anusorn nakdee

Amyris’ (NASDAQ:AMRS) business model appears to be poorly understood, leading many investors to expect an inevitable bankruptcy. Amyris has a serious liquidity issue and will likely need access to hundreds of millions of dollars of financing over the next 12 months. If they can get over this hump, the business has a clear path to profitability and a long growth runway ahead of it.

John Melo recently pointed towards Amyris achieving adjusted EBITDA profitability in 2023 and positive free cash flows in 2024. A more sanguine perspective puts operating profitability in 2024 (depending on molecule licensing deals) and positive free cash flow in 2025/2026 (contingent on CapEx). Depending on revenue growth and supply chain issues going forward, Amyris may still need up to 800 million USD in cash over the next three years to reach cash flow breakeven. Amyris has avenues to raise this capital without diluting existing shareholders, but the likelihood and timing of licensing deals is crucial. Without these, forced asset sales or a highly dilutionary equity raise are likely.

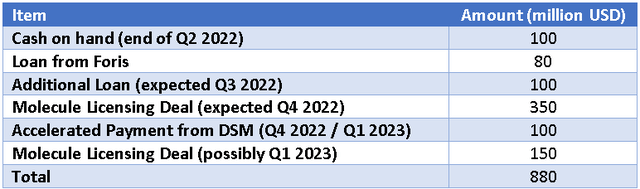

Table 1: Amyris Potential Sources of Cash (source: Created by author using data from Amyris)

Gross Profit Margins

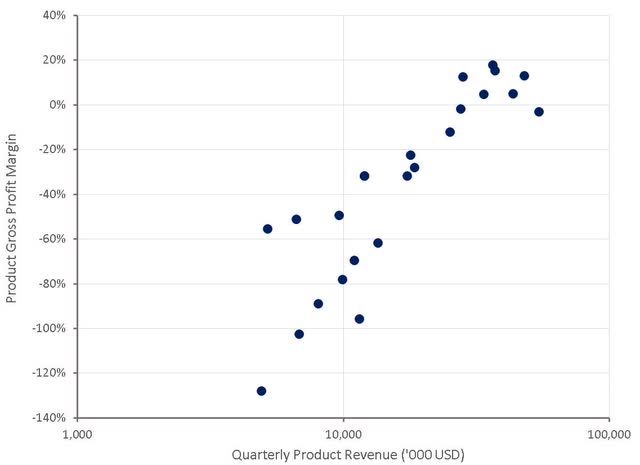

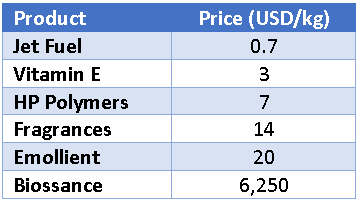

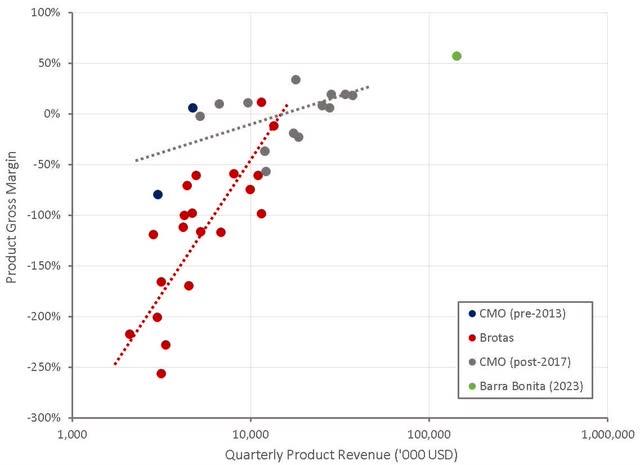

Much of the doubt surrounding Amyris’ business model stems from their inability to generate meaningful gross profits from product sales. To a large extent, this is a reflection of their past focus on marginal businesses (biofuels and commodity chemicals), but it is also due to their inability to achieve sufficient scale.

Figure 1: Estimated Amyris Product Gross Profit Margins (source: Crated by author using data from Amyris)

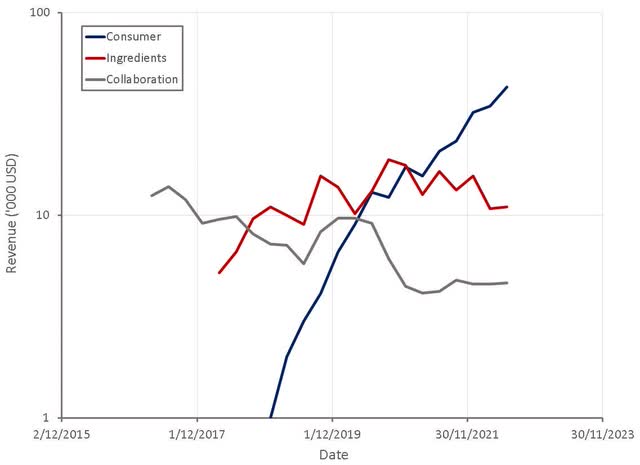

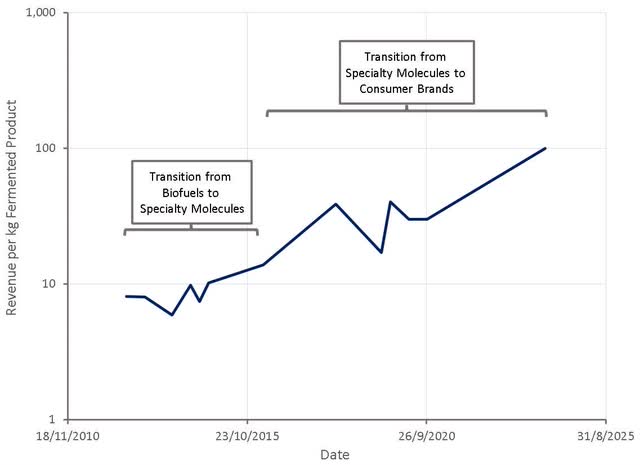

Over the past decade Amyris has shifted from producing bulk commodities (biofuels) to specialty molecules (squalane) and now consumer brands. Amyris’ revenue now comes from businesses with inherently better economics, and over the past three years this has been accompanied by strong growth.

