Kimberly Delaney/iStock via Getty Images

TerrAscend (OTCQX:TRSSF) is a top vertically-integrated cannabis company operating in the US and Canada. The firm is in five US states, and 10 Canadian provinces and sells 10 premium brands throughout 26 operating dispensaries. TerrAscend is best known for its outstanding senior leadership team headed by Executive Chairman Jason Wild along with President & COO Ziad Ghanem. This, coupled with their deep footprint in fast-growing states, makes TerrAscend one of the most compelling cannabis companies.

History

TerrAscend was founded in 2017 and publicly listed on the Canadian Securities Exchange in May of that year as a Canadian LP. JW Asset Management (headed by Executive Chairman Jason Wild) and Canopy Growth (CGC) made an initial investment in TerrAscend of 52.5 million in December of 2017. The following year the firm pivoted to the US market and began building out its operations in what would become key limited-license environments.

In December of 2018, they were awarded a New Jersey vertically-integrated license – a market that finally began adult-use sales in April 2022. Months later they acquired an award-winning chain of dispensaries in California called Apothecarium and in the fall of 2019 acquired Ilera Healthcare to establish a presence in Pennsylvania.

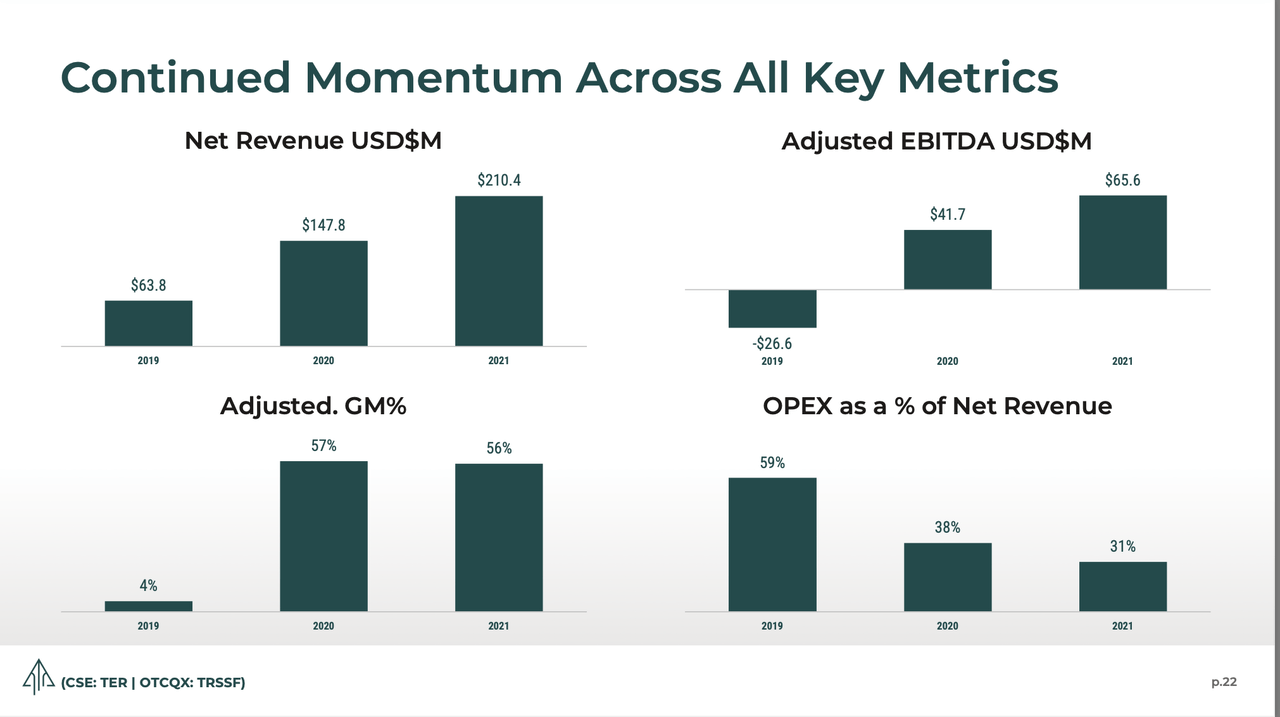

In late December 2020, they closed on $140 million in debt financing and followed this up by raising $175 million in a private placement one month later. This cash was put to use in opening additional Apothecarium stores and acquiring KCR dispensaries in Pennsylvania and a grower/processor in Maryland called HMS. By Q4 2021, TerrAscend was doing over $210 million in quarterly revenue, $65 million in Adjusted EBITDA, and had over $79 million in cash reserves.

In March of 2022, TerrAscend completed its acquisition of Gage, a leading vertically-integrated operator focused on the Michigan market. Most recently, New Jersey began allowing adult-use sales on April 21st, 2022 and TerrAscend is capitalizing on its licenses secured back in 2018.

Today, the stock rates on the Canadian Stock Exchange (CSE) under the ticker TER and TRSSF on the US OTC Exchange.

Leadership

One of the most important components of any multi-state operator is the management team. We are still very early in the cannabis growth story and the decisions made today by senior management will alter the company’s prospects three, five, and even ten years from today. For example, TerrAscend was awarded a New Jersey license almost four years ago and this is finally paying big dividends as the medical market finally flips to recreational.

Jason Wild is Executive Chairman of TerrAscend and also President and Chief Investment Officer of JW Asset Management, a $2 billion money manager. Jason began his career as a pharmacist, which trained him to find outsized opportunities in the healthcare industry. Jason started his first fund in 1998 with $100,000 in assets. Today, JW Asset Management oversees more than $1 billion.

Ziad Ghanem is the other key piece of the senior management puzzle. Ziad was most recently President of all markets at Parallel, a private US multi-state operator. Prior to this, he spent 15 years in senior positions at Walgreens Boots Alliance (WBA). Ziad holds a Doctorate of Pharmacy from the University of Houston.

