Justin Sullivan/Getty Images News

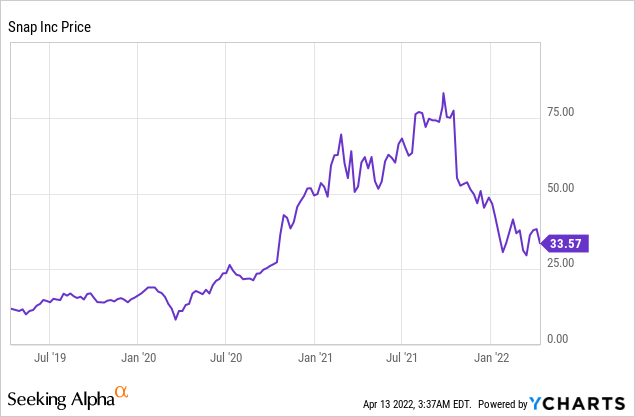

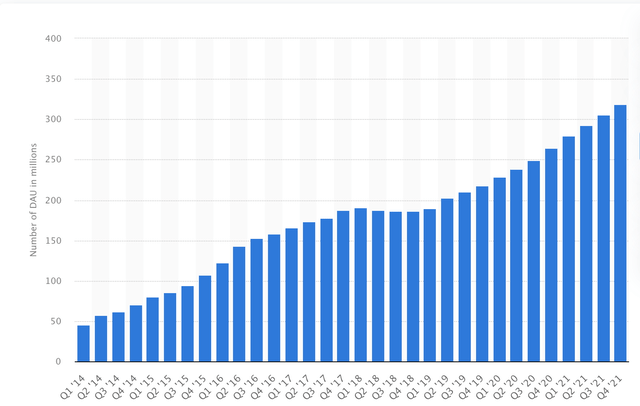

Snapchat (NYSE:SNAP) the camera focused video app saw its share price tread water between its IPO date in 2017 up until the end of 2019. The company’s share price hovered around the $20/share mark up until 2020, tracking the flat user base, as they faced increasing competition from rivals such as Facebook. Then as the pandemic hit, lockdowns caused user growth to accelerate sharply jumping from 229 Million MAU to 319 million MAU in 2 years, which equates to an increase of 39%. The share price went meteoric on this growth and rose by 432% up until October 2021.

The company released a poor earnings report in Q32021 as revenue missed analyst estimates because of Apple’s new privacy policies. Snapchat also offered poor guidance for Q42021 which caused the share price to decline further, leaving it now down 59% from its highs. SNAP continues to innovate, grow revenues and margins, but the stock price has gone the opposite way. Let’s dive into the innovation of Snapchat and the firm’s valuation in more detail.

Snapchat Share price (Y charts)

The Innovator

Snapchat was founded on September 16, 2011, by Evan Spiegel and Bobby Murphy, who relaunched “Picaboo” as Snapchat. The company pioneered the “camera focused” social media application and was dubbed the “next Facebook” at the time. Previously, applications such as Facebook had a heavy focus on the Newsfeed and yes, images/videos were uploaded, but there was not a focus on real time.

The disappearing element of Snapchat’s images/photos made the content very appealing to people. Spiegel said he modeled this on “real life conversions” as people would be less embarrassed uploading something if it disappeared after just 24 hours. This was genius at the time, as the lack of social pressure boosts engagement and posting frequency compared to other social media apps, such as Instagram which was acquired in 2012 by Facebook.

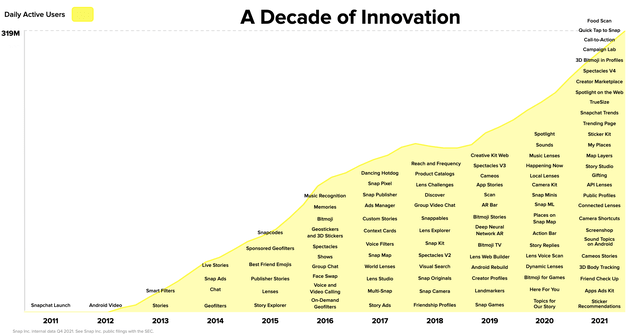

Snapchat Innovation (Investor relations)

“Innovation” is a word which gets thrown around a lot, but in Snapchat’s case it is justified. Snapchat has always been an incredible innovator. Their augmented reality filters were pioneering at the time. These not only increased user engagement but also offered brands the opportunity to create custom geofilters, which opened up a new method of advertising. Snapchat even introduced “Snapcash,” a money transaction feature way back in 2014.

