Marko Geber

BM Technologies (“The Company” or “NYSE:BMTX“) is a fintech deposit servicer that specializes in developing white label banking products for consumer-focused brands and facilitating deposit relationships for college aid disbursements. For a more detailed background on the company and the investment case, please see Ryan Bowen’s articles here, here, and here.

For the purposes of this article, to not bore readers or to not be redundant, I’d like to focus on the recent events that have transpired post the third quarter earnings release and why I believe the company is still a fantastic investment (if not even better than before).

Background

BMTX was incubated by Customers Bank (“CUBI”) as a way to increase banking relationships and drive deposits into the parent bank. Then, BMTX and CUBI grew too big and CUBI (due to regulatory issues) needed to divest BMTX. After trying to spin off the company in 2018, CUBI eventually decided to sell BMTX via the SPAC market. Now, BMTX is its own company looking to grow its core business without the shackles of being a part of a larger banking operation.

Keep in mind, for better or for worse, the entire operation has been a whole family affair. The CEO and chairman of CUBI at the time and the owner of the SPAC are both related to Luvleen, the CEO of BMTX.

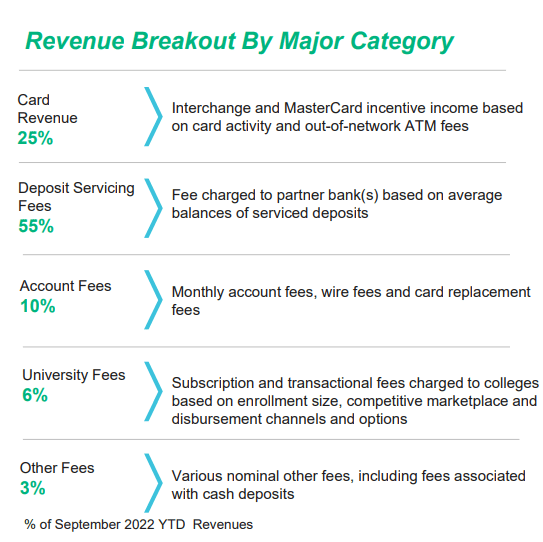

Currently, BMTX’s business is made up of five parts: Card Revenue, Deposit Servicing Fees, Account Fees, University Fees, and Other Fees. See below for a breakdown.

Q3 Company Presentation

Card Revenue

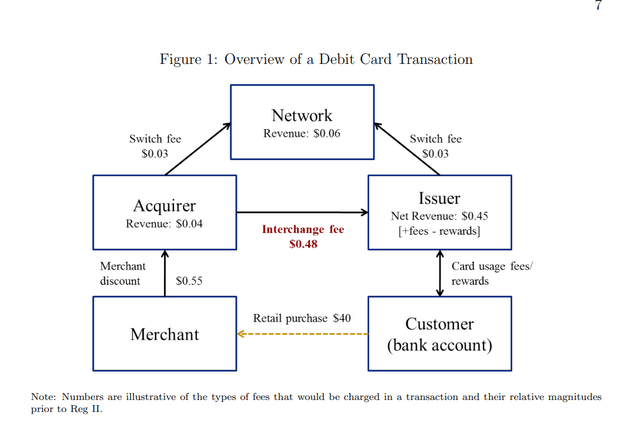

Let’s start with card revenue. BMTX opens accounts for its clients and sends those deposits over to CUBI. When clients spend money on their debit cards, CUBI receives interchange network fees. On average interchange fees banks receive range from ~$0.20 to ~$0.50 per transaction. See the below flow chart depicting the flow of money on every debit card transaction.

Federal Reserve

However, there is a catch.

In 2010, an amendment came out regarding these fees known as the Durbin Amendment.

Prior to the Durbin Amendment, banks were charging retailers 44 cents per transaction. According to the Federal Reserve, these banks collected approximately $20 billion annually on interchange fees in order to cover fraud prevention and administrative costs. When the amendment went into effect in October 2011 these charges were capped at 12 cents.

There were also additional provisions in the Durbin Amendment that affected regulated and unregulated debt. As explained in a previous Due post;

“The Durbin Amendment has established two ratings for banks that are based on their assets. If the card issuing bank is regulated, also known as an exempt bank, it means that their assets equal more than $10 billion. However, if the card issuing bank is non-regulated, aka a non-exempt bank, then they have assets under $10 billion.”

