Torsten Asmus

(This article was co-produced with Hoya Capital Real Estate.)

In a recent article, I featured Vanguard Total International Stock ETF (VXUS), a proxy for the total investable foreign market.

In recommending that investors hold some portion of their portfolio in foreign stocks, I cautioned against falling victim to recency bias, which has been defined as “the unfounded conviction that recent trends will continue into the near-term future.”

In the comments section of the article, some readers agreed with my analysis and others didn’t. No surprise there. However, what did surprise me was that a common argument against my recommendation fell back on the very same trap I had so clearly identified in the article; that of recency bias. Some version of “You dummy, can’t you see that international stocks have performed horribly for x number of years?”

As it happens, that was the precise point of the article. Specifically, that recent historical underperformance can lead to the possibility of future outperformance.

Whatever you think of that debate, here’s another question. What about international bonds? Do these deserve any place in your portfolio?

Why Should I Consider International Bonds?

This is a most interesting question. At first glance, it would seem easy to dismiss these when constructing one’s portfolio. You’ve probably heard or read of certain countries actually floating bonds with negative interest rates, although this is starting to change as other countries face the same inflation challenges we are experiencing here in the US. Further, investing in foreign bonds might intuitively feel more risky than ‘staying local.’ After all, certain countries may have a higher level of political risk. And then there is the whole question of different currencies, and how they move relative to one another.

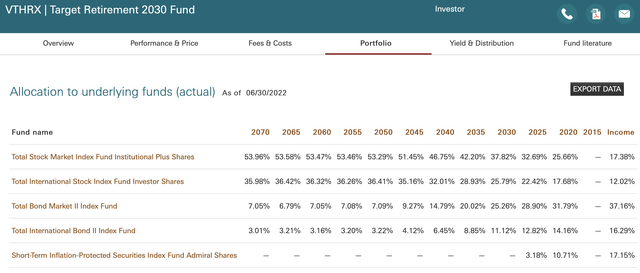

And yet, take a look at something interesting, from the webpage for the Vanguard Target Retirement 2030 Fund (VTHRX).

Components – Vanguard Target Retirement Funds (Vanguard)

Look at the second component from the bottom. That’s right. Vanguard, in their professionally-managed target retirement funds, includes an allocation of between 3.01% and 14.16% in an index fund specifically dedicated to international bonds!

Given what we have discussed above, why would the professionals do this?

In a word; diversification.

Harry Markowitz, a Nobel laureate economist and the father of modern portfolio theory, called diversification “the only free lunch in finance” for its potential to reduce risk without sacrificing returns.

As it happens, research has tended to demonstrate that, for a dollar-based investor, hedging foreign currency exposure on lower-yielding global bonds may potentially result in higher yields than U.S. Treasuries.

In other words, while in isolation a given foreign market might appear riskier or more volatile than the U.S., an investment that includes multiple markets can actually benefit from the imperfect correlations between these markets and actually lessen overall portfolio risk.

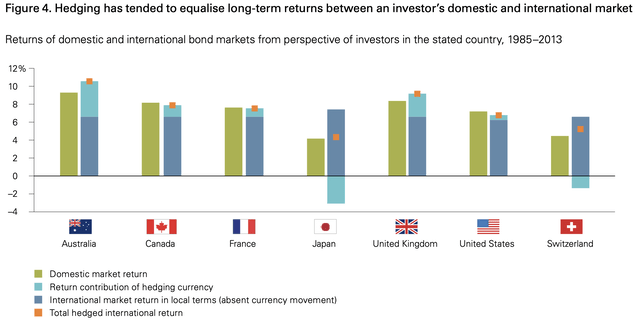

From a recent Vanguard research report, here is a graphic that helps to understand this.

Hedging and Foreign Bond Returns (Vanguard Research)

While that graphic is from a report primarily aimed at Australian investors, note that the concept basically holds true in the column related to the United States.

