PytyCzech

There is quite a bit of economic anxiety in the United States. Indeed, much of the world is concerned over supply chains, inflation, and the possibility of recession. Many pundits expect a recession to hit the American economy in 2023. The depth of the recession is unknown, but people expect it. This means that further weakness in the stock market is possible.

When there is a downturn in the economy, it’s a good idea to consider stocks that provide a reasonable likelihood of capital preservation. A bit of income on the side can offset some of the drop that’s likely to hit most, if not nearly all, stocks. Stocks that pay dividends tend to do better during a recession because of their lower volatility.

Additionally, stocks that provide products or services people need will tend to do better during a recession. People will cut back on discretionary spending before they will cut back on necessities. Discretionary spending involves luxuries that are not necessary. Travel-related companies will not benefit from a recession and will likely see revenue streams dry up. On the other hand, while revenues might not go up rapidly for companies that produce consumer staples like Coca-Cola (KO), they aren’t likely to drop rapidly.

Utility companies can click both boxes when it comes to navigating a recessionary environment. They bring in revenue during recessions because people need to heat and cool their houses, and, in developed nations, running water and sewage treatment are expectations. Additionally, most utility companies pay dividends to encourage investment. Frequently, these dividends are higher than one might expect to get from a technology company that’s reinvesting most of its free cash flow. One such company that investors might look into is Southern Company (NYSE:SO).

Southern Company

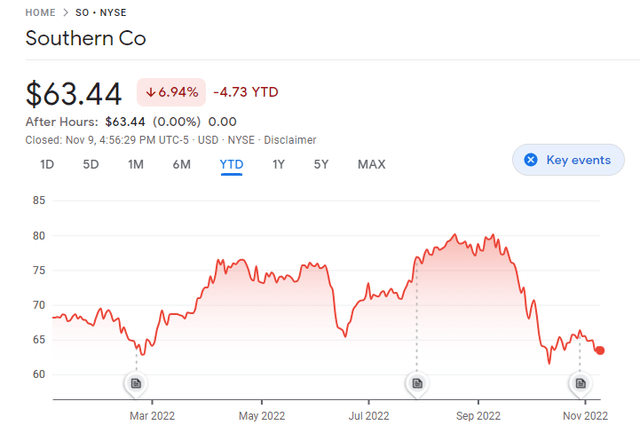

A solid dividend payer that’s already down about 20% from its recent all-time high is Southern Company. This utility company provides a diversified array of services for consumers in the Southeast. In addition to providing electricity and gas for customers, SO provides fiber optic telecom services. From a high of just north of $80/share earlier this year in September, the closing price of Southern Company was $63.44 on November 9. Shares are down around 7% from the beginning of the year, but this is quite a bit better than the 21% that the S&P 500 (SPX) is down over the same time.

Southern Co is likely to grow at a slower rate than growth stocks, but as a utility, those interested in preserving capital might consider the stock in a down market.

SO is somewhat unusual as a power company. It’s currently in the process of bringing two new nuclear reactors online. These reactors are supposed to be online within months. While nuclear power is controversial, it is the most efficient energy source in terms of peak production. It operates at peak production 92% of the time, according to the Department of Energy. This contrasts with solar energy, which produces at its peak only 24.9% of the time, and coal, which operates at peak capacity 40.2% of the time. In many nations, the cost of producing nuclear power is less than other sources. In the US, it’s lower than the production cost of coal. Partially owned by Southern Company, the Vogtle Units 3 and 4 will bring power production at the facility to 1 million customers and contribute to the company’s goal of becoming carbon neutral.

Revenue

The most recent quarterly report for the company showed strong revenue numbers on stronger sales. Additionally, the cost of production went up, but net income increased by $0.08 per share on a year-over-year basis when allowing for exclusions related to the construction of the Vogtle units and dismantling of coal gasifier assets. GAAP income increased from $1.101 billion to $1.472 billion in the three months ending in September 2022. The first three quarters of the year have also shown some solid revenue numbers, growing from $2.608 billion in 2021 to $3.611 billion this year. While higher fuel costs have no doubt improved revenue (as well as costs), the company has also added customers over the past quarter–11,000 electric customers and 8,000 gas customers. Over time, more customers will likely lead to more revenue.

EPS has grown over the past year, from $3.05 to $3.35 on a non-GAAP basis. Estimates for the next five years have analysts guessing that EPS will increase from $3.60 to $4.40 by 2026. This will be decent growth in a sector that tends to grow slowly. The cost of energy will impact how this will play out in the long run, but it is unlikely that people will stop using the products that SO offers. Therefore, a drastic drop in profitability is not as likely as it might be for other companies.

Dividends

Those who invest in utility companies tend to view them as “widows and orphans stocks” that provide passive income. When those companies grow their dividend payment on a regular basis, it’s a welcome development. SO has increased its dividend for 20 straight years. Although increases have been in the 3% to 4% range, those small increases have added up over time. The dividend has nearly doubled since 2001. Those who reinvest the dividends will see their dividend grow around 7% or 8% if these increases continue. This is the combination of the real increase and the 4.19% yield (as of November 9, 2022).

Those who spend the money they receive from dividends will likely need to count on a lower growth rate, which may not keep up with inflation if it stays near recent levels. However, some income with a less volatile stock price can provide for less stress and a higher level of capital preservation during a recession. A relatively high dividend will go further than a lower one when one needs access to cash. Those who own SO might hold, while those who are looking for a solid dividend growth stock that should hold up well during a recession might consider initiating a position.

Be the first to comment