This means that merchants will have to pay a different fee based on the bank that issued the debit card. For instance, the regulated debit fee is 0.05% + $0.21, while the unregulated is 1.60% + $0.05. Before the Durbin Amendment the fee was 1.190% + $0.10/.

As you can see from the quote within a quote, interchange revenues banks could charge shifted dramatically after the Durbin Amendment. Now, if a bank has more than $10 billion in assets, they are considered regulated and cannot charge the standard $0.44 cents per transaction. So, what does this mean for BMTX?

Well, CUBI is a regulated entity (i.e. has greater than $10 billion in assets). Thus, they only make a fraction of the interchange revenues a much smaller bank would make. However, to throw BMTX a bone, CUBI has agreed to pay the difference between the rate a Durbin-regulated bank gets versus what a Durbin-exempt bank gets. This has been a huge windfall for BMTX. Just last year, BMTX earned $28.08MM in interchange revenue paid by merchants to CUBI and relayed over to BMTX.

However, just last month, BMTX announced that, although they will extend the arrangement with CUBI, CUBI will no longer pay the difference between Durbin-exempt and Durbin-regulated. Unfortunately, that will likely cause a roughly 50% compression in interchange revenue going forward. However, this is a temporary compression in earnings that will likely only last 3-6 months. So, although BMTX will likely only earn $2.5MM – $3.0MM in quarterly interchange revenue for Q1 and Q2 of 2023 (instead of $5MM – $6MM), once they move their deposits over to a new bank partner, their interchange revenue will immediately jump back up to their historical interchange revenue figures.

I believe this temporary compression in revenue has caused the market to misunderstand BMTX’s future viability. This compression is temporary and the market is misguided to think BMTX will not find a new Durbin-exempt bank sponsor. Bob Ramsey, the CFO of BMTX, has confirmed that BMTX is only looking for new Durbin-exempt sponsor banks for this very reason. Banks need deposits now and BMTX has a lot of them.

Catalyst #1 will be the announcement of a new Durbin-exempt bank partner. Once announced, the market will realize that a compression in interchange revenue is temporary. Now, let’s jump into Catalyst #2, the new bank partner.

Deposit Servicing Fees

The overall market is pricing additional rate hikes into the remainder of the year and 2023. This is a HUGE opportunity for BMTX.

As mentioned above, BMTX is negotiating a new bank partner to transfer its 1.6 billion deposits. As per the language of the team, BMTX received “robust interest” from multiple financial institutions. At this time, they are in late stages negotiations with a new bank partner that will provide a variable fee in exchange for housing BMTX’s deposits. The market is not fully internalizing how tremendous this will be for BMTX. Let’s illustrate with an example.

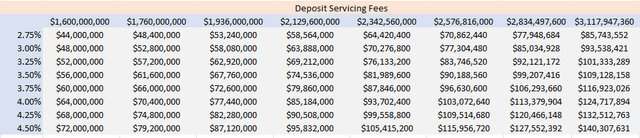

BMTX currently has roughly 1.6 billion deposits and CUBI pays roughly 3.00% for these deposits. That equates to $48 MM in fee income annually. But, that’ll get much larger with a new variable partner. Today, the Fed Fund Rate is roughly 3.80%. If the Fed raises interests into next year, it isn’t inconceivable for the Fed Fund Rate to head closer to 4.00% or 4.50% (or greater). If that’s the case, why wouldn’t a bank partner pay BMTX 3.50% or 4.00% for their sticky deposits?

See below for an illustration of BMTX’s deposit servicing fees with a variable rate product.

Author’s Estimates

In 2020, BMTX made $22.5MM in deposit servicing fees. In 2021, BMTX made $45.1MM. And, in 2022, BMTX (according to my estimates) will likely make about $47.4MM. If BMTX launches with a new variable rate partner sometime in Q1 or Q2 of next year, even if they don’t grow their deposit base, they’ll earn somewhere in the range of $50MM – 65MM in deposit servicing fees.

But wait, there’s more!

It’s almost consensus across the economic and investment landscape that interest rates will likely stay higher for longer. Obviously, I have no idea if the Fed will raise rates, keep them the same, or cut them, but what I do know is that the days of 2.00% interest rate are over (for now). If BMTX launches a variable rate servicing agreement and even manages to grow its deposit base, it’s possible they will earn over $80MM in servicing fees annually. Wow!

Let’s dive into Catalyst #3, the juiciest of all.