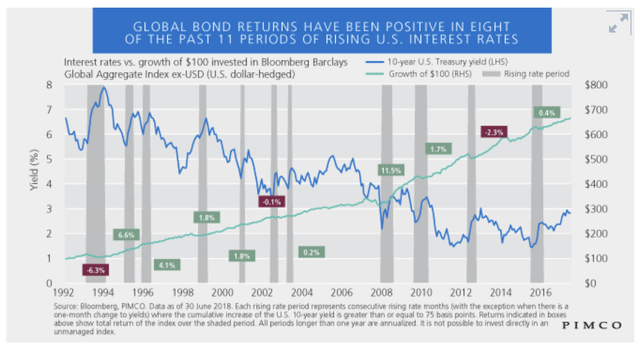

To close this section, one more interesting graphic from PIMCO, discussing what they refer to as “the global bond paradox.”

Global Bond Returns Amidst Rising U.S. Interest Rates (PIMCO)

Here’s the basic idea. Over long periods of time, the research appears to show that, when currency-hedged, the long-term returns from global and U.S. bonds end up being very similar. However, the overall volatility of such returns is reduced.

With that in mind, let’s dive in and take a look at the featured ETF for this particular article, the Vanguard Total International Bond ETF (NASDAQ:BNDX).

Vanguard Total International Bond ETF – Digging In

When it comes to any bond fund in which one chooses to invest, minimizing expenses is key. This is no different when it comes to international bonds.

As it turns out, Vanguard offers a wonderful ETF to assist in this endeavor; the Vanguard Total International Bond ETF.

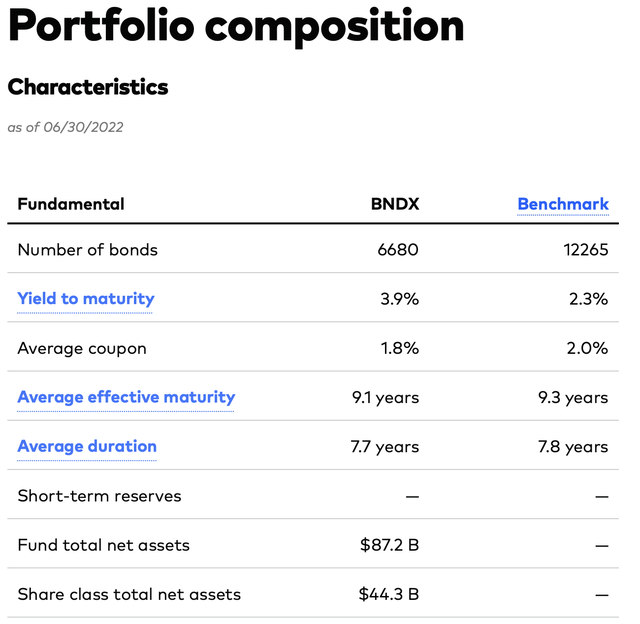

BNDX has an inception date of May 31, 2013, so has been around just a shade over 9 years. It tracks – and get ready because this is quite a mouthful – the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). As of June 30, 2022, it has a whopping $44.3 billion in total assets. As some idea of how the rate at which BNDX has been amassing assets, when I last wrote about this ETF in August, 2018, that value was a “mere” $11.277 billion.

Some more good news for investors. As of February 25, 2022, Vanguard dropped BNDX’s expense ratio to .07%. Again, as of 6/30/22, there were some 6,680 bonds in the fund.

In the previous section, I discussed the benefits of hedging foreign currency exposure. Here is the wording as presented in the summary prospectus for BNDX.

The Fund will attempt to hedge its foreign currency exposure, primarily through the use of foreign currency exchange forward contracts, in order to correlate to the returns of the Index, which is U.S. dollar hedged. Such hedging is intended to minimize the currency risk associated with investment in bonds denominated in currencies other than the U.S. dollar.

Put succinctly, Vanguard is attempting to, as closely as possible, give you the actual return from those foreign bonds in U.S. dollars.

Again, in the previous section, I featured the benefits of diversification when it comes to including international bonds in your portfolio. And it is here that BNDX delivers!

