Dan Kitwood/Getty Images News

Introduction

Dollar General (NYSE:DG) continues to look solid YTD thanks to strong 1H22 earnings. The company demonstrated to investors a stable level of profitability, revenue growth and effective work with the product mix and cost management. I believe that in the current macro situation, DG is an excellent bet for capital preservation and growth, in my personal opinion.

In addition, companies that are focused on basic needs are less sensitive to the interest rate hike cycle.

Forecasting

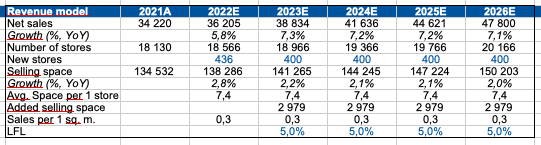

For more accurate forecasting, I built a separate model to model the company’s revenue. Thus, I believe that Dollar General, according to its strategy, will continue to: 1) open new stores 2) maintain a positive level of SSS (LFL) (same store sales). Thus, we see that the company’s revenue will continue to grow faster than the growth of selling space.

Revenue model:

Personal calculations (Personal calculations)

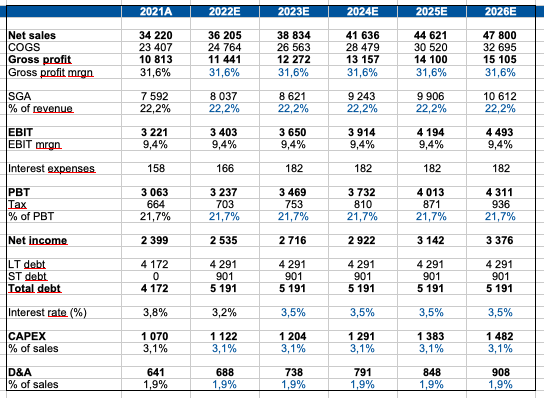

In addition, making assumptions for the following periods, I believe that:

Gross profit margin: The company will continue to show a strong gross margin due to price growth (at least by the inflation rate), efficient work with suppliers and a favorable product mix.

SGA (% of revenue): The company will continue to effectively manage costs. I mean that the company will be able to keep the cost of rent and staff at a stable level in view of the strong negotiating position and reduced competition for labor.

Tax (% of PBT): Stable level based on historical data.

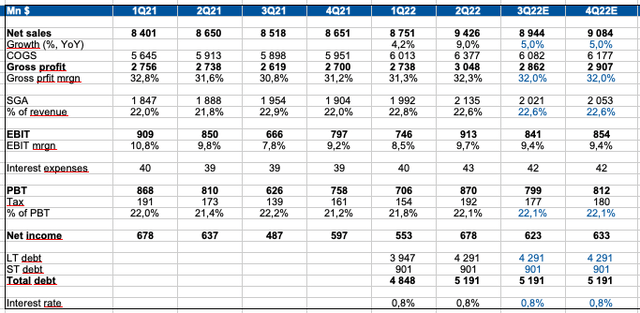

Quarterly:

Personal calculations (Personal calculations)

Yearly:

Personal calculations (Personal calculations)

Valuation

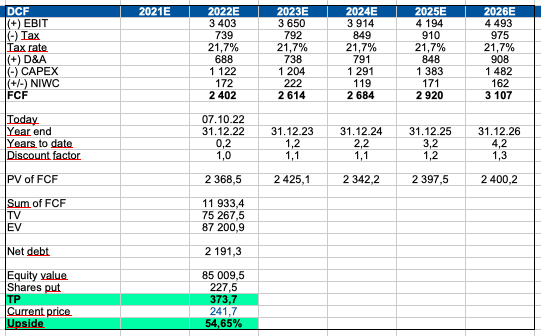

To value companies like Dollar General, I prefer to use the DCF model because the company:

1) Has a stable and predictable cash flow,

2) the company’s management informs the market about plans to open new stores, and

3) we have a sufficient period of historical data on which to make assumptions about future periods.

Main assumptions:

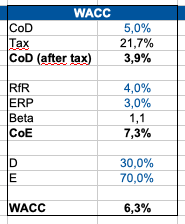

1) WACC: 6.3%

2) Terminal growth rate: 3%

WACC:

Personal calculations (Personal calculations)

DCF model:

Personal calculations (Personal calculations)

Thus, the fair value of the share is $374, upside potential of 55%. According to my calculations, the company is now trading below the fair level. As a result, in my opinion, we have an attractive entry point for opening a position.

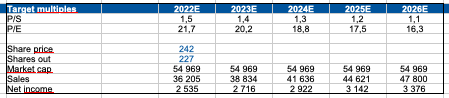

Also, I calculated multiples based on current capitalization and my revenue and net income estimates. As a result, we see that capitalization growth will come on the basis of the company’s strong reporting on growth and profitability and not on the growth of multiples.

I believe that the operating and financial statements for the next periods will serve as a catalyst for the growth in stock price.

Target multiples (based on my projections):

Personal calculations (Personal calculations)

Drivers

Macro

Decrease in macro uncertainty, lower inflation and rising consumer confidence will have a positive impact on same store sales (SSS) and revenue growth in future periods.

Product mix

An effective management approach to managing the product mix in stores will allow the company to both maintain the loyalty of its audience and maintain sales profitability.

Effective cost control

Effective cost management for rent, personnel and product losses should support the company’s operating margin in the following periods.

Risks

Macro pressure on the consumer

Higher inflation and rising cost of living could put pressure on the consumer, which could lead to lower costs in multiline retail.

Rising input costs

Rising costs for goods, as well as for personnel and rent, can put pressure on the operating margin of the business, which will be negatively perceived by the investment community.

Product mix

A change in the product mix in favor of less profitable categories is also a negative factor for investors’ assessment of the company’s prospects and a fair share price level.

Conclusion

I think that Dollar General is an excellent company that is successfully handling the current macro pressure. Firstly, the company continues to show growth in revenue and average check. Secondly, the company is working effectively with suppliers and its own product mix, which has a positive impact on the gross margin. In addition, cost control on SGA (% of revenue) allows the company to demonstrate a strong level of operating profitability during macro uncertainty, which is especially important for investors. According to my calculations, the fair share price is $374 with an upside potential of 55%. At the moment, DG is one of my top picks for 2022.

Be the first to comment