peshkov/iStock via Getty Images

We’re now entering the bottom of the second inning and energy investors are now playing defense. We’re currently 4-0 on the opposition, so while the lead is great, it’s far from certainty on winning the game. There are still a lot of innings ahead of us, but it’s all about defense for the bottom half.

Things look very bullish for oil. Refining margins are roofing, physical oil market signals are strong, global oil inventories are still trending lower, and energy stock price action is bullish. With the exception of some anecdotal bearish indicators (like Jim Cramer turning bullish on oil), fundamentals are still firmly bullish.

It’s during times like this that we have to prepare ourselves for signposts to watch for in case the tide turns.

The oil bull market we’re witnessing today isn’t your normal bull market. In normal times, we have seen instances of refining margins lag while the crude tightness overwhelms. In today’s market, we have a serious shortage of refining capacity, refined products, and crude. It’s a triple whammy. Refining margins have never been higher, timespreads are very backwardated, and oil inventories are very low.

In order for the oil market to show signs of turning, we must first see physical oil market signals turn bearish. In this case, Brent timespreads will be the first to flip.

Barchart.com

As you can see from the latest Brent 1-2 chart above, we’re still far away from that. But when we do see the spreads fall and possibly close below 0 (and into negative), that’s when we will know something has shifted in the market.

If Brent timespreads start to fall and refining margins are not moving higher, then something is amiss.

Barchart.com

In normal markets, if the end-user demand is strong, and crude falls, then refining margins will rise. If crude falls and refining margins follow, then it implies even weaker demand. Now given how elevated refining margins are, a drop back shouldn’t be seen as severe demand weakness, but if the recent surge is materially reduced, then we should be aware that material demand weakness is on the horizon.

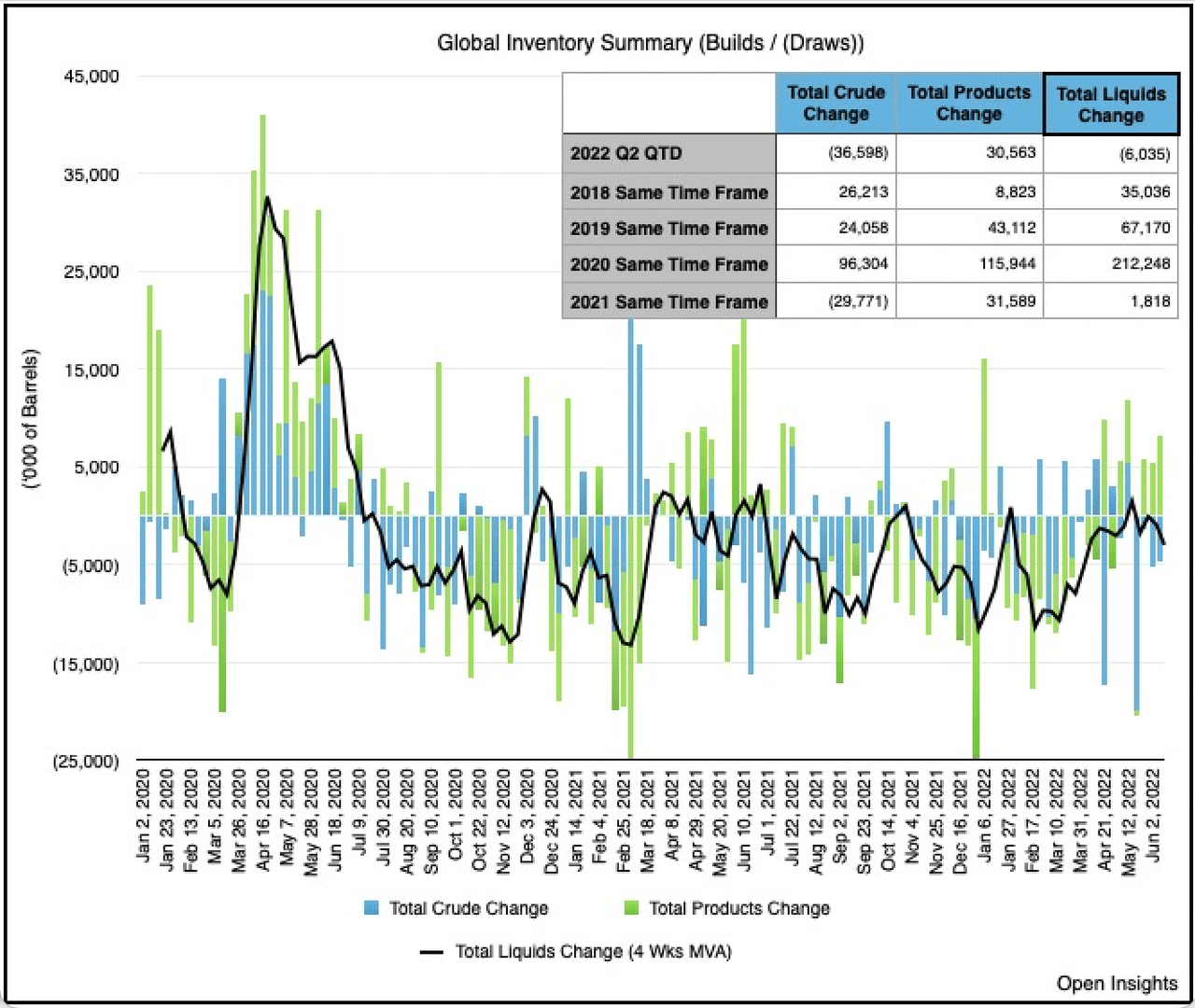

Finally, if our OECD inventory tracker starts to change from a draw into a build, then the oil market balance is shifting.

Open Square Capital

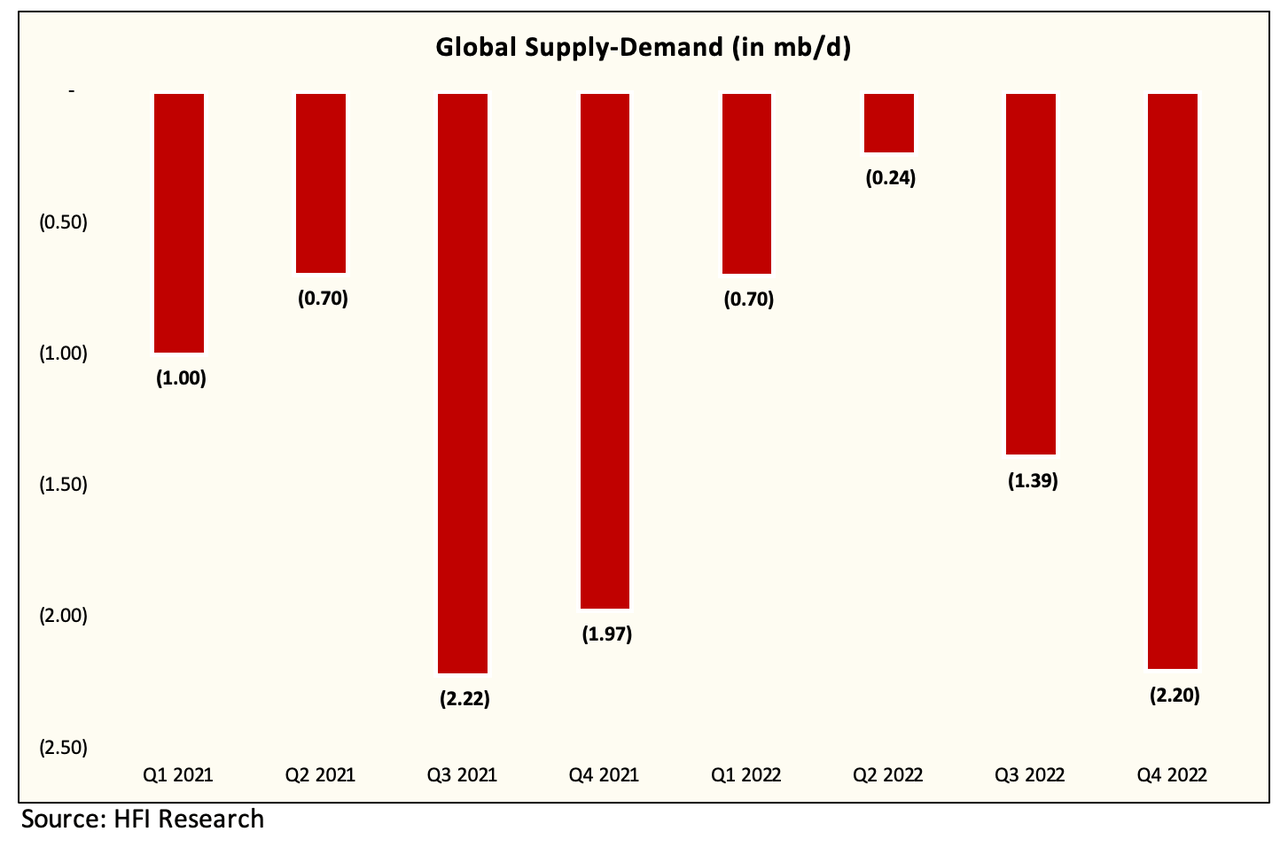

Open Square Capital tracks this weekly, so we will get early warning signals on when this will change and should give us ample amount of time to reduce position sizes and whatnot. According to our fundamental supply and demand model, we should be seeing a rather large deficit in Q3 and Q4. And if you watch the way the market is trading crude, it’s expecting the same thing.

HFIR

As a result, if the data is disagreeing with our assumptions, then we need to be aware of our misses and readjust.

Conclusion

Hopefully, by publishing articles like this, you are aware that I’m aware of the potential pitfalls ahead of us. As I’ve said many times already, this is still in the very early stages of a very long oil bull market. This, however, does not mean the road will be smooth, and we should just fall asleep on the wheel.

Given everything that’s currently happening, I still maintain that being cautiously optimistic is the best way forward. We can never be certain of anything, so being open minded and aware of the potential dangers ahead will allow us to best manage risk. And at the end of the day, portfolio management is really just risk management. Whoever best manages their risks well will outperform.

It’s the bottom of the second, so let’s play good defense into the third inning (2023).

Be the first to comment