Let’s take a look at some of the details in the next 4 graphics, all from Vanguard’s BNDX webpage.

First, a high-level look at overall portfolio composition.

BNDX – Portfolio Characteristics (Vanguard)

Just one comment here. As BNDX includes a full range of maturities in its stable of international bonds, from very short-term all the way out to over 25 years, its average duration is 7.7 years.

As a reference point, its US-focused sibling, Vanguard Total Bond Market ETF (BND), has a duration of 6.7 years. So, overall volatility of the two funds is relatively close, but BNDX is slightly higher.

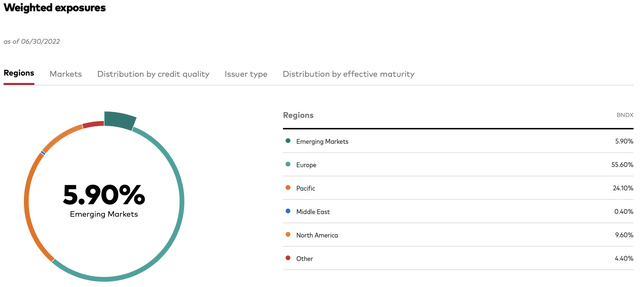

Next, a look at geographical exposure.

BNDX – Geographic Exposure (Vanguard)

As it happens, the single largest geographic exposure is in Japan, at 16.6% of the fund. Once you get past that, however, by far the bulk of the remaining exposure is in Europe. Most of the North America exposure is in Canada.

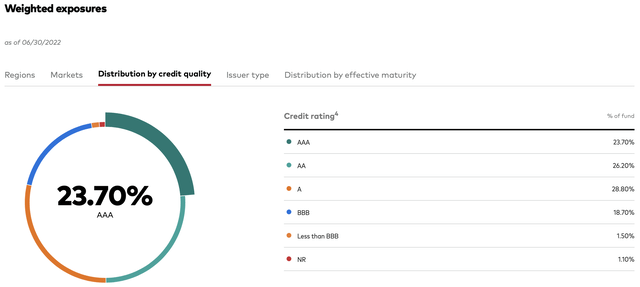

Next, we move to credit quality.

BNDX – Credit Quality Distribution (Vanguard)

Just a little more color around those numbers. While BNDX includes government, government-related, corporate, and securitized bonds, according to Morningstar, as of June 2021, government bonds accounted for 65% of the fund’s assets, with bonds issued by Japan, the eurozone, and Great Britain accounting for 50% of the fund’s assets.

In terms of quality, this is offset somewhat by the roughly 20% of the fund that is in BBB-rated or lower bonds.

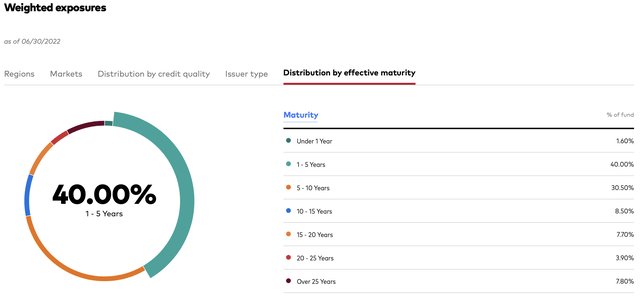

Finally, the effective maturity distribution.

BNDX – Effective Maturity Distribution (Vanguard)

This adds just a little more detail to the overall duration of 7.7 years listed in the first graphic.

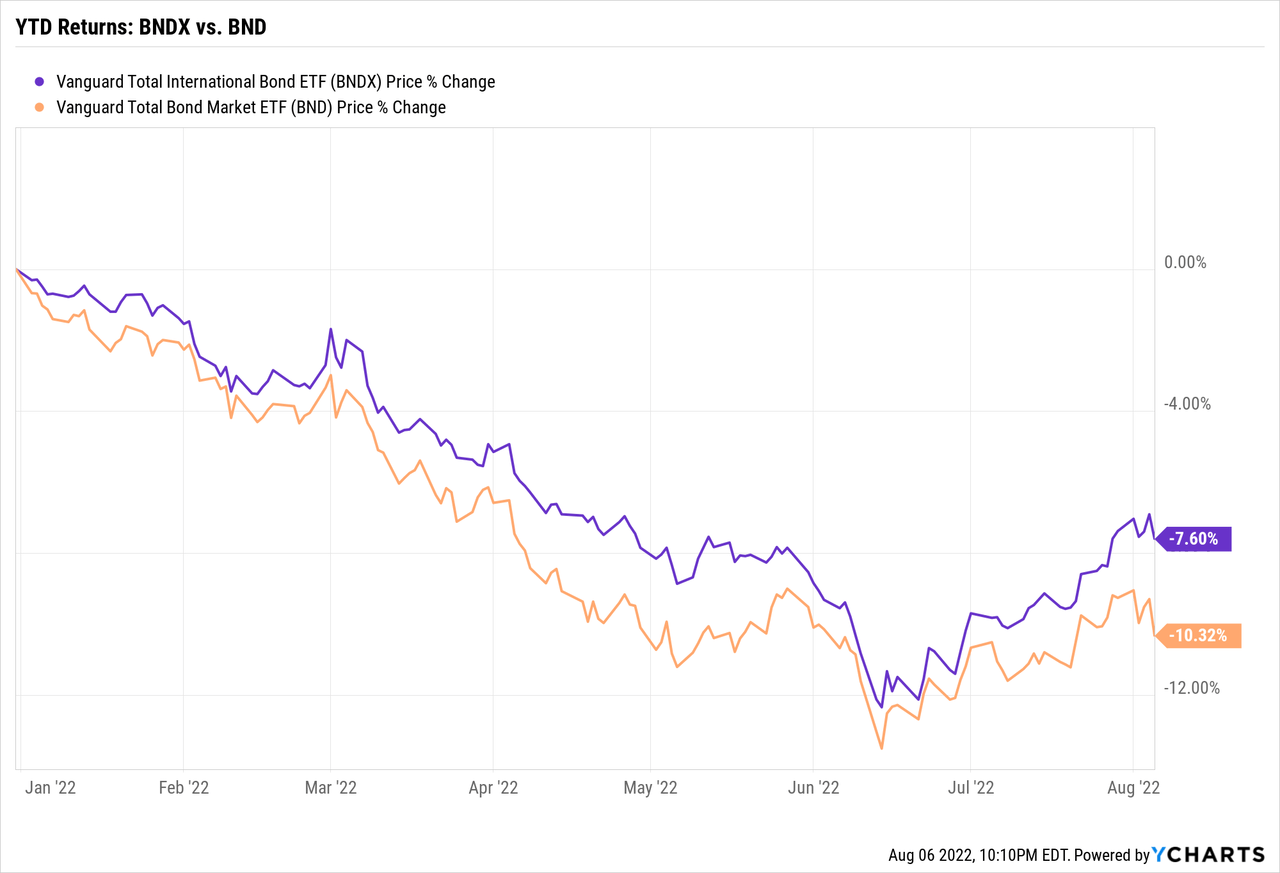

Finally, a quick look at performance.

Interestingly, as featured in the discussion on diversification in our opening section, something happens here that might seem counterintuitive. We mentioned at the outset that one might take a quick look at the yield offered by BNDX and perhaps think of dismissing it. And yet, during this tumultuous year of 2022, it has actually held up quite well against its U.S. counterpart.

Summary and Conclusion

In this article, I hope I have given you something to think about.

As featured, professional investment managers such as Vanguard include an allocation to international bonds in their target-date retirement offerings. Why? Because their research appears to show the benefits of adding such diversification; over the long term achieving results competitive with sticking purely to domestic bonds, while possibly lessening volatility along the way.

If after examining this information, you would like to do similar in terms of your self-managed investments, BNDX makes an excellent tool with which to do so.

Be the first to comment