franckreporter

I’m sure you’re familiar with the term “full faith and credit,” describing the unconditional guarantee or commitment by one entity to back the interest and principal of another entity’s debt – typically used by a government to help lower the borrowing costs of a smaller, less stable government or a government-sponsored agency

It’s generally accepted the U.S. government will never default on its loan obligations and so these four words – full faith and credit – have tremendous value in describing America’s credit quality.

The U.S. government is the largest employer in the world – and the largest office tenant in the U.S.

In July 2022 Fitch Ratings affirmed the United States of America’s Long-Term Foreign Currency Issuer Default Rating (‘IDR’) at ‘AAA’, and revised the Rating Outlook to Stable from Negative.

“The Outlook Revision to Stable reflects the improved near-term government debt dynamics driven by the strong post-pandemic economic recovery and buoyant government revenues, which Fitch expects to grow by 19% in 2022, propelled by strong personal and corporate income taxes.

Fitch has substantially improved its fiscal and debt projections since its last review. Fitch now forecasts a decline in the general government debt ratio to 113% of GDP at YE 2022, from 118% in 2021 (and a peak of 123% in 2020) before beginning to rise again at a gradual pace in 2024.”

What if I told you that there were investments backed by the US Government that were not Treasury Bonds?

Sounds Interesting?

Well in fact there are two REITs that are backed by the full faith of the US Government – Postal Realty Trust (PSTL) and Easterly Government Properties (DEA). In this article we’ll take a closer look at both REITs…

Postal Realty Trust

When I research a company, a driving principle of mine is to have an open mind without any preconceived bias one way or another.

I must admit that when I first heard of a REIT that primarily focuses on post offices my first two thoughts were – isn’t the Postal Service losing money every year?

And when was the last time I mailed a letter?

The problem with any preconceived notion or bias is that it can form your opinion and give you a false sense of knowledge, all while being ignorant of the real facts.

So let’s take a closer look at Postal Realty to see what the facts really are. First though I’d like to provide some history on the Postal Service itself:

facts.usps.com

Even without the information above, most of us know that the postal service has been around since the inception of America and is a critical piece of the country’s infrastructure.

In large part, the losses it has been experiencing are due to the mandates placed on it. For example, the Postal Service is bound by a Universal Service Obligation – USO – that requires everyone in the country to receive a minimum level of mail service at a reasonable price.

An even more challenging law, passed in 2006, required the Postal Service to fund retiree health care benefits in advance of their retirement.

According to the U.S. Government Accountability Office, the Postal Service has lost $87 billion over the past 14 fiscal years (Source: GAO.gov).

As a landlord, losses like this from an operator would normally spell certain doom, especially if it was the largest tenant, but this is where the “backed by the full faith of the US” comes in to play.

Below is an excerpt from a New York Times article dated March 8, 2022 –

New York Times

The larger point here is that many of the operational deficiencies that the Postal Service has experienced are due to government regulations, but at the same time the Postal Service is far too vital for the government to allow it to fail.

I feel confident that the US government will continue to do what’s necessary to keep the mail running for the foreseeable future.

My second concern, even though it is anecdotal, is that I haven’t sent something in the mail in a very long time. While it’s true that first class mail volumes have been declining recently, package delivery volume has been increasing.

Forbes

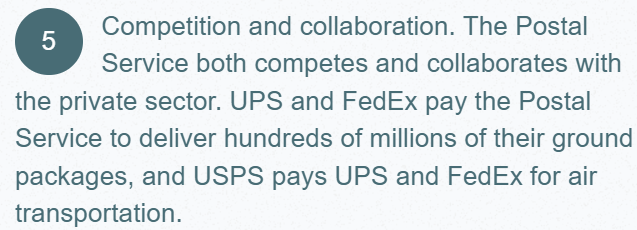

The Postal Service is very much involved in shipping packages and works with shipping companies like FedEx (FDX) and UPS (UPS), especially for last mile delivery.

reveelgroup.com

So even though mail volumes are in decline, package deliveries are increasing and will likely continue to do so with the current e-commerce boom. The Postal Service not only delivers mail, but they also are a critical piece of the logistical infrastructure for package delivery.

facts.usps.com

Postal Realty Trust 3Q22 Investor Presentation

Now that we have some background on the Postal Service, let’s dig into the landlord, Postal Realty Trust:

Postal Realty Trust primarily invests in Post Office Real Estate which makes them unique in the REIT space. They are the only public REIT with this focus in a highly fragmented market. They own 1,239 properties across 49 states, have a weighted average lease term of ~4 years, and have occupancy rates of 99.7%.

