Rob Kim/Getty Images Entertainment

Investment Thesis

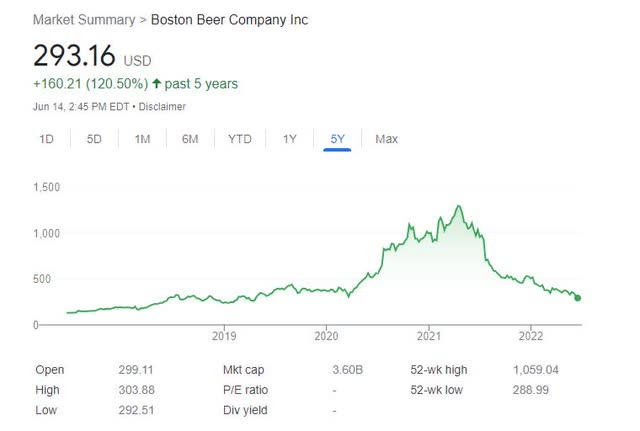

The Boston Beer Company (NYSE:SAM) has experienced a major reversal in terms of the share price over the last year. After reaching a high of nearly $1,300 per share in early 2021, the stock has collapsed over 75% to hit a fresh 52-week low of around $290. This phenomenon was in part due to an operating margin collapse on the back of the Truly Hard Seltzer debacle, in which management severely overestimated demand for their products.

Now that the ‘hard seltzer bubble’ has popped, the stock looks a lot more attractive on valuation. The Price-to-Sales metric shows only 1.9x, which is reasonable given continued revenue growth. Gross margins have been hit more recently, but with a potential rebound in operating margins next year, the stock could once again become a favorite for beverage company investors. Return on equity should normalize as well, and new product rollouts could contribute substantially to near-term and long-term shareholder value.

Introduction

Beverage companies are some of my favorite companies to research and invest in. We have all more than likely played the game ‘Lemonade Stand’ when we were children, as it teaches the basics of running a business and how to plan effectively for controlling costs, pricing, volumes, etc. I have always been interested in different drinks and brands ever since I was a kid, with Coca-Cola being my main introduction into these types of companies and a jump-off point for potential investing opportunities. Looking back, some of the first stocks I ever purchased were Pepsi (PEP) and Coke (KO), among others.

Since the beginning of my investment journey, one of my most successful investments has been a beverage company by the name of Celsius Holdings (CELH). I bought my first shares in Celsius in early 2020, just before the pandemic rattled global markets, and the beverage company quickly became my first 10-bagger in the stock market. I still hold the stock to this day, and have authored several articles on the company, with it being the subject of my debut Seeking Alpha article in April 2021.

The point of speaking on these past investments illustrates that this sector has produced many great long-term investments for a variety of people. From Warren Buffett buying Coca-Cola stock long ago to newer market participants, such as myself, investing in energy-drink/fitness beverage companies, there are many reasons to like the sector. Boston Beer Company is now on my radar, as I was aware of the surging stock in 2020, but wanted to see the stock price settle back into a normal trading range before starting a position. The massive collapse in the shares appears to be a temporary problem, and not a fundamental change in how the company’s products are viewed in the marketplace or the state of the industry as a whole. For this reason, value investors may latch onto the company sooner rather than later, as the stock has just recently traded at a fresh 52-week low, below the Covid-induced crash prices of March 2020.

Approaching Long-term Support Level

Boston Beer Company’s stock has retraced all the way back down to under $306, which was the lowest point on the chart in 2020. Looking at the chart from a longer-term time frame of 5 years, we see that the price is beginning to hit a support level at the $275-300 range. The stock has not been this cheap since 2018, despite a nearly doubling of revenues over the same period. The main problem with SAM over the last year stems from a margin collapse, which should prove to be temporary and will normalize over time as inventory management is addressed and supply chain problems abate.

Operating Margin Collapse

SAM 10 Yr Valuation History (QuickFS.net)

As seen in the above table, Boston Beer Company experienced a complete collapse of their operating margins in 2021, after overestimating the demand for the Truly Hard Seltzer brand. Despite setting a record amount of revenues at over $2 billion, the company only took in around $57 million in operating profit.

The last two quarters of 2021 were the heaviest of losses, with earnings taking a massive hit and a recovery still has yet to take place. However, the picture is getting better with an earnings loss of only 16 cents per share, versus -$4.22 from the previous quarter.

If the company can return to more normalized operating margins of 11-14%, the stock could become very attractive. However, the hard seltzer craze remains a substantial risk, as the company sees the market maturing far more quickly than many realized early on. With competition heating up, seltzers are everywhere now, and there is still a very real risk that bigger beverage industry leaders will take all of the share for themselves, leaving the Truly brand to wallow in misery. Still, new additions and flavors of Truly are hitting the market right now, with the Margarita Style Mix of hard seltzer and other new products, such as Truly-branded flavored vodkas which could cause growth to pick back up.

Once management can effectively deal with supply chain problems, inventory build-up, and operating margins, the company’s return-on-equity should rebound and the stock price will begin to match the fundamentals. At this point, the bear market in shares of SAM will likely continue, even though the stock is below $300 and lower than in March of 2020.

Risks: Mainly Competition And Further Margin Troubles

While the Truly brand of hard seltzer continues to grow revenues for the company, this comes with a hefty price. Bigger players such as Constellation Brands (STZ) have a worthy product with their Corona hard seltzers, which has an extremely recognizable brand name. It used to be that Truly and Whiteclaw had the seltzer market almost all to themselves, but times have changed rapidly. While Corona is not growing as fast as Truly, the rapid maturation of the hard seltzer market spells further margin pressure ahead. While I expect Boston Beer Company to return to normalized margins in the years ahead, they may not be as high as they once were.

Inventory remains elevated, which will take some time to work out for the company. Perhaps this is why Truly has now introduced flavored vodkas to the marketplace, in an attempt to keep sales growth going without relying overly on the hard seltzer craze. Ultimately, the problem is not the revenue growth, but management’s credibility after such an obvious misstep in 2021.

The hard seltzer category became a true gold rush for many companies, and competition remains as the number one risk for Boston Beer Company going forward. The seltzer category has also been compared to the energy drink category, which has matured to the point where there are three or four major players, and many smaller brands cannot break into the mainstream. The example of Celsius Holdings also fits into this narrative, as CELH and SAM now have similar market capitalizations. Boston Beer Company actually is worth less than Celsius at this time of writing, so there could be a possibility of a buyout offer from a larger beverage company on the horizon. At this time, Boston Beer seems undervalued when compared to Celsius, and while I have not purchased any shares of SAM, it is definitely on my radar.

Conclusion

Boston Beer Company’s bubble has popped, and the stock is close to hitting a long-term support level. The share price is now below the Covid-induced lows of March 2020, and is starting to look attractive from a long term value investing standpoint. While operating margins collapsed in 2021 due to an overestimation of demand for the company’s Truly Hard Seltzer brand, margins should rebound as management works through issues surrounding inventory build-up and supply chain problems. While margins may not be as high as they once were due to competition, new product releases and continued growth of the brand portfolio should help in terms of profitability. With a Price-to-Sales of only 1.9x, the stock is getting cheap given continued revenue growth and future potential. I currently view the shares of Boston Beer Company as a Hold, and would likely be a buyer on continued weakness in the coming months.

Be the first to comment