ferrantraite

Earnings of Ameris Bancorp (NASDAQ:ABCB) will most probably plunge this year due to the normalization of both provisions and mortgage banking income. On the other hand, the top line will benefit from a rising rate environment. Further, moderately high loan growth will likely support the bottom line. Overall, I’m expecting Ameris Bancorp to report earnings of $5.0 per share for 2022, down 7.5% year-over-year. Compared to my last report on the company, I’ve increased my earnings estimate because I’ve revised upward both the loan growth and margin estimates. For 2023, I’m expecting earnings to increase by 3.7% to $5.19 per share. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Ameris Bancorp.

Strong Job Markets to Keep Loan Growth from Slowing Down too Much

Like many peer banks, Ameris Bancorp’s loan growth during the second quarter of 2022 was exceptionally high. The portfolio grew by 8.8% during the quarter, or 35% annualized, which is the highest loan growth in a quarter since the second quarter of 2020. The management mentioned in the latest conference call that the high growth was attributable to borrowers pulling their borrowing requirements to an earlier time so as to lock in rates before they increase too much. This was especially true in the mortgage segment wherein people planning to buy homes over the next few quarters decided to enter into mortgage agreements during the second quarter only to avoid future higher interest rates. Such preemptive borrowing will make loan growth significantly slow down in future quarters.

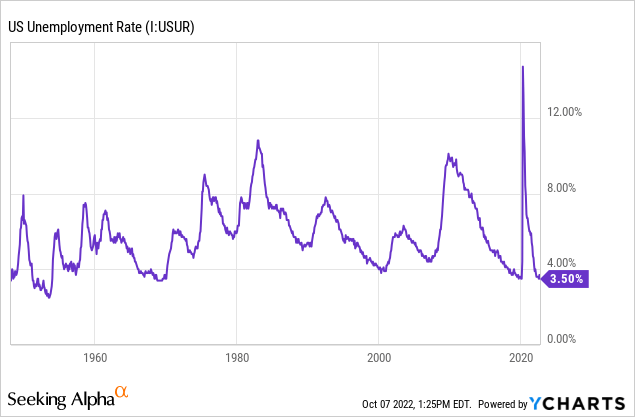

Nevertheless, the management was optimistic about loan growth because of heightened commitments that are still unfunded, as mentioned in the conference call. Further, some economic factors will sustain loan growth. Ameris Bancorp serves businesses and individuals across the southeastern United States. Further, the loan portfolio is well diversified across segments ranging from commercial loans to residential mortgages. Therefore, broad-based economic metrics are appropriate gauges of Ameris Bancorp’s product demand. The unemployment rate continues to remain near record lows, which bodes well for loan growth.

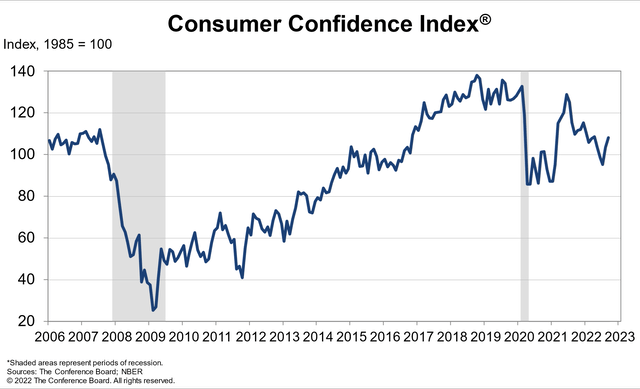

Further, the nation’s consumer confidence improved for a second consecutive month after plummeting earlier this year. The turnaround in the trend is good news for both consumer and commercial loans as it affects consumer spending.

Considering these factors, I’m expecting the portfolio to grow by 2% every quarter till the end of 2023. This will lead to loan growth of 15% for 2022. In my last report on Ameris Bancorp, I estimated loan growth of 10% for 2022. I’ve increased my loan growth estimate mostly because of the second quarter’s outstanding performance. Meanwhile, I’m expecting other balance sheet items to grow mostly in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 8,483 | 12,780 | 14,282 | 15,707 | 18,091 | 19,582 |

| Growth of Net Loans | 40.9% | 50.7% | 11.7% | 10.0% | 15.2% | 8.2% |

| Other Earning Assets | 1,836 | 3,503 | 4,093 | 5,731 | 3,881 | 4,201 |

| Deposits | 9,649 | 14,027 | 16,958 | 19,666 | 20,480 | 22,168 |

| Borrowings and Sub-Debt | 261 | 1,547 | 561 | 872 | 532 | 491 |

| Common equity | 1,456 | 2,470 | 2,647 | 2,966 | 3,157 | 3,475 |

| Book Value Per Share ($) | 33.7 | 42.1 | 38.1 | 42.5 | 45.6 | 50.1 |

| Tangible BVPS ($) | 20.7 | 24.7 | 23.7 | 26.2 | 29.1 | 33.7 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Moderately High Rate-Sensitivity Owed to Sticky Deposit Costs

In anticipation of rising interest rates, Ameris Bancorp has improved its deposit mix over the last year and a half. Non-interest-bearing deposits made up 42% of total deposits at the end of June 2022, up from 36.3% at the end of December 2020. These deposits will ensure the average deposit cost remains upward sticky as interest rates increase. Meanwhile, the average loan yield is only moderately rate-sensitive as fixed rates make up a majority of total loans. Variable-rate loans made up just 30% of total loans at the end of June 2022, as mentioned in the earnings presentation.