Table 2: Price per kg of Amyris Products (source: Created by author using data from Amyris)

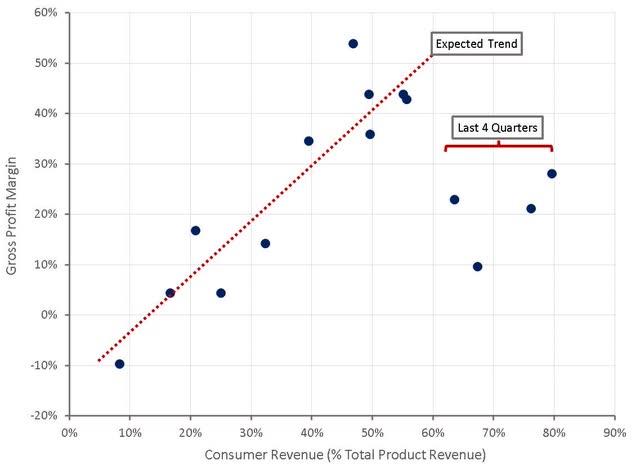

As revenue from consumer brands grow in relative importance, Amyris’ margins are improving, but this is being hidden by a relative decline in high margin collaboration and licensing revenue and elevated expenses due to supply chain issues. With supply chain issues beginning to resolve, the start-up of Barra Bonita, the co-location of downstream processing and the insourcing of consumer manufacturing, Amyris will likely begin to achieve its target gross margins for each segment over the next 12 months.

Figure 2: Amyris Revenue by Segment (source: Created by author using data from Amyris)

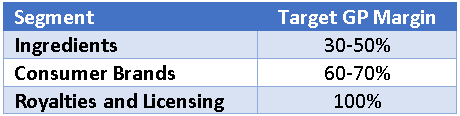

Table 3: Amyris Target Gross Profit Margins by Segment (source: Created by author using data from Amyris)

Amyris’ target ingredient gross profit margins probably need to be taken with a grain of salt, as Amyris continues to use ingredient licensing deals to finance their consumer business, and management has stated that after one of these deals, ingredient gross margins are closer to 10-20%. This is not that material to the company though, as ingredient revenue will soon be less than 20% of total revenue and Amyris may choose to stop doing licensing deals once the business is self-sustaining.

Depending on the revenue mix that is ultimately achieved, Amyris should end up with gross profit margins of around 55%. As the business has scaled and the consumer segment grown in relative importance, Amyris has been moving towards this point. The past year has seen a rapid deterioration in margins though, as a combination of issues have undermined profitability.

Figure 3: Amyris Gross Profit Margins (source: Created by author using data from Amyris)

Gross margins should begin to improve significantly going forward as supply chain issues abate and Amyris insources production. For example, John Melo recently pointed to a 50% reduction in COGS for Biossance, presumably only referring to the cost of ingredients, production and packaging rather than all COGS. This should still result in something like a 7.5% gross profit margin improvement for their largest source of revenue. Price increases are also expected to deliver a 10 million USD improvement in the second half of 2022 (5% improvement to gross margins) and over 30 million USD in 2023 (5% improvement to gross margins).

The improvement in gross profit margins and the increase in revenue over the next 12 months could increase gross profits by over 250 million USD compared to the past 12 months. This is likely to be due to a relatively even split between an improvement in margins and an increase in revenue. This improvement alone would go a long way towards eliminating Amyris 450+ million USD operating profit loss over the past year.

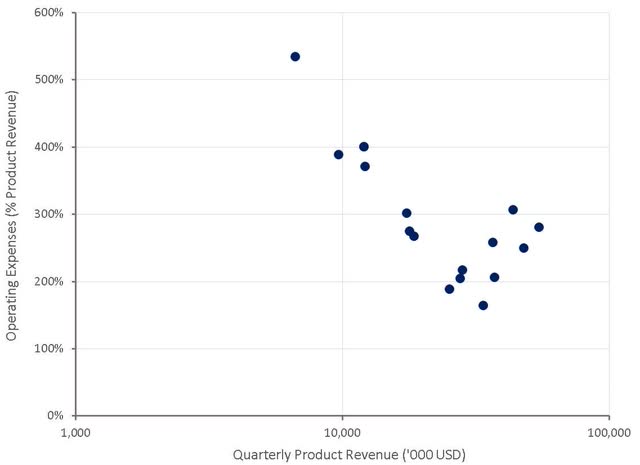

Operating Expenses

In addition to poor gross profit margins, Amyris has faced elevated operating expenses over the past 12 months, due in part to supply chain issues, but primarily from the fact that they are investing aggressively in future growth. Operating expenses are currently 100 million USD a quarter above trend levels, and while Amyris has plans to reduce operating expenses, most of the improvements in operating margins will need to come from revenue growth.

Figure 4: Amyris Operating Expenses (source: Created by author using data from Amyris)

Cost Drivers

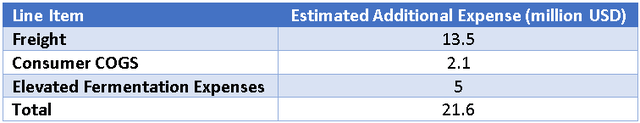

Supply chain issues have weighed heavily on Amyris over the past year. In the first quarter of 2022, management attributed 20 million USD to global supply chain issues (higher manufacturing costs, inflated freight costs and air freight to deal with delays). Based on a bottom-up calculation, I estimate that additional expenses related to supply chain issues totaled approximately 25 million USD in the second quarter of 2022. This amounts to 46% of product revenue, compared to management’s estimate of supply chain costs totaling 44% of revenue in the first quarter of 2022. Additional expenses can be broken into COGS and operating expenses to show that marketing and increased headcount are currently Amyris’ biggest problems.

