Torsten Asmus/iStock via Getty Images

Investment Thesis

Bonds have performed poorly since the start of the year due to a spontaneous and aggressive monetary policy recalibration. That said, I believe the prospects of an economic downturn are likely to prompt policymakers in the US to pivot in order to provide accommodative monetary policy to support the economy. While inflation is likely to remain well above the Fed’s 2% long-term target for the next months, weaker demand is ultimately going to have a disinflationary impact. Long term inflation expectations have been decreasing in recent weeks, while the Eurodollar futures curve remains inverted, signaling rate cuts starting in 2023. If the recession scenario coupled with a pivot in monetary policy materializes, I expect investment grade bonds to perform once again as safe-haven assets.

Strategy Details

The Vanguard Long-Term Bond ETF (NYSEARCA:BLV) tracks the performance of the Bloomberg U.S. Long Government/Credit Float Adjusted Index. The fund invests in a basket of long-term investment-grade US bonds.

If you want to learn more about this strategy, please click here.

Portfolio Characteristics

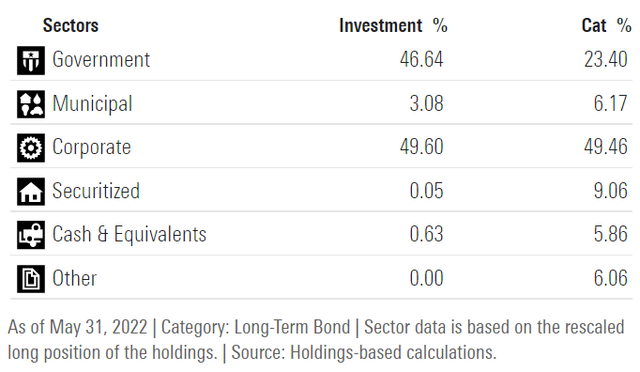

The fund invests in a diversified basket of government and corporate bonds. Corporate bonds represent nearly 50% of the portfolio, while government bonds account for ~47%. The remaining ~3% is invested in municipal bonds.

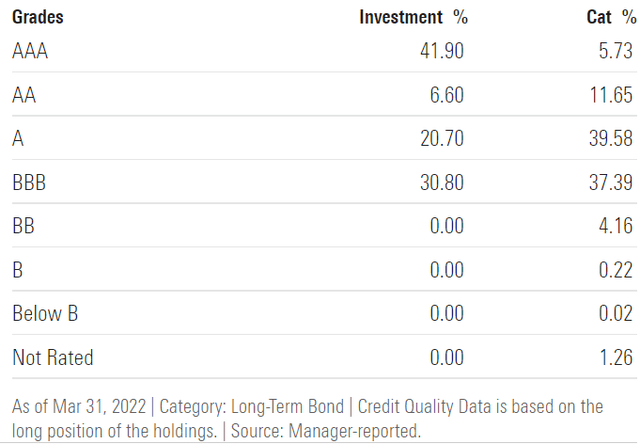

~42% of issuers are rated AAA, which is the highest level of credit quality. Entities and instruments rated AAA demonstrate exceptional credit quality and the lowest expectation of default risk. All issuers in the portfolio are rated BBB or above, which means that BLV invests exclusively in investment-grade securities.

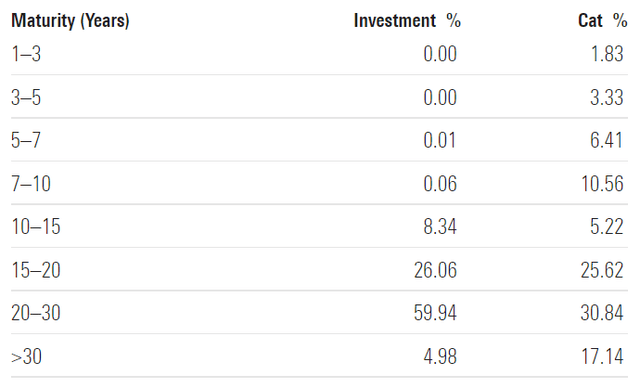

According to Morningstar, the portfolio’s average maturity is ~24 years. The strategy focuses on long-term securities that offer a higher yield.

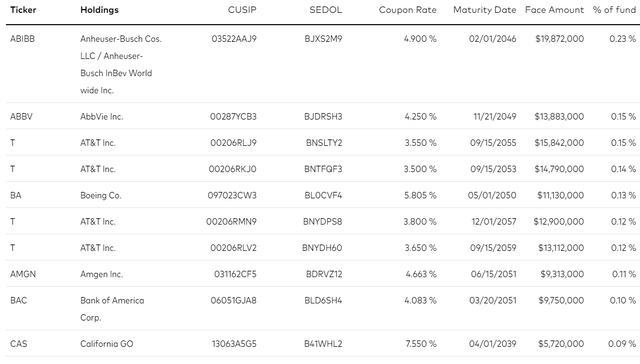

The fund is currently invested in 2,892 different bonds. The top ten holdings account for 1.34% of the portfolio, with no single issuer weighing more than 1%. All in all, BLV is very well-diversified across issuers, which limits unsystematic risk.

Based on data from Morningstar, the fund has an effective duration of ~16, meaning that for each 1% increase in interest rates, the portfolio’s NAV is expected to decrease by 16%. This very high duration is one of the reasons why BLV by more than 20% year-to-date. It’s important to keep in mind that the longer the duration is, the more you will be exposed to changes in interest rates. BLV has a ~3.6% TTM dividend yield, which is definitely higher than a few months ago when the yield was well below 3%.

A Recession Will Force A Bottom in Investment-Grade Bonds

Inflation has been the main culprit for the bond debacle over the last couple of months. In this treacherous market, even investment-grade issuers have been affected by the influence of rising rates, as illustrated by BLV’s year-to-date price action.

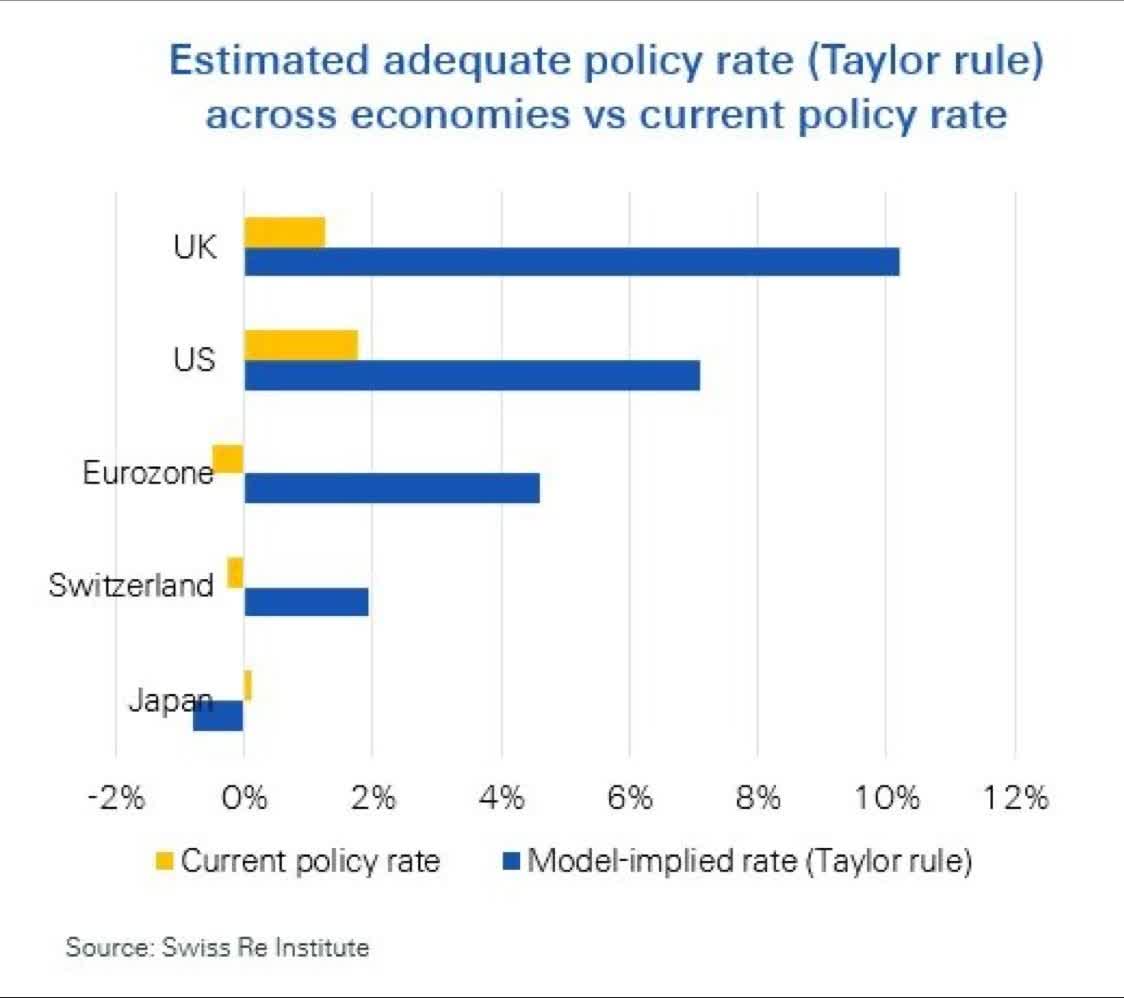

The aggressive pace of rate hikes combined with tightening financial conditions across the economy is incomparable to anything experienced in the US credit market over the last decade. While YoY inflation is now much higher than a year ago, the Fed is trying to step in and lower future inflation expectations, despite some analysts concluding the Fed is still behind the curve. According to the Taylor rule, the Fed Funds rate should be closer to 8% rather than 2%. However, I don’t believe that 8% or anything close to that number is achievable given the high level of both government and corporate leverage and the state of the economy.

Swiss Re

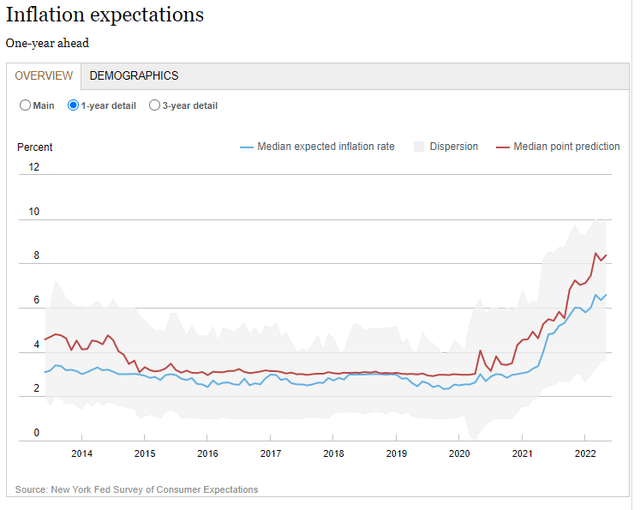

Yet, for many, raising rates closer to 5% over the next 18 months would be something necessary to curb inflation expectations. As illustrated in recent surveys, 1-yr forward consumer inflation expectations are near 8%, which requires a much higher Fed Funds rate than we have presently to tackle this issue.

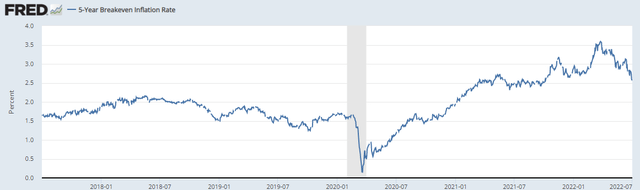

However, the bond market is telling us that inflation is unlikely to be a persistent long-term problem at this point, as illustrated by the declining 5-yr breakeven inflation rate. While breakeven rates across the curve are higher than pre-2020, I believe the market is waking up to the idea that weaker demand will turn out to be disinflationary.

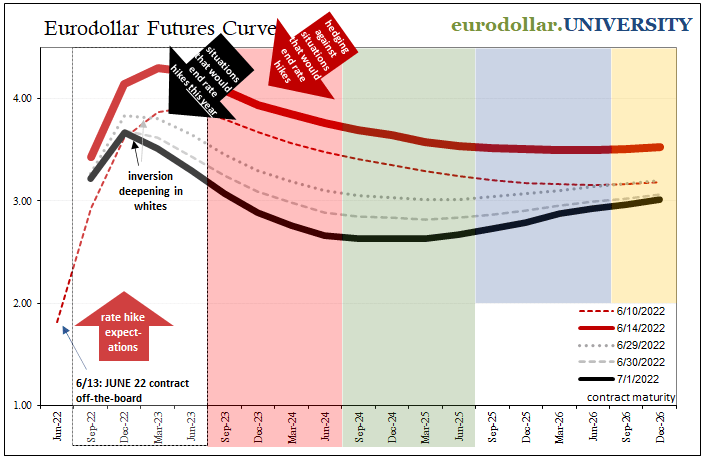

Weaker demand and sluggish economic activity will ultimately lead to a recession. This scenario is illustrated in the Eurodollar futures curve, where we can see that the inversion is deepening at the front-end of the curve. In other words, the market is anticipating a reversal in monetary policy in 2023. Given how high inflation is likely to be by year-end relative to the Fed’s long-term target of 2%, the only reason that will push them to pivot is a recession or a credit event.

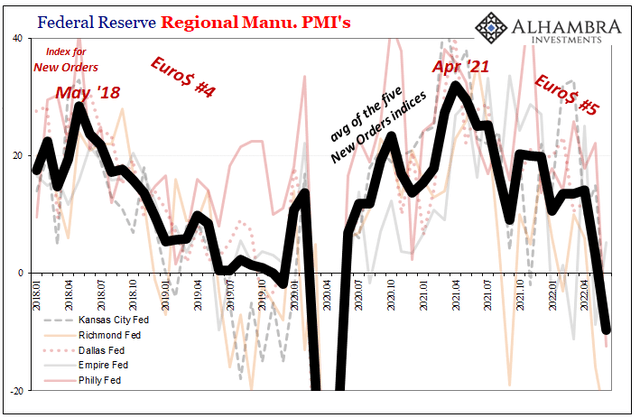

Jeff Snider

Cracks are already appearing in recent economic data such as PMI New Orders, which have been sharply dropping to levels last seen during the COVID-19 recession in 2020. Other areas of concern include depressed consumer sentiment levels and sluggish GDP data.

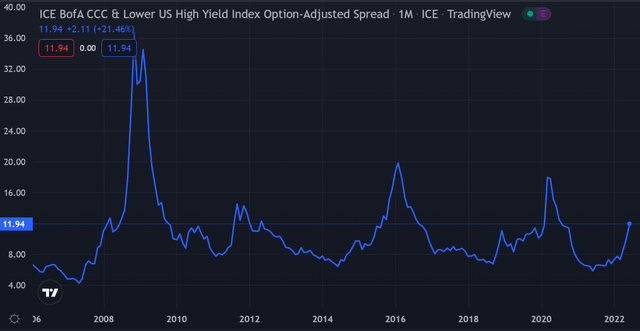

At the same time, credit spreads have been widening, and I expect this trend to persist going forward. The credit market is indicating the odds of a credit event happening in the near future are rising, which should lead to bidding for “safe-haven” assets such as US Treasuries and other investment-grade securities.

Key Takeaways

Bonds have performed poorly since the beginning of the year as a result of a sudden and aggressive monetary policy rebalancing. Having said that, I believe the prospect of an economic downturn will cause policymakers in the US to pivot in order to support the economy. While inflation is likely to remain well above the Fed’s long-term target of 2% in the coming months, weaker demand will eventually have a deflationary impact. Long-term inflation expectations have fallen in recent weeks, while the Eurodollar futures curve has remained inverted, indicating that rate cuts will begin in 2023. If the recession scenario is realized, along with a shift in monetary policy, I expect investment-grade bonds to perform once again as safe-haven assets.

Be the first to comment