New Banking as A Service (“BaaS”) Partner

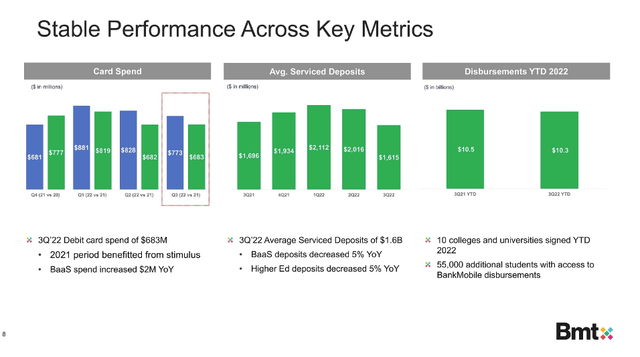

Right now, BMTX’s deposits consist of college student accounts and clients from the T-Mobile Money program. As you can see from the chart below, barring the most recent quarter, deposits have stayed relatively consistent.

Q3 Company Presentation

This past quarter, however, deposits have begun to leak out. This can be attributed to customers removing funds to seek higher yielding investments and BMTX purposely removing highly interest rate-sensitive accounts. Regardless, BMTX still has a massive, low-cost banking base that provides clients with a legitimate value proposition. Regarding the T-Mobile partnership:

One of BMTX’s most high-profile partnerships involves it providing a unique, turnkey solution to mobile carrier T-Mobile for its T-Mobile MONEY app. A common theme of its client relationships is how BMTX manages to remove the legwork from the services it enables: in the case of T-Mobile MONEY, it deploys the application, owns the end-to-end VPO and owns all the user experience and back-office functions too. This meant the lead times on the T-Mobile project were longer by BMTX’s standards, because it had to create a purpose-built app for them, but generally the company can go from introduction to implementation in as little as 90 days.

(Source: Fintech Magazine Article)

But, the fun is just getting started for BMTX. They have been working tirelessly on a new BaaS partner with a global operation and tens of millions of customers in the US. As of now, we can only speculate as to who the BaaS partner is, but even without knowing who the partner is, we can assume the relationship will drive more low-cost deposits. BMTX’s customer acquisition costs are far lower than traditional banks. If they can drive deposits back to $2 billion, coupled with a variable rate bank partner, the stock could rocket higher.

T-Mobile makes up roughly $1 billion of BMTX’s deposits. If the new BaaS partner can provide $500 MM – $750MM in additional deposits within 12 – 18 months of launch, BMTX could be looking at over $2.3 billion in deposits. As you can see from the table I present above, that could translate into close to $100 MM in deposit servicing fees annually – over 2.0x higher than the current run rate deposit revenue.

So, let’s summarize.

Catalyst #1 – Announcing a new Durbin-exempt bank partner, further assuring to the market that the temporary compression in interchange revenue is, in fact, temporary.

Catalyst #2 – Announcing a new variable interest rate bank partner, solidifying BMTX’s ability to earn 3.50% – 4.00% for their serviced deposits.

Catalyst #3 – Announcing more details on the new BaaS partner and further follow-on announcements of additional inflows of deposits into BMTX accounts from said launch.

Now, let’s talk valuation

Valuation

See below for my model.

Author’s Estimates

Let’s take it step by step:

1. I assume a 50% initial drop in interchange revenue in Q1 and Q2 2023. This will then revert back to normal levels by Q3 2023 when the new Durbin-exempt bank is fully integrated.

2. I assume deposit servicing fees will continue to fall and drop below $10MM in the quarter. The markets are shaky and without stimulus tailwinds, I imagine deposits will continue to drop a bit. Then, in 2023 I envision fees increasing considerably, generating $57MM on the year. This will be driven by the continued growth of the college business, new BaaS partner rolling out in a couple months, and the new variable rate bank partner.

3. In 2024, with a larger deposit base, a stronger customer ecosystem, a new BaaS partner, and a better banking partner, I assume interchange fees will head back to 2021 levels and deposit fees will be above $75MM – 50% higher than 2022.

4. I assume modest 10% expense growth every year.

The results are astounding. I estimate, by Q4 2023, BMTX will have run-rate EBITDA generation of over $28MM – or 72% of its current enterprise value.

Today, BMTX has roughly 12.2MM shares outstanding, $20MM in cash, and a $58.8MM market cap. Meaning, at $4.82 you are effectively paying $38MM for a company that could legitimately earn $6MM in EBITDA in 2023 and $28.8MM in EBITDA in 2024. That means you are effectively getting nearly all of your money back (in the form of EBITDA – which I’m aware is not directly the same as FCF) in 24 months!