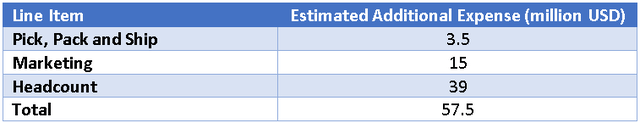

Table 4: Amyris Estimated Additional COGS (source: Created by author using data from Amyris)

Table 5: Amyris Estimated Additional Operating Expenses (source: Created by author using data from Amyris)

Path to Profitability

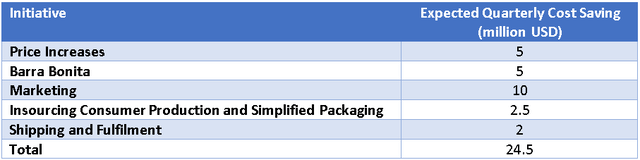

Amyris has also detailed a fit-to-win plan that they believe will help to significantly improve profitability over the next 12 months. While this is a positive, it should also be recognized that this plan is being implemented in response to problems with the business. The fit-to-win plan in expected to result in a 24.5 million USD improvement in operating profitability per quarter in the second half of 2022.

Table 6: Projected Cost Savings from Amyris’ Fit-to-Win Initiative (source: Created by author using data from Amyris)

The combination of the fit-to-win initiative and a normalization of Amyris’ supply chain could result in quarterly cost savings of approximately 50 million USD. This is likely an upper estimate though as there is probably overlap in some areas between expected fit-to-win improvements and supply chain related expenses. Given the majority of the savings from fit-to-win are not supply chain related (price increases and reduced marketing spend) there should be at least a 40 million USD total improvement. Operating leverage could also improve operating profits by approximately another 35 million USD a quarter through next year, depending on how quickly revenue continues to grow.

Ingredient Business Economics

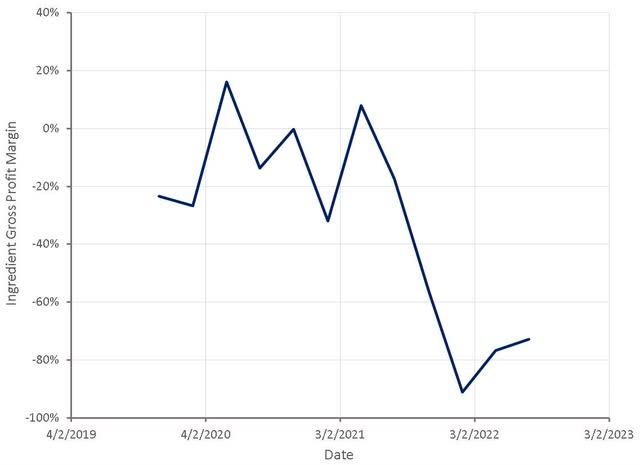

Despite being almost a decade old, Amyris’ ingredients business has likely never been consistently profitable, even on a gross profit basis. Over the last 12 months, supply chain issues have exacerbated the problems of the ingredients business, causing large losses. The start-up of Barra Bonita, and a normalization of supply chains, will dramatically change the economics of the ingredients business over the next 12 months, aiding Amyris’ transition to profitability.

Figure 5: Estimated Amyris Ingredient Gross Profit Margins (source: Created by author using data from Amyris)

Fermentation

Amyris continues to be viewed primarily as a synthetic biology company, and hence the focus of investors is on their ability to profitably ferment molecules at scale. While strain engineering and fermentation at scale are at the heart of Amyris’ business, fermentation is likely only currently contributing a single digit percentage to total costs, and hence is only a small component of Amyris’ path to profitability.

Amyris’ business model has evolved over time from the production of bulk commodities, to specialty ingredients and now consumer brands. This has meant that the amount of revenue they are able to generate per kilogram of fermented product has increased over time. This should generally make it easier to generate profits, although specialty molecules and consumer brands do incur additional costs.

Figure 6: Amyris Revenue per kg of Fermented Product (source: Created by author using data from Amyris)

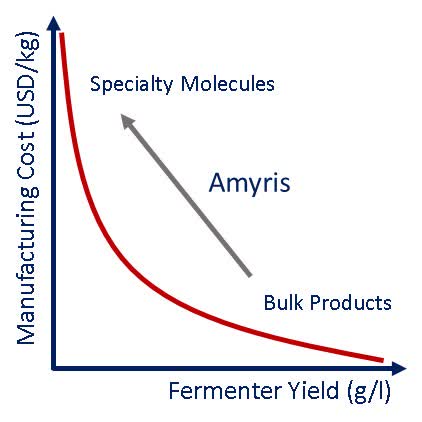

Figure 7: Dependence of Manufacturing Cost on Fermenter Yield (source: Created by author)

Table 7: Typical Fermentation Cost Breakdown for Specialty Molecules and Bulk Products (source: Created by author)

Brotas

Amyris’ first attempt at insourcing production was at their Brotas facility, which was opened in 2012 and eventually sold to DSM in 2017. Brotas was designed as a high-volume plant for the production of farnesene. When Amyris pivoted away from biofuels toward specialty molecules they were left constantly trying to switch production at Brotas, which was inefficient. Brotas was estimated to have a theoretical maximum production capacity of approximately 40 million liters per year, but doesn’t appear to have ever achieved production anywhere near this. In the past, Amyris pointed towards the Brotas facility being underutilized by 20-30% due to the switching of products, which took an average of approximately 10 days. They were planning to reduce this to 6-8 days, although it is unclear whether they actually ended up achieving this goal. When Brotas was only producing farnesene, utilization was approximately 80-90%. At the time the Brotas facility was sold it was producing Farnesene for nine months of the year, with the remaining three months used to produce two additional products and ADL Bionatur used for the remaining products. DSM acquired the Brotas facility and intellectual property related to farnesene for 58 million USD, in addition to a value share arrangement over a three year period totaling 37.5 million USD. DSM was to continue existing supply-agreements to Amyris and other parties, as well as supply Amyris with specialty compounds until their specialties production facility was operational.

Barra Bonita

The focus on a range of specialty molecules led to the Barra Bonita plant, which is designed for the concurrent production of multiple ingredients. Barra Bonita has six 200,000 litre fermenters spread across five production lines. The Barra Bonita facility is majority owned by Amyris, with Ingredion having a 30% stake. The Barra Bonita plant is expected to significantly lower COGS for the ingredients business, with production and shipping costs projected to fall by 10 million USD in the second half of 2022 (5% improvement in gross margins) and 30 million USD in 2023 (5% improvement in gross margins). Management specifically mentioned a two thirds cost reduction from CMOs for farnesene on the Q2 2022 earnings call, indicating how large an impact Barra Bonita will eventually have, although this won’t be the same for all molecules. It is not clear how much of this improvement is from reducing costs (inputs, CMO margins etc.) versus improved productivity. Third-party fermentation capacity is not as efficient and has a significantly greater risk of contamination. Barra Bonita is a state-of-the-art facility that is designed to maximize efficiency, capture the value of waste streams and reduce labor requirements through automation.

Barra Bonita will also help to de-bottleneck production and allow Amyris to meet customer demand, which outstripped their ability to supply by approximately 15 million USD in the first half of 2022. The immediate impact of this may not be as positive as many assume though as there are significant overheads associated with operating this type of facility. Until the facility is operating at capacity, production costs will be elevated relative to long-run expectations.

CMOs

Amyris has historically relied on a range of CMOs for both consumer product manufacturing and fermentation. This can be a successful strategy, and is the only viable option until a company reaches the minimum viable scale to begin insourcing, but it can be problematic when CMO facilities are sub-standard, product margins are narrow or excessive demand causes high CMO pricing. Amyris has given little insight into the burden of utilizing CMOs, but has hinted at it in a number of ways. In the second quarter of 2019 management stated that they expected a 30% unit cost improvement in five of their products as a result of renegotiating contracts with their largest CMO. Amyris also expects that the shift to Barra Bonita will reduce costs by 50-67% for many molecules. While much of this is likely to be the result of lower input costs and improved facility productivity, a large portion is also likely to come from the elimination of CMO margins.

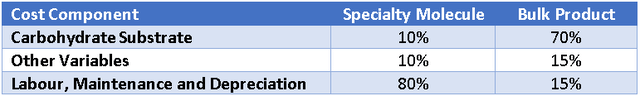

One of Amyris’ main fermentation CMOs in recent years has been ADL Bionatur. ADL Bionatur is a CMO of non-Pharma grade molecules in Spain, primarily focusing on ingredients for the food, personal care and pharma industries. ADL’s facility has a fermentation production capacity of 2.4 million litres, including 8 x 225,000 litre fermenters. Amyris has also made significant investments in downstream processing equipment at the facility.

Figure 8: ADL Bionatur Facilities (source: ADL Bionatur)

ADL Bionatur’s facility had an 80% capacity utilization rate in 2021 with some of the main clients including:

- Fermentalg

- DSM

- Evolva

- Amyris

- Jennewein

Some of the products manufactured at the facility include:

- Beta-carotene

- Flucosyl-lactose

- Patchouli

- Farnesene

- Omega 3

- Probiotics

Patchouli and farnesene are likely produced for Amyris, and this is confirmed by freight data.

Amyris first entered into an agreement with Antibióticos (ADL Bionatur) for the production of Biofene at its facilities in Leon Spain in 2011. Amyris stopped utilizing ADL Bionatur when their Brotas facility opened, but returned in the first half of 2017 as a result of capacity constraints at Brotas. At the time, the plan was to use ADL Bionatur to introduce new products and allow the Brotas facility to focus on the large cash generators. While this was likely never a particularly attractive option from an economic standpoint, given the cost of energy, feedstock and labor in Europe, it has become disastrous in the past 12 months due to the spike in European energy prices. Amyris renewed their contract with ADL in 2019, with the plan of producing up to five ingredients and contract revenues amounting to at least 12 million Euro.

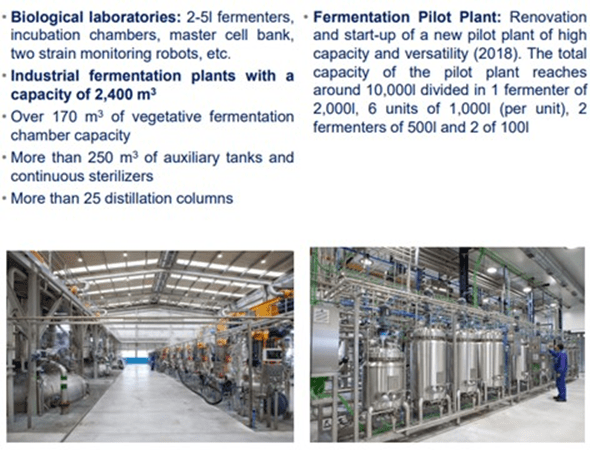

ADL Bionatur is a public company and hence financial data is available, although margins are not broken out by segment. Fermentation contract manufacturing is their main source of revenue and gross margins are over 50%. The company is targeting EBITDA margins of 30% by 2024. While the exact margins on contract manufacturing is unknown, it is clearly quite high, making it difficult for customers to profitably manufacture low-margin products.

Table 8: ADL Bionatur Financial Performance (source: Created by author using data from ADL Bionatur)

Over the years, Amyris has utilized a range of other CMOs, including Biomin and Tate & Lyle. Amyris entered into an agreement with Biomin in 2010 to utilize their facility in Piracicaba, Brazil. Amyris expected to begin production of farnesene at the Biomin facility in the first half of 2011. Details of the facility are unknown, but at the time it was stated that all of the contract manufacturing facilities Amyris was involved in utilized fermenters having production output ranging between 100,000 and 600,000 liters. In August 2018 this facility was acquired by the Canadian company Lallemand.

Amyris utilized a Tate & Lyle fermentation facility in Illinois to produce farnesene, prior to the start-up of their Brotas facility. Amyris stopped using this facility in the first half of 2013, after the Brotas facility began to scale-up production successfully. This facility had previously been impaired by Tate & Lyle, and when commercial viability was established by Amyris, Tate & Lyle reversed the previous 7 million pound write-down. Genomatica has utilized the same facility to produce Bio-BDO.