Mostly due to sticky deposit costs, the margin is moderately rate sensitive. The results of the management’s interest-rate sensitivity simulation given in the presentation show that a 200-basis points hike in interest rates can boost the net interest income by 7.4% over twelve months.

I’m expecting the fed funds rate to increase by 150 basis points till the end of 2023 from the current level of 3.25%. Considering these factors, I’m expecting the margin to grow by 20 basis points in the second half of 2022 and a further 10 basis points in 2023. Compared to my last report on Ameris Bancorp, I’ve increased my margin estimate as my interest rate outlook is now more hawkish than before.

Provision Normalization Ahead

Ameris Bancorp reported above-average provisioning for the second quarter of 2022, in tandem with the outstanding loan growth. Allowances were 0.98% of total loans, while non-performing loans were 0.75% of total loans at the end of June 2022. This coverage doesn’t seem very comfortable considering the prolonged high interest-rate environment that will soon start affecting the solvency of borrowers that are already stretched. However, as I’m expecting loan additions to decline from the second quarter’s level, the provisioning will also be lower than in the second quarter.

Overall, I’m expecting normalized provisioning in every quarter till the end of 2023. I’m expecting the net provision expense to make up around 0.26% of total loans (annualized) till the end of next year, which is the same as the average for the last five years.

In my last report on Ameris Bancorp, I estimated a net provision expense of $28 million for 2022. I’ve now increased my net provision expense estimate to $47 million because of the second quarter’s high provisioning. Further, I’ve increased my provisioning estimate for the second half of this year because of the heightened inflation and interest rate environment which will result in financial stress for borrowers.

Expecting Earnings to Dip by 7.5%

Normalized provisioning will likely be one of the biggest contributors to an earnings decline this year. Further, earnings would be lower this year because of the decline in mortgage income from refinancing activity. Mortgage refinancing activity had been elevated in the last two years because of the interest rate cuts and is likely to return to a normal level this year.

On the other hand, the anticipated loan additions and margin expansion will support earnings growth. Overall, I’m expecting Ameris Bancorp to report earnings of $5.0 per share for 2022, down 7.5% year-over-year. For 2023, I’m expecting earnings to grow by 3.7% to $5.19 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 343 | 505 | 638 | 655 | 776 | 897 |

| Provision for loan losses | 17 | 20 | 145 | (35) | 47 | 52 |

| Non-interest income | 118 | 198 | 447 | 366 | 327 | 310 |

| Non-interest expense | 294 | 472 | 599 | 560 | 598 | 682 |

| Net income – Common Sh. | 121 | 161 | 262 | 377 | 347 | 359 |

| EPS – Diluted ($) | 2.80 | 2.75 | 3.77 | 5.40 | 5.00 | 5.19 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report on Ameris Bancorp, I estimated earnings of $4.72 per share for 2022. I’ve increased my earnings estimate mostly because I’ve revised upwards both my loan growth and margin estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Maintaining a Buy Rating

Ameris Bancorp has maintained its dividend at $0.15 per share since the third quarter of 2019. Given the earnings outlook, I don’t think the company will increase its dividend next year. The earnings estimate of $5.19 per share and the quarterly dividend estimate of $0.15 per share suggest a payout ratio of 11.6% for 2023, which is close to the five-year average of 15.9%. My dividend estimate implies a forward dividend yield of 1.2%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Ameris Bancorp. The stock has traded at an average P/TB ratio of 1.78 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 20.7 | 24.7 | 23.7 | 26.2 | |

| Average Market Price ($) | 49.8 | 38.5 | 28.7 | 50.4 | |

| Historical P/TB | 2.41x | 1.56x | 1.21x | 1.92x | 1.78x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | |||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $29.1 gives a target price of $51.7 for the end of 2022. This price target implies a 5.8% upside from the October 6 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.58x | 1.68x | 1.78x | 1.88x | 1.98x |

| TBVPS – Dec 2022 ($) | 29.1 | 29.1 | 29.1 | 29.1 | 29.1 |

| Target Price ($) | 45.9 | 48.8 | 51.7 | 54.6 | 57.5 |

| Market Price ($) | 48.9 | 48.9 | 48.9 | 48.9 | 48.9 |

| Upside/(Downside) | (6.1)% | (0.1)% | 5.8% | 11.8% | 17.8% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 2.80 | 2.75 | 3.77 | 5.40 | |

| Average Market Price ($) | 49.8 | 38.5 | 28.7 | 50.4 | |

| Historical P/E | 17.8x | 14.0x | 7.6x | 9.3x | 12.2x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | |||||

Multiplying the average P/E multiple with the forecast earnings per share of $5.0 gives a target price of $60.9 for the end of 2022. This price target implies a 24.6% upside from the October 6 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.2x | 11.2x | 12.2x | 13.2x | 14.2x |

| EPS 2022 ($) | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 |

| Target Price ($) | 50.9 | 55.9 | 60.9 | 65.9 | 70.9 |

| Market Price ($) | 48.9 | 48.9 | 48.9 | 48.9 | 48.9 |

| Upside/(Downside) | 4.1% | 14.4% | 24.6% | 34.8% | 45.1% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $56.3, which implies a 15.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 16.4%. As a result, I’m maintaining a buy rating on Ameris Bancorp.

Be the first to comment