See the below chart for an EV/Adj. EBITDA calculation.

Author’s Calculation

Let’s take it a step further and explore another possible reason for the stock to head higher: It’s obscene short interest.

Price Action / High Short Interest

Since the less-than-deal Q3 earnings, BMTX has nosedived. The stock is now down nearly 50% in three weeks of trading. But, if we look under the hood, it seems that the selling is mostly due to short selling (coupled with some people that think the business is dead).

Here is a depiction of the short interest progression over time:

Fintel Short Data

BMTX is trading with 50% of its market cap in cash yet its short interest is approaching all-time highs while the stock is trading at all-time lows. This scenario is VERY similar to what happened at GME before the massive squeeze. Although BMTX doesn’t have 150% of its float short, people are shorting the stock, paying high borrow rates, and not realizing that the business is 1-2 quarters away from generating gobs of free cash flow.

So, what exactly is the short ratio? According to Fintel, it’s about 20% of the float, but I actually think it is much more than that for two reasons.

1. Short interest is presented on a delay and thus the excessive short selling post-third quarter earnings are not reflected in the 1.54 MM shares “supposedly” short as of 11/15/22. The daily short volume in both the stock and the warrants has exceeded 50% – 60% on most days over the past three weeks. That can only mean short interest is even higher than actually reported.

2. The float is a lot smaller than the 12.2 MM shares outstanding.

Let’s take a look at the ownership structure and my assessment of short interest.

Public Filings

With such a tiny tradeable float coupled with a true 38% short interest, BMTX is ripe for a massive short squeeze if retail traders get wind of the stock or if any number of the positive developments I’ve mentioned materialize. The stock has squeezed last year a handful of times due to some chatter on Reddit (see here and here). I wouldn’t be shocked to see it again squeezed materially higher given that short sellers are doubling down on their position without understanding the bigger picture.

Putting It All Together

As mentioned, BMTX has a number of game-changing catalysts that can propel the stock higher. Once people get wind of the long-term story, the stock should move much higher to reflect its true fair value. A company that will likely earn $30MM + in cumulative EBITDA over the next two years should not be trading at an Enterprise Value of less than $40MM. I believe a more appropriate 3x – 5x 2024 EBITDA figure is more suitable for a company with this much potential. That would put the stock much closer to $10/share than its current price of $4.82.

Granted, there are a number of risks that should be mentioned.

Risk 1: The T-Mobile Money partnership is set to expire in February of 2023. There is always a chance T-Mobile does not renew the contract and either shutter the program or partner with a different provider. I view this as a highly unlikely scenario, but it is nonetheless a risk worth noting. FYI – T-Mobile Money has 4.8 stars on Google Play.

Risk 2: The warrant overhang is challenging and could be causing downward pressure on the common stock. BMTX has 22.7 MM warrants outstanding. These warrants represent a dilutive overhang on common shareholders. However, it is important to note that they only dilute shareholders if BMTX trades above $11.50. And even then, they convert with cash. I don’t foresee the warrants representing an issue if BMTX trades below $11.50. To be honest, given that the stock has sold off quite a bit since Q3 earnings, those warrants could actually end up being a tailwind for an earnings beat. As the warrants decrease, BMTX marks their books with a gain on warrant liability. Though that figure won’t impact EBITDA, it’ll help BMTX earn a potentially large EPS surprise to the upside when they announce earnings in a couple months.

Risk 3: BMTX is trying to buy a bank to seamlessly integrate more products into their already existent suite of offerings. Unfortunately, regulators have pushed back on the acquisition due, in part, to a lack of internal infrastructure at FSWA and BMTX to justify the purchase. The market has perceived this as a risk and, as a result, has bid down the stock considerably. Though a rejected bank merger will impact BMTX’s future earnings. It doesn’t matter. They do not need to buy a bank. With a variable bank partner, they were going to service most of their deposits anyway if they closed on the deal. So, although they will miss out on some nice Net Interest Margin if they don’t buy the bank, they still will get hefty fees and other revenues from their standard day-to-day business.

All that being said, I have a substantial portion of my net worth in BMTX. Though the company will experience a temporary compression in revenue over the next 1-2 quarters, the overall story is very much intact. The compelling valuation, high short interest, high insider ownership, and many upcoming catalysts make this stock my best pick into 2023 – by far.

Price target: $10+

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment