NguyenDucQuang

A Quick Take On Jamf Holding

Jamf Holding Corp. (NASDAQ:JAMF) recently reported its Q3 2022 financial results on November 9, 2022, beating expected revenue and EPS estimates.

The company provides IT services for companies using or interfacing with Apple (AAPL) products.

JAMF’s operating losses have been increasing and the firm faces a negative hiring environment for its customers.

I’m on Hold for JAMF in the short term.

Jamf Holding Overview

Minneapolis, Minnesota-based Jamf was founded to provide a comprehensive set of services it calls Apple Enterprise Management.

Management is headed by Chief Executive Officer Mr. Dean Hager, who has been with the firm since June 2015 and was previously CEO of Kroll Ontrack and prior to that held various senior roles at Lawson Software, later acquired by Infor.

The firm enables enterprises to more easily integrate all types of Apple products and software into their existing systems ‘without ever having to touch the devices.’

Jamf sells its SaaS solutions via a subscription revenue model and sells larger accounts through a direct sales force and smaller accounts via its online portal.

Company products include:

-

Lifecycle Application Management

-

Inventory & Device Management

-

Identity & Security Management

-

Threat Prevention & Remediation

-

Visibility & Compliance

The firm also sells through channel partners, which include Apple itself.

Jamf’s Market

According to a management-cited IDC survey of U.S. commercial IT decision-makers, it expected the penetration of Apple Mac computers to increase from 11% to 14% by the end of 2022.

Additionally, more enterprises are seeking to allow employees to use more of the technology of their choice as solutions to integrate various platforms become more available and cost-effective.

The increase in the use of mobile devices is mostly the reason for Apple’s use growth in the enterprise, although the Mac has been an important contributor.

Management says its focus on providing a vertically integrated suite of options means it can compete better against small startups that are usually focused on one functionality as well as against the large providers who do not offer specialized solutions.

Jamf’s Recent Financial Performance

-

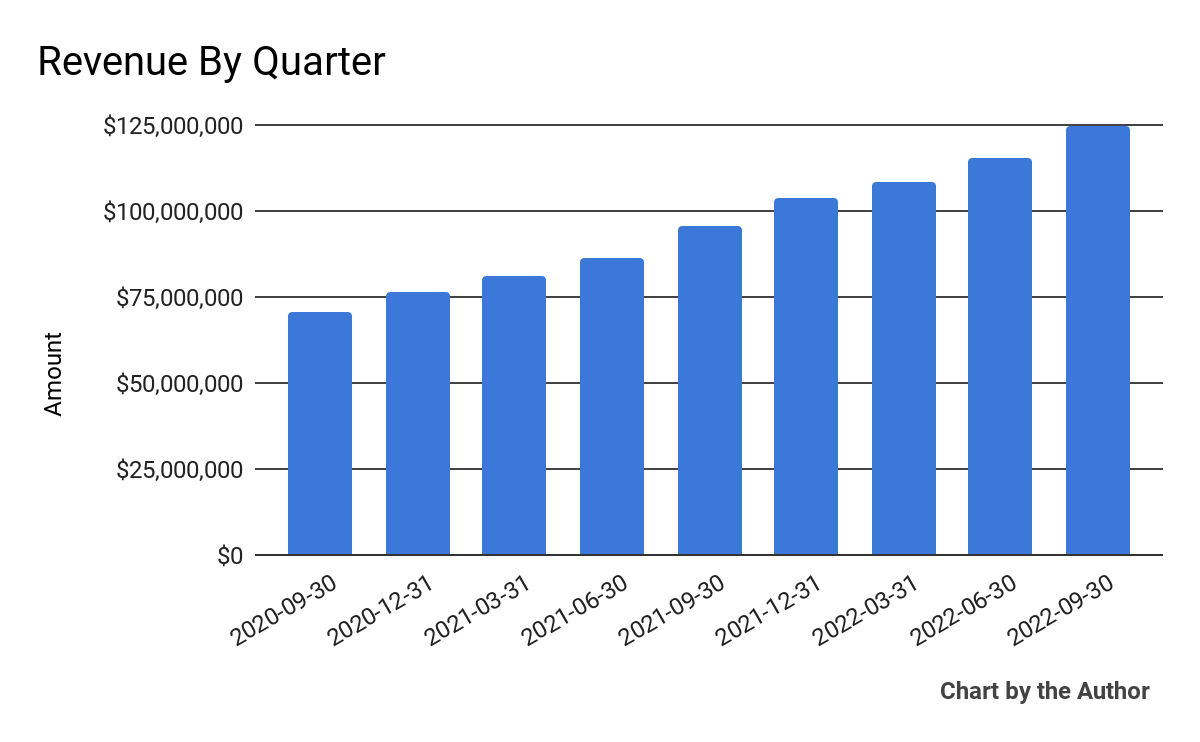

Total revenue by quarter has risen per the following chart:

9 Quarter Total Revenue (Financial Modeling Prep)

-

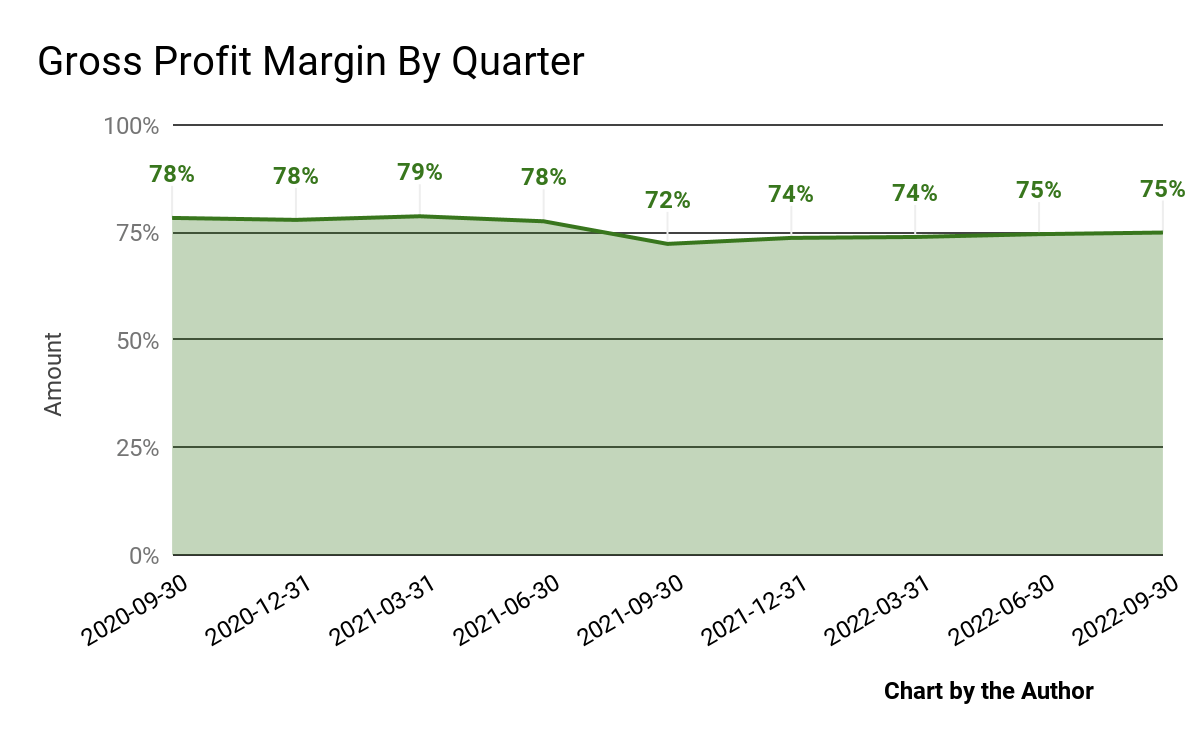

Gross profit margin by quarter has trended lower in recent quarters:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

