DNY59

Sage Therapeutics, Inc. (NASDAQ:SAGE) is a large ($2.4 billion market cap) biopharmaceutical with research and development efforts focused on modulation of GABA and NMDA receptors (see Figure 1). Its first product, ZULRESSO, launched as a treatment for postpartum depression (“PPD”) in June 2019. However, it has to be infused intravenously over a 60-hour period, while the follow-up, zuranolone, has the bioavailability and half-life suitable for oral, once-daily dosing. On Dec. 6, Sage and partner Biogen Inc. (BIIB) filed a New Drug Application to the Food and Drug Administration (FDA) for zuranolone as a rapid-acting, 14-day treatment of major depressive disorder (“MDD”) and PPD. The market wasn’t impressed by the last Phase 3 (CORAL) results on February 16, when shares dipped 17.5%, a sign that zuranolone could struggle with approval.

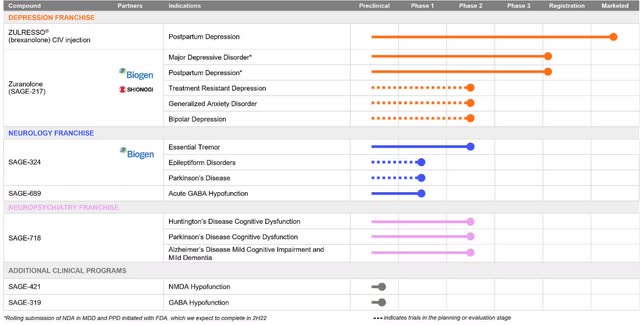

Figure 1. Sage Therapeutics Pipeline

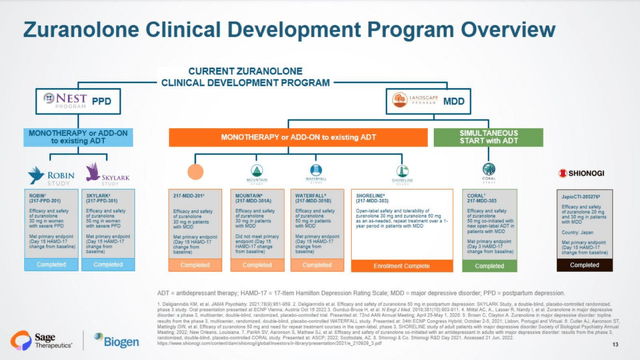

ZULRESSO is chemically identical to allopregnanolone, a naturally occurring neuroactive steroid positive allosteric modulator of GABAA receptors. Zuranolone (formerly SAGE-217/BIIB125) is in the same class. GABA is the major inhibitory signaling pathway of the central nervous system. The FDA granted zuranolone Fast Track and Breakthrough Therapy Designation for MDD and Fast Track Designation for PPD. In the U.S., Zuranolone is being evaluated by the LANDSCAPE and NEST programs (Figure 2). The LANDSCAPE program studies people with MDD (217-MDD-201 (Phase 2), MOUNTAIN, SHORELINE (open label safety), WATERFALL, and CORAL Studies), while the NEST program is on women with PPD (ROBIN and SKYLARK trials).

In MOUNTAIN, the first Phase 3 trial, 581 patients were randomized to zuranolone 20 mg, 30 mg, or placebo daily for 14 days. The primary endpoint (or PEP) was reduction (change from baseline or CFB) compared to placebo in the 17-item Hamilton Rating Scale for Depression (HAM-D) total score at Day 15. There was little separation between zuranolone 30 mg and placebo at Day 15 (-12.6 versus -11.2 points, least squares mean difference in change, −1.4, p=0.115), and none with zuranolone 20 mg. These results were a huge come-down from the Phase 2 RCT of zuranolone 30 mg compared to placebo in 89 MDD patients, which saw a LS mean difference of -7 points, -17.4 vs -10.3 points (p<0.001), The whopping differential had been especially promising given that baseline HAM-D were 25.2 and 25.7 points, respectively, meaning that the drug would bring patients with average scores and improvements to the upper limit of Normal (7 points).

Next was WATERFALL (NCT04442490), a Phase 3, multicenter, double-blind, randomized, placebo-controlled trial (RCT) of zuranolone that assessed a 14-day monotherapy course of zuranolone 50 mg daily. The PEP was CFB in HAM-D scores at 15 days. In total, 543 subjects had a mean baseline HAM-D of nearly 27 points. At Day 15, CFB was −14.1 vs -12.3 points in the zuranolone 50 mg group and in the placebo group, respectively (LS mean difference, -1.7 points; p=0.0141).

Response is still arbitrarily “defined as a score reduction of 50% or more,” and while the mean cleared it, the response rate was not reported. The nondisclosure isn’t surprising; the high baseline meant that a responder would need a full 14-point improvement, and it would come nowhere close to the through-the-roof 79% response rate in Phase 2. Furthermore, a drug-placebo difference of 3 points was recommended by the National Institute for Clinical Excellence in England and only the Phase 2 trial achieved that. Even this liberal threshold isn’t universally accepted because clinicians can’t detect a 3-point HAM-D improvement, which corresponds to “no change” on the Clinical Global Impressions-Improvement scale. Finally, the higher dose also revealed an increased incidence of somnolence, 15.3% vs 3.0% in placebo.

Most recently, CORAL (NCT04476030) was a Phase 3, double-blind RCT in 440 participants comparing zuranolone 50 mg plus an antidepressant (or ADT) to placebo (standard of care ADT only). The mean HAM-D score at baseline was 26.8 points in the zuranolone group and 26.6 in the placebo group. On Day 3, the LS mean CFB was −8.9 vs −7.0 points in zuranolone and placebo, respectively (p=0.0004), which met the PEP. However, the difference on Day 15 was not significant, and the somnolence signal was seen again, 18.4% vs 8.3%.

Unlike the MOUNTAIN trial, there was no saving post-hoc analysis to suggest that CORAL’s failure at 15 days was due to noncompliance with the treatment regimen or high placebo effect from patients with relatively mild symptoms. Perhaps Sage should’ve been bolder in Phase 3. Alas, patients with treatment-resistant depression or suicidality, who probably need a rapid response and could benefit the most, were not included in any of these trials. As for the rest, it is common knowledge that the first-line ADTs, selective serotonin reuptake inhibitors, take weeks or months to work, and patients have to be resigned to the wait.

Financials

For 2022, nine-month ZULRESSO sales were $4.8 million, up only from 3.3% from the same period last year. With $1.4 billion in cash and average quarterly losses in 2022 in the $130 million range, it’s reasonable to believe management’s claims it can sufficiently fund operations for at least 12 months. Sage earned D-grades on Seeking Alpha’s Quant Analysis of Valuation and Growth if it were to rely on ZULRESSO alone. That’s because the company gets F’s in Enterprise Value (EV, $948 million)/Sales, 12 month trailing (TTM, $6.46 million including Q4 2021), EV/Sales FWD, Price/Sales TTM/FWD, and negative Revenue Growth YoY/FWD (due to 2020’s one-time collaboration revenues). Zuranolone in the PPD market would most likely eclipse ZULRESSO numbers, but MDD revenue is critical if Sage is to justify its valuation.

Risks

Seeking Alpha doesn’t offer a Don’t Buy option, and fundamentals aren’t so bad as to earn a Sell, so SAGE gets a Hold. Biotechs are risky in a bear market, and the approval action date is a binary event. Failure would be catastrophic because the company’s other pipeline agents are so far behind in development. Buying SAGE is riskier than, say, Intercept Pharmaceuticals, Inc. (ICPT), which shares similarities of one approved product and a drug candidate in another wide open multi-billion-dollar market opportunity. Intercept has a smaller cap, less cash, and far larger revenue, but its pivotal trial performance is better and, therefore, so are its candidate’s prospects of approval, in the area of nonalcoholic steatohepatitis with no approved products.

Longs who already bought Sage Therapeutics, Inc. are willing to gamble on successful zuranolone approval. Some researchers theorize that zuranolone would work better in females, which is fine in PDD, but it’s understandable the company doesn’t want to cut potential MDD income by half right off the bat. Investors shouldn’t blindly hope that FDA will endorse both Sage Therapeutics, Inc. indications; the Agency would be within their rights to ask for more analyses, or an adjustment to a 12-day regiment in MDD, the latest for which MOUNTAIN and CORAL both show significant improvement. A delay could be just as deleterious to share prices as outright rejection.

Be the first to comment