Postal Realty Trust 3Q22 Investor Presentation

Postal Realty Trust 3Q22 Investor Presentation

Due to the highly fragmented space, Postal Realty has a major size and scale advantage when compared to private owners of Post Office real estate, so the potential is there for future consolidation and increased market share for Postal Realty.

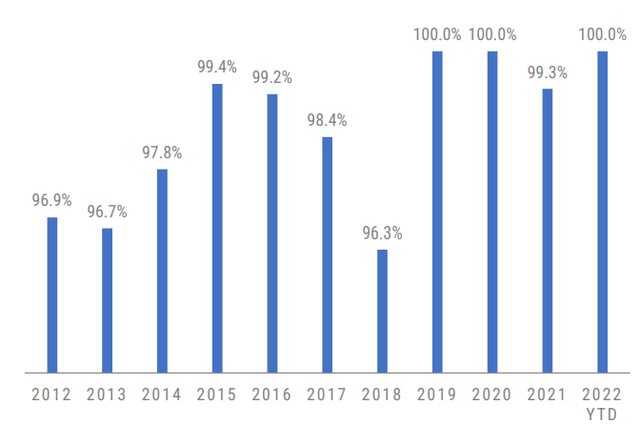

Postal Realty Trust also has a very strong track record of tenant retention rates, which has been 100% three out of the last four years:

Postal Realty Trust 3Q22 Investor Presentation

Along with strong retention rates, there’s no issue with receiving the rent checks. As far as I know, they are the only REIT that can say 100% of rent payments are made on time.

Postal Realty Trust 3Q22 Investor Presentation

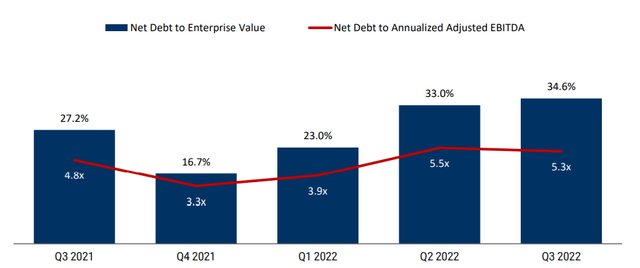

Postal Realty Trust does not appear to be over leveraged with a current Net Debt to Adjusted EBITDA of 5.3x.

Postal Realty Trust 3Q22 Investor Presentation

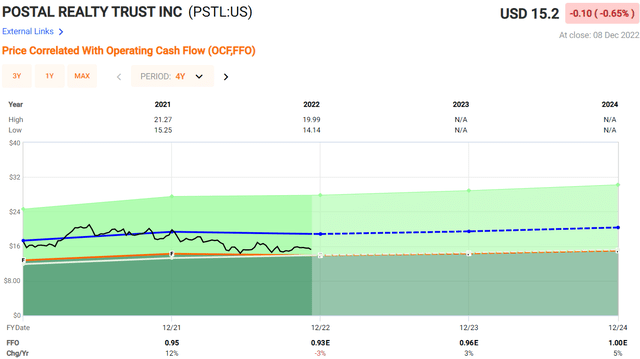

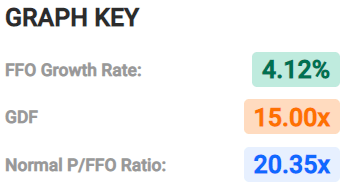

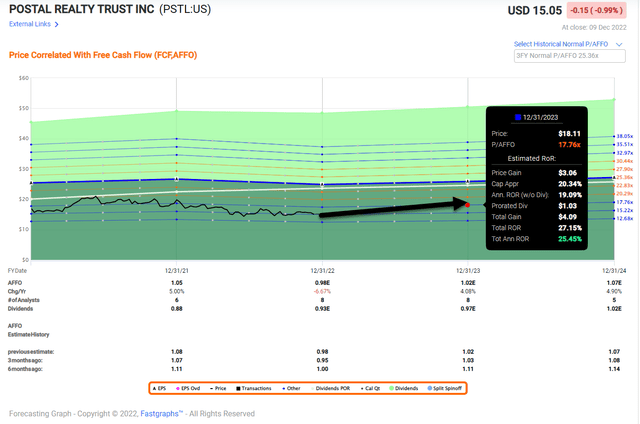

When looking at valuation, Postal Realty is trading at an FFO multiple of 15.89 while its normal FFO multiple is 20.35. FFO is expected to increase 3% in 2023 and 5% in 2024.

iREIT

FAST Graphs

Postal has maintained a 98.8% historical weighted average lease retention rate over the past 10-plus years, which reflects the strategic importance of these properties to both the Postal Service and the communities they serve.

This high rate continues to validate Postal’s due diligence process when identifying locations that are vital to the Postal Service. Year-to-date (as of Q3-22) Postal has not received any notices of termination by the Postal Service.

FAST Graphs

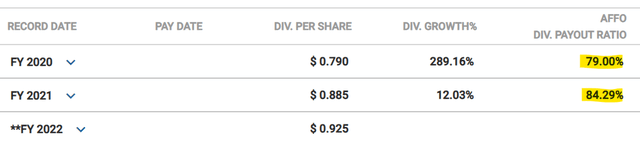

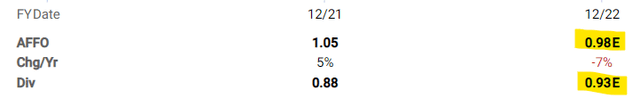

Currently Postal Realty has a dividend yield of 6.23%, and over its short history, the AFFO payout ratio has been reasonable at 79% in 2020 and 84.29% in 2021.

In Q3-22 the company approved an increase in the quarterly dividend to $0.2350, which annualized to $0.94 per share, a 4.4% increase from Q3-21. This continues the steady history of increasing the dividend every quarter since the IPO.

FAST Graphs

For 2022, the expected dividend is $0.925 and the expected AFFO is $0.98 which would put the 2022 AFFO payout ratio at ~94%. Low to mid-80% payout ratios are common for Net Lease REITs. The expected 2022 AFFO payout of 94% is a little high and something to keep an eye on.

FAST Graphs

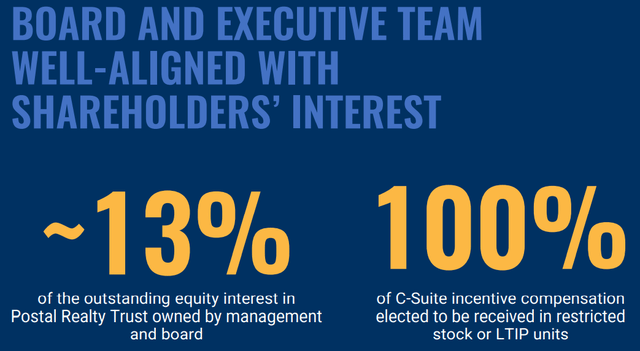

Insider ownership is strong with Postal Realty with 13% of equity owned by management and the board. So on this front it looks like management’s interest is well aligned with shareholders.

Postal Realty Trust 3Q22 Investor Presentation

A few weeks ago, I met with the company’s CEO, Andrew Spodek, who has solid experience in the postal service industry, and the management team has over 30 years of cycle-tested experience and a strong network of relationships built over time, which are meaningful differentiators.

We rate Postal Realty as a Spec BUY with a 12-month total return forecast of 20% or more.