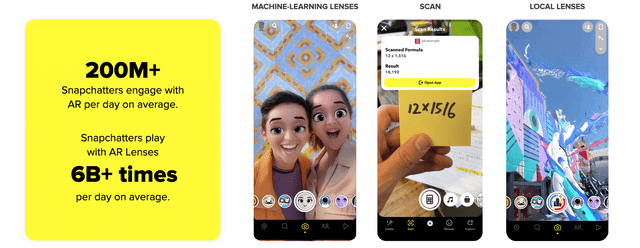

Snapchat AR (Investor presentation)

Snapchat’s innovation was quickly muted as larger rivals such as Facebook gained “inspiration” from the idea of “Stories” which disappear after 24 hours and integrated this feature into their Facebook and Instagram apps.

As a former avid user of Snapchat many years ago, I remember one day seeing the same feature on Instagram and thinking it would take too long for me to upload content on multiple platforms, thus I decided to delete the Snapchat app. I’m sure many others did the same. This feature was rolled out internationally between 2016 and 2018, the flat user growth part of chart 1.

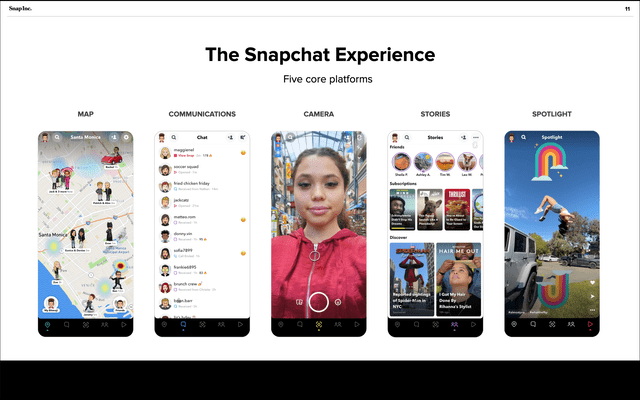

Snapchat still does have a large appeal to the Gen-Z and millennial audience with over 50% below the age of 29. However, TikTok is stealing the thunder in this area, with over one billion MAU and 43% of their audience, between 18 and 24 years old. Luckily for Snapchat, they have gained “inspiration” from TikTok and introduced a new spotlight feature which is very similar to TikTok and Instagram reel features.

Snapchat features (investor presentation)

The trend suggests all of these major social media apps are converging into a hodgepodge of “innovative” features from other apps. The challenge for Snapchat is despite being mostly original, they are the smaller player with 319 million MAU vs. Facebook 2.9 billion MAU and TikTok which now has 1 billion MAU.

Snapchat’s Secret Weapon

A key feature of Snapchat has been its focus on “close friends”, unlike Facebook where many people will have thousands of “friends” or Instagram where people may follow an array of influencers. Snapchat doesn’t make the number of friends a kind of social currency, like on other platforms.

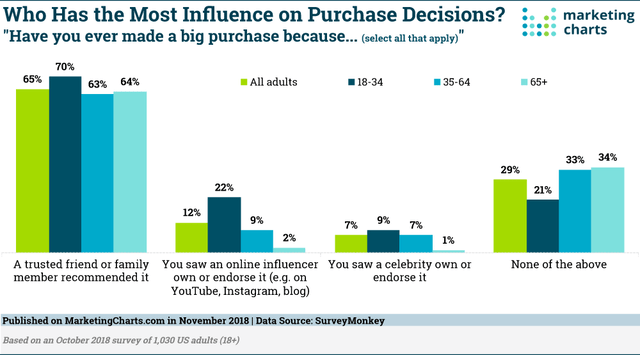

There are a few key reasons why this is powerful. Firstly, higher engagement is expected from interacting with friends. Secondly, multiple studies such as the one below show close friends influence buying decisions more than influencers or companies. This is extremely powerful for potential advertisers and virality as the chart below shows 70% of 18 to 29 year olds are influenced by close friends when making buying decisions.

Purchase influence (Marketing Charts)

The challenge for Snapchat now is to find a way to monetize these close friends effectively. Perhaps Snapchat could introduce a feature called “Close Friends Recommended”, a kind of affiliate scheme where if you buy a product your friend uses, you both gain points, but I’m just spitballing here unless the CEO is reading this.

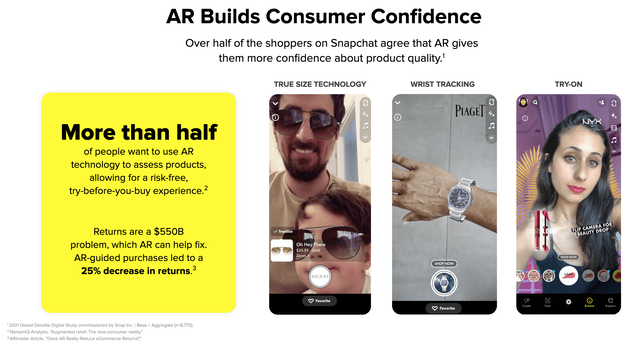

Snapchat is still leading the way in Augmented Reality lens and has introduced “try on” and “wrist tracking” which could revolutionise the way we shop online.