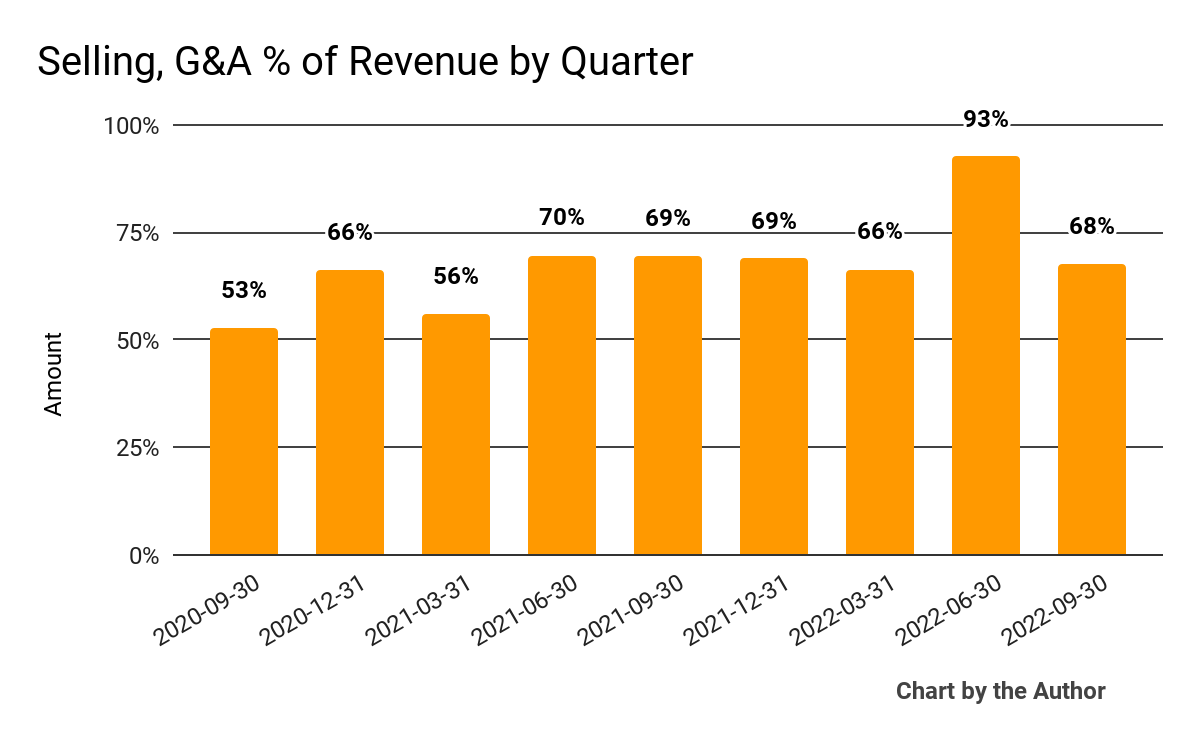

Selling, G&A expenses as a percentage of total revenue by quarter have been somewhat uneven lately:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