In addition to lower efficiency and higher costs, Amyris has had to invest in CMO facilities and sometimes been subjected to unfavourable contracts. During 2011 and 2012 Amyris reimbursed CMOs 13.8 million USD for facility modifications. Some CMOs have at times imposed manufacturing agreements with fixed purchase commitments, regardless of production volumes, making manufacturing expensive if operating below the committed amount.

Vertical Integration

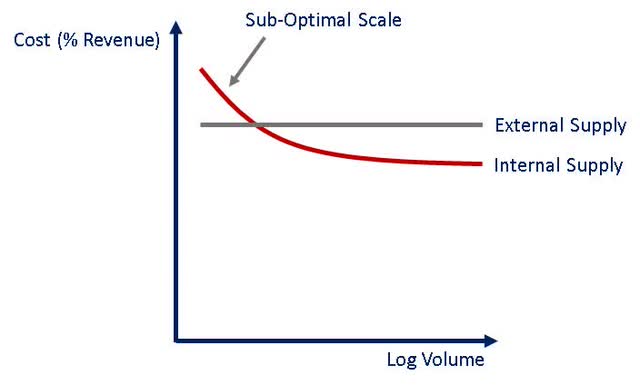

While the decision to insource fermentation has the potential to significantly reduce expenses, it can only be done once a company has reached a minimum viable scale, as vertical integration lowers variable costs in exchange for higher fixed costs.

Figure 9: Potential Impact of Vertical Integration on Production Costs (source: Created by author)

The impact of leverage from vertical integration can be seen in Amyris’ historical product gross profit margins. Margins were far more dependent on scale when operating the Brotas facility, and it appears that Amyris never really achieved sufficient revenue to make this facility economical. With Barra Bonita focused on higher value molecules and Amyris having access to larger end markets, Barra Bonita is far more likely to be profitable.

Figure 10: Amyris Product Gross Margins (source: Created by author using data from Amyris)

Amyris is currently in the process of scaling up production at Barra Bonita, and hence their production costs are likely to be elevated for the next 1-2 quarters. Amyris has also likely been incurring substantial costs related to the start-up of Barra Bonita, which will not have all been capitalized. For example, Amyris began recruiting and training employees for Barra Bonita in the first quarter of 2021.

Amyris’ is also planning on adding four 600,000 litre tanks to Barra Bonita in 2023. CapEx for this is expected to be under 80 million USD as existing infrastructure at the facility will be utilized in a modular fashion. It is likely that these tanks will primarily be used for farnesene production to support squalane and hemi-squalane sales. It is not clear whether this is due to strong demand or the relative expense of utilizing CMO facilities.

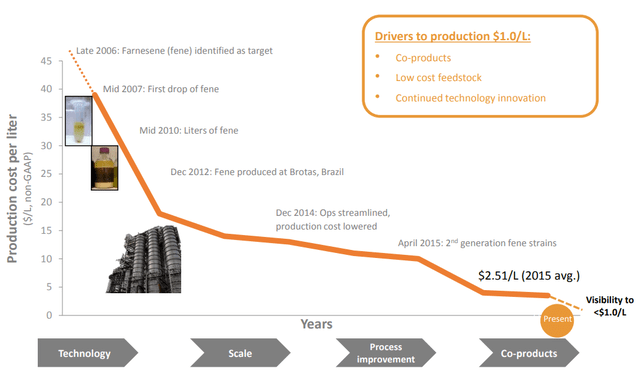

Farnesene Production Costs

In the past Amyris has provided detailed information on farnesene production costs, with a record low cost of 1.75 USD per liter achieved in 2015. Amyris planned to introduce a new strain in 2016 which was expected to reduce costs by a further 10%. Amyris also stated in 2014 that they were targeting cash production costs of under 1.0 USD per liter in the next 2-3 years. No information is available on the cost trajectory of farnesene since 2015, but it seems likely that costs at Barra Bonita should be around or below 1.5 USD per liter.

Figure 11: Amyris Farnesene Production Costs (source: Amyris)

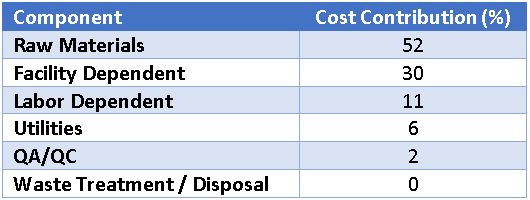

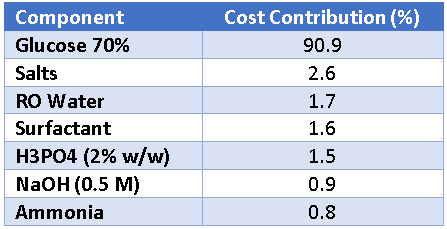

While a detailed breakdown of costs is not available for most of Amyris’ target molecules, information is available for farnesene. Farnesene is more of a bulk commodity, and hence its production cost is driven primarily by raw material costs, glucose in particular. The large contribution of facility and labor costs also highlight the importance of running a fermentation facility at capacity. These figures seem reasonable, as Amyris stated in 2015 when farnesene production costs were around 5 USD/litre, that feedstock was contributing over 50% of production costs.

Table 9: Calculated Costs for Farnesene Fermentation (source: Created by author using data from researchgate)

Table 10: Calculated Raw Material Costs for Farnesene Fermentation (source: Created by author using data from researchgate)

While the relative importance of each line item is likely to vary across molecules, and downstream processing also needs to be considered, these figures are at least indicative and show why Amyris has chosen to locate their fermentation facilities in Brazil.

Brazil

Brazil is the world’s largest sugarcane producer, contributing approximately 38.6% of the world’s total production in 2019. Brazil’s primary sugar production area is in the central/southern region, particularly in the States of Sao Paulo and Parana. It is estimated that this region is consistently among the world’s lowest cost producers of cane-sugar, which explains Amyris’ decision to locate Barra Bonita in Sao Paulo.