SNAP also has large full scale augmented reality experiences, which are very advanced compared to rival platforms.

AR Lens (Investor presentation)

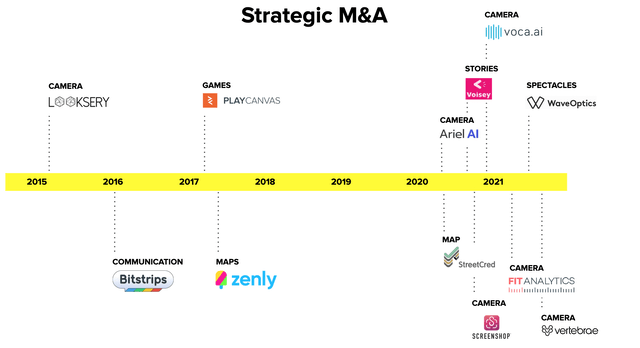

The company has also completed a series of acquisitions as it aims to stay innovative and current compared to competitors.

Growing Financials

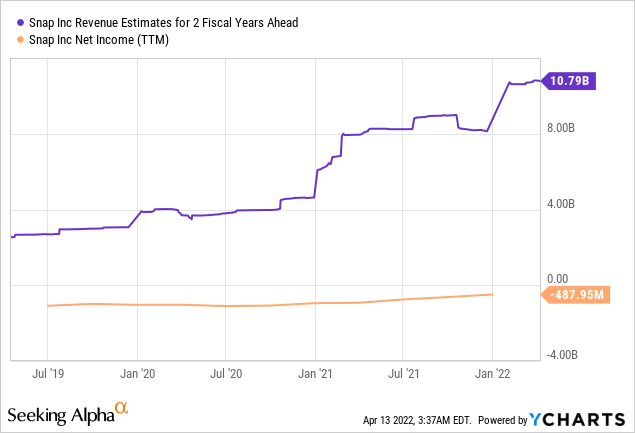

Snapchat has 5x’d their revenue since 2017, going from $825 million to $4.1 billion by 2021. In recent times, the company is still growing revenues fast and reported a 64% increase year over year.

Snapchat revenue (created by author )

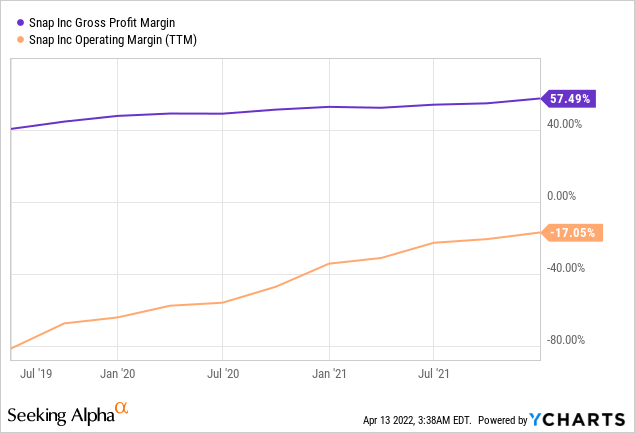

Gross profit also jumped from $1.3 billion to $2.3 billion, up 76% year over year. With gross margins trending upwards from 40% in 2019 to 57% year to date.

Margins Snapchat (Created by author)

Snapchat is still operating at a loss of -$702 million, but if we minus the $1.5 billion R&D spend, they would be firmly profitable. They were free cash flow positive to the tune of $293 million in 2021. On their balance sheet, Snapchat has $3.692 billion in cash and cash equivalents, but surprisingly high debt levels of $2.2 billion, which isn’t maturing until 2025.

Fair Valuation

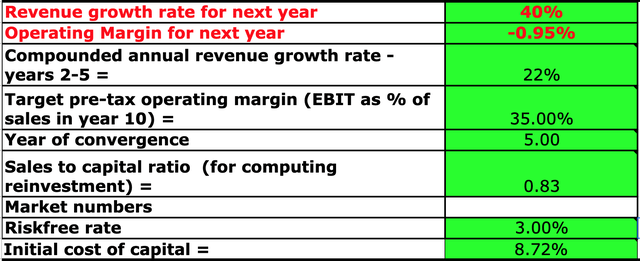

In order to value Snapchat, I have plugged the latest financials into my discounted cash flow model. For greater accuracy, I have capitalized R&D expenses. For revenue growth, I have estimated 40% for next year and then a conservative 20% for the next 2 to 5 years. These are both substantially lower than prior growth rates of over 60%.

Snap Financials (Created by author at Motivation 2 Invest)

For the operating margins, I have predicted them to increase to 35% in the next 5 years, which is optimistic but not impossible as that is still much lower than Facebook (Meta) operating margin.

Snapchat stock Valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $33/share, which is where the stock trades at today.

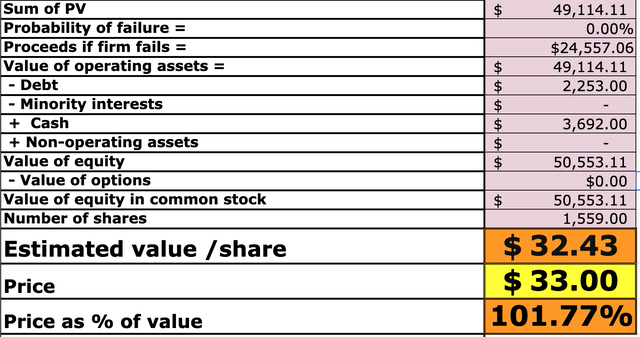

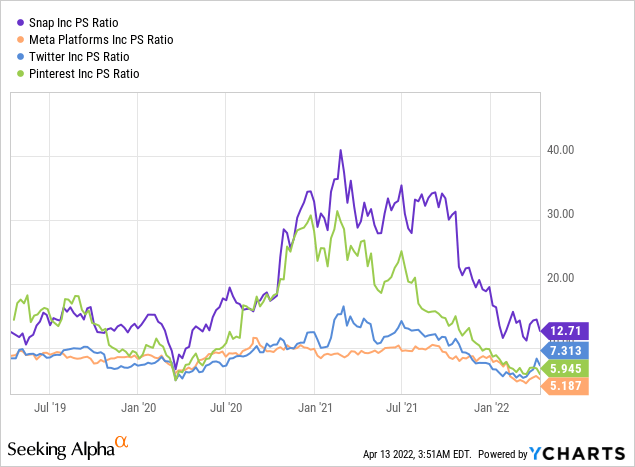

In terms of relative valuation, Snapchat has the highest valuation on an EV/EBITDA multiple (forward) of 59 vs. Twitter (23), Pinterest (17) and the cheapest Meta at an EV to EBITDA of just 8. However, the expected growth rate is also the highest (50%+) compared to these other players.

EV to EBITDA (created by author)

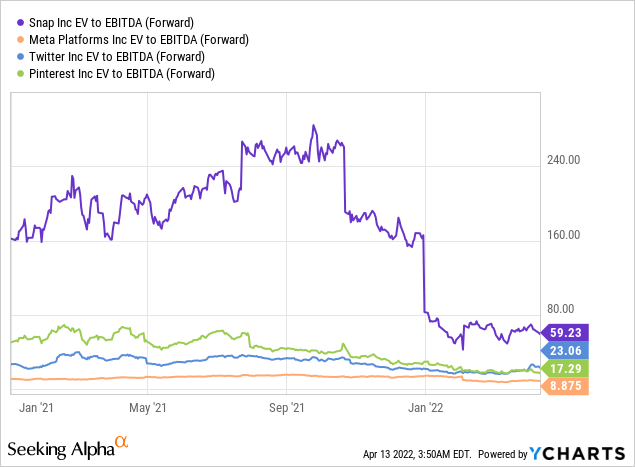

The price to sales ratio shows a similar story with Snapchat having a price to sales ratio of just 12 compared to Meta at just 5.

Price to Sales Ratio (created by author)

Risks:

Governance Issues

It should be noted that Snap’s class A shares have no voting rights. Now although this may not be an issue for the average retail investor, many institutional investors do not like this lack of governance, as Snapchat’s two founders have 99.5% of the voting power.

Social Media Wars

Fierce competition from rivals such Facebook and disruptors such as TikTok is not great news for Snapchat. TikTok has recently announced to be rolling out an AR Filter tool called the “effect house” which directly competes with Snapchat’s offering. Now although Snapchat is still the leader in augmented reality, this is not good news. My prediction of the major social media apps converging with the same features seems to be playing out.

At the time of writing (April 13th), Yahoo finance reports global TikTok revenue has just surpassed Twitter and Snapchat combined! It is still crazy to watch how fast the social media landscape changes.

Macroeconomic issues

Growth stocks tend to do poorly in a high inflation, rising interest rate environment, as their valuation is based upon cash flows weighted more towards the future. The 10 Year T bond rate which is a commonly used discount rate has jumped from 0.59% in 2020 to 2.7% at the time of writing.

Final Thoughts

Snapchat is a fantastic company and a true innovator in the world of Social Media and Augmented Reality. They have grown users, revenues and profits substantially over the past couple of years, but fierce competition from rivals threatens future growth. The company is fairly valued right now, but relative to competitors is not exactly cheap. The social media landscape is always changing and my eyes would be on a TikTok IPO, which the CEO stated could be a couple years down the line.

Be the first to comment