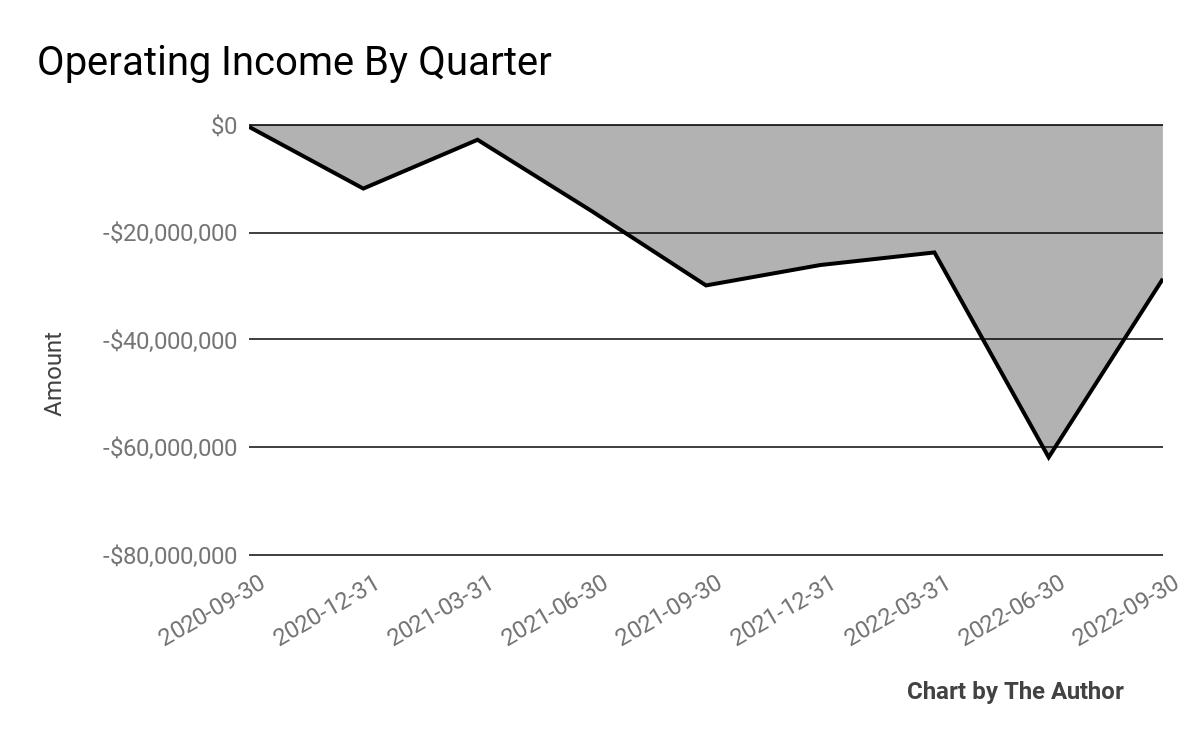

Operating losses by quarter have worsened in recent quarters, as the chart shows below:

9 Quarter Operating Income (Financial Modeling Prep)

-

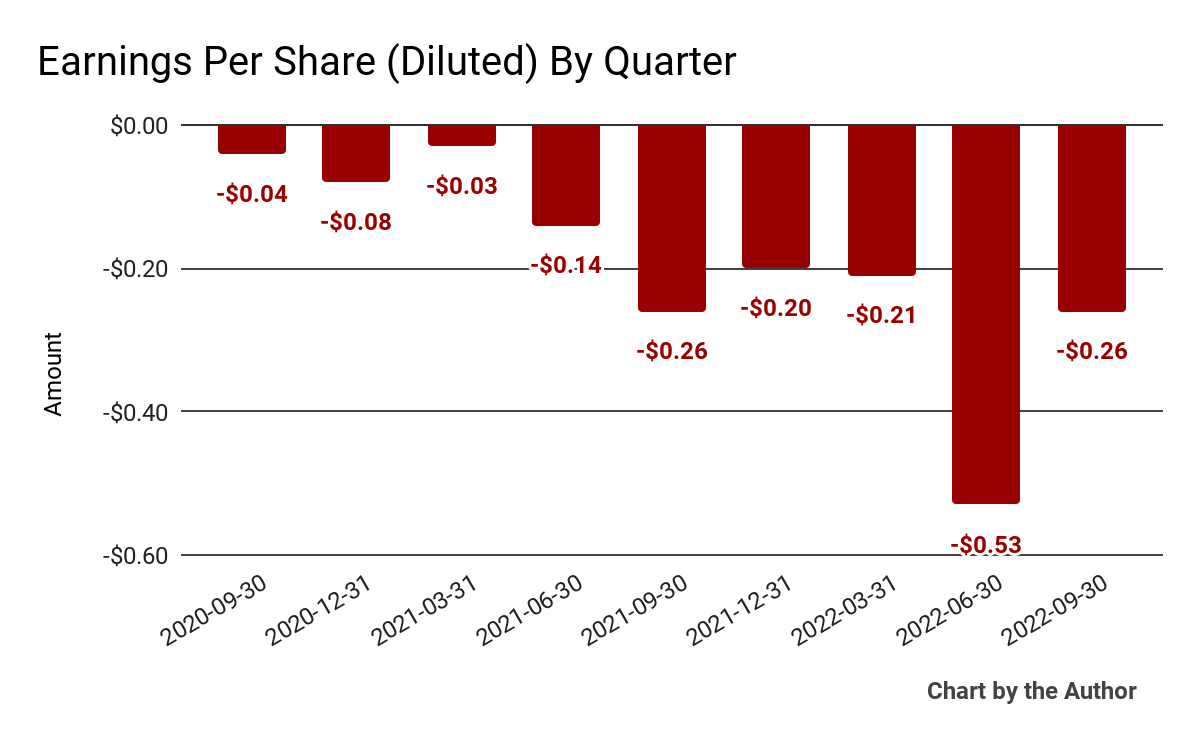

Earnings per share (Diluted) have also worsened further into negative territory more recently:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

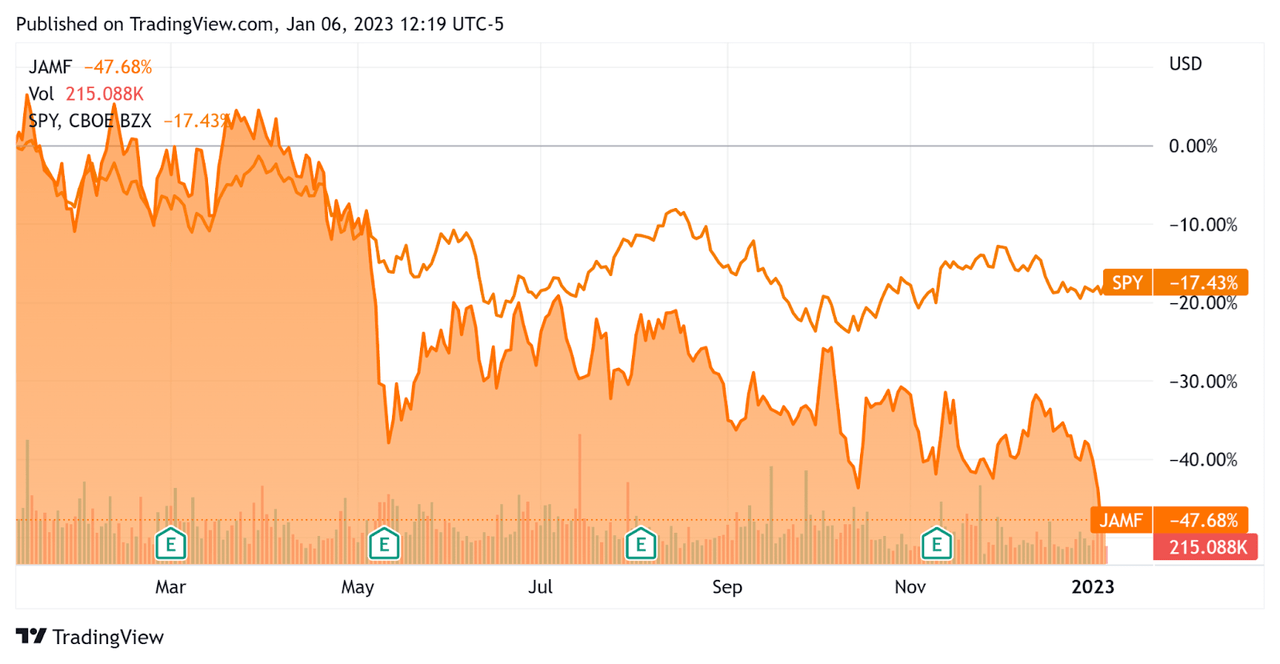

In the past 12 months, JAMF’s stock price has fallen 47.7% vs. the U.S. S&P 500 index’s drop of around 17.4%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Jamf Holding

