alexsl

BM Technologies (NYSE:BMTX) is a profitable fintech with an established moat enabling some of the lowest customer acquisition costs in the industry, and it’s trading at a P/FCF of 2.97x. Upcoming acquisition of First Sound Bank will position the company with a national bank charter enabling new ways to monetize their over $2b in deposits. While they have delayed filings and have a delisting notice currently, it’s likely these issues will be resolved in the coming months. With a quarterly earnings call announced for August 16th it could be even sooner.

The thoughtful structure of this business has created huge growth in their deposits which have grown 141% annually since 2019. The bank charter will transform the company’s ability to monetize their deposit base and capitalize further on their growth. Management has indicated they expect to beat consensus EBITDA estimate of $30m in 2022. An EV/EBITDA of just 5x based on the $30m estimate implies a price of $12.22 or 88% higher than today’s prices at $6.50.

With many upcoming catalysts and high short interest it’s possible this name could jump above $10.00 within months if news is positive. I’m setting a 1-2 year price target of $12.22 as my base case with an estimated 20% downside as the bear case.

All calculations are done with BMTX at a price of $6.50.

BM Technologies Company and Business Overview

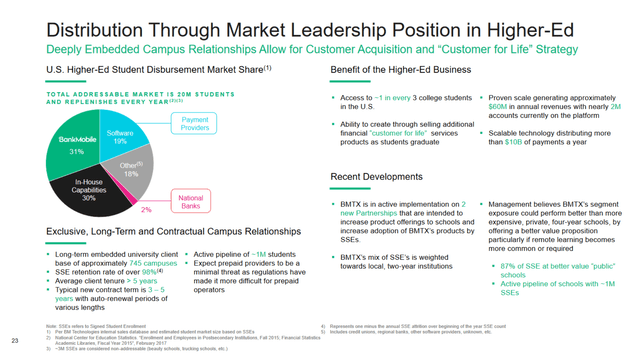

BM Technologies started trading publicly via a merger with SPAC Megalith Financial Acquisition around January 2021. Originally, BM Technologies was created as a subsidiary of Customers Bancorp (CUBI) and was intended to be spun off but went public via the SPAC instead as CUBI was running into Durbin amendment restrictions. The company is a fintech banking platform which enables digital banking and disbursement services through a banking as a service (BaaS) model. I believe BMTX has developed a moat via their higher-ed disbursement services which controls 31% of the market currently and continues to add schools and products.

The disbursement services line supports colleges and universities disburse leftover financial aid to students. Back in 2016, they acquired the student checking and disbursement business of Higher One and have built on that base thoughtfully. BMTX’s technological platform enables more efficient disbursement and support with administrative burdens related to regulations, bookkeeping, and quality assurance. Through this business they process over $10b in disbursements which students can choose to receive via check, wire transfer, or in the form of a BankMobile Vibe checking account. Last year the company processed $13.4b disbursements and $1.8b of those chose to set up a checking account – a 13.43% conversion. These are annual disbursements exposing the company to a new crop of potential deposits every year through the normal course of their profit making disbursements business.

I like this model because it creates operating leverage in their partnerships with schools. One form of revenue comes from the schools themselves: fees paid for the disbursement services provided. Each time another school starts using the service all of their students become another potential customer for BM Technologies given the BankMobile Vibe checking account option. This creates a second stream of revenue for the company and provides a yearly influx of new potential customers in the form of students.

This has a compounding benefit. The more schools BM Technologies services, the greater student population their BankMobile Vibe checking account is offered to. For many, this will be the first banking account they will ever have which creates a greater stickiness in their model. While currently a deposits only company, closing on the acquisition of First Sound Bank will give them a bank charter enabling the company to hold those deposits on their balance sheet by originating loans. These new lending offerings could target their current student base for years to come and create new benefits to their disbursement model.

Management has identified what they are calling “5 Pillars of the BMTX Banking Platform”: banking, lending, advice, crypto, investing and insurance. From the looks of it, they are expecting to capitalize on their student customer base and upcoming bank charter to cross sell many new lines of business.

BMTX IR

With nearly a third of the disbursement market already, 98% retention, and 16 schools added in the last year I think BM Technologies has created a defensible moat in this area which provides a unique low-cost deposit base. With a bank charter the value of that low-cost deposit base can be amplified by generating income on those deposits, and the company clearly expects to expand into that space given their guidance. And this is just one part of their business.

BMTX also operates as a white label banking as a service (BaaS) provider with one major client at the moment. T-Mobile has partnered with BMTX as a turnkey provider for their online banking offering T-Mobile MONEY. The partnership started in 2017 and was renewed for three years in 2020 – February 2023 is the upcoming renewal date which will be material to the company. At one point the company was partnered with Google as well for a similar offering called Google Plex though it was shelved late last year because Google decided not to enter the space.

