Kobus Louw/E+ via Getty Images

The medical technology industry can be incredibly lucrative for companies that create groundbreaking advances that can be effectively monetized. This is true across the medical spectrum. But at the same time, this space is fraught with risks. Approval times for new technologies can take years, on top of the years required to create said technologies. This results in significant costs and there’s always the risk that some other player might come along with a superior technology in the meantime. For companies that are in the early stage of life and that really focus on one or two core products, this risk can create some very binary outcomes. A great example of this can be seen by looking at Nano-X Imaging (NASDAQ:NNOX). In recent months, the company has seen its share price soar higher as management has reported some revenue generation. There are also claims by management that a significant number of shipments of their offering will eventually take place. At the same time, however, the company is still a dubious prospect from a fundamental perspective and there are significant questions regarding whether or not management can pull off what they claim they can.

A complicated picture

Back in March of this year, I wrote an article discussing the investment worthiness of Nano-X Imaging. At that time, I mentioned the fact that the company had not really generated any revenue and I stressed the problems that its large and growing net losses and cash outflows posed investors in the long run. Ultimately, I ended up acknowledging that the business was a binary prospect that would either rise significantly in price or decline precipitously. At the end of the day, this led me to rate the business a ‘hold’, reflecting my belief that the risk-to-reward ratio was more or less in balance. Since the publication of that article, things have actually gone quite well for Nano-X Imaging. Shares of the company have risen a tremendous 52.2%. This compares to the 7.4% decline experienced by the S&P 500 over the same timeframe.

Based on this massive upside, you might think that some fantastic event has taken place. But at the end of the day, what we have seen has been fairly unremarkable. For starters, let’s touch on the good news. And that is that the company has finally started generating revenue. For the second quarter of its 2022 fiscal year, which is just reported a few days ago, the firm generated sales of $2.20 million. That beat analysts’ expectations by $0.15 million. And as a result of this, total sales for the first half of the year came in at just over $4.01 million. This all compares to nothing the same time one year earlier. It’s worth noting that all of its revenue came from acquired assets, not from its core business.

There were also some non-financial updates worth sharing. For instance, on April 5th, the company announced the opening of a fabrication plant in South Korea, with the facility set to produce semiconductor chips for the firm’s Nanox.ARC 3D X-ray system. This facility, which spans 12,000 square meters, was not the only interesting development the company has announced recently. On April 28th, for instance, the firm said that its deep learning medical imaging analytics subsidiary, Nanox.AI received FDA 510(k) clearance for its HealthOST device, which is an AI software that helps to analyze the spine based on CT scans. This marks the company’s 10th such FDA 510(k) clearance. The company announced, during its latest quarterly results, that it has also been preparing for the deployment of its Nano.ARC technology in Nigeria, plus it also struck an agreement with Bio Ventures for Global Health to develop and implement a medical imaging training initiative in Nigeria as well. One last driver for the company seems to have been the fact that, on June 27th of this year, its stock was also added to the Russell 2000 and Russell 3000 Indexes. This alone can create some buying pressure from index funds and other institutions.

At first glance, all of this looks like fantastic news. On the other hand, not everything regarding the company is great. One other author, Macrotips Trading, wrote an excellent article detailing some problems with the firm. So as to not rehash everything that he or she mentioned, I will summarize the article by saying that the company has repeatedly moved goalposts when it comes to gaining regulatory approvals and launching its products. another highlight of the article involved concerns over potential misdealings, issues brought up by Citron and Muddy Waters. Both analyses appeared thorough and brought to light many legitimate questions that investors should consider before buying.

Obviously, claims of misdealings should be taken very seriously. At times, they can prove to be correct. In other cases, these arguments fall apart. In a completely unrelated case, for instance, the famed investigator Harry Markopolos, most famously known for reporting the Bernie Madoff fraud, published a short report back in 2019 alleging that industrial conglomerate General Electric (GE) had been engaging in financial misdealings. In articles here and here, you can see how I debunked his claims. Today, the company is still alive and well. And its future looks better than it has in a long time. This is not to say that current allegations regarding Nano-X Imaging are baseless. In fact, the Citron research looks rather compelling. But even if these arguments fall through, it’s difficult to justify how the company is valued today.

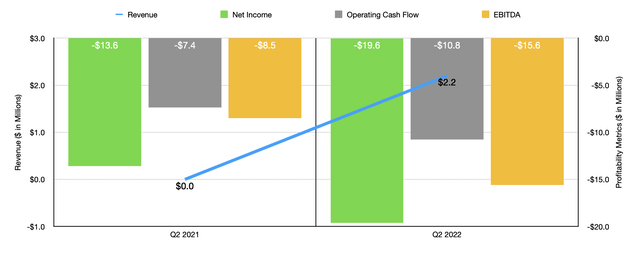

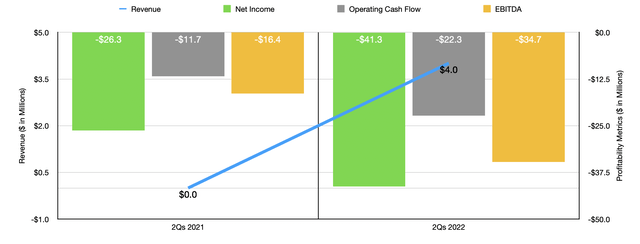

To see what I mean, we need only look at recent financial performance achieved by the business from a profitability perspective. during the second quarter of the year, the company generated a net loss of $19.61 million. That compares to the $13.58 million loss generated one year earlier. On a per-share basis, earnings came out to $0.38. That missed analysts’ expectations by $0.13 per share. That took its net loss for the first half of the year up to $41.28 million, well above the $26.29 million loss generated in the first half of 2021. Operating cash flow has also suffered, going from negative $7.37 million in the second quarter of 2021 to negative $10.77 million the same time this year. Meanwhile, EBITDA went from negative $8.50 million to negative $15.60 million. As the chart below illustrates, the data covering the first half of the year as a whole looks quite bad compared to the same time last year.

It is true that Nano-X Imaging is protected some by the fact that it has cash and cash equivalents of $126.83 million. This compares to debt of just $3.48 million. This leaves the company a decent amount of cash to burn through. And with its market capitalization standing at $767 million, it can easily raise more if it doesn’t mind diluting shareholders. But one problem we face is that it’s not really possible, particularly for a company that involves technology, to place a value that’s based on negative earnings or cash flows. However, what we do know is that, even if all goes well, its current contracts, which extend for several years, with some capable of being canceled, have an aggregate value of no less than $187.5 million per annum. Of this, however, only $145 million would flow to the business, with the rest going to its partners. A successful launch of its product would surely usher in additional revenue. But for the company to justifiably trade where it is today, it would need to generate a significant amount of cash flow.

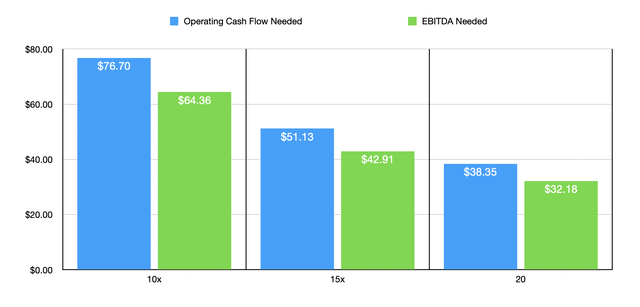

As an example, we need only take the following scenarios. In the first scenario, we ask ourselves what kind of cash flow and EBITDA the company would need to generate in order to warrant at least its current valuation while trading at a price to operating cash flow multiple and at an EV to EBITDA multiple of no greater than 10. In the second scenario, I move this up to 15, while in the third scenario I moved it up to 20. The result of my work can be seen below. But as you can see, the company would need to generate operating cash flow of between $38.35 million and $76.70 million per year, while EBITDA would need to be between $32.18 million and $64.36 million. While the low end of this range would certainly not be out of the question if all goes well, Investors are now having to work really hard by assuming that multiple things go just right. They have to assume that there are no misleadings within the company and that its technology truly is as remarkable as they claim. They have to assume that there will not be any further delays and that the production of its units goes well. They have to assume that current contracts are honored. They have to assume that margins will be high enough to make the company a worthwhile investment. They have to assume that current cash will be enough to get the company to this major milestone, without which the end result could be significant shareholder dilution. And they have to also assume that this extremely volatile market will recognize the value created by these activities. In short, there are a lot of assumptions that need to be made just for the company to be fairly valued.

Takeaway

Getting in at the ground floor of a growth prospect, particularly one on the cutting edge of technology, can be exciting. It can also be incredibly rewarding when things go right. On the other hand, it can be incredibly risky. Technology on its own can be a risky thing, especially when it involves the medical space. But then you throw in allegations of improprieties and look at the overall fundamental picture of the enterprise, and things don’t look great. Given how much shares have risen, even if everything is proven to be fine, it could still result in downside for shareholders if the operational picture for the company falls short of expectations. For all of these reasons and when considering that there are safer prospects out there that likely have just as much, if not more, upside potential as Nano-X Imaging, I have decided to downgrade the company from a “hold” to a “sell.” In the event that all goes well, upside could still be significant. But between the company’s share price rising and the other issues plaguing it, I believe that the risk outweighs that potential reward at this moment.

Be the first to comment