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.5 |

|

Enterprise Value / EBITDA |

-27.9 |

|

Revenue Growth Rate |

33.2% |

|

Net Income Margin |

-31.8% |

|

GAAP EBITDA % |

-19.6% |

|

Market Capitalization |

$2,350,052,352 |

|

Enterprise Value |

$2,481,242,332 |

|

Operating Cash Flow |

$63,169,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.20 |

(Source – Financial Modeling Prep)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

JAMF’s most recent GAAP Rule of 40 calculation was 13.6% as of Q3 2022, so the firm is in need of improvement in this regard, per the table below:

|

Rule of 40 – GAAP [TTM] |

Calculation |

|

Recent Rev. Growth % |

33.2% |

|

GAAP EBITDA % |

-19.6% |

|

Total |

13.6% |

(Source – Financial Modeling Prep)

Commentary On Jamf Holding

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted 27% ARR growth (Annual Recurring Revenue).

Its commercial market segment was the bright spot, generating 33% growth versus the slower-growing education segment having produced only 15% growth.

Management noted its challenges in attracting and retaining enough staff ‘to meet the market demand for Apple First management and security solutions.’

As to its financial results, total revenue rose 30% year-over-year, exceeding the high end of its previous guidance.

The company’s net retention rate was 115%, slightly lower sequentially but still indicating solid product/market fit and sales & marketing efficiency.

The firm’s Rule of 40 results have been in need of improvement, with a reasonably strong revenue performance offset by a negative operating result contributing to a sub-par figure for this metric.

Gross profit margin has trended lower, while operating losses have worsened in recent quarters, as have negative earnings per share.

For the balance sheet, the firm finished the quarter with $225.5 million in cash and equivalents and total debt of $363.9 million.

Over the trailing twelve months, free cash flow was $55.1 million, of which capital expenditures accounted for $8.1 million. The company paid a whopping $102.6 million in stock-based compensation.

Looking ahead, management is seeing some customers reduce their future outlook for hiring and related device growth needs.

Leadership is also seeing continued supply chain challenges with hardware products.

For full-year 2022, management expects revenue growth of 30% year-over-year and non-GAAP operating income of around $24 million at the midpoint.

Non-GAAP operating income does not include stock-based compensation, which the company has been using copiously.

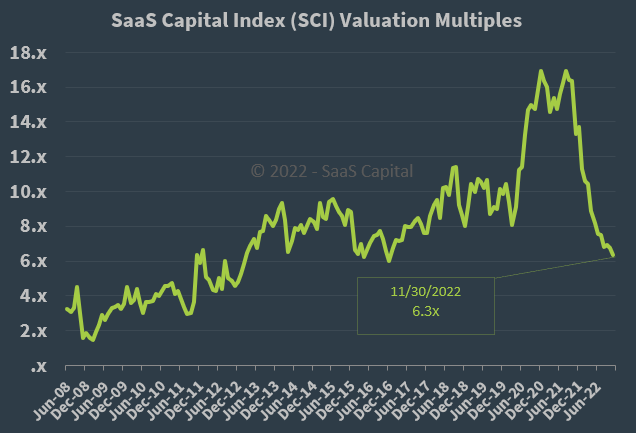

Regarding valuation, the market is valuing JAMF at an EV/Sales multiple of around 5.5x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on November 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, JAMF is currently valued by the market at a discount to the broader SaaS Capital Index, at least as of November 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may reduce its revenue growth trajectory, especially as technology companies may eliminate employee positions at an increasing pace in 2023.

A potential upside catalyst to the stock could include stronger growth in Apple product sales as supply chain pressures ease.

Given the company’s generally worsening operating results and the expected recession immediately ahead, I’m on Hold for JAMF in the near term.

Be the first to comment