overall demand have remained strong. Further, the ongoing expansion of lending and business services teams will also boost loan growth. Moreover, the new commercial loan origination system launched in March 2022 is likely to continue to bear fruit.

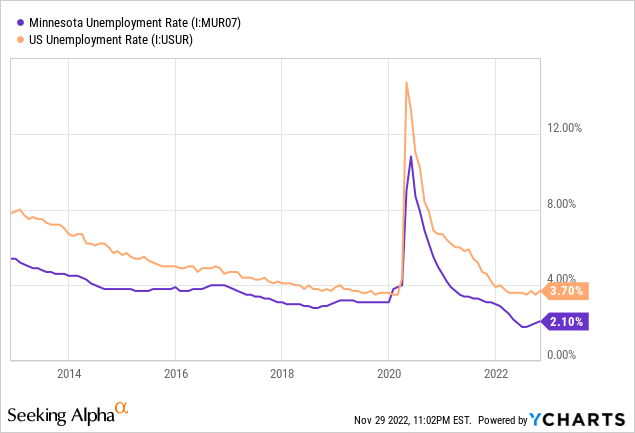

Further, the local economy is conducive to loan growth. Bridgewater Bancshares operates in Minnesota, which currently has the hottest job market in the country. The state had an unemployment rate of only 2.1% in October, which is much below the national average.

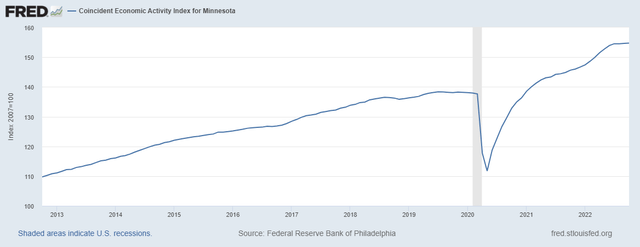

The state’s economic activity is much better now than before the pandemic, as can be gleaned by the trendline below, which has gotten steeper this year.

The Federal Reserve Bank of Philadelphia

Considering these factors, I’m expecting the loan portfolio to grow by 4% in the last quarter of the year, leading to full-year loan growth of 25%. For 2023, I’m expecting the loan portfolio to grow by 17%. Meanwhile, I’m expecting deposits to grow mostly in line with loans. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 1,640 | 1,884 | 2,282 | 2,770 | 3,457 | 4,045 |

| Growth of Net Loans | 23.7% | 14.9% | 21.1% | 21.4% | 24.8% | 17.0% |

| Other Earning Assets | 257 | 293 | 393 | 441 | 562 | 573 |

| Deposits | 1,561 | 1,823 | 2,502 | 2,946 | 3,437 | 4,021 |

| Borrowings and Sub-Debt | 182 | 174 | 142 | 135 | 380 | 395 |

| Common equity | 221 | 245 | 265 | 313 | 323 | 373 |

| Book Value Per Share ($) | 7.5 | 8.2 | 9.1 | 10.8 | 11.3 | 13.0 |

| Tangible BVPS ($) | 7.4 | 8.0 | 9.0 | 10.7 | 11.2 | 12.9 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Margin to Start Rising in Late 2023

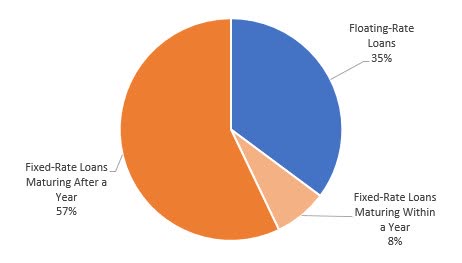

Fixed-rate loans maturing after one year made up a majority of total loans at the end of September 2022. Therefore, the average loan yield is not very rate sensitive.

3Q 2022 10-Q Filing

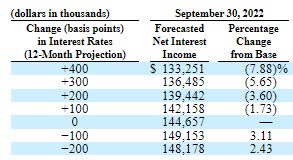

In contrast, the deposit cost is highly rate-sensitive as interest-bearing transactions, savings, money market, and broker deposits made up 62% of total deposits at the end of September 2022. The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that the balance sheet is liability sensitive in the near term. A 200-basis points hike in interest rates can decrease the net interest income by 3.6% over twelve months.

