echoevg

Introduction

As an income-oriented investor, I focus on companies that pay out a percentage of their cash flow in the form of dividends. However, it would be a mistake to look only at dividend yield and judge dividend coverage by comparing dividend per share (DPS) to current earnings per share (EPS). Dividend safety is especially critical when dealing with companies whose earnings are dependent on business cycles. The Boeing Company (NYSE:BA) serves as an excellent but unfortunate example. It has been paying a continuous dividend since 1941, but had to suspend its payout in 2020 when it found itself in a perfect storm as the COVID-19 pandemic hit and BA was still licking its wounds after the 737 MAX debacle. Conversely, L3Harris Technologies, Inc. (NYSE:LHX), a similarly traditional industrial company involved in the aviation industry, has also paid a dividend since World War II and continues to do so today.

In this article, I will compare the two companies and discuss why, as a conservative, long-term investor, I look beyond the traditional dividend payout ratio (DPS/EPS) when evaluating the reliability of a company’s dividend payout. However, I understand that most investors do not want to spend a lot of time analyzing financial statements. Therefore, I provide some quick and simple but effective tools to assess dividend reliability and to evaluate management’s prioritization of returning cash to shareholders.

Overview Of Boeing And L3Harris, Their Risks, And Valuations

The Boeing Company

This very well-known industrial is the largest aerospace company in the world. Its size (market capitalization of over $100 billion) and widely recognized products suggest that Boeing is indeed a blue-chip company. The company is engaged in the design and manufacture of commercial aircraft, defense products, and space systems. The company is organized in four segments, namely Boeing Commercial Airplanes (BCA), Boeing Defense, Space & Security (BDS), Boeing Global Services (BGS), and Boeing Capital (BCC).

BCA is engaged in the development, manufacture and marketing of commercial aircraft such as the 737 narrowbody and the 747, 767, 777 and 787 widebodies, and is currently advancing the development of 737 MAX derivatives and the 777X program. Boeing had to ground its 737 MAX in March 2019 after two crashes in 2018 and 2019 due to a design flaw in the model’s maneuvering characteristics augmentation system. In December 2020, the first 737 MAX with its tarnished image took off on its first flight after the debacle. As of the third quarter of 2022, most countries have approved the resumption of 737 MAX operations, with the exception of China and a few others. BCS accounted for 31% of total revenues in 2021, and the segment has been making a significant loss for several years.

On a positive note, 737 deliveries have rebounded strongly since the low point in 2020. The BCS backlog represents 79% of Boeing’s 2021 backlog ($377 billion, 7.3 times 2021 product sales). Of course, given the dynamic nature of the 787 and 737 MAX programs (e.g., delays in new derivatives entering service, further development in the China situation), the BCS backlog is subject to significant uncertainty.

Boeing, like Lockheed Martin (LMT), for example, is a major government contractor. The U.S. Department of Defense is BDS’s largest customer, accounting for 81% of the segment’s revenues in 2021. BDS produces several well-known military aircraft, including the F/A-18E/F Super Hornet, CH-47 Chinook, and AH-64 Apache. BDS accounted for 16% of Boeing’s 2021 backlog. The segment contributed 42% of Boeing’s 2021 revenue, dampening the highly cyclical nature of BCS.

Like many other companies in the industrial sector, Boeing not only sells its products to also benefit from recurring service revenues (BGS segment, 26% of total revenues in 2021), but also leases its aircraft and equipment and offers financing services to customers wishing to purchase Boeing products (BCC segment). In this way, the company is naturally exposed to credit risks. Because Boeing offers its products and services globally, the company’s revenues are sensitive to exchange rate fluctuations, as underscored by the 37% share of the company’s international revenues in 2021.

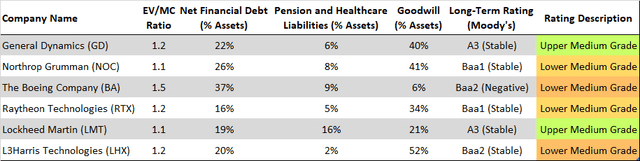

In addition to internal operational risks, Boeing is of course highly exposed to macroeconomic developments, as demonstrated by the COVID-19 pandemic and related government actions. This is one reason why I rely on Lockheed Martin and Raytheon Technologies (RTX) in my own portfolio, appreciating the former’s cycle insensitivity as an almost pure government contractor and the latter’s focus on high-margin service revenues and indirect exposure to commercial aviation (see my recent comparative analysis). Another risk, in addition to the obvious risks associated with litigation, claims for damages, and regulatory issues, is associated with Boeing’s extremely complex supply chain as is very noticeable at the moment. Boeing’s balance sheet is among the worst in the industry, as illustrated, for example, by its high enterprise value (EV) to market capitalization (MC) ratio and net financial debt (including discounted lease obligations) of 37% relative to total assets. As a more positive note, pension plan liabilities were about 9% of total assets, a very low figure compared to the peer group (Table 1, end of this section).