Beyond T-Mobile, BMTX started a partnership with BenefitHub in 2020 to offer a workplace banking platform. BenefitHub is a service provider for major companies around the world offering them a marketplace of offerings to assemble a customized benefits offering for their employees. As a result of this partnership BankMobile Workplace is part of the suite of offerings included to BenefitHub’s over 100 Fortune 500 companies and thousands of smaller clients. This is a huge amount of exposure for a lightweight digital solution which the company maintains already with likely minimal additional cost.

When Q1 preliminary results were announced and included a note that “The Company recently executed a term sheet with a significant new BaaS partner and expects to finalize a contract over the next approximately 90 days and provide details over the next few quarters.” This is a net positive for the company as it expands the reach of its offerings.

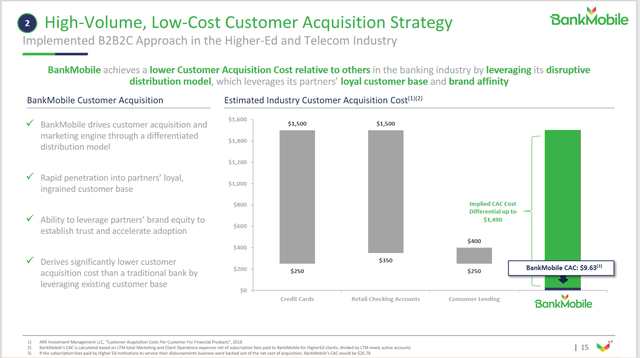

These partnerships with higher education institutions and companies around the world enable one of the lowest customer acquisition costs (CAC) in the market at $9.63. Fellow Seeking Alpha contributor Michael-Paul James highlighted the mechanics of this well in a previous article on the company.

BM Technologies is a leader in the BaaS and B2B2C model. They already work with higher education institutions, lowering their monetary distribution costs by an average of ~$125,000 annually for more than 700 institutions. They expect a 99.7% retention of disbursement services this year.

Their white-label banking has captured underserved segments with branded rewards and unique offerings to increase customer satisfaction and revenue streams for their partners. Workplace banking allows firms to execute financial wellness strategies, both offering interest-bearing accounts and lower fees, garnering greater employee loyalty. Through partnerships, BM Technologies has one of the lowest CAC in the market. CAC can cost up to $1,500 for some financial firms. The average CAC for BM Technologies is $9.63. Both small and large banks alike will struggle to compete at that price point.

This is a massive operating benefit to the company developed strategically around the moat of their higher ed disbursement business model. By building on that core business idea they have expanded their BaaS partnerships providing even more low cost exposure with some impressive results.

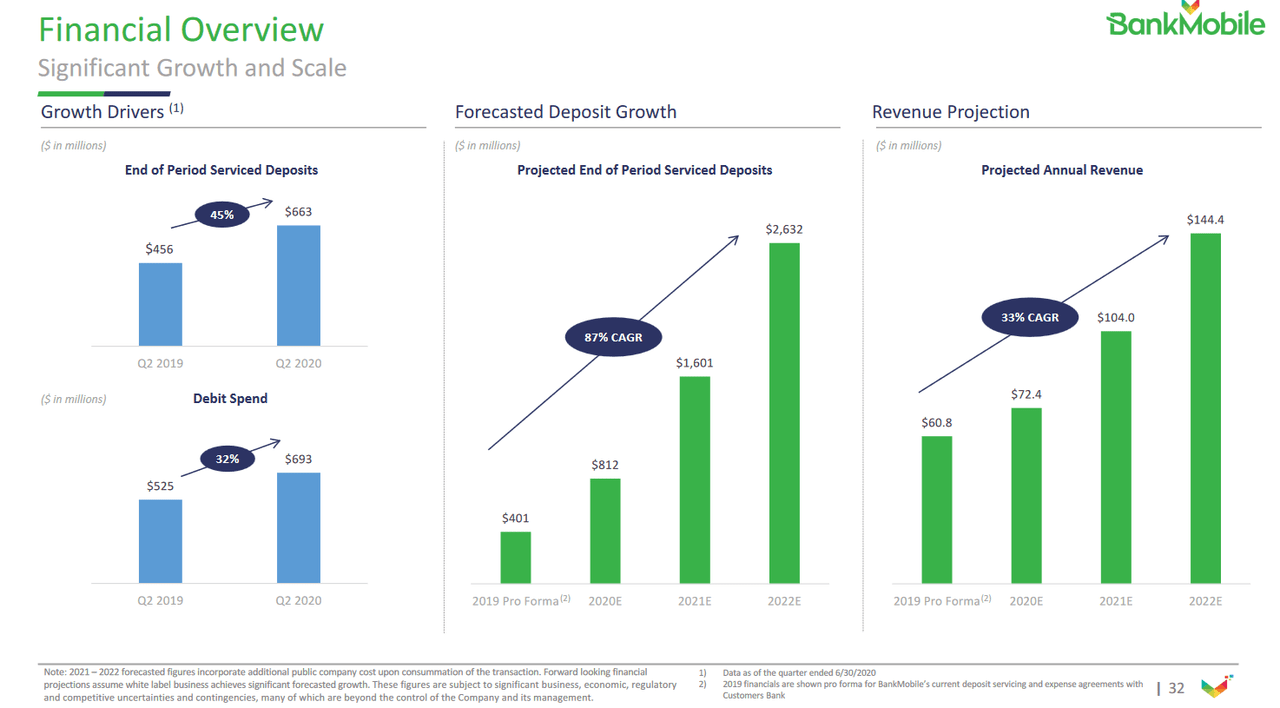

Consider that deposits were $401m in 2019 and Q1 preliminary results had deposits at $2.1b – a 424% increase which translates to 141% annually. Back in 2019 they estimated that end of year deposits for 2022 would be $2.632b which I think reflects management’s understanding of the business. They seem not only on track for that number, but are likely to surpass it.

BMTX IR

Despite a competitive environment BM Technologies seems to have no trouble driving low-cost deposit growth. Their differentiated business model creates a large and defensible moat for the business in how they derive those low cost deposits. And with a bank charter coming soon management will be poised to monetize their deposits in even more ways.

National Bank Charter and The Deposits of BM Technologies

Historically BMTX deposits have not been held on the balance sheet and were instead serviced by partner Customers Bank and their value came through the income statement. Customers Bank paid BMTX a 2.75 – 3% service fee on deposits which given the low interest rate environment at the time was considered a sweetheart deal. In April Customers Bank indicated they would no longer serve as their partner after 2022. The reason given in the filing is at the advent of the partnership it was a profitable model to acquire deposits for Customers but they have since launched a new offering which they believe will drive low-to-no cost deposit growth.

Rather than reflecting anything about BMTX, it’s likely a reflection of each business maturing and changes in the family. The Sidhu family essentially runs both companies. Luvleen Sidhu is the CEO of BMTX and her brother Sam Sidhu recently succeeded their father as CEO of CUBI. The family has decades of experience in the banking industry and both siblings seem keen to carve their own path. What’s notable is Customers Bank’s announcement to not continue partnering with BMTX came subsequent to the announcement that BMTX was acquiring a bank charter.

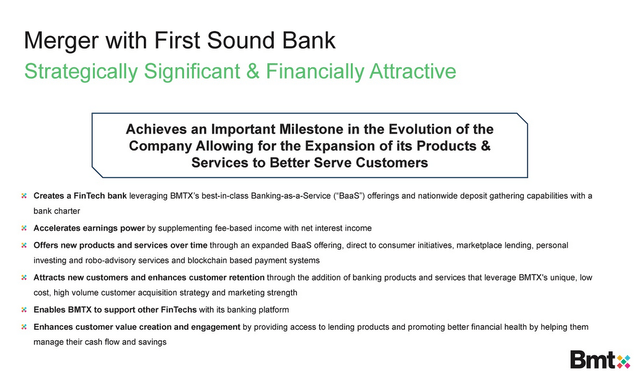

BMTX agreed to purchase First Sound Bank (OTCPK:FSWA) for $23m cash or $7.22 per share in November 2021. As described in the release:

First Sound Bank is a locally owned, independent community bank providing commercial and private banking services to small to medium sized businesses, not-for-profit organizations, entrepreneurs, and professional service firms throughout the Puget Sound market. FSB operates through a single office location in downtown Seattle.

The acquisition is expected to be immediately accretive as FSB is profitable and it positions BMTX with a national bank charter. This is a key asset for the company and is reflective of a trend of fintechs seeking out bank charters which one article headline describes “How Fintechs Buy, Rent and Fight Their Way Into Bank Charters”. The key differentiator with a bank charter is “only banks are permitted to take FDIC-insured deposits from the public and have access to deposits as a source of funding.”

Basically it transitions BMTX from being a company which provides digital infrastructure to support banking like activities to a company that does that and can actually start to handle banking activities directly. One way they can monetize this newfound ability is through student refinance given it’s a population they already work with. Students that choose to receive disbursements through BankMobile could be offered student refinance options considering BMTX would already have insight into their loans given the disbursement information. Coupling that with credit monitoring data from their partnership with Array the company should be able to target credit worthy customers and say, “I see you have a loan with Navient for 7%. Let us refinance it at 5%.”