Footprint

TerrAscend’s footprint spans five US states, along with select assets in Canada. The US markets tend to be large states, with an emphasis on medical markets moving to adult use. Within the open-license adult-use states, they focus on premium products and locations. This emphasis on premium products and locations, along with limited-license environments provides higher margins and greater differentiation as competition increases.

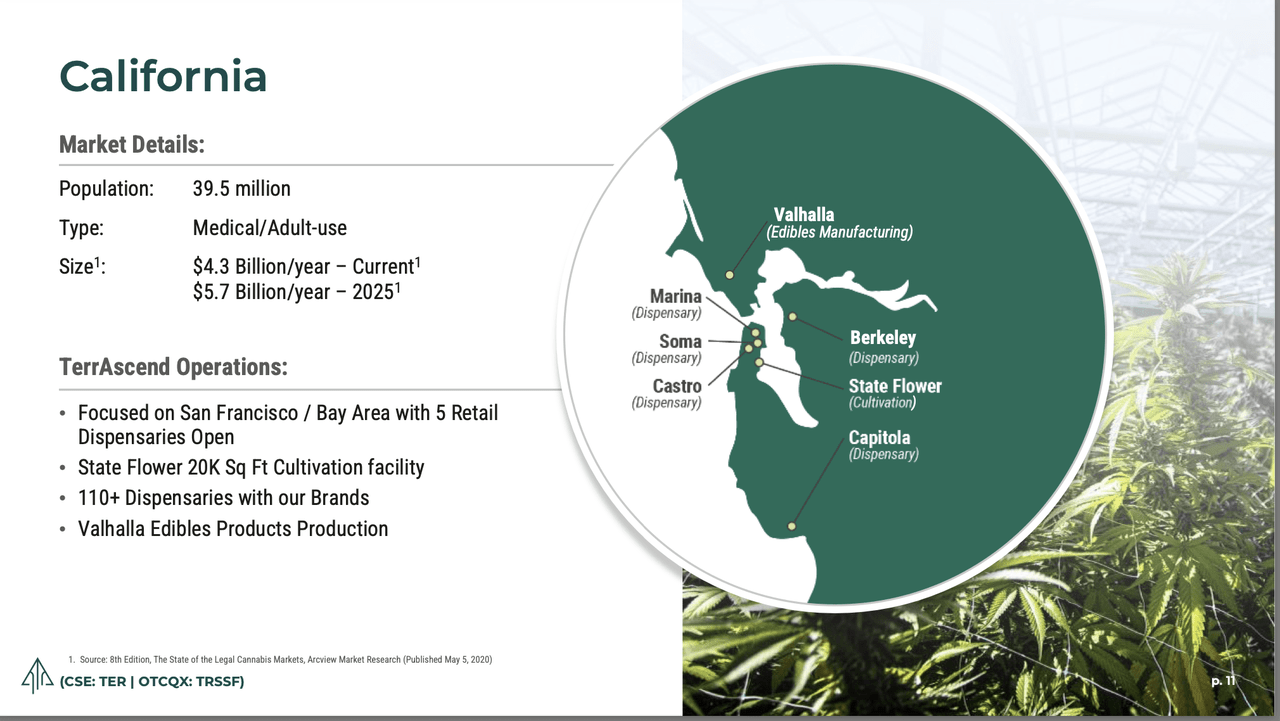

California

California is a massive adult-use market. It is known for innovation, high taxes, and a thriving legacy market. The thing not to do in California is own dispensaries in crowded markets and produce undifferentiated products. This plan is proving to be a death sentence, especially for smaller, less-capitalized operators.

TerrAscend is well-positioned to fight these dynamics. Their retail is concentrated in the Bay Area, with exceptional locations in San Francisco, Berkley, and Capitola. The flagship Castro location in San Francisco was named the best-designed dispensary in America. Friends in San Francisco routinely tell me Apothecarium is their favorite store.

They also have State Flower cultivation in the Bay Area. These are top-shelf genetics grown in a state-of-the-art indoor facility. I tried to locate a 1/8th to review, but I could not find State Flower in my area. Given that it is a smaller 20k square foot facility, perhaps most of the output goes to the Bay Area stores.

The final piece of the California puzzle is Valhalla edibles. These are also produced in the Bay Area, providing a tight network of vertically-integrated assets. I know first-hand that California is an extremely competitive market and I believe TerrAscend’s approach is among the most intelligent means of serving and ultimately thriving as the state becomes a more profitable market.

TerrAscend May 2022 Investor Presentation

Michigan

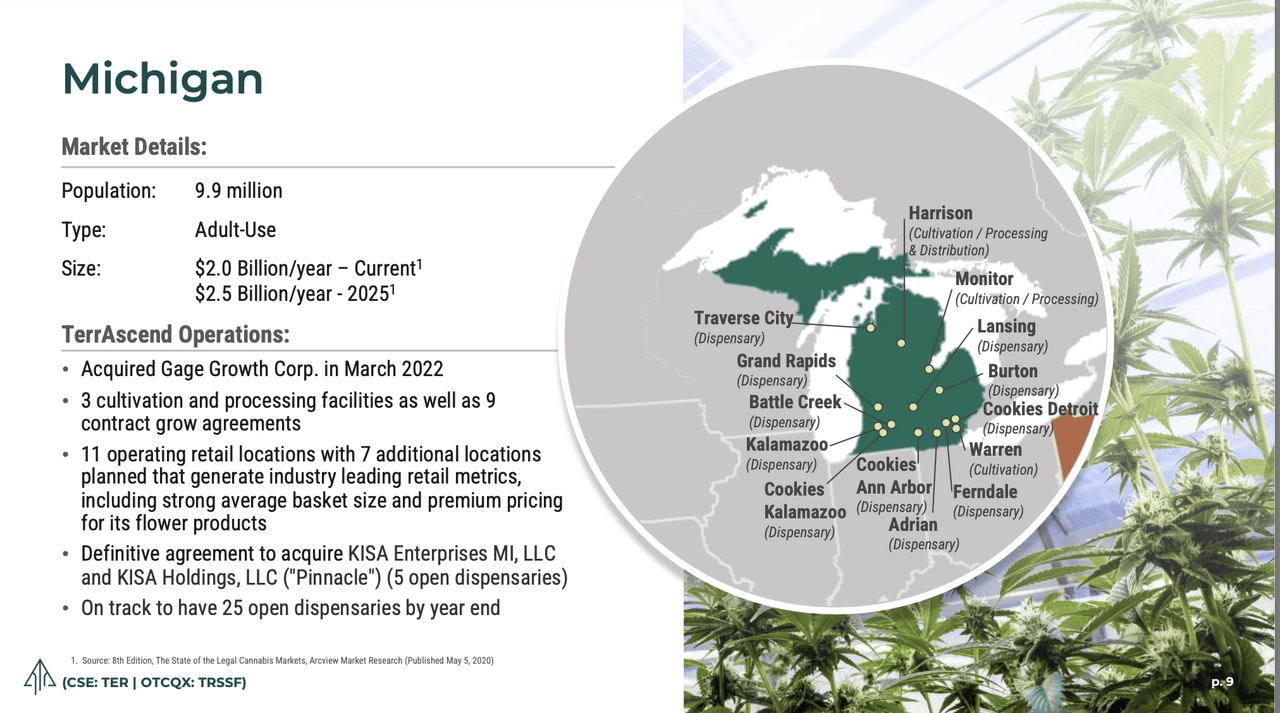

Michigan is the third-largest cannabis market in the United States (behind California and Colorado). Similar to California, it is an open-license state and highly competitive. TerrAscend gained access by purchasing Gage Growth Corp. in March 2022. To learn more about this transaction and the Gage business, please watch my CEO Interviews episode with Jason Wild and Gage CEO Fabian Monaco.

Similar to how TerrAscend is tacking the California market, Gage focuses on premium products and locations. They have an exclusive retail partnership for Cookies in Michigan. Gage specializes in top-shelf small-batch hydroponic indoor-grown flower. Thanks in part to Cookies, they are also known for having the hottest strains on the market. I routinely hear that when new strains drop there are lines around the door and consumers flock from across the state to grab the new thing.

Gage has 11 operating dispensaries with seven more on the horizon. In addition, they are slated to acquire KISA Enterprises and KISA Holdings, which will bring their retail footprint to 25 stores by year-end. This includes three Cookies stores located in Detroit, Ann Arbor, and Kalamazoo. Gage stores have higher-than-average revenue and big basket sizes. This is likely due to the focus on the high-end flower and trendy genetics, including the exclusive Cookies cuts.

With a population of 10 million, Michigan is a big opportunity for TerrAscend, with plenty of competition from the legal and traditional markets. The focus on premium products, densely populated locations, and the Cookies partnership make them well-positioned to survive and thrive.

TerrAscend May 2022 Investor Presentation

Pennsylvania

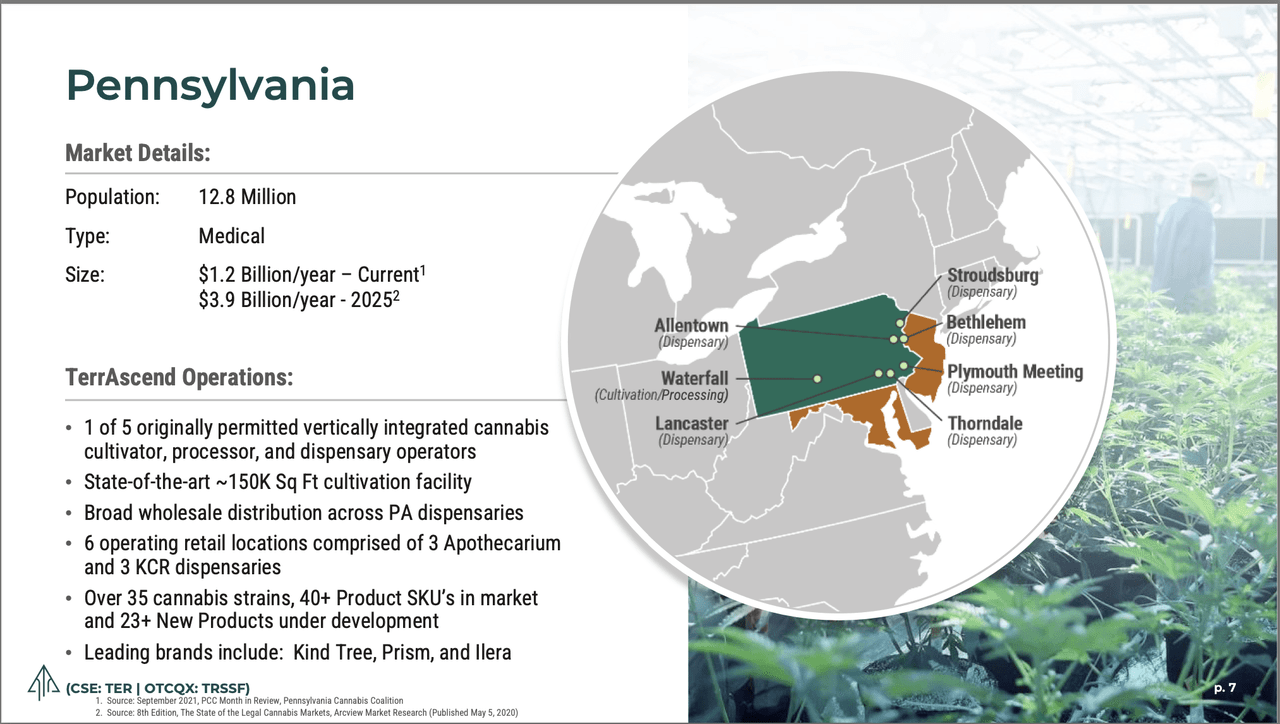

Pennsylvania is a massive medical market. It’s a big state with almost 13 million people and did 1.2 billion in medical cannabis sales in 2021. The East Coast has just started transitioning from medical to adult-use sales. New Jersey was first to flip, and Connecticut and New York are slated for later this year (or possibly Q1 2023, as things tend to get delayed in our industry).

Pennsylvania is in that next wave of states that will be soon making that transition and entering the cannabis investing sweet spot — limited-license medical markets flipping to adult use. Arcview Market Research expects this to be a 3.9 billion/year market in 2025.

TerrAscend is one of five vertically integrated MSOs in Pennsylvania. They have a beautiful 150k square foot cultivation facility and six retail locations split between Apothecarium and KCR branding. Vertical integration leads to higher margins (as you capture the distributor markup) and gives you greater control of the supply chain.

Their large cultivation facility grows enough flower to feed the Pennsylvania wholesale market as well. In total, TerrAscend offers over 40 SKUs and they have more than 23 additional products under development.

TerrAscend May 2022 Investor Presentation

Maryland

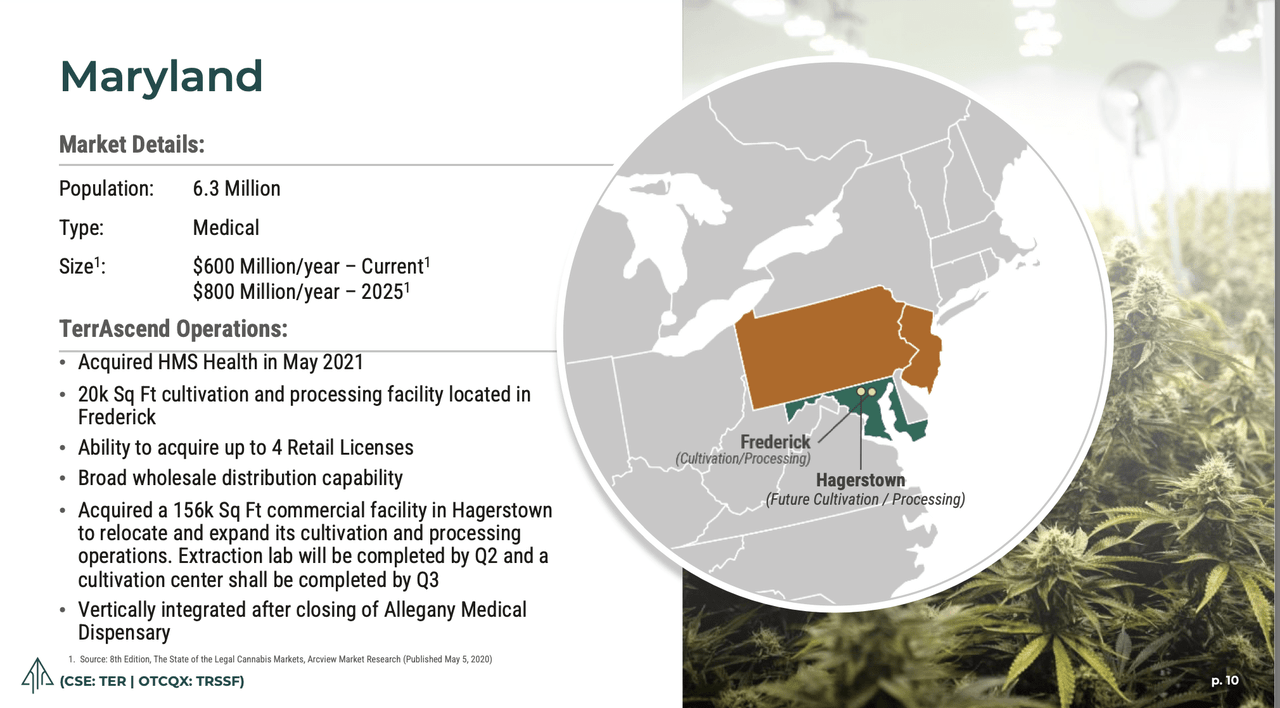

Maryland is another attractive East Coast medical market moving toward adult-use sales. The state has over six million people and does approximately $600 million annually in medical cannabis sales. TerrAscend entered the market in 2021 by acquiring HMS Health and is still building out its presence.

Currently, they have a small 20k square foot cultivation and processing facility in Frederick and are vertically integrated via their Allegany Medical dispensary. Cultivation is set to expand as they acquired a 156k square foot facility in Hagerstown. This new cultivation and manufacturing facility is being built out and TerrAscend expects to have the extraction piece done in Q2 and cultivation the following quarter.

Once completed, the new Hagerstown facility will bolster its wholesale opportunities with both flower and extracts. TerrAscend can also acquire up to three more stores to fill the four-store cap. The combination of expanding cultivation, producing extracts and the potential to quadruple their retail makes Maryland an exciting market over the next several years.

TerrAscend May 2022 Investor Presentation

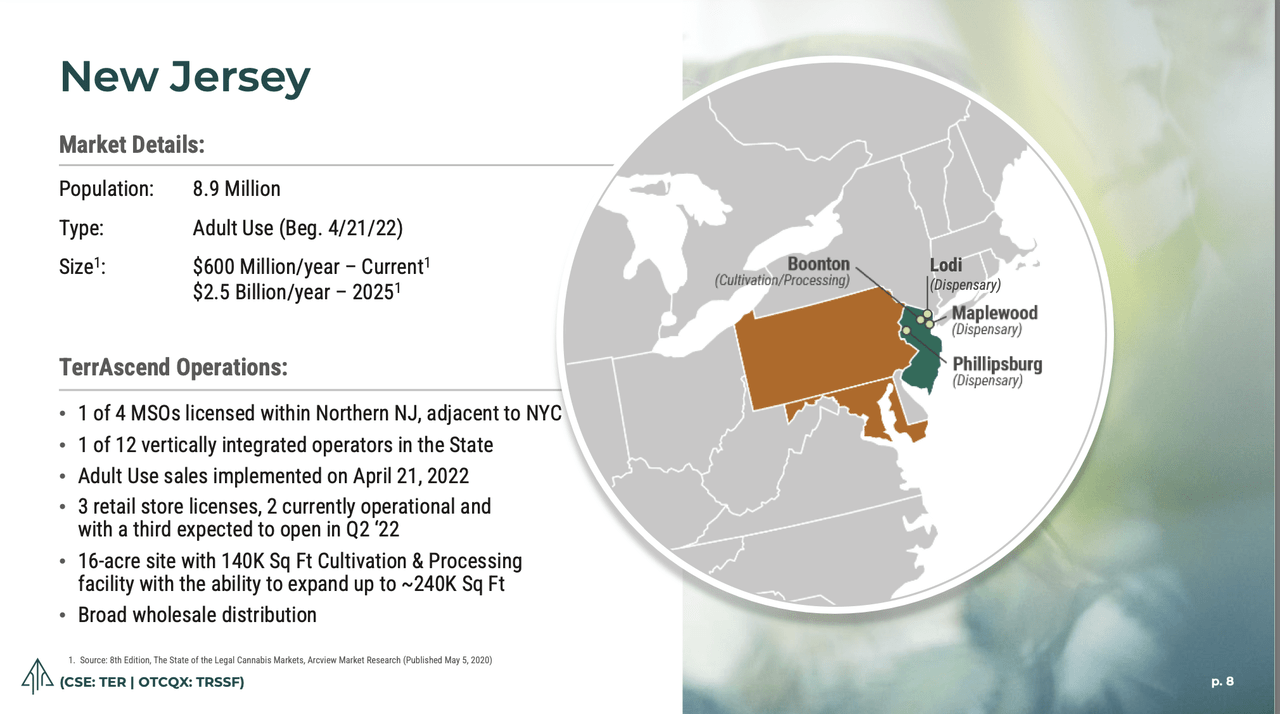

New Jersey

New Jersey is the most exciting market in 2022 and TerrAscend has excellent assets in The Garden State. TerrAscend acquired New Jersey licenses back in 2018 and the investment is starting to pay off. They have three stores (NJ has a three-store cap) along with a 140k square foot cultivation and processing facility with the ability to add another 100k square feet. This will allow them to feed their three busy stores and be a leader in the wholesale market.

TerrAscend’s dispensaries are in Northern New Jersey, which puts them close to New York. Thanks to the limited licenses in New Jersey and prime locations, these stores have the potential to do $30-50 million in annual sales.

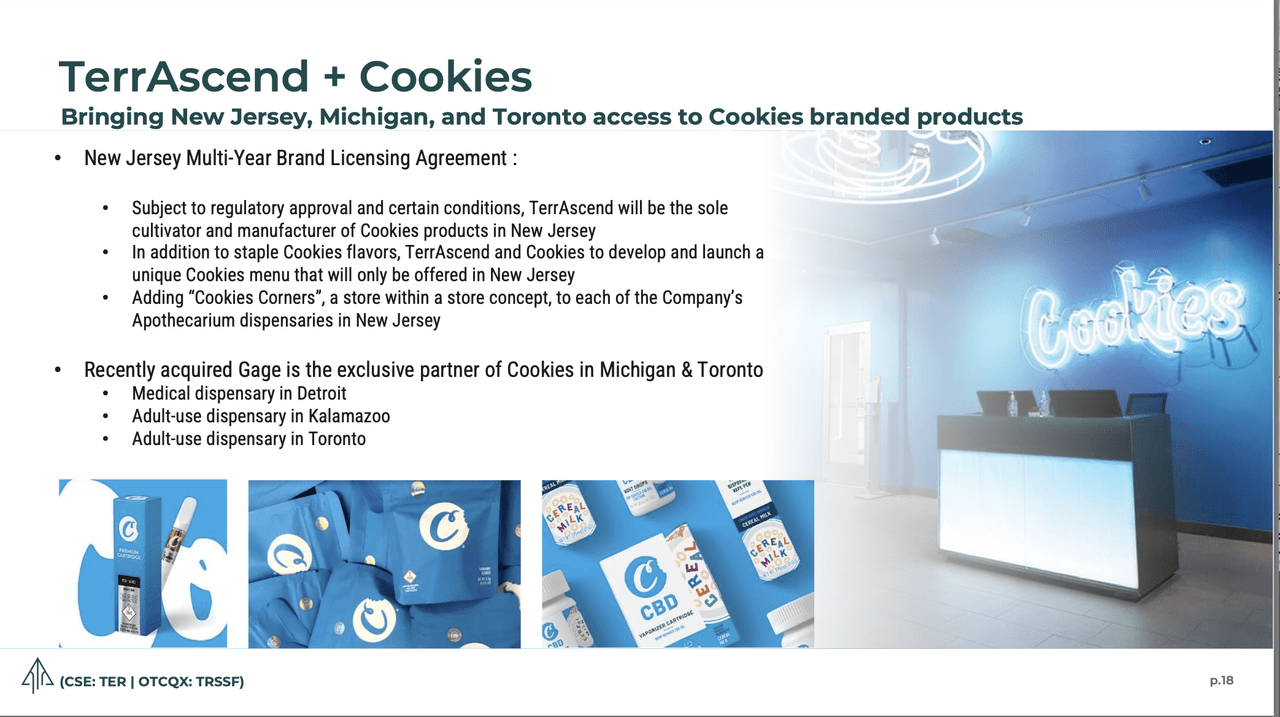

TerrAscend has the exclusive right for Cookies branded products in New Jersey. Each Apothecarium dispensary will have a “Cookies Corner”, a store within a store concept to feature the products. Cookies crush in all markets, but I believe their splashy style and top-shelf products are an ideal fit for New Jersey.

TerrAscend May 2022 Investor Presentation

Canada

TerrAscend also has roots in Canada. This is an unlimited license adult-use and medical market serving a population of over 37 million people. Corporate headquarters are in Mississauga, Ontario and they also have a 45k square foot cultivation facility.

They have a flagship Cookies store in Toronto. The Gage acquisition gave TerrAscend exclusive rights to Cookies in Canada. This opportunity is expected to drive growth in the Canadian market.

I’m not a big fan of the Canadian market. It’s smaller than California and is overbuilt. This has led to lower margins and slowing revenue growth for most operators. I am pleased Canada is not a major market for TerrAscend and feel their Cookies exclusive is the right way to compete in a saturated market.

TerrAscend May 2022 Investor Presentation

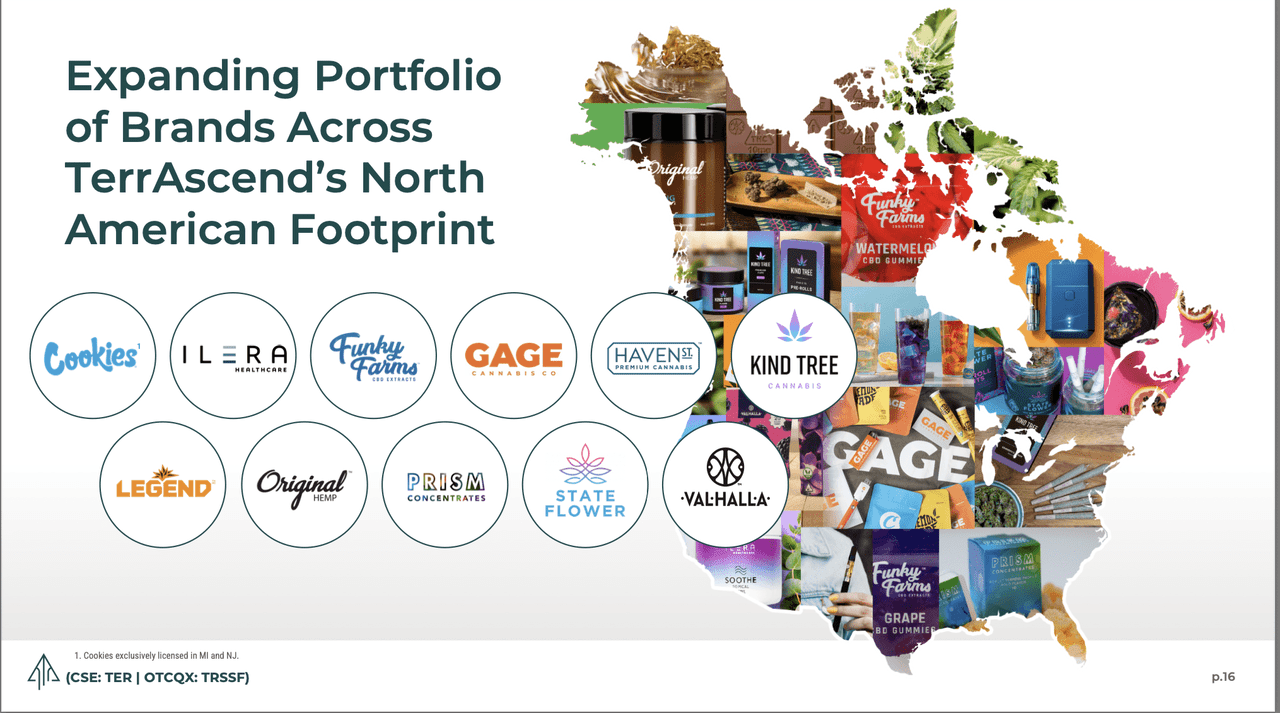

Brands

Similar to Verano (OTCQX:VRNOF), TerrAscend focuses on premium products and higher-end brands. This tends to lead to bigger basket sizes and higher margins. This is most apparent in their flower line where they have Cookies, Gage, Kind Tree, and State Flower. TerrAscend has a number of other brands that span CBD, concentrates, cartridges, pre-rolls, topicals, and edibles. Below is a list of their full roster.

TerrAscend May 2022 Investor Presentation

The Cookies relationship is the most interesting piece of the puzzle. Cookies is the most recognizable brand in cannabis. It was founded by the rapper named Berner and pioneered cherished cultivars including Girl Scout Cookies, Cherry Pie, and Gelato. TerrAscend has the exclusive partner of Cookies in Michigan, New Jersey, and Canada. For these 56 million people, the only way to get legal Cookies is through TerrAscend.

TerrAscend May 2022 Investor Presentation

I believe Cookies relationship, Gage acquisition, and the Apothecarium chain of dispensaries are among the reasons TerrAscend has historically traded at a premium to industry peers.

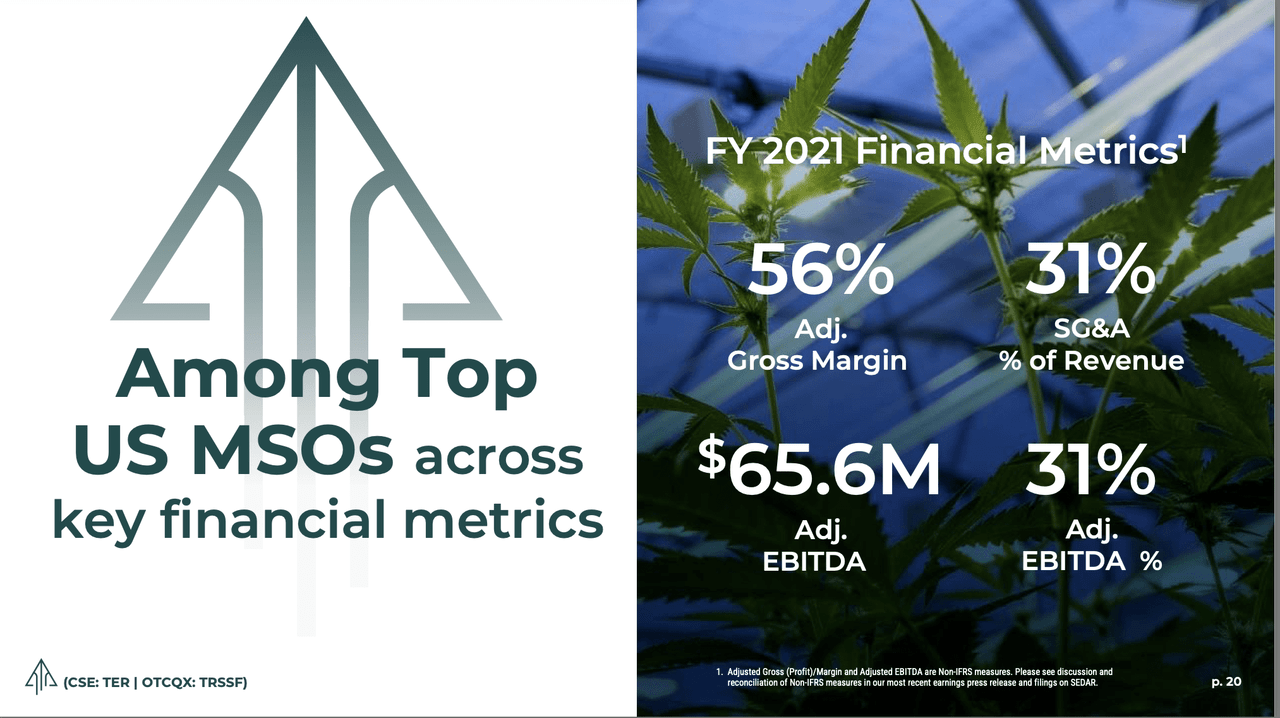

Financials

TerrAscend is well-positioned financially. Their adjusted EBITDA margins are slightly lower than the tier-one average of 34%, but we should see a significant shift over the next couple of quarters. This is primarily due to New Jersey’s opening and new states typically have the highest margins. FactSet consensus estimates for TerrAscend in 2023 are $177 million, which is more than double the 2022 forecasts. Here is a summary from full-year 2021.

TerrAscend May 2022 Investor Presentation

Below is a look at how key metrics have improved over the last three years. TerrAscend is not including 2022 or 2023, and this is where they are seeing the most meaningful growth. Not only are new states turning on, but also CAPEX from prior years will pay off.

TerrAscend May 2022 Investor Presentation

I would keep an eye on margins, as we are seeing compression across the industry as it matures. Theoretically, TerrAscend’s focus on premium products and key assets in limited license states should offer them protection. I would also monitor political progress in Pennsylvania and Maryland. When these markets move to adult-use sales, it will be a big boost to their sales.

Finally, TerrAscend does not have anysale leasebacks. This is a common financing tool in the cannabis industry where the owner of an asset (like a cultivation facility) will sell it to a financing provider and then lease it back at an agreed-upon rate. While these deals can be a relatively easy source of capital, they are often at 12-14% interest rates, making them less than ideal.

Valuation

To evaluate TerrAscend’s valuation, I compared it to the ten largest US cannabis stocks. TerrAscend is currently the sixth-largest MSO. While TerrAscend is cheap relative to the vast majority of stocks outside of cannabis, within the cannabis universe it is expensive.

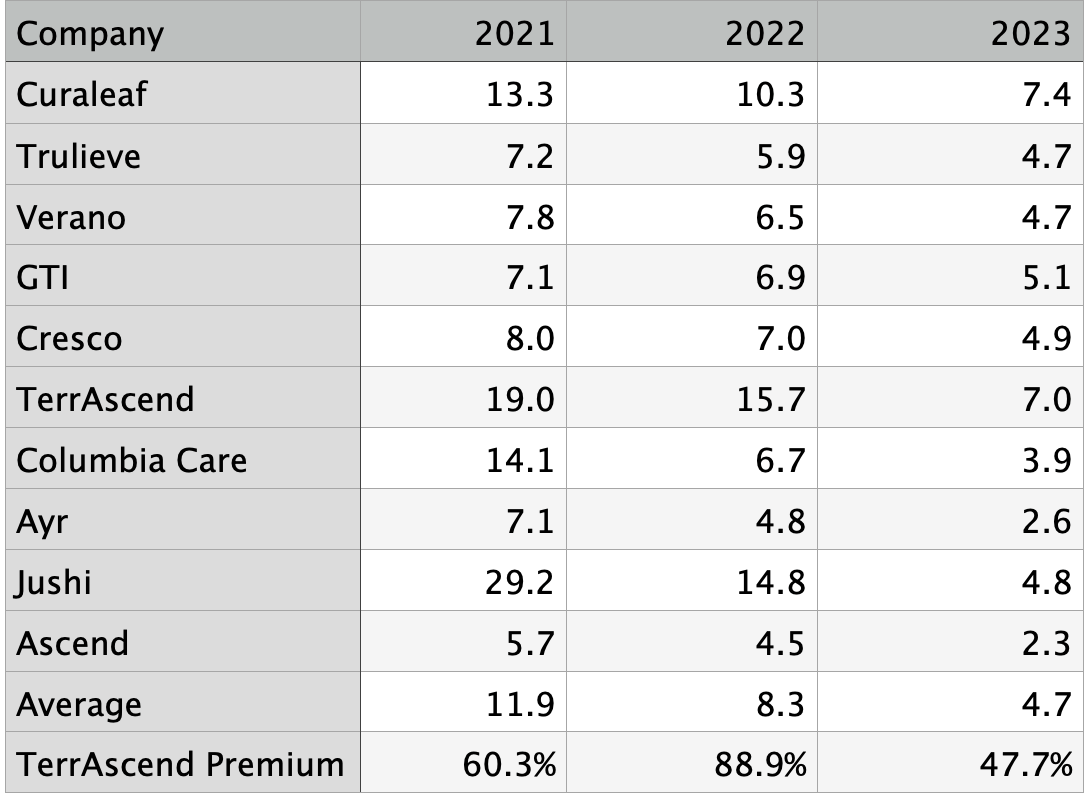

Enterprise value to adjusted EBITDA is the first perspective. The market tends to look at least six months ahead, so I give the most weight to 2023 estimates and TerrAscend is 48% more expensive than the average. Curaleaf is the only one trading at a richer multiple.

Enterprise Value / Adjusted EBITDA

FactSet data as of 06/24/22

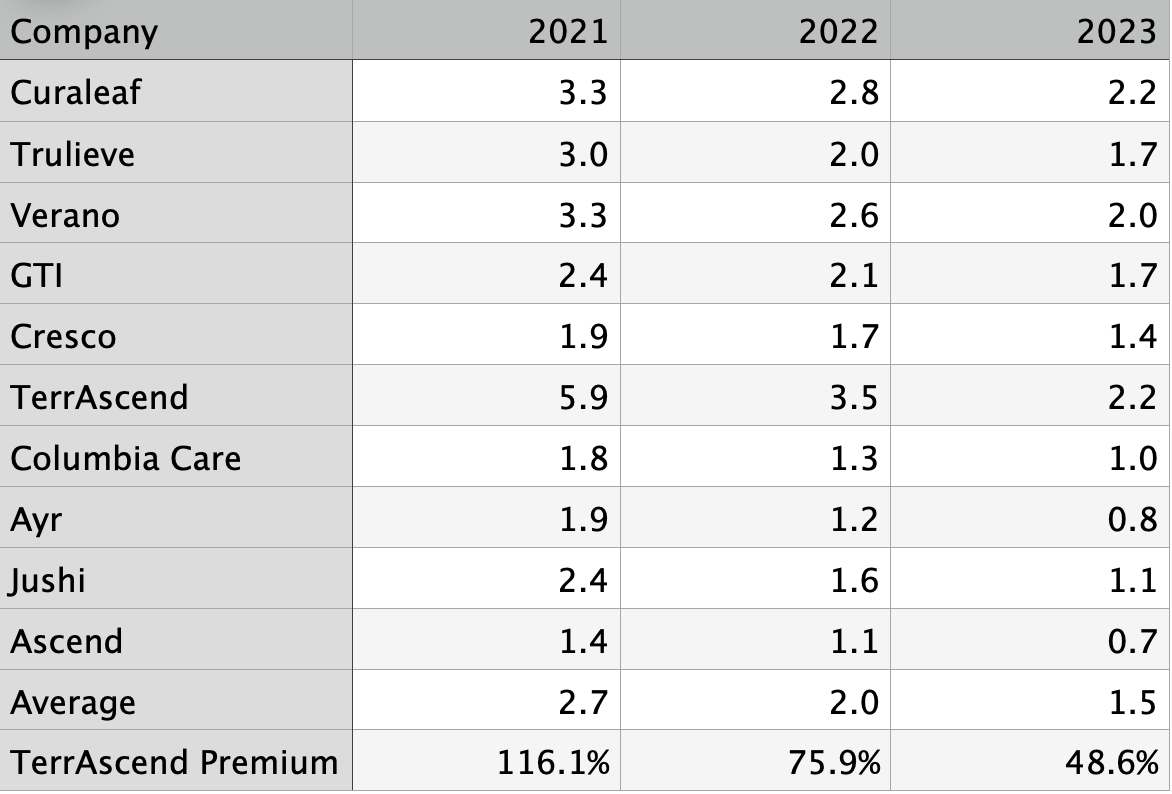

Next, I evaluated enterprise value to sales. In this comparison, TerrAscend commands a 49% premium and is tied with Curaleaf (OTCPK:CURLF) for the most explosive valuation. Note in both cases the TerrAscend premium is diminishing as we got further out on the calendar. Depending on the timing of new East Coast markets going adult use, these numbers could change meaningfully going out to 2024 and 2025. But, for now, TerrAscend looks expensive by both valuation metrics.

Enterprise Value / Sales

FactSet data as of 06/24/22

Conclusion

TerrAscend is one of my favorite businesses. I like the footprint, premium products, and strong balance sheet. More than anything, I feel their senior leadership team of Jason Wild and Ziad Ghanem are as good as any MSO management. On a how much do I like the company basis, TerrAscend is at the top of my list.

The stock is cheap compared to most names outside of cannabis. 2.2x 2023 sales and 7.0x 2023 adjusted EBITDA are compelling valuations. Especially considering sales are growing at more than 50% annually. Investors with a 3-5-year time horizon will likely do well by scaling in and harvesting the long-term gains.

However, I feel there are more attractive cannabis stocks. TerrAscend is almost 50% more expensive than the average for the top ten MSOs based on 2023 numbers. Compared to Ayr and Ascend, which also have significant leverage to New Jersey, TerrAscend is even more expensive. TerrAscend is a higher probability bet than Ayr and Ascend, but the valuation gap is too large.

Bottom line: relative to almost everything outside of our badly beaten up space, TerrAscend is a screaming buy. It’s possible that the valuations narrow and I would be keen to enter TerrAscend at the right price. However, there are even cheaper prices on similar-enough quality cannabis companies. TerrAscend is an excellent business and is worth a premium over most other MSOs, I just can’t get comfortable at the current levels.

Disclosure: As of 07/01/22 I am not invested in TerrAscend and I was not compensated to write this report.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment