Edwin Tan/E+ via Getty Images

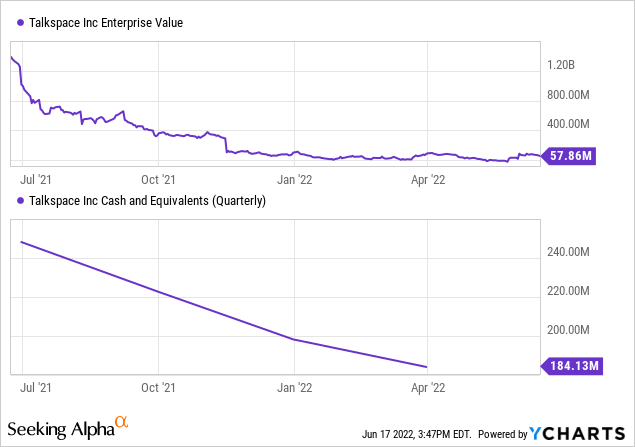

Talkspace (NASDAQ:TALK) stock has rallied strongly in recent weeks on news of a possible takeover. Per an Axios report, TALK was first approached by privately-owned Mindpath Health, then it was American Well (AMWL) who was reported to have expressed interest in acquiring TALK. While TALK turned down the approaches, I still think a takeout is on the table – the steep YTD share price correction across the digital health space has made consolidation a far more likely outcome, particularly in fragmented spaces such as behavioral health. Plus, TALK’s search for a new CEO has yielded no results thus far, and interim CEO Doug Braunstein’s equity comp award is closely tied to a change of control scenario. At the current ~$58m enterprise valuation, TALK is valued only slightly above its ~$184m cash pile, making this a particularly attractive M&A opportunity for private equity or a strategic buyer.

M&A Interest Rises Following YTD Selloff

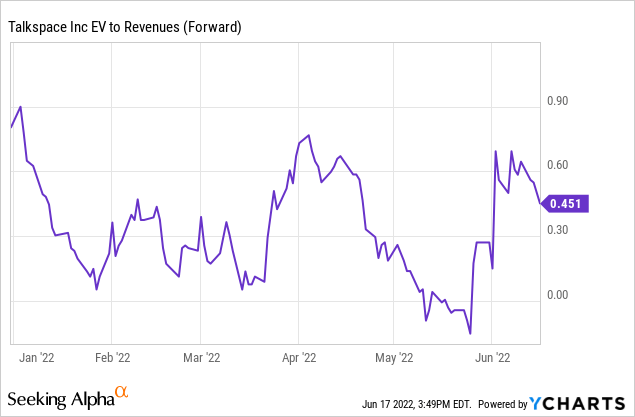

Since TALK went public through a SPAC at a ~$1.4bn valuation in mid-2021, valuations have come down significantly across private and public companies. In tandem, TALK stock has suffered a significant decline since the merger of its SPAC transaction was completed. Not helping matters was a string of earnings disappointments post-listing – the Q3 2021 report, for instance, saw underwhelming B2C customer conversion rates and, by extension, consumer revenue. Management has since pulled its full-year guidance due to uncertainty related to the ongoing CEO search (note, the company does not currently have a permanent CEO in place) and broader market conditions. Understandably, market confidence has taken a hit, but with the stock now trading at a depressed ~0.45x fwd revenue multiple and its cash balance at ~74% of the market cap, I suspect we may have reached peak pessimism.

In response to the deep valuation discount, a slew of acquirers has expressed interest. First, it was privately-owned Mindpath Health, a tech-enabled behavioral health company, that emerged as a potential suitor to acquire TALK for ~$500m. Given that Mindpath also operates virtual care (~30% of the overall business), the strategic rationale of adding scale to its portfolio via TALK makes good sense. While the Axios article noted that the talks have since ended, it was unclear how serious the initial approach was. Since then, AMWL has also been reported to be interested in acquiring TALK (offer price undisclosed), but again, TALK turned down the approach. Although the initial approaches have not yielded any progress, I suspect, as explained below, that M&A optionality remains very much on the table.

Still An Attractive Asset In An Industry With Ample Growth Potential

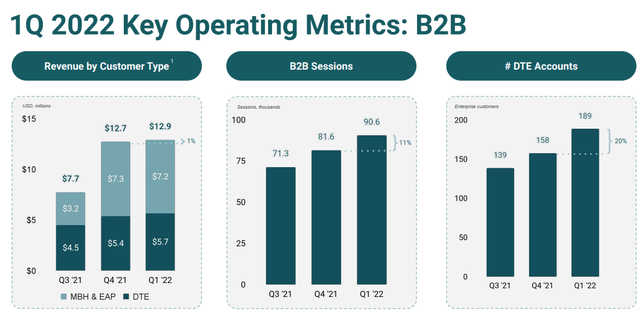

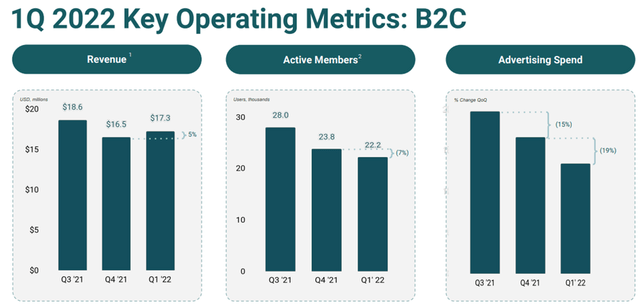

Recent challenges aside, it is important to remember that TALK still operates in a behavioral health services market with secular growth tailwinds. Furthermore, the TALK brand has weight among consumers – the company continues to grow post-COVID, ending its latest quarter with 64.5k active subscribers (+10% YoY). B2B utilization is also gaining meaningful traction, reaching 76.5m eligible B2B lives – +54% YoY and well above the 69 million base at the end of 2021. On the sales front, B2B sales were up 50% YoY to a solid ~$12.9m, as total sessions also rose to 90.6k. B2C was relatively resilient, posting a modest 7% YoY decline to $17.3m despite a ~19% decline in marketing spend. More importantly, B2C conversion metrics remain on an uptrend, supporting the flat QoQ sales performance.

Fundamentally, management’s focus on cash is a key positive, and based on the current business trajectory, there is a clear path to narrowing adj EBITDA losses as we move into the back half of the year. The company also ended its most recent quarter with ~$184m in cash and equivalents, so even if the current cash burn continues, there is likely no need for future capital raises down the line. For context, the current TALK cash burn is ~$14m, implying over a year of runway even if management does not deliver on the guided operating improvements. The current guidance is for a gradual reset in the cash burn rate in line with the company’s adj EBITDA, implying a near-term path to breakeven and self-sufficiency. TALK’s 2022 guidance remains suspended, though, pending further visibility into its turnaround, so any progress here could catalyze the stock higher.

Strategic Alternatives Are Appealing Given Current Market Valuation

Relative to the current market cap, the $500m offered by Mindpath highlights the value currently on offer. For context, a $500m equity value (almost double where the stock trades today) represents a ~2x multiple on fwd revenues and would imply a stock price of ~$3.25. Though such a premium might appear meaningful at first glance, I would point out that the company currently has ~$184m of cash on its balance sheet – a staggering ~74% of its market cap. Plus, precedent telehealth transaction multiples have been significantly higher than TALK’s current valuation multiple – for instance, Accolade (ACCD) acquired PlushCare, another behavioral health service provider, for >10x revenue.

|

USD ‘M |

|

|

Cash |

184 |

|

(/) Market Cap |

248 |

|

= Cash as % of Market Cap |

74% |

Source: Author, Market Data (18th June 2022)

While management might argue that executing its turnaround strategy would yield even more upside from these levels, I suspect shareholders might favor an outright sale over more turnaround uncertainty. After all, TALK has still not had success in hiring a permanent CEO (recall that co-founder and CEO Oren Frank and co-founder and Head of Clinical Services, Roni Frank, stepped down in Q3 2021). Perhaps more indicatively, a recent filing on interim CEO Doug Braunstein’s equity compensation award revealed a clause allowing for full vesting upon a change of control, suggesting the Board is open to a takeout. That said, caveats are in order – Fed hawkishness means this is a very different market environment from recent years when behavioral healthcare deals (direct-to-consumer in particular) went for hefty revenue multiples.

Deep Value Opportunity Primed For A Takeout

While the macro is clearly not in its favor, TALK’s enterprise valuation at ~$58m (or a modest premium to its ~$184m cash pile) strikes me as far too cheap given TALK went public at a ~$1.4bn equity valuation in June 2021. The extent of the undervaluation creates M&A optionality here, with the universe of ample potential buyers spanning private equity, competitors, or a diversified player looking for a foothold into the high-growth behavioral health space. The recent disclosure of interim CEO Doug Braunstein’s equity compensation package fully vesting upon a change of control also indicates the Board is open to a takeover. Even if a takeout doesn’t materialize anytime soon, TALK’s $184m of cash on its balance sheet and progress towards EBITDA breakeven ensures a sufficient runway without the need for future capital raises.

Be the first to comment