That’s just one example of the type of lending they could do. Management has indicated interest in credit cards and personal loans as well. When the acquisition goes through, the bank charter will enable BMTX to start monetizing their growing $2b of deposits as a source of funding for whatever kind of lending they choose to pursue.

The purpose of the Customers Bank partnership was a way to monetize their huge deposit base by selling it to a bank with a charter which could use those deposits for lending. The 2.75 – 3% service fee that CUBI paid to BMTX was essentially a share of expected net interest income generated from lending out those deposits. With a national bank charter BMTX will be able to lend out those deposits directly rather than needing a partner. While the partnership with CUBI ending may be perceived as a negative, I think it’s simply a reflection of the evolution of both businesses and should have little impact on BMTX.

While the national bank charter would enable BMTX to lend their own deposits, they still have the ability to partner with other banks to service their deposits as well. How this plays out is dependent upon their capital moving forward which I’ll discuss next, but more information regarding their strategy is likely to come very soon.

The acquisition is expected to close in the second half of 2022. First Sound Bank stock trades at $6.65 currently. There’s an arbitrage scenario here for those interested as the cash deal is $7.22 or 8.57% higher than current prices. With very little risk in the deal failing this may be an area of interest as well though volume for FSWA is low with average 10-day volume of just 2900 shares.

Closing The First Sound Bank Acquisition Caps A Five Year Strategic Process

BM Technologies has been working to position themselves as a public company with a bank charter for years. While under Customers Bank in early 2017 Flagship Community Bank made an offer to buy the BankMobile division for $175m cash. The deal was driven in part by Customers Bank running into limitations regarding the Durbin amendment affecting expected profitability. Customers intended to deal with this by keeping their assets below the $10b mark through divesting BankMobile for an expected $100m gain.

The deal ran into subsequent issues. First, Flagship was unable to raise the capital necessary to finance the deal. To get around this, management at CUBI got creative and developed a spin-off transaction where post-spin Flagship would merge with BankMobile. Then they encountered regulatory issues which essentially killed the merger. Due to an anticipated overlap in shareholders the combined Flagship/BankMobile entity was expected to be a subsidiary of Customers Bank still.

So they terminated the merger in October 2018 and Customers Bank intended to focus on developing their white label BaaS offering further. Megalith Financial Acquisition Corp, the blank check company which brought BankMobile public, priced their IPO in August of 2018 and were ringing the opening bell by October when BM merger was terminated. Why does this matter? Well it turns out that this blank check company was run by Sam Sidhu – Luvleen’s brother.

So even as they terminated the agreement with Flagship the opportunity to bring BankMobile public via the spac was just budding. By May 2020 the agreement was in place between Megalith and BankMobile valuing the latter at $140m. While this brought the company to the public markets they still were missing a vital piece from the Flagship merger: a bank charter.

With the First Sound Bank acquisition it seems we are nearing the end of this five year strategic process to position BankMobile as a public company with a bank charter. From here they will be focused on redesigning their operations with this strategic asset in place.

Some Notes On Bank Capital Requirements

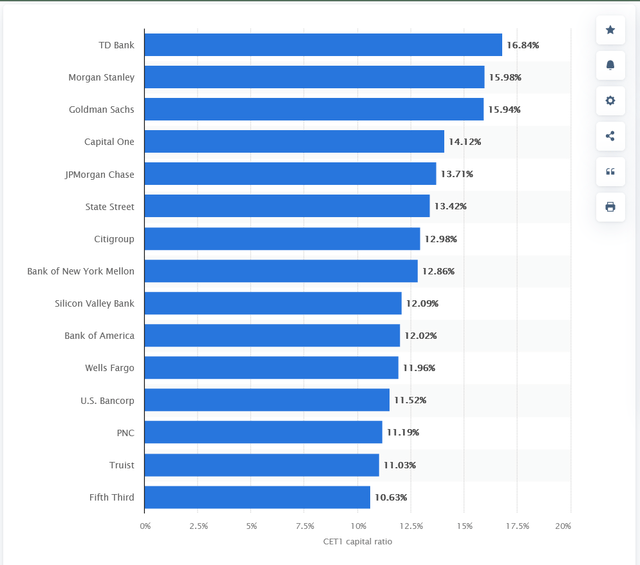

There are additional regulations that BM Technologies will fall under with a bank charter. According to Basel III, an international banking regulatory framework, banks must maintain a total capital ratio of 8% of their risk weighted assets (RWA) with 6% of this required to be Tier 1 capital. This requirement is material for BM Technologies as the acquisition of the bank charter brings them under this regulatory framework.

It’s material in that it prevents the company from immediately rolling all of their deposits into risk weight assets, like loans, which can then be held on the balance sheet. If we consider their $2.1b in deposits, the tier 1 capital requirement if all of this were invested in RWA would be $126m. The company had $30m cash in March and if we assume the acquisition closes for $23m that would leave them net $7m in cash.

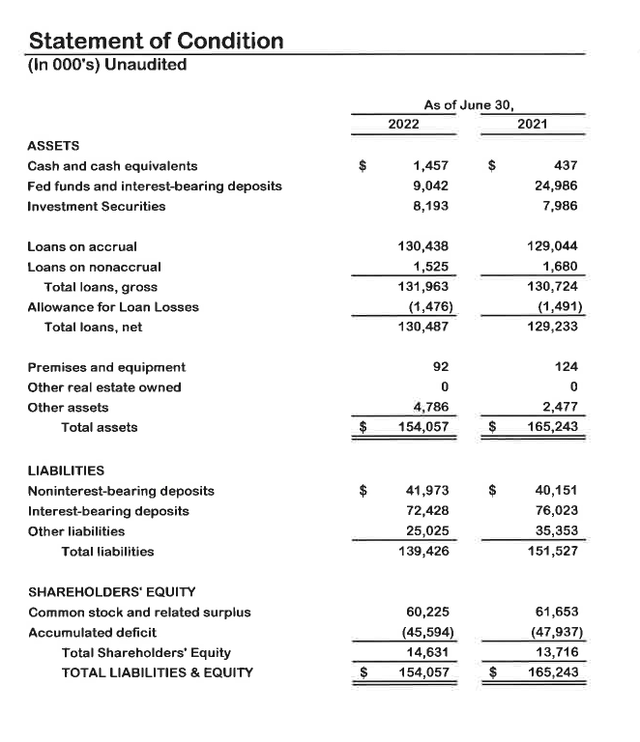

We also need to consider the balance sheet of FSB.

From this we can see that $18.629m of their assets are liquid so we could add that back to the $7m net amount for an estimate of $25.629m in tier 1 capital. Loans on the balance sheet are $130.487m which would imply a tier 1 capital ratio of 19% post closing of acquisition. If this rate stayed at the 19% level they may face criticism that the company is inefficient and holding too much cash, but this would just be the starting point. Once the acquisition is closed they would likely start to deploy more capital and target a lower ratio. If we look at the CET1 ratios of the largest US banks as proxy we could gauge that the average value of 13.10% could be targeted.

To get to that ratio loans on the balance sheet would increase to $195.64m with no decrease in their cash amount. What all this means is that if the acquisition goes through and given some estimates regarding capital, of their $2.1b in deposits they would only be able to bring around $65.12m onto their balance sheet – just 3% of the total. While the company could choose to decrease the ratio to levels below the average of 13.1% even a 10% ratio would only enable $256.29m in loans meaning only $126m of their $2b deposits could be used for lending.

The bank may benefit from continuing to partner with other banks as they did with Customers Bank to hold deposits as they build their capital base. This creates a hybrid model where the company has a couple different options to monetize their deposits base:

-

Partner with other banks to hold the deposits and collect a small % fee. Customers Bank paid a 2.75-3% fee and with interest rates high it’s likely that range is possible for new partners.

-

Invest deposits themselves in loans or other risk weighted assets.

-

Invest deposits in no-risk government bonds. This could be done in excess of the 13.1% ratio rate given these bonds are not considered risk weighted assets.

What’s important in all of this is to note that the company will not be able to immediately roll all of their deposits into investments held on the balance sheet. Regulatory requirements would prevent them from doing so without increasing the amount of capital they have on hand to secure it. It’s possible the company could do another equity raise to increase capital position though I think given the low stock price and the dynamics noted above it’s really not necessary. This is backed up given CFO Bob Ramsey’s comment in the last call “I think one of the way to think about it is we have flexibility in terms of the timing as we onboard deposits and capital we need to raise. We obviously don’t have appetite to raise a lot of capital where the stock sits today, and we have the flexibility to delay or defer and bring the deposits on balance sheet at a more gradual pace.“

BM Technologies Valuation

At current prices of $6.50 and 12.273m shares outstanding market capitalization is $79.77m. Last year’s free cash flow was $26.81m with capital expenditures coming in at only $0.733m. Capital expenditures since 2017 have only been $4.753m as compared to $45.429m in operating cash flow in the same time. This cash flow has been driven in part by the huge growth in deposits which have grown 141% annually since 2019.

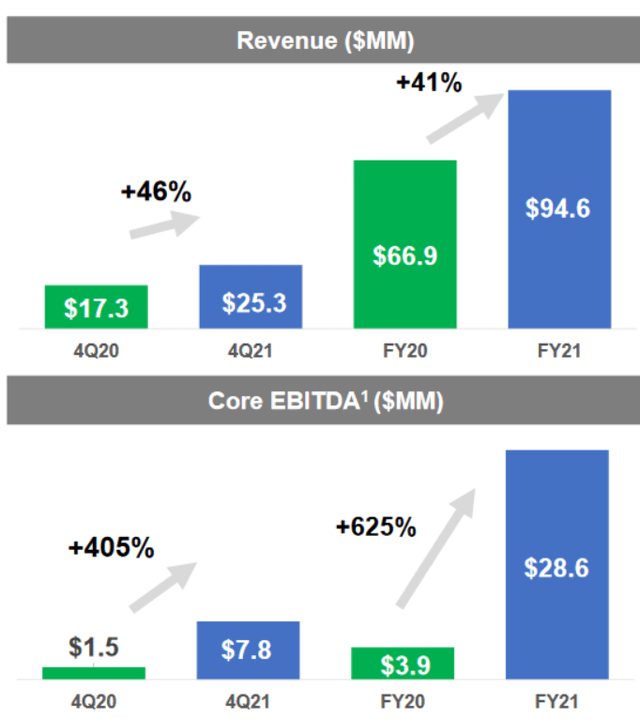

So if we look at P/FCF based on last year’s number it is 2.97. Preliminary results for Q1 “the company expects to report EBITDA in excess of $8 million“. We can annualize this as an estimate which is likely conservative as it assumes no growth and no operating benefits as the company transforms – so we’d get $32m in EBITDA. Cash and cash equivalents were stated to be at $30m and with zero debt that gives BMTX an enterprise value of $49.775m. Using the FY22 estimate above that would imply an EV/EBITDA of 1.56x. 2021 EBITDA came in at $28.612m which means BMTX is currently trading at an EV/EBITDA of 1.74x.

While banks are often valued on P/E I’m using the EV/EBITDA multiple here given the high amount of cash on hand and no debt makes enterprise value more representative of the value overall. Additionally, BMTX in its present form isn’t a bank. It is only once the acquisition with First Sound Bank closes that they will become an official bank at which point it’s likely more reasonable to gauge on P/E and P/B values. At present though given that they do not hold their deposits on the balance sheet they do not generate interest income from them but instead receive a service fee which comes through the income statement.

Earnings last year came in at $5.667m which implies a P/E of 14.07x. The big difference between these earnings and EBITDA is related to two items: stock based compensation and depreciation/amortization. These items were $10.5m and $11.96m respectively last year. The company has been amortizing their banking as a service digital platform which they heavily invested in previously though has minimal capex requirements currently. Stock based compensation is a number I want to keep an eye on moving forward.

We can observe the operating leverage inherent in the company as 41% revenue growth this past year has driven a 625% increase in EBITDA.

Given such low valuation, no debt, and huge catalysts coming to enable growth I think it’s possible we could see high returns as the market starts to understand what is at play. Even an undemanding EV/EBITDA re-rating to 5x would bring the stock price up meaningfully. Management has indicated in their last call that they expect to beat the consensus estimate of $30m EBITDA in 2022. If we use this estimate enterprise value would be $150m or 88% higher than today’s market cap. Given the growth of their deposits and operating leverage I’d say fair value is likely at above 5x EV/EBITDA but I’m setting a fair value proxy here to be conservative.

As the stock appreciates above the $11.50 mark there will be dilution given 23.873m outstanding warrants. If all warrants are exercised outstanding shares will jump 195% to 36.146m shares. The dilution is somewhat mitigated given the capital raised in the process which should be beneficial to the company with the bank charter.

As the company completes the acquisition and more of the deposits are held directly on their balance sheet through lending then it will be likely more appropriate to use P/E and P/B valuation methods. That transformation will happen likely over the next year.

Why Does This Opportunity Exist?

Cedar Creek Partners released a fund letter recently which outlined some thoughts regarding their investment in BMTX. This is where I first found the idea and I think they do a good job highlighting why there is such a mispricing.

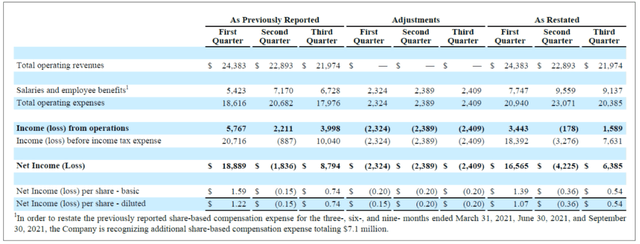

Another issue also came up at the beginning of the year. BMTX had to restate their financials due to how they treated some stock compensation. Previously the cost had been borne by Customers Bancorp, but auditors decided BMTX should have amortized it over calendar 2021 and 2022. BMTX made the adjustment, filed its annual report, and then dismissed its auditors.

Just one of the major issues BMTX faced – needing a capital raise when you are seen as desperate, are associated with a former SPAC, have had an accounting issue that led to changing auditors, and being in the midst of a sharply declining market – would be a challenge. Facing all was a perfect storm. Buyers were waiting for a bottom.

The auditor and stock based compensation issues are of particular note and in their most recent earnings call management announced a restatement of 2021 quarterly filings with an increase of $7.1m to stock based compensation. CEO Luvleen Sidhu started the call with this explanation:

Before we get started, I wanted to also acknowledge that we announced yesterday, a noncash restatement of our financials related to severance awards granted by Customers Bank to certain employees and executives of BMTX in connection with its January 4, 2021, divestiture of BM Technologies. These awards were reported in our company’s filings, but the associated expense was not recognized by BMTX because it was considered an expense of Customers Bank since they made the award.

BM Technologies’ management and Board were not involved in the granting of these awards. However, upon further analysis of technical accounting principles, the company determined that this noncash share-based compensation expense related to these customers bank granted severance awards should be included in BM Technologies’ stand-alone financials. I want to emphasize that this correction has no impact on the company’s previously reported revenues, core EBITDA and cash balance, assets or equity and no impact on the company’s operations or its underlying business fundamentals.

After restating their 2021 quarterly statements they fired their auditor and brought on KPMG in July. The restatement of filings muddied the waters and the delay in current filings hasn’t helped matters. Since late May the company has been in noncompliance with NYSE American listing standards given their late Q1 filing – they have a six month grace period to rectify this. This represents a risk of delisting though I suspect they should be current with filings by the end of September. That should be a huge positive catalyst by lifting the delisting notice and giving investors clarity on current financials.

If we take a look at the information provided during their last call on the expense it seems the impact is rather minimal and I’d say doesn’t materially impact the thesis.

What I will note is that there is a potential risk that as KPMG comes on that they discover other issues which require further restating of financials. There’s nothing particular which suggests this may be the case and the current stock based compensation issue seems to have just been an error, one rectified by firing their previous auditor. Nonetheless the risk exists that there may be more to uncover. We will find out more as soon as this week with their earnings call.

At this point BMTX is 20% above 52-week lows which are all time lows for the company overall. A look at the long term chart shows the downward trend.

It also reveals another feature of this story which we can see in the volatility late last year which caused the stock to jump from trading in the $8.20 range to a high of $15.10. Despite the term “meme stock” being thrown around these days, I’d offer that BM Technologies is actually a meme stock in the traditional sense. What I mean by that is retail investors using the Reddit platform have shared information and discourse regarding BMTX as a short squeeze candidate and a huge growth potential company. You can find examples of this discourse here and here both from around nine months just before the spike.

A highlight of the time was the estimated shares floating around only being about 1.6m and with 808k shares short that implied short interest of 58% in a company that is highly undervalued, no debt, and huge catalysts moving forward. A short squeeze ensued and then many took gains and looked the other way it seems. Of note is that Cedar Creek Partners themselves seem to have bought, sold in that run up, and have bought back in during the current downtrend.

Consider that currently there are 1.2m shares shorted which is 49% higher than at that time. There’s even less to short here with the company below the $8.20 range last time there was a short squeeze. An average of 46.62% of volume in the last thirty days was shorted. That’s definitely created pressure on the stock price.

One short story that I’ve noted is related to a fear of nepotism. Luvleen Sidhu, BMTX’s CEO, is the daughter of Jay Sidhu who is the Executive Chairman of Customers Bank. Luvleen’s brother Sam Sidhu succeeded Jay last year as CEO of Customers Bank. Given the family affairs, some have been worried there may be something awry underneath. From my take it looks like BM Technologies going public provided a way for both of Jay Sidhu’s children to run public companies without competing over succession. What’s more is that Luvleen actually developed and pitched the idea of BankMobile to Customers Bank herself – it’s been her idea from the beginning with support from the family business. I think there’s benefit to the company that the family is well connected and versed in banking.

Failure of First Sound Bank Merger?