3Q 2022 10-Q Filing

After the ongoing up-rate cycle ends, probably by the middle of 2023, the margin will likely start inching upward as asset repricing will finally overtake liability repricing. Loans will continue to reprice upwards long after the rate cycle ends, while the repricing of deposits will soon taper off.

On the plus side, new loans will originate at higher rates, which will boost the margin. Considering these factors, I’m expecting the margin to remain somewhat stable through the mid of 2023 and then rise slightly in the back half of the year.

Earnings Likely to Surge by 13%

The anticipated loan growth will be the chief earnings driver through the end of 2023. Further, the bottom line will receive some support from margin expansion in the latter part of 2023. Meanwhile, I’m expecting provisioning for expected loan losses to remain at a normal level. I’m expecting the net provision expense to make up around 0.27% of total loans in 2023, which is close to the average for the last five years.

Overall, I’m expecting Bridgewater Bancshares to report earnings of $1.73 per share for 2022, up 13% year-over-year. For 2023, I’m expecting earnings to grow by a further 13% to $1.95 per share. The following table shows my income statement estimate.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 65 | 74 | 88 | 110 | 132 | 156 |

| Provision for loan losses | 4 | 3 | 13 | 5 | 9 | 11 |

| Non-interest income | 3 | 4 | 6 | 5 | 6 | 6 |

| Non-interest expense | 32 | 37 | 45 | 48 | 56 | 70 |

| Net income – Common Sh. | 27 | 31 | 27 | 45 | 50 | 56 |

| EPS – Diluted ($) | 0.91 | 1.05 | 0.93 | 1.54 | 1.73 | 1.95 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

In my last report on Bridgewater Bancshares, I estimated earnings of $1.69 per share for 2022 and $1.94 per share for 2023. I haven’t changed my earnings estimates much following the third quarter’s results.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Upgrading to a Buy Rating

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Bridgewater Bancshares. The stock has traded at an average P/TB ratio of 1.46 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 7.4 | 8.0 | 9.0 | 10.7 | |

| Average Market Price ($) | 12.5 | 11.5 | 10.7 | 16.4 | |

| Historical P/TB | 1.69x | 1.43x | 1.20x | 1.54x | 1.46x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | |||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $12.9 gives a target price of $18.9 for the end of 2023. This price target implies a 0.6% upside from the November 29 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.26x | 1.36x | 1.46x | 1.56x | 1.66x |

| TBVPS – Dec 2023 ($) | 12.9 | 12.9 | 12.9 | 12.9 | 12.9 |

| Target Price ($) | 16.3 | 17.6 | 18.9 | 20.2 | 21.5 |

| Market Price ($) | 18.8 | 18.8 | 18.8 | 18.8 | 18.8 |

| Upside/(Downside) | (13.1)% | (6.3)% | 0.6% | 7.5% | 14.3% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.7x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 0.91 | 1.05 | 0.93 | 1.54 | |

| Average Market Price ($) | 12.5 | 11.5 | 10.7 | 16.4 | |

| Historical P/E | 13.7x | 11.0x | 11.5x | 10.7x | 11.7x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | |||||

Multiplying the average P/E multiple with the forecast earnings per share of $1.95 gives a target price of $22.9 for the end of 2023. This price target implies a 21.7% upside from the November 29 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.7x | 10.7x | 11.7x | 12.7x | 13.7x |

| EPS 2023 ($) | 1.95 | 1.95 | 1.95 | 1.95 | 1.95 |

| Target Price ($) | 19.0 | 21.0 | 22.9 | 24.9 | 26.8 |

| Market Price ($) | 18.8 | 18.8 | 18.8 | 18.8 | 18.8 |

| Upside/(Downside) | 0.9% | 11.3% | 21.7% | 32.1% | 42.5% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $20.9, which implies an 11.2% upside from the current market price.

In my last report on Bridgewater Bancshares, I adopted a hold rating with a target price of $18.3 for December 2022. Now that I’ve rolled over the target price to the end of next year, the target price and the implied upside are higher. Therefore, I’m now upgrading Bridgewater Bancshares to a buy rating.

Be the first to comment