FAST Graphs

Easterly Government Properties

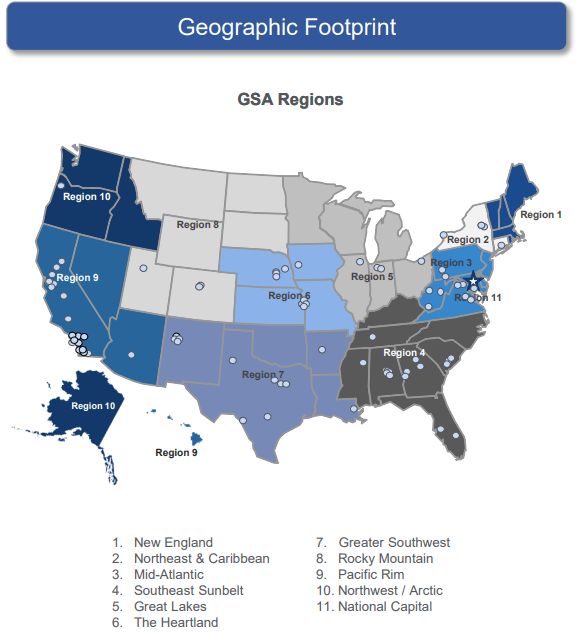

Easterly Government is a REIT that primarily focuses on properties leased to the US government. It owns 86 properties of which 99.3% are leased. The weighted average lease term is 10.5 years, and their geographic footprint is well diversified across the US.

Easterly Government Properties Investor Presentation

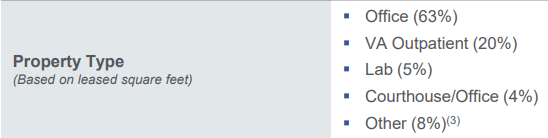

Easterly Government owns multiple property types leased to the government which include office buildings, VA outpatient facilities, labs, and courthouses.

Easterly Government Properties Investor Presentation

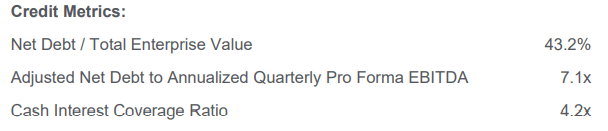

Easterly Government has an adjusted net debt to EBITDA of 7.1x, which is higher than I’d like to see in terms of its overall leverage. However, their Interest Coverage Ratio is 4.2x so they can service their interest payments several times over.

Easterly Government Properties Investor Presentation

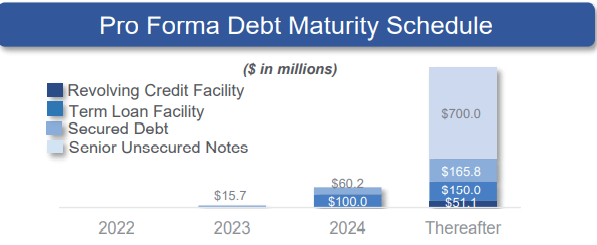

The debt maturity schedule does not break out information past 2024, but from the information provided it shows that no major maturities occur until after 2024.

This at least gives them a couple of years of flexibility in the current interest rate environment. Additionally, approximately 95% of their debt is fixed rate.

Easterly Government Properties Investor Presentation

Easterly Government Properties Investor Presentation

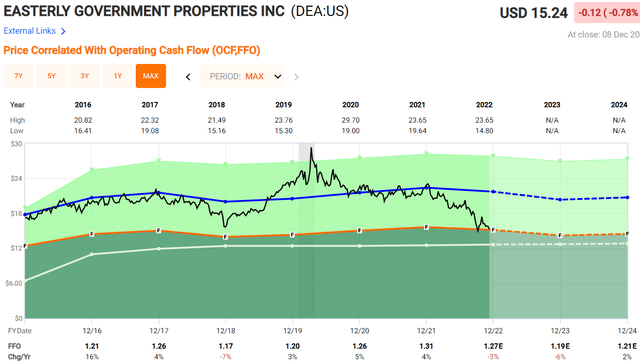

Since 2016 Easterly Government Properties has had an average FFO growth rate of just 1.72%. The expected FFO growth rate in 2023 is negative -6% before improving to an expected FFO growth rate of 2% in 2024.

FAST Graphs

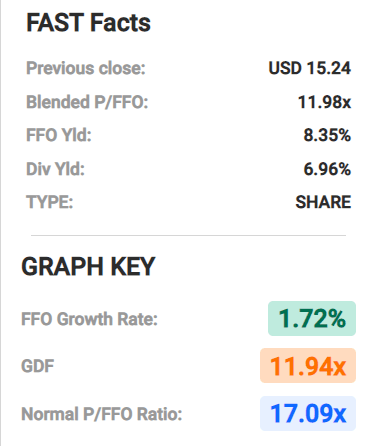

Easterly Government Properties appears to be trading at a discount with a current FFO multiple of 11.98x when compared to its normal FFO multiple of 17.09x, but the lower multiple may reflect concern over a dividend cut.

FAST Graphs

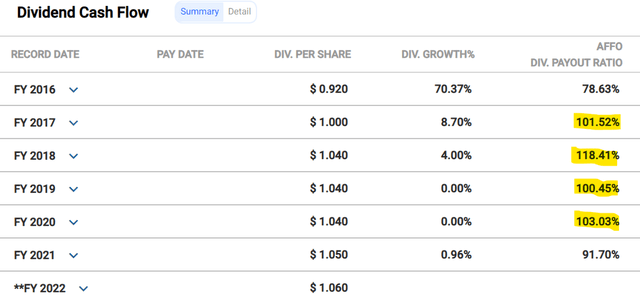

Easterly Government Properties currently has a dividend yield of 6.94%, but their AFFO payout ratio is concerning. For several years they paid out more in dividends than the free cash they generated from operations.

(Note: DEA is on our Dividend Alert List at iREIT on Alpha)

The AFFO payout ratio improved to 91.70% in 2021 and is expected to be 90.5% in 2022.

That’s still uncomfortably high, especially for a REIT that’s not a triple net lease and where office properties make up the majority of their assets.

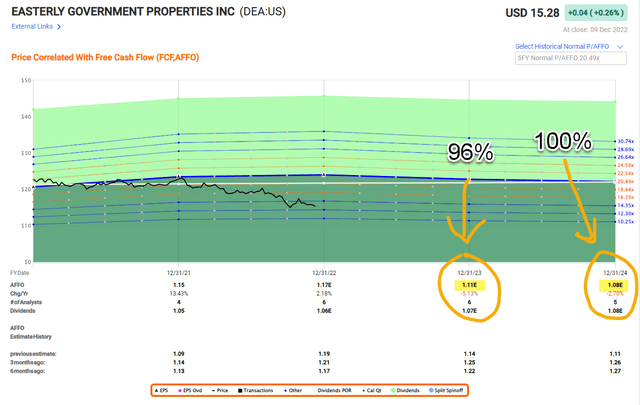

The high payout ratio is especially concerning since they didn’t even raise the dividend for three years in a row and their cash flow is expected to decline in 2023. The low FFO multiple may be justified if investors suspect a dividend cut on the horizon.

FAST Graphs

Easterly Government Properties has some good qualities, in particular they have an advantage in that their tenant is the US government, which is always growing and needing more space.

However, I’m becoming increasingly concerned with the safety of the dividend, and as you see below, analysts are forecasting negative growth in 2023 (-5%) and 2024 (-3%) which puts more pressure on the dividend. The payout ratio (based on AFFO) is projected (by analyst consensus) to hit 100% in 2024.

FAST Graphs

Given this bearish forecast, we’re downgrading Easterly from a Spec Buy to a Hold. We believe there are better opportunities in the Net Lease and/or Office sectors. Although we like the high-quality credit behind the leases, we consider the elevated payout ratio a sign of caution.

In Closing…

We’re constantly researching REITs that offer the most attractive risk-adjusted returns. Within the micro-sector of US government-backed leases we prefer Postal Realty over Easterly Government.

Our fundamental-based research provides us with optimized results that has allowed us to steer away from higher risk securities that oftentimes generate unfavorable results.

Simply put, we’re not chasing yield, and it’s our focus on fundamentals that separate the best from the rest. As always, thank you for reading and happy REIT investing!

Be the first to comment