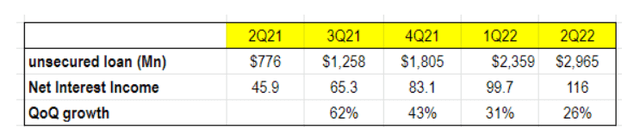

One of the key elements to the thesis and growth of BMTX is that the First Sound Bank acquisition actually closes. Without a bank charter a lot of the growth potentials that I’ve outlined will not be possible. I’ve noted that some think there is a risk here given a fintech merger with a bank, but we’ve actually seen in the last few years a trend of this happening with no issue. LendingClub, another fintech peer, similarly acquired a bank charter through acquisition of Radius Bank in 2020. Since then they have redesigned their business model to leverage the bank charter generating significant quarter-to-quarter growth which fellow contributor Siyu Li highlights in this article. The below table refers to Lending Club’s performance and is borrowed from Siyu Li’s article for reference.

SoFi is another fintech peer which also acquired a bank charter through the acquisition of Golden Pacific Bancorp. In their most recent call SoFi management noted that:

The bank charter could not have come at a better time and the economic benefits are already starting to positively impact our operating and financial results. First, the ability to offer an industry-leading APY and value prop has led to strong growth in SoFi Money members, high-quality deposits and great levels of engagement. Money members have increased nearly 92% year-over-year to 1.8 million accounts and growth in balances has accelerated significantly. We exited the quarter with $2.7 billion in deposits, and spend trends have improved significantly.

The $2.7b in deposits compares to $2.1b of deposits for BMTX in Q1. For reference, SoFi’s market capitalization is $7.2b compared to BMTX at $79.775m. If we consider a market cap to deposit ratio SOFI is 2.66 versus BMTX at 0.038. That’s a reference point for how low of a P/B that BMTX may trade at if their deposits start to sit on the balance sheet.

Given that both Lending Club and SoFi were able to complete their acquisitions I do not see any reason why the much smaller BM Technologies would be prevented from doing theirs. Enough cash is on the balance sheet to fund the acquisition so I expect it to move forward. Once the acquisition is completed the company will have the bank charter capabilities — any issues there would come in the form of regulators preventing the acquisition itself.

Upcoming Catalysts for BM Technologies

The low valuation of BM Technologies is paired with a number of catalysts in the coming months. These include:

-

Having filings current which management indicated should happen within five business days of 8/16.

-

Closing of the First Sound Bank acquisition and benefits of bank charter becoming available. Still on track to close by the end of this year.

-

A new whitelist partner has already been announced but details are likely to be revealed in quarterly filings. Additionally, management had indicated commercial launch early next year with full details likely then.

With all of the upcoming information it’s possible a short squeeze will also occur as the market starts to better understand the story. As filings come current and the acquisition closes, I think the market could rerate the name pretty immediately as these overhangs disappear. The potential benefit of the whitelist partner could be huge as well. Their 8/16 quarterly call highlighted that “this new best partner has global operations and 10s of millions of U.S. customers” which implies a huge new customer base that BMTX may be servicing soon.

If we gauge based on last year’s 32% jump during the squeeze that would imply a jump to prices in the $8.00 range. This short squeeze has the potential to be bigger given the greater number of shares shorter. This isn’t really material to the long term thesis, just something of note that may be at play for those looking to invest.

The acquisition closing is a huge catalyst in that it will enable a whole new suite of product offerings for the company. By leveraging their already established moat in the disbursement world they are poised to unlock significant cross-selling opportunities and expand further.

Finally, I’d say there’s a bonus catalyst of potential Reddit attention again. From my perusing there does not seem to have been much if any interest on the platform since the last short squeeze.

BM Technologies In Summary

It’s not often that a company with the growth potential ahead of it that BMTX has trades at a EV/EBITDA multiple of less than 2. The impact of a down market, de-spacing, auditor issues, and delayed filings has compounded pressure on the stock price. Assuming an EV/EBITDA re-rating to at least five I think is highly conservative. Based on a $30m estimate of 2022 EBITDA and an undemanding 5x multiple I think there’s an 88% margin of safety to fair value implied here.

The company generates huge cash flow, has no debt, has multifaceted opportunities to expand, and maintains an established moat in higher ed disbursements which enables their industry leading low customer acquisition costs. Those features suggest a higher EV/EBITDA multiple than 5x is likely warranted, conservatively somewhere between the 10-15x range. If BMTX re-rated to 10x their 2022 EBITDA estimate the implied return would be 276% in a bull case.

In a bear scenario I’d say the stock could lose another 20% of value indiscriminately or as a result of any negative concerns coming out of updated filings. The upside potential versus the downside seems to represent an asymmetric opportunity to buy what may be a long term compounder.

| Type | Return | Price Implied |

| Bear: continued 20% selloff | -20% | $5.20 |

| Base: EV/EBTIDA rerate to 5 | 88% | $12.22 |

| Bull: EV/EBITDA rerate to 10 | 276% | $24.44 |

Be the first to comment