Boeing is clearly in the midst of a perfect storm, and I believe that the company’s key risks are currently very visible. As a result, the stock is rather cheap according to Morningstar (Table 2, end of section). However, it is understandable that Boeing is subject to considerable uncertainty as a turnaround investment, as the company is currently fighting windmills. In addition, intense competition from foreign competitor Airbus SE (OTCPK:EADSF, OTCPK:EADSY) should be factored into the equation. In this context, I welcome the positioning of Raytheon Technologies, which benefits from both Boeing and Airbus aircraft production through its Pratt & Whitney subsidiary.

L3Harris Technologies Inc.

Due to its comparatively small size (market capitalization of only about $43 billion), L3Harris is not as well-known as other defense companies. It is heavily dependent on defense spending by Western governments, with all the advantages and caveats, and its main customers are the U.S. Department of Defense, but also international entities such as the U.K. Ministry of Defense and the Royal Australian Air Force. L3Harris is the successor to Harris Corp. following its merger with L3 Technologies in 2019, and since 2022 the company has had three reportable segments – Integrated Mission Systems (IMS), Space & Airborne Systems (SAS)) and Communication Systems (CS). The businesses of the former fourth segment – Aviation Systems – have been integrated into the other segments.

IMS comprises the company’s involvement in intelligence, surveillance and reconnaissance, as well as communication systems for maritime platforms and electro-optical and infrared products. Through the SAS segment, L3Harris is active in cyber defense and tracking equipment, avionics and electronic warfare. L3Harris develops and manufactures sensors for satellite navigation, weather- and missile defense. The company’s CS segment develops and produces tactical communications systems, security radios, as well as global communications solutions. Profitability of the three segments has been very stable during the COVID-19 pandemic, with the understandable exception of the Aviation Systems segment, which is no longer reported (2020 and 2021 operating margins of -5% and 12%, respectively). CS is L3 Harris’ most profitable segment, with an operating margin of around 25%, while SAS and IMS had 2021 margins of 19% and 16%, respectively.

LHX generated about a quarter of its 2021 revenue from services, while three-quarters came from product sales. The company is more U.S.-focused than Boeing, which is understandable given its defense focus, and generated 78% of its 2021 revenue domestically. The company’s backlog at the end of 2021 was $21.1 billion, significantly lower than Boeing’s in both absolute and relative terms. In contrast to Boeing, L3Harris expects to convert about 50% of its backlog into revenue by 2022. The company is more flexible and enters into shorter-term contracts with its customers, largely due to the nature of the products it designs and manufactures. As a result, it is better protected against cost overruns that can occur in fixed-price long-term contracts. That said, it is nonetheless important to remember that 74% of LHX’s revenue in 2021 came from fixed-price contracts.

LHX is also less capital intensive than Boeing. This is evidenced by the fact that depreciation and amortization as a percentage of total revenue is much lower at LHX (1.8%) than at Boeing (3.7%). Note that due to the merger of L3 Technologies and Harris Corp. in mid-2019, I used two-year (2020-2021) averages for comparability. The ratio of total assets to total revenue also confirms Boeing’s pronounced capital intensity (242% vs. 199% for LHX). Accounting for goodwill, as most of L3Harris’ goodwill was recorded in connection with the merger ($18.1 billion at the end of 2021), the gap between the two companies in terms of capital intensity widens further: 229% versus 96%.

In terms of risks, L3Harris is more dependent on the defense budgets of Western world governments. Of course, in contrast to Lockheed Martin, which is highly dependent on the F-35 program, LHX is not suffering from such a concentration risk. At least in the short term, however, the dependency on defense spending should be seen more as a tailwind, as budgets are unlikely to be cut in light of the ongoing conflict in Ukraine and the likely permanent deterioration of relations with Russia. Compared to Boeing, LHX’s balance sheet is much more robust (Table 1). While the company is certainly more agile due to its smaller size and the nature of the products it develops and manufactures, it might conversely be in a weaker bargaining position and have weaker economies of scale. Due to its long-standing relationship with the U.S. government and its proven track record, I doubt that L3Harris’ bargaining position is at risk and its products and technologies are unlikely to be replaced by those of a cheaper competitor. The barriers of entering the defense sector are particularly high, considering the typically classified and mission-critical projects. LHX’s dependency on high-tech components make it sensitive to supply-side pressure, as is currently the case and I believe this is one reason for the reasonable valuation. However, considering the mission-critical nature of many of its products, the company maintains relationships with dependable suppliers for the most part.

Considering that L3Harris is relatively insensitive to business cycles, I view the company as a fairly favorable pick valuation-wise (Table 2). I suspect that the relative discount to LMT, RTX, etc. is due to the lower coverage of this smaller company, the lower rating, and of course the current issues discussed in the Q3 2022 investor letter. However, unlike Boeing, L3Harris has no major issues at this time, and the current headwinds should be viewed on the supply side rather than the demand side – also considering that L3Harris is a significant government contractor. I am considering adding LHX to my defense portfolio as an ancillary position, appreciating its status as a broadly diversified provider of high-tech equipment, its conservatively managed balance sheet, and its shareholder-friendly management.

Table 1: Selected financial metrics and long-term debt ratings of several aerospace and defense companies (own work, based on the companies’ 2021 10-Ks, the stocks’ share prices as of November 25, 2022 and data from Moody’s) Table 2: Business quality and valuation metrics of several aerospace and defense companies; Q denotes that the data was obtained using a computational model, i.e., not by an analyst (own work, based on the companies’ 2021 10-Ks, the stocks’ share prices as of November 25, 2022 and data from Moody’s and Morningstar)

Why The Conventional Dividend Payout Ratio Can Be Responsible For False Hopes

In the second part of this article, I will explain why it is worth looking beyond the conventional dividend payout ratio when assessing a company’s dividend safety and its ability to continue to grow its payout to shareholders.

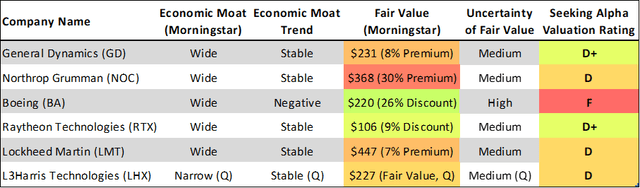

Boeing paid its first dividend in 1937 and began paying a steady and mostly growing dividend in 1942. It was not until 2020 that Boeing finally had to suspend its dividend, largely because of the 737 MAX disaster and the COVID-19 pandemic. The company is a good example of why investors should not rely on a company’s seemingly secure status as a dividend king or aristocrat. L3Harris Technologies (formerly Harris Corp.) has paid cash dividends every year since 1941 and continues to pay a dividend also in 2022. Its track record in recent years appears somewhat spotty (Figure 1), but the apparent dividend cut in 2000 was due to the spinoff of Lanier Worldwide in November 1999 (p. 16, fiscal 2000 10-K). The company has increased its dividend every year since 2002 at a compound annual growth rate (CAGR) of more than 20%.

Figure 1: L3Harris Technologies’ (formerly Harris Corporation) dividend track record since 1998 (own work, based on the company’s 10-Ks and data published by Nasdaq, Inc.)

Don’t Let Adjusted And GAAP Earnings Mislead You

The earnings of companies with operating problems are often burdened by restructuring and impairment charges, which management typically does not take into account when reporting non-GAAP earnings. While the former are often cash charges, the latter are non-cash expenses. As long as such charges are reported infrequently, they are not problematic and it is acceptable to rely on adjusted earnings. However, if a company routinely reports restructuring charges, thereby adjusting its (non-GAAP) earnings for these costs, actual cash earnings may be significantly lower than reported due to higher associated cash flows from investing (capital expenditures, acquisitions). Similarly, recurring goodwill and/or other intangible asset impairments suggest that management could be trying to mask a lack of organic growth with desperate acquisitions for which it paid too much or that did not result in expected operating performance.

In this context, the FAST Graphs website allows for a quick comparison of adjusted (reported) EPS with GAAP earnings per share. Of course, those who do not wish to subscribe to the FAST Graphs service can obtain similar results by retrieving data from other investment websites and comparing them in a spreadsheet. Figure 2 shows LHX’s FAST Graphs chart using adjusted and unadjusted earnings per share, highlighting some recurring charges that warrant further investigation. In fiscal 2009, the company reported a $256 million impairment of goodwill and other long-lived assets in its Broadcast Communications segment due to “the global recession and postponement of capital projects which significantly weakened demand, and the general decline of peer company valuations impacting [Harris’] valuation.” The difference between adjusted and unadjusted results in fiscal 2012 and 2013 was due to divestitures (Cyber Integrated Solutions and Broadcast Communications) and related impairment charges. Fiscal 2015 and 2016 were also impacted by impairments, largely attributable to the Harris CapRock Communications business.

Finally, in 2020 and 2021, the company had to recognize impairments largely due to the pandemic-related downturn in the commercial aviation market and its impact on LHX’s customers, but also assets related to the company’s Combat Propulsion Systems business and others related to its Commercial Training Solutions reporting unit.

Figure 2: FAST Graphs chart for L3Harris Technologies [LHX] – adjusted operating earnings (top) versus diluted earnings (bottom) (with permission from www.fastgraphs.com)![L3Harris Technologies [LHX] – adjusted operating earnings (top) versus diluted earnings](https://static.seekingalpha.com/uploads/2022/11/29/49694823-16697100357064703.png)

Boeing also reported impairment and restructuring charges in the past, but they were not as significant as for LHX, so the two FAST Graphs charts do not differ significantly (Figure 3). However, unlike LHX, Boeing’s cyclicality is much more noticeable in the charts. Of course, an investor who does not want to subscribe to FAST Graphs or spend a lot of time analyzing financial statements could simply open the company’s 2008 annual report, as the multi-year comparisons in the income statement and cash flow statement give an easy-to-grasp impression of the company’s cyclicality.

Figure 3: FAST Graphs charts for The Boeing Company [BA] – adjusted operating earnings (top) versus diluted earnings (bottom) (with permission from www.fastgraphs.com)![Boeing [BA] – adjusted operating earnings versus diluted earnings](https://static.seekingalpha.com/uploads/2022/11/29/49694823-16697100739746048.png)

Of course, I am not suggesting that L3Harris Technologies is a company in distress because of the impairment charges mentioned above. However, the company’s recent history serves as a vivid example of why investors should look beyond reported earnings and try to understand the nature of the extraordinary charges.

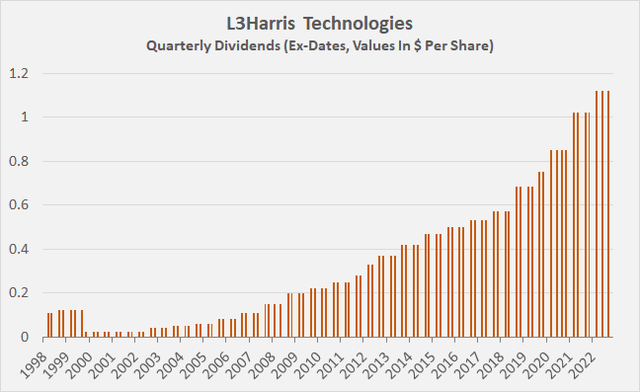

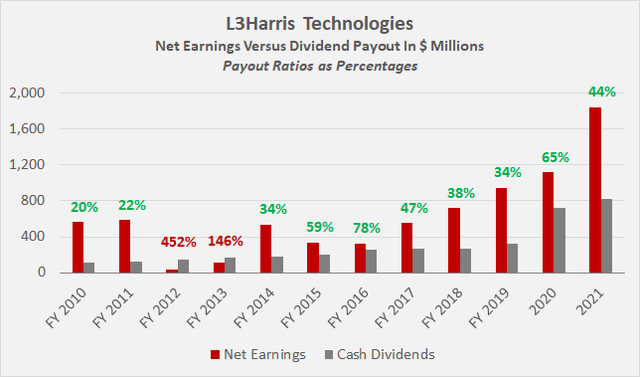

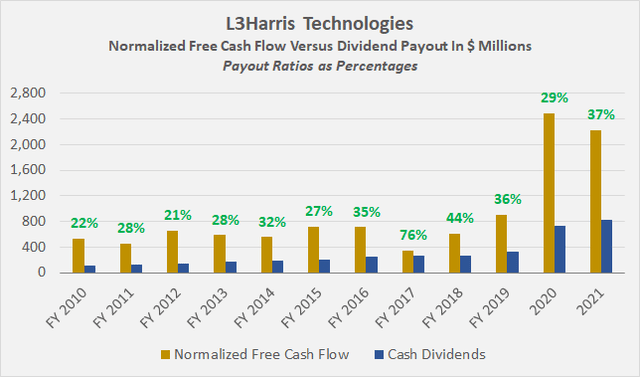

In summary, it pays to compare adjusted earnings to GAAP earnings when assessing a company’s dividend safety and the likelihood and magnitude of future increases. While investors who look only at dividend payout ratio as a percentage of adjusted earnings can be in for negative surprises, the opposite can also be true. The example of L3Harris Technologies shows that GAAP and adjusted earnings differed significantly in several years, but the impairments had no impact on the dividend (Figure 4). In fact, the company has grown its dividend at a CAGR of over 20% over the last twenty years. An investor who refrained from investing in LHX in fiscal 2012 or 2013, when the company appeared to be failing to cover its dividend, would have missed out on a great opportunity – capital gains of over 470% and a yield on cost of over 9%.

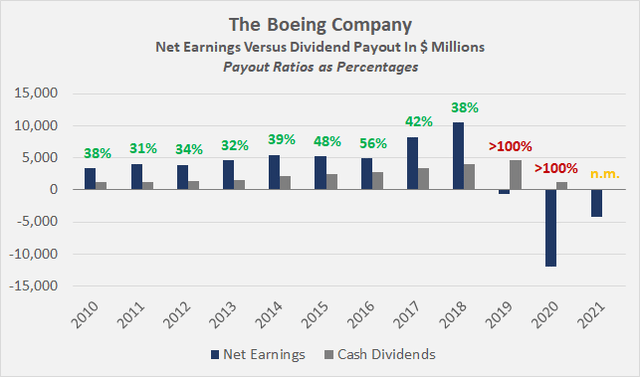

Finally, a low payout ratio should be targeted, as it leaves more room for future growth and serves as a buffer in troubled times. This is especially true for cyclical companies like Boeing (Figure 5). While the suspension of the dividend was understandable due to the double whammy of the 737 MAX disaster and the COVID-19 pandemic, I still would have liked to see more conservative management in terms of share buybacks and maintaining a solid balance sheet.

Figure 4: L3Harris Technologies’ net earnings, cash dividends and payout ratios; note that the company changed its fiscal year end effective 2020 due to the merger with L3 Technologies (own work, based on the company’s fiscal 2010 to 2021 10-Ks)

Figure 5: Boeing’s net earnings, cash dividends and payout ratios (own work, based on the company’s 2010 to 2021 10-Ks)

Assessing Dividend Safety Through Free Cash Flow

My regular readers are accustomed to my emphasis on the cash flow statement when analyzing a company. I firmly believe that cash flows, unlike earnings, are much harder to manipulate and the cash flow statement provides a much clearer view of a company’s cash generating power.

I typically normalize free cash flow (FCF) in terms of working capital movements, recurring impairments and other items (see my detailed article). Comparing the resulting free cash flow numbers to cash dividends (and share repurchases, if desired) provides an easy-to-understand approach to evaluating a company’s true ability to pay dividends.

However, I understand that sometimes investors do not want to spend a lot of time analyzing financial statements. In many cases, working capital movements even out over the long term, so a much simpler approach can be taken. Of course, such an approach carries the risk of overlooking potentially important cash flow items, but it certainly serves as a good estimate.

A rough estimate of the company’s cumulative FCF can be obtained by summing the operating cash flow (OCF) and capital expenditures (with a negative sign) over a sufficiently long period (e.g., ten years). Dividends paid to shareholders – a separate item in the cash flow statement – are summed over the same period and related to the cumulative FCF. Of course, such simple data can also be obtained from financial websites and inserted into a spreadsheet with the click of a mouse. The ratio of accumulated dividends to accumulated FCF represents a long-term average cash payout ratio. A value of 100% or more, of course, means that the company has certainly not been able to fund its dividend from actual FCF. In such a case, a more detailed investigation is warranted because the company may have generated unexpected cash flows from the sale of assets that were returned to shareholders through dividends, or the company is suffering from operational problems and has used debt to pay out to its shareholders.

Looking at the two examples at hand, Boeing’s long-term average payout ratio (2012 to 2021) was 73%, significantly higher than L3Harris Technologies’ (32%). Over the period from 2012 to 2019 – before the 737 MAX disaster and the pandemic – the ratio is much more comfortable at 41%, but was still significantly lower for LHX (26%).

Of course, an investor who does not want to create a multi-year or decade-long history of a company’s free cash flow and dividend payments could simply compare FCF generated in difficult times (e.g., 2009 or 2020) with dividend payouts over the same period. Since dividend payments represent financing cash flow, they are also reported in the cash flow statement – an investor would not need to look any further.

Using Share Repurchases To Assess Management Prudence

Especially when analyzing cyclical companies, conservative investors should also include share buybacks in their considerations. Of course, the argument that buying back shares with cheap debt in the low interest rate environment after the Great Financial Crisis (GFC) was not a bad idea is not entirely unfounded. However, there is a fine line between enhancing shareholder returns through opportunistic share repurchases and what I consider financial engineering with the primary purpose of increasing earnings per share. In this context, a look at the company’s executive compensation scheme can do wonders. Clearly, a company with per-share-based performance targets that buys back shares en masse should be critically examined for its actual organic growth potential.

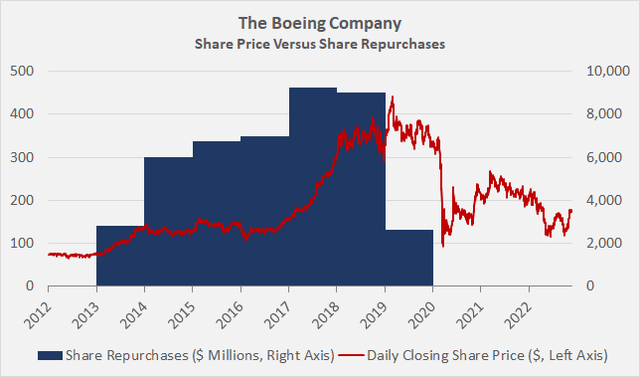

As for the two examples at hand, Boeing spent 121% of its cumulative FCF on dividends and share repurchases between 2012 and 2019. This is particularly unfortunate for shareholders because management spent a significant amount of cash on share repurchases when BA stock was relatively expensive (Figure 6, compare to Boeing’s FAST Graphs chart in Figure 3). Of course, it is easy to judge with the benefit of hindsight, but putting myself in the shoes of a Boeing shareholder, I would have preferred somewhat more conservative balance sheet management with stronger reserves and less emphasis on share buybacks. After all, the company is very cyclical.

In contrast, LHX’s management has spent only 79% of cumulative FCF from fiscal 2012 to fiscal 2019 on dividends and share repurchases. However, it seems worth noting that L3Harris has placed an increasing emphasis on buybacks since the merger, as the ratio rose to 115% of cumulative FCF when 2020 and 2021 data are included. As a side note, the company changed its fiscal year end to calendar year after the merger. I therefore refer to fiscal years when discussing the pre-merger period.

Figure 6: Share price of BA versus share repurchases (own work, based on the company’s 2012 to 2021 10-Ks, the 2022 third-quarter 10-Q and the daily closing share price of BA stock)

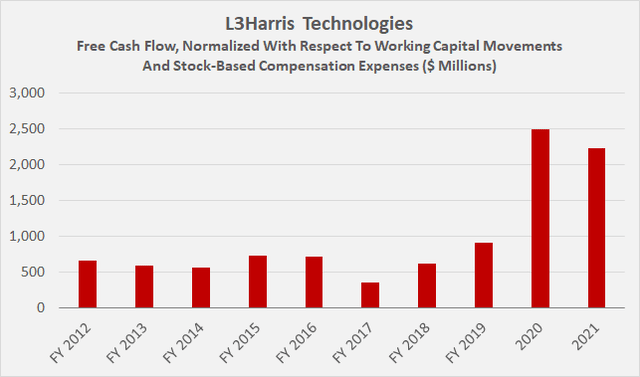

The fact that L3Harris management has increased its focus on share buybacks since the merger in 2019 alarms me as a conservative investor. However, a closer look at the company’s free cash flow profile (Figure 7) suggests that the company’s ability to generate cash flow has increased proportionately since the transaction, and the relatively low cyclicality and increasing focus on defense contracts are also reassuring.

Figure 7: L3Harris Technologies’ normalized free cash flow (own work, based on the company’s fiscal 2012 to 2021 10-Ks)

In connection with potentially too generous share buybacks, another “quick-and-dirty” safety assessment is worth mentioning. As a company grows, it is only natural that its debt will also increase. There is nothing wrong with using a certain amount of debt to finance operations, as long as the debt remains proportionate. Of course, companies that are sensitive to economic cycles should be careful not to take on too much debt, as the debt burden could become unsustainable in a rising interest rate environment. I therefore like to compare a company’s sales growth to its net debt growth.

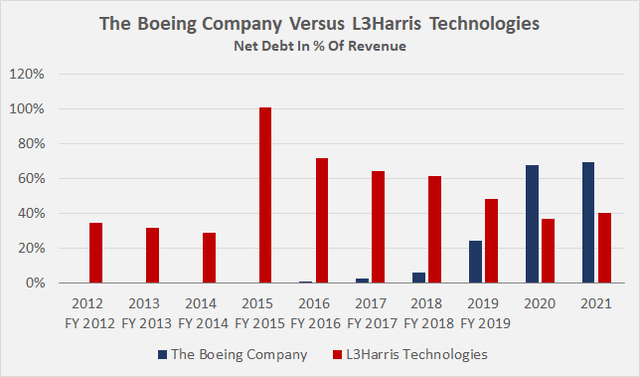

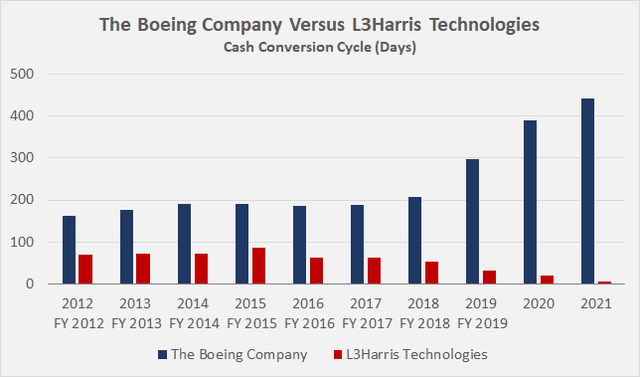

L3Harris’ leverage does not appear to be of undue concern, as net debt (including discounted lease obligations) grew at a similar CAGR to sales (about 15% since fiscal 2012). In contrast, Boeing’s revenue has actually declined since 2012, while net debt grew to nearly $19 billion before the 737 MAX disaster and pandemic, from a net cash position of about $2 billion in 2012. By the end of 2021, the company’s net debt was a staggering $43 billion. This readily apparent discrepancy was evident years ago and certainly set alarm bells ringing among conservative investors (Figure 8). Clearly, Boeing has been growing its earnings per share in an unsustainable manner via share buybacks, and has likely been masking its lackluster operating performance by leveraging its balance sheet. The company’s weakening operating performance is evident, among other things, by its steadily increasing cash conversion cycle (CCC, Figure 9). In contrast, L3Harris’ agility is underscored by its superior and continuously improving working capital management, as evidenced by the decline in the CCC.

Like Boeing, L3Harris has leveraged its balance sheet considerably in the past, and one could argue that the company’s management has been at least as aggressive in terms of buybacks. In contrast, however, it should be remembered that L3Harris is less capital intensive, less cyclical, and a more agile company that is less dependent on long-term fixed-price contracts and can therefore handle higher leverage. Of course, as an investor in LHX in 2015, I would have definitely taken note of the significant increase in net debt (Figure 8). However, a quick look at page 2 and following of the company’s fiscal 2015 10-K shows that just before the end of the fiscal year, Harris Corp. acquired Exelis, a global aerospace, defense, information and services company. The acquired company generated $3.3 billion of sales in 2014, but due to the timing of the acquisition, only a fraction of that was reflected in Harris Corporation’s fiscal 2015 income statement.

Figure 8: Net Debt in percent of revenue for BA and LHX (own work, based on the companies’ 2012 and fiscal 2012 to 2021 10-Ks, respectively) Figure 9: Cash conversion cycles of BA and LHX (own work, based on company-specific data by Morningstar)

Investors who do not want to go to the trouble of charting a company’s long-term debt and earnings profile can, as before, simply compare the net debt-to-revenue ratio from ten years ago with the ratio from the last fiscal year – a significant increase should be examined more closely. Likewise, the magnitude of a company’s reliance on debt during troubled times can also be very telling.

Of course, this quick-and-dirty approach is not applicable to companies that have changed their operating model over the years. One such example, which I discussed in depth in a recent article, is The Coca-Cola Company (KO). Sales declined over the years, but operating and free cash flow margins improved dramatically due to increased subcontracting of its bottling. To spot such exceptions to the rule, investors should take a quick look at the non-GAAP operating and (if available) free cash flow margins for the years under consideration.

Quick Assessment Of The Importance Of Dividend Growth For Management – The 5/10 And 5/20 Ratios

The knowledge that a company can demonstrate dividend growth that exceeds the GFC is in itself very reassuring. However, as long-term investors, we need to focus on the best companies that have a high likelihood of growing their dividends at rates that provide investors with inherent inflation protection (see my article on this topic).

In our example, LHX serves as a prime example of a solid dividend growth stock. The company has grown its dividend at a CAGR of over 20% since 2002. However, with such a growth rate, the question is whether the generous dividend increases can continue? With low cyclicality, strong working capital management, diverse operations, and last but not least, an obviously shareholder-friendly management team, several criteria are already met. The dividend payout ratio as shown in Figure 4 (see above) looks very reasonable but more importantly, LHX’s payout is also rather conservative in terms of normalized free cash flow (Figure 10). I think LHX’s post-pandemic performance is very solid. Of course, the company is not completely immune to supply chain disruptions and recently lowered its 2022 free cash flow guidance to $2 billion. In addition to ongoing supply chain issues, the timing of a Mideast aircraft missionization program and the strong dollar were also factors. Nevertheless, taken together, I believe the company’s free cash flow is strong enough to justify future increases and also management “remains focused on paying a competitive dividend rate” (p. 15, Q3 2022 investor letter).

Figure 10: L3Harris Technologies’ normalized free cash flow, cash dividends and payout ratios; note that the company changed its fiscal year end effective 2020 due to the merger with L3 Technologies (own work, based on the company’s fiscal 2008 to 2021 10-Ks)

In addition to checking the ability to further increase dividends against historical normalized FCF, calculating the 5/10 and 5/20 ratios can help to get a quick picture. A company whose prospects are deteriorating or which is facing operational problems is usually not in a position to continue to grow its dividend rapidly. At some point, rating agencies and creditors get involved, and the company could even find itself in a position of violating important debt covenants. However, investors do not have to enter a company’s entire dividend history into a spreadsheet. By noting the current dividend and relating it to dividends paid five, ten, and twenty years ago, the 5/10 and 5/20 CAGR ratios (Equation 1) can be calculated by dividing the five-year CAGR by the ten- and twenty-year CAGRs, respectively.

Equation 1: Formula to calculate the compound annual grow rate of a dividend.

For LHX, the 5/10 ratio is 1.24 and the 5/20 ratio is 0.96. A ratio above 1 means that dividend growth has accelerated in recent years, while a ratio below 1 signals a slowdown. However, at 0.96, the 5/20 ratio is still very close to 1, signaling that management continues to place an emphasis on substantial dividend growth. In this context, I would not overinterpret LHX’s latest increase of “only” 10%, especially since the previous year’s increase was as high as 20%.

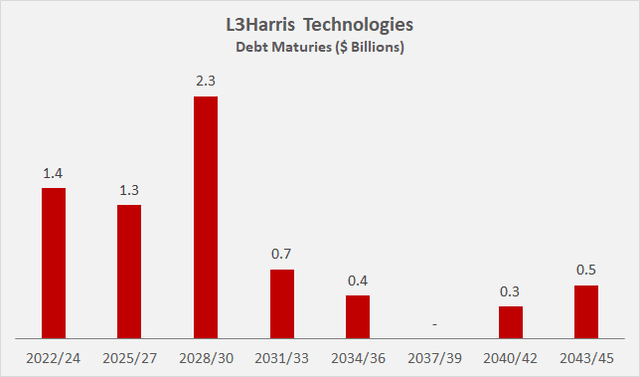

In addition to these considerations, enterprising investors should also consider the company’s debt maturity profile. In a rising interest rate environment, debt service costs increase as debt matures and refinancing is required at less favorable rates. This can negatively impact a company’s ability to grow its dividend. Obviously, the more a company’s debt profile is geared toward later years, the better. Page 93 of LHX’s 2021 10-K summarizes the company’s long-term debt, which I have parsed into the bar chart shown in Figure 11. Accordingly, and taking into account the company’s free cash flow and operational characteristics, the debt profile is of little concern, and I do not consider LHX to be overly vulnerable to higher interest rates. Therefore, and taking into account the weighted average interest rate of approximately 4.0%, it seems logical to conclude that LHX has the ability to grow its dividend from this perspective as well.

Figure 11: LHX’s debt maturity profile as of December 31, 2021 (own work, based on the company’s 2021 10-K)

Key Takeaways

Relating dividends to earnings per share or adjusted earnings per share can lead to nasty surprises for investors. Adjusted earnings are sometimes too optimistic, especially if a company has ongoing operational problems. Conversely, GAAP earnings can be too conservative in assessing dividend safety, as the example of Harris Corporation in fiscal 2012 and 2013 shows. A look at the cash flow statement provides a much clearer view of the situation. Personally, I would rather spend one minute on a cash flow statement than ten minutes on an income statement.

Investors who are not interested in spending a lot of time normalizing cash flows can simply calculate the cumulative free cash flow from a freely available data source and relate the result to the cumulative dividend payout, which gives a good idea of management’s behavior with respect to the dividend. Consideration of share buybacks may also reveal potential financial engineering, especially if the company’s compensation structure is designed accordingly.

Putting current net debt in relation to revenue and comparing the result to the same data from a few years ago can also point to problematic developments. An even quicker way to assess a company’s dividend safety is to look at cash flow during difficult times, such as during the Great Financial Crisis or the COVID-19 pandemic, and relating it to dividend payout. While no one can determine with certainty the future ability of a company to increase its dividend, a conservative ratio of dividends to normalized free cash flow is a good first indicator. By comparing short- and long-term dividend growth rates, investors can quickly get an idea of a company’s dividend growth trend (i.e., the 5/10 and 5/20 ratios).

Of the two companies analyzed in this article, I think L3Harris Technologies is the better investment because the company is more agile, less dependent on long-term fixed-price contracts, and less capital-intensive than Boeing, which is currently fighting windmills. The company is still licking its wounds from the pandemic and the 737 MAX disaster, facing an extraordinarily high debt mountain and operational challenges. I would not go so far as to call the stock a value trap, but I dislike investing in a cyclical company that faces major challenges on multiple fronts, in particular when the world is headed for a recession.

L3Harris is not what I would call deep value, but the stock is cheap enough to warrant dipping a toe in the water. It should not be forgotten that there is still no clear view of the company’s baseline operating performance, because of the ongoing macroeconomic challenges since the formation of L3Harris in 2019. As a result, investing in L3Harris Technologies is subject to significant uncertainty. Nevertheless, management is communicating near-term challenges in a transparent manner, and the company has the balance sheet quality to weather the current environment. I have the stock on my watch list and could see myself opening a small initial position at the current level.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to read from you in the comments section below.

Be the first to comment