Sugarcane in Brazil can be harvested from April to December in the south-central area, which potentially has an impact on production costs. In the past, Amyris has based facility maintenance around the sugarcane harvest season, in an attempt to avoid elevated production costs. During the offseason Amyris has had to use raw VHP sugar crystals as feedstock, rather than concentrated cane syrup. Amyris has previously estimated the cost of switching feedstock as somewhere around 0.6-0.75 USD per liter, which is quite large relative to the production cost of farnesene.

Brazil also provides access to a relatively low-cost pool of labor, another important cost driver.

Electricity is another cost driver for fermentation due to the energy required to pump large volumes of liquid, control fermentation conditions (e.g. temperature) and generate steam for sterilization purposes. Steam at the Barra Bonita facility is supplied through a co-generation system that utilizes a sugarcane byproduct, bagasse, as a fuel source during the sugarcane growing season. It is only during the off-season that steam is supplied by a conventional boiler. Electricity for the plant will be supplied by hydroelectric power plants in the area.

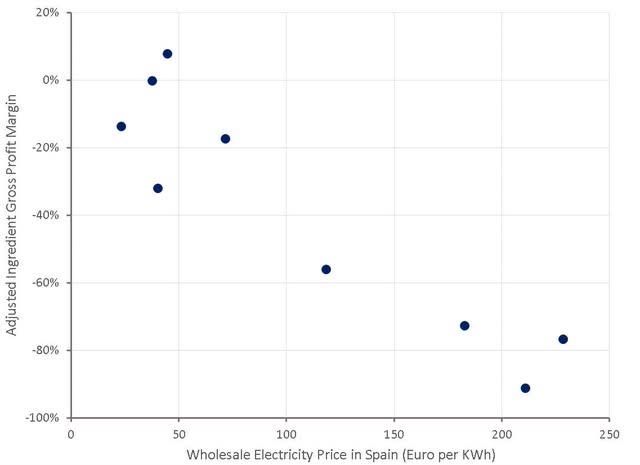

Impact of European Energy Prices

Energy costs are one of the reasons that Amyris’ margins have deteriorated so much over the past 12 months. The combination of high CMO costs due to strong demand and extreme energy prices in Spain have caused Amyris to lose a large amount of money producing ingredients. It is not known exactly how much Amyris has been producing in Spain, but freight data indicates they have been producing farnesene and patchouli there, both of which are produced in large volumes. Amyris has also stated that they were producing CBG in Spain, although quantities are likely to have been relatively small. It is possible that something like 25-30% of Amyris’ ingredients production has been in Spain over the past 12 months. This, along with a 5-10x increase in wholesale electricity prices in Spain has likely turned utility costs from a relatively minor expense into a primary cost driver.

While Amyris does not break out gross margins by segment, an estimate of ingredient gross margins can be made by assuming consumer gross margins have been relatively constant. This was done using Amyris’ adjusted gross profits to minimize the impact of elevated freight expenses over the past 12 months. This analysis shows that there appears to be a strong relationship between ingredient gross margins and electricity prices in Spain.

From a fundamental perspective this does not seem unreasonable, if utilities contribute approximately 6% of the production costs of farnesene at around 7.5 cents per kWh. At 2.25 Euro per kWh, utilities would increase production costs by approximately 175%. If one third of production was affected, this would reduce ingredient gross margins from 0% to approximately -60%. At current production volumes, this represents a cost of approximately 6 million USD per quarter. Electricity prices have declined significantly since the peak and Amyris has likely now moved the majority of their production from Spain to Brazil.

Figure 12: Wholesale Electricity Prices in Spain and Amyris’ Adjusted Ingredient Gross Profit Margins (source: Created by author using data from Amyris and Statista)

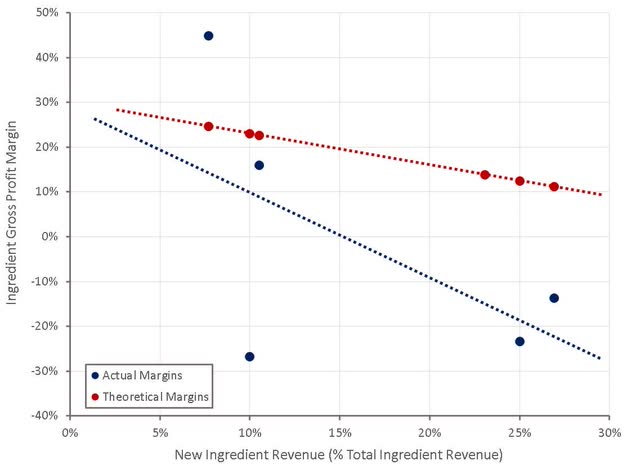

Impact of Product Portfolio Maturity

Ingredient gross margins are also impacted by the maturity of the programs in Amyris’ portfolio. When new molecules are first scaled-up, margins are likely to be negative until the strain / processes are optimized (expected over the first 18-24 months of production). In the first quarter of 2020 Amyris stated that scale-up production of 7 million USD reduced gross profits by approximately 3 million USD (implying -40% gross margin on average). This should be a relatively small problem going forward, as Amyris has an increasingly large portfolio of mature molecules.

Figure 13: New Ingredient Revenue and Ingredient Gross Profit Margins (source: Created by author using data from Amyris)

Downstream Processing

Downstream processing is generally ignored in the synthetic biology industry. While downstream processing does not generate the excitement of robotics, AI and gene editing, it is critical to the successful scale-up of many products. For biopharmaceuticals it is fair to state that downstream processing generally dominates production costs (45-90% of total costs). For bulk fermentation products downstream processing generally only accounts for 20-40% of total costs.

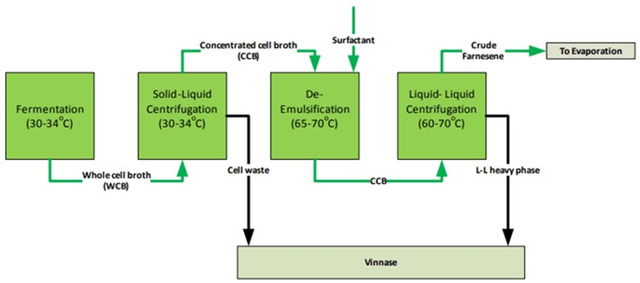

Downstream processing consists of converting the fermentation broth into a purified product ready for sale, or any additional steps to convert the purified molecule into the desired end product (e.g. conversion of farnesene into squalane).

Downstream processing costs may include expensive equipment, consumables, energy, waste handling, labor and maintenance. For example, for the purification of farnesene at the pilot scale Amyris used:

- Solid liquid centrifugation

- De-emulsification

- Liquid-liquid centrifugation

Figure 14: Farnesene Pilot Scale Recovery Process (source: Amyris)

Amyris has given little detail on downstream processing costs, despite their potential importance. In 2014 John Melo stated that squalane finishing costs had been reduced by over 10%, with downstream processing costs in the 8-10 USD per liter range. Since then, there have been no further figures on downstream processing costs, but there have been continual references to process improvements.

Our downstream finishing costs for our finished products, such as our Neossance Squalane, continue to decrease as well, allowing us to expand market share and margins. – Q4 2014

Our teams implemented process and capacity improvements that increase our Squalane throughput by twofold from the 2018 levels. We are now completing a new set of improvements that will add another 30% productivity by the fourth quarter. – Q2 2019

During the third quarter, we invested 200,000 USD in our plant, and increased its production rate by 45%. – Q3 2019

We continued making process and technical improvements to our squalene production processes, these changes were implemented during the second and third quarter and they are paying off in our production throughput. – Q3 2019

Our year-to-date production of Squalane is 60% higher than what we have producing the first half of 2019. Our team is also focusing on improving our unit costs for that product. We have delivered 20%-unit cost reductions compared to the average unit cost of Squalane in 2019. – Q2 2020

We delivered our third consecutive quarter of Squalane cost improvements and we are producing Squalane at our lowest unit cost ever. – Q3 2020

Squalene is one of these examples where we achieved better efficiency and deliver unit cost savings of 23% compared to the previous quarter. – Q4 2020

We’ve done a lot to improve and see continuous improvement in our downstream processes, the chemistry that polishes and cleans the molecules that come from fermentation – Q1 2021

Amyris initially utilized Glycotech as a CMO for downstream processing at Leland, North Carolina for turning farnesene into derivative products. The two consolidated VIEs for which Amyris was the primary beneficiary had 22 million USD of assets, consisting primarily of 15 million USD in PP&E. In 2016 Amyris, Glycotech and Salisbury entered into a purchase and sale agreement for the facility, the property and the related fixtures, equipment, materials and supplies. Amyris was to purchase the assets from Glycotech and Salisbury for a total of 4.35 million USD. Amyris owns 50% of the Leland facility through its joint venture with Nikko.

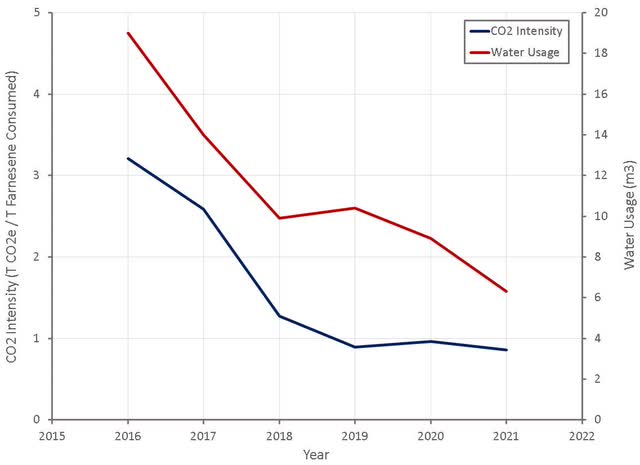

The Leland facility has implemented process and facility improvements to increase energy efficiency, including consolidating production steps, improving insulation and retrofitting equipment. Amyris’ ESG report contains a number of data points which are supportive of process improvements and cost reductions at the Leland facility.

Figure 15: Aprinova ESG Metrics Performance Improvement (source: Created by author using data from Amyris)

Amyris recycled 300 metric tons of isopropyl alcohol from the Leland plant in 2020 and 607 metric tons in 2021. Another 103 metric tons of isopropyl alcohol were sent to a company that reuses the chemical in products such as window cleaner. The value of these initiatives is uncertain but might equate to something like a 1-2% improvement in DSP costs for squalane.

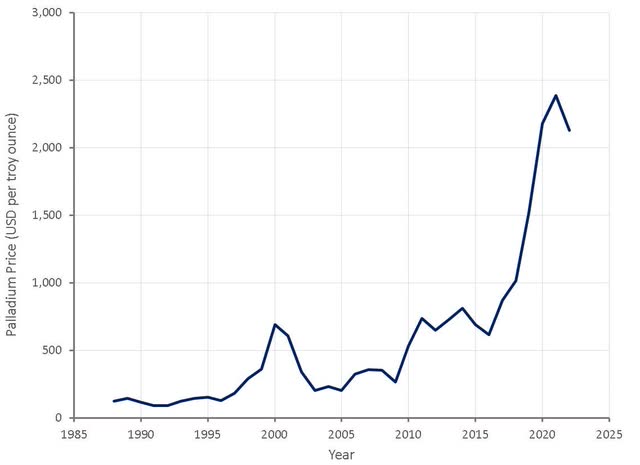

In the first quarter of 2020, Amyris pointed to a 10-15% reduction in the purchase price of palladium as an important contributor to squalane costs, as it is one of the highest cost raw materials in the production process. Palladium prices increased dramatically between 2015 and 2020, but have since levelled off. It is unclear how important the cost of palladium is to squalane production costs.

Figure 16: Palladium Price (source: Created by author using data from macrotrends)

In the third quarter of 2020 Amyris stated that their squalane business delivered 7.5 million USD of revenue with 3.7 million USD of adjusted EBITDA. This probably means that gross margins were in the 60-70% range, and assuming an average sales price of 20 USD per liter, implies a squalane production cost of approximately 6-8 USD per liter. Assuming CMO production costs for farnesene of 3 USD per liter, downstream processing for squalane would cost 3-5 USD per liter (in line with expected range based on the information above).

There is no information available on downstream processing costs for Amyris’ other molecules, but management has discussed continuous productivity improvements. Downstream processing for hemisqualane was also occurring at the Leland plant, but was shifted to a production site in Brazil in 2019. In the third quarter of 2019 Amyris stated that they had implemented a new process that would increase production yield by 14% and were also working on reducing transportation costs, with the combined impact expected to reduce unit costs by 18%. In the first quarter on 2020 Amyris stated that the shift to Brazil, along with an improvement in the reprocessing of a waste stream helped them to reduce unit costs by 25%.

In 2019, Amyris invested 7 million USD in their sweetener production line, with an expectation of tripling throughput. After the upgrade, sweetener production capacity was expected to be sufficient to generate 5 million USD revenue per month. This process improvement reduced RebM unit costs by 50%.

As Amyris’ ingredients portfolio grows, there is potential to pursue a platform approach to downstream processing which can be used for multiple molecules that fall into the same class for the steps beyond primary clarification. This can potentially reduce the burden of expensive capital investments by improving utilization.

Amyris’ strain engineering teams also contribute to downstream processing cost improvements by increasing titers and reducing impurities during fermentation, particularly impurities that are molecularly similar to the target molecule and hence difficult to separate. Melo has also suggested that long-term there is potential to bring more of the chemistry into the organism. This would increase the complexity of strain engineering but has the potential to reduce costs and make the business more scalable. Sunil Chandran has suggested that this is something that needs to be looked at on a case-by-case basis.

Freight

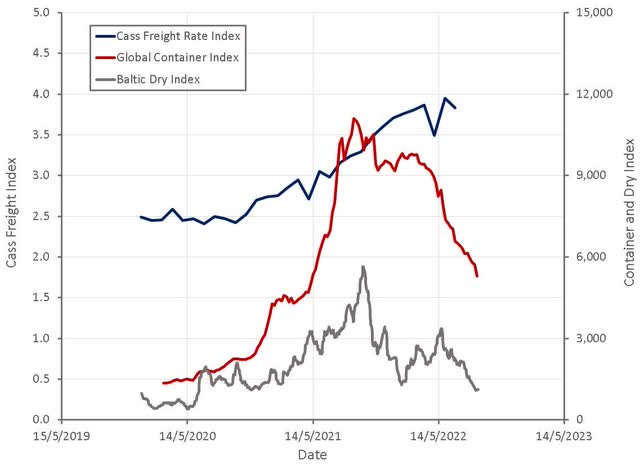

Amyris ships thousands of tonnes of product and packaging around the globe annually, and given the relatively low value per unit weight of products like farnesene, freight is an important cost driver. Elevated freight costs over the last 12 months have impacted both COGS and shipping expenses (currently falls under operating expenses) and significantly reduced Amyris’ profitability.

Amyris ships ingredients in recyclable totes, jerricans and drums. For shipments of key intermediates (presumably farnesene), they utilize flexitanks. This means that a container shipping index is probably most relevant for understanding the impact of shipping costs on Amyris’ COGS over the past 12 months. It is unknown whether Amyris is paying spot or contract rates for freight and costs will depend on the freight route and timing.

Figure 17: Indicative Freight Rates (source: Created by author using data from Cass, Freightos and tradingeconomics)

Amyris has been producing farnesene in both Brazil and Spain, which then gets shipped to North Carolina for conversion into squalane. Amyris produces something like 1,500 tonnes of squalane annually, making shipping an important expense.

Finishing for hemisqualane occurs in Brazil and downstream processing is primarily co-located in Spain, helping to reduce freight expenses for ingredients like patchouli and CBG. DSP will be co-located with fermentation at Barra Bonita over the next 12-18 months which will help to reduce freight costs. This could amount to something like a one million USD quarterly reduction in COGS through a reduction in freight expenses.

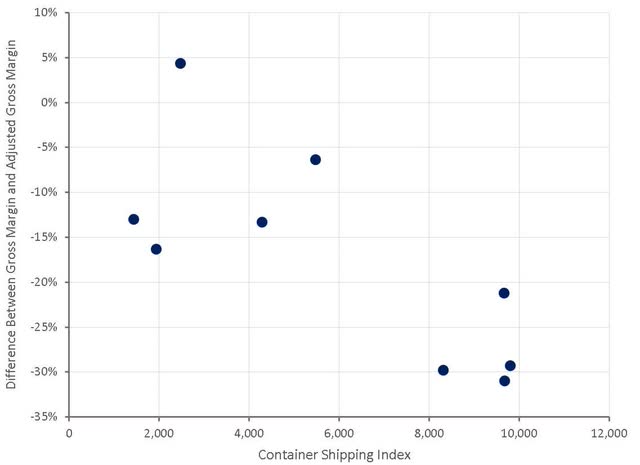

While Amyris does not break out freight expenses, the difference between actual margins on product sales and adjusted gross margins is indicative. Adjusted gross margins exclude a number of costs, including some related to freight and certain manufacturing expenses, which are lumped under “other costs and provisions”. The size of this adjustment is closely related to global shipping rates, indicating that freight has been a key driver of the deterioration in gross margins over the past 12 months. If container shipping costs were to return to pre-pandemic levels, it could result in a 10-15 million USD improvement in gross profits, depending primarily on the volume of ingredients being shipped at the time.

Figure 18: Potential Impact of Shipping Costs on Amyris’ Gross Profit Margins (source: Created by author using data from Freightos and Amyris)

Conclusion

Amyris should realize a 75% improvement in operating profit margins through supply chain normalization and their fit-to-win initiatives next year. They should also achieve another 150% improvement in operating profit margins through operating leverage. The combination of the above should leave operating profit margins in the vicinity of negative 20-30% next year, with ingredient licensing deals possibly taking this to near breakeven. Due to Amyris’ current cash position, ingredient licensing deals will be necessary to avoid forced asset sales or further financing.

Barra Bonita will de-bottleneck the ingredients business and significantly improve unit economics. This, along with a reduction in freight rates should make the ingredients business profitable over the next 12 months.

Be the first to comment