MF3d

Dear Partners,

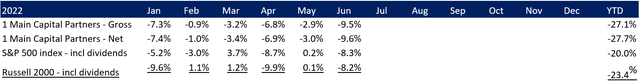

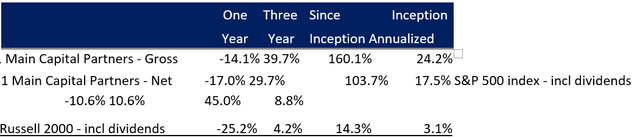

For the second quarter, 1 Main Capital Partners, L.P. (the “Fund”) returned (18.3)% net of fees and expenses[1], compared to a return of (16.1)% and (17.2)% for the S&P 500 and Russell 2000 indexes, respectively. For the first half, the Fund returned (27.7)% net, compared to (20.0)% and (23.4)% for the SPX and RTY, respectively.

In prior letters I’ve highlighted that from the beginning of COVID there was growing speculation in markets (Q3’20) along with increasing willingness to use options to leverage these speculative positions (Q4’20). These dynamics were a tailwind to risk assets. In the first half of this year, prospects of a slowing economy, sustained inflation and more restrictive monetary policy including higher rates and quantitative tightening caused investors to become more cautious, turning many of these tailwinds into headwinds.

I made a conscious effort to avoid the froth, but our holdings have not been spared from the unwind, despite their reasonable valuations and relatively strong fundamental performance to this point. Though I am always emphasizing that there will be ebbs and flows to performance, experiencing a paper loss is of course more trying than opining about one that may theoretically occur at some point in the future. With nearly my entire liquid net worth invested in the Fund, I certainly feel the sting of this drawdown.

Of course, stocks typically get cheap exactly when there are things to worry about and right now there is no shortage of them. In fact, the list seems to be getting longer by the day. In periods such as these, our minds try to convince us to avoid additional near-term pain by selling things until the skies are clear. However, we must remind ourselves that today’s lower prices are better, not worse, for long-term investors when compared to those from the start of the year.

As such, those with a time horizon measured in the years rather than months are likely best served staying the course and selectively adding exposure if prices continue heading lower. Accordingly, the discomfort of this draw down will not cause me to change the strategy, which is to optimize for long-term growth of our capital on a risk adjusted basis, just to minimize volatility. I believe it is a fool’s errand to jump in and out of the market, or from sector to sector, consistently without detracting from the long-term compounding of effect of business’ earnings.

Instead, I continue to underwrite existing and prospective positions to account for the changing economic environment – namely using more conservative assumptions on revenue growth, margins and multiples – and to make sure our businesses can not only survive any potential downturn but come out of one stronger and better positioned than they were before it.

This has led to me doubling down on some positions, where I believe the market has gotten it wrong, and reducing a few others where the uncertainty has made the risk / reward less favorable. For example, I have doubled down on KKR (more below) and sold some names that are overly exposed to rapidly rising interest rates.

As I look forward, I am increasingly optimistic about the prospects of the Fund’s portfolio and am excited to seeing how the underlying businesses we own perform in the months and years ahead.

Top 5 Positions

As of June 30th, the Fund’s top 5 positions were Alphabet Inc (GOOG), Basic-Fit NV (BFIT), KKR & Co (KKR), Pershing Square Holdings (PSH) and RCI Hospitality (RICK). Together, these holdings accounted for approximately 50% of the Fund’s capital.

KKR – Doubling Down

KKR was the largest detractor to the Fund’s performance in the first half, costing us around 6%. It was our largest position coming into the year and is down nearly 40% through June. It also remains our largest position today, as I have used weakness in the company’s share price to add meaningfully to our investment. In fact, it is approximately 2x the size of our next largest holding. The only other time I have had this type of outsized position in the portfolio was with RICK in late 2019, which went on to quadruple over the next two years.

KKR is an alternative asset manager that manages around $500 billion for clients. It gets paid a management fee and share of profits on much of the capital it puts to work. Importantly, KKR is very well positioned within its field.

For one, alternative asset managers (“Alts”) have been taking share from traditional strategies. On top of that, the largest of these managers have been taking share from smaller ones. Given its size, strong brand, and impressive long-term track record, KKR has been able to grow its AUM and fees at double digit CAGRs for decades and should continue capitalizing on the above trends for the foreseeable future.

Additionally, scaled Alts such as KKR enjoy meaningful operating leverage, allowing them to earn operating margins of greater than 60% on fee revenues and 40% on performance revenues.

Despite these attractive attributes, KKR and the Alts more broadly are perceived as cyclical and get hit every time the prospect of an economic slowdown enters the picture. The thinking is that their underlying portfolios are leveraged, so when the market declines their investments will be hit disproportionately, which will negatively impact performance and inevitably future fundraising.

I believe that these worries are misplaced. In fact, I believe that Alts are better positioned than any other asset manager to thrive through market volatility due to their long-term capital commitments, which allow them to not only hold onto investments during bad times, but also use their massive pools of dry powder to lean into attractive new opportunities as well.

The illiquid nature of their investments also prevents them from trying to time the market like much of active management does unsuccessfully, selling when things are scary and buying back when skies look clear, which in most cases detracts from long-term performance. In essence, the Alts plant more seeds when things are scary and harvest more crops when things look great – exactly what you want stewards of your capital to be doing for you.

It is for this very reason that there are so many high-profile billionaires associated with alternative asset managers: Steve Schwartzman, Henry Kravis and David Rubenstein are just a few of the high-profile ones.

On top of ordinary cyclical worries, there is an additional worry now that higher rates will be lethal for the Alts as well. The only real test we have for this thesis is the performance of private equity funds in the late 1970s through the late 1980s, when rates were double digits. For KKR, its 1976, 1980, 1982, 1984, 1986, 1987 funds returned 17x, 5