Ronny Gäbler/iStock via Getty Images

It’s hard for me to justify the current BorgWarner (NYSE:BWA) price. Yes, they have uncertainty, increased debt levels, high inventory, and worsening working capital requirements while also having lower returns and overall margins. However, that should be expected when redirecting the business for long-term growth, especially when done by acquisitions. I still see long-term value potential in a company that is expected to deliver $1B of FCF next year and $3.6B from 2022 to 2025. It might be worth being a contrarian.

What is BorgWarner

Founded in 1987, BorgWarner developed to be one of the largest manufacturers of vehicle components to a broad number of OEMs around the world. It is divided into four main areas:

- Air Management – including turbochargers, emissions systems, battery components, and more with almost 50% of 2021 sales

- e-Propulsion & Drivetrain – including electric motors, alternators, inverters, transmission modules, and more with roughly 35% of 2021 sales

- Fuel Injection – including fuel injection components and systems for vehicles with ICE with almost 12% of 2021 sales

- Aftermarket – recurring and stable revenue stream comprised of replacement parts, representing a bit more than 5% of 2021 sales.

Furthermore, the company had by the end of 2021 13 joint ventures, unconsolidated in its accounts, delivering sales of more than $1B.

Since mainly 2015, the company has been actively trying to integrate electric and hybrid components by acquiring existing businesses with the most significant of them being Delphi and Akasol. BWA expects the percentage of sales regarding electric vehicles to increase exponentially over the next few years, reaching 25% of all sales in 2025 and 45% in 2030. With automotive sales being booked years in advance, BorgWarner can better predict sales for the coming years.

While internal combustion engines have been getting negative press with also the European Union voting on a ban for new ICE vehicles after 2035, I believe that no one expects them to end soon, especially for developing parts of the world. This time window will help the industry address the expanding electric market, set to grow at 21.7% CAGR until 2030, having BorgWarner benefitted from being one of the first movers into the space.

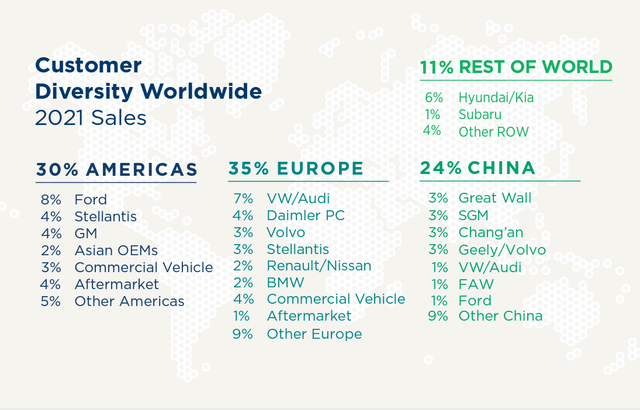

Worth highlighting the incredible diversification of clients that they are exposed to, decreasing their risk.

BWA Customer Diversification (Annual Report)

The “Underdog” of the Car Component Industry

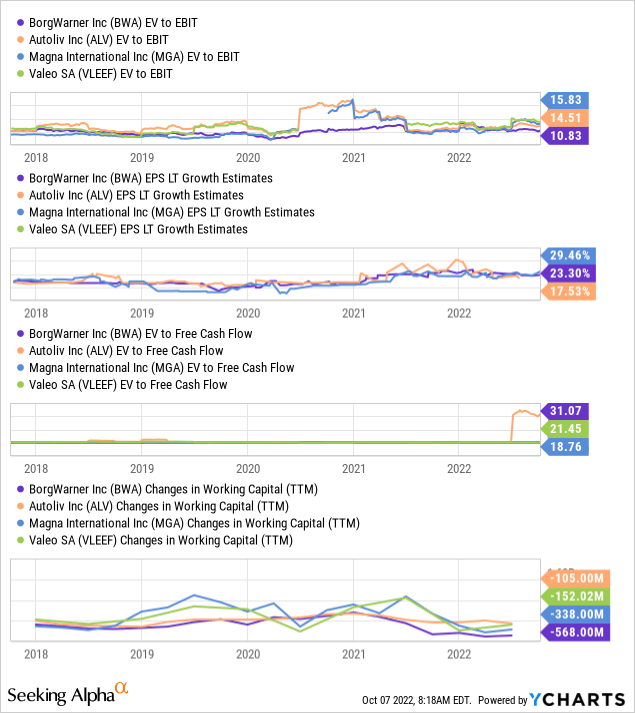

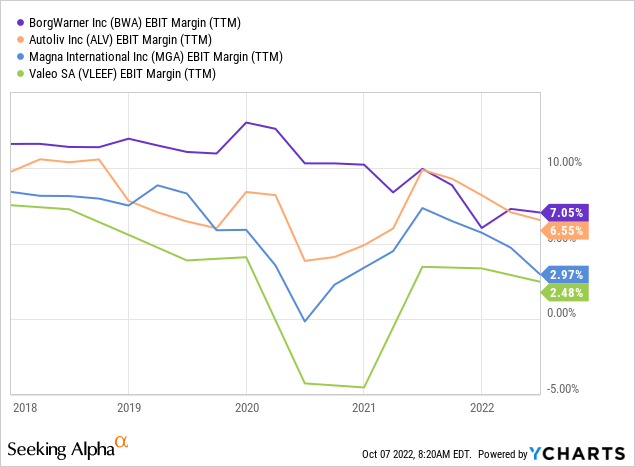

The following displayed charts support the idea that BWA trades at a discount to its industry peers, mostly since the introduction of its new development plan to “electrify” its produced products. Benchmark competition used for this purpose was Autoliv (ALV), Magna International (MGA), and Valeo (OTCPK:VLEEF), all vehicle component producers.

Despite having the best EBIT margin of the three competitors and an interesting estimated growth rate, BWA is worth 10.83x EV/EBIT while Magna is significantly higher at 15.83x. The potential ability to generate free cash flow collaborates with the same idea. If the effect of recent accruals, like the recent inventory build-up, is normalized, then it’s possible to establish an identical undervalued case on a cash basis. I’m considering and expecting that recent headwinds will normalize over the medium to long term.

I believe BWA has narrow competitive advantages provided by its close to 8.200 active patents or patent applications and long-standing relationships and contracts. It’s also known for its reliability, employee experience, and quality.

Recent Developments

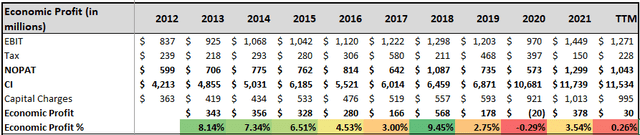

It’s easy to see that recent years haven’t been favorable to the (normal) car industry and BorgWarner in specific. Taking a look at the last ten years’ performance from the company, from an economic profit point of view, we see that the value added by it is worsening.

Economic Profit Table (Seeking Alpha Data and Own Calculations)

The invested capital has increased more than the results mostly because of the acquisitions done which apparently haven’t (yet) produced the expected results. BWA is returning less value per capital employed than before. Recent increases in inventory levels and the larger cash position to be able to accomplish M&A are increasing the invested capital, which ultimately ends up reducing the value created. COVID-19, chip shortage, and lately the Ukrainian war likewise affect and distort recent results.

I’m of the opinion that these recent headwinds are only short-term and that the growth plan continues to be valid and strong.

Valuation

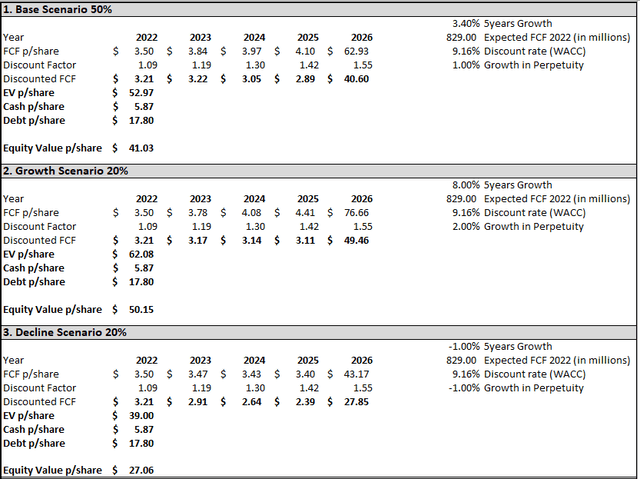

For the normal valuation, I’ve used a simple free cash flow model with a very conservative projection, for the base scenario, of a 3.4% growth rate going to 2026 and a 1% perpetuity rate. The 9.16% WACC presented was calculated based on market values, 3.83% risk-free, and a 6% risk premium with an estimated Beta of 1.57. The optimistic scenario had an 8% growth rate and a 2% perpetuity rate while the pessimistic scenario took a -1% decline in FCF and a -1% in perpetuity, giving both a 20% chance.

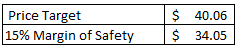

FCF Model (Seeking Alpha Data and Own Calculations) Price Target (Own Calculations)

The current price is in the range of my intrinsic value calculation, using a reasonable 15% margin of safety for this cyclical stock. This result is obtained without considering the recent headwinds and not expecting additional margin improvements with the completion of acquisition synergies and efficiency improvements. I believe that there is a good possibility of an upside with the right macro environment after the headwinds are cleared.

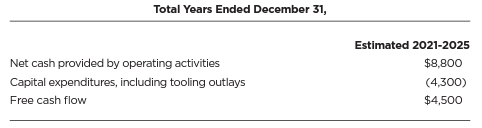

Management expects a similar to slightly superior projection of FCF over the next years even despite high growth CAPEX weight it down.

FCF Projections from BWA (Annual Report)

What Might Go Wrong

There are always risks involved in an investment and, for me, these are the main ones that can adversely affect the business medium to long term:

- Growth by Acquisitions Strategy – It’s well known to be a harder and more expensive way to increase sales, there is always the chance of overpaying for it because of exuberant pricing and expectations. This strategy might prove costly to the shareholders if it isn’t well planned and executed.

- Disposing of Profitable ICE Assets – To bolster its change, the company is intending to sell parts of its profitable assets to finance the purchase of (maybe) not-so-profitable ones.

- Competition in a Trendy Industry – Electric vehicles appear to be a prominent part of future mobility, hence we should expect many new competitors to move into the market which might hurt profitability overall.

- A Longer and More Serious Recession – Present state of the world leaves doubts and uncertainty over the future. If this negative period prolongs in time, we might see possible underlying business deterioration.

Final Point

BorgWarner is an interesting business trying to steer away from the now “disliked” ICE area with an ambitious plan that might just work out. Nobody can determine the bottom of this bear market, but I believe this to be an interesting time to start a contrarian position in cyclical stocks if the price is right. The downside appears to be already priced in while a potential upside coming from a successful strategy could mean a significant upside to the stock.

The best time to get involved with cyclicals is when the economy is at its weakest, earnings are at their lowest, and public sentiment is at its bleakest.

Peter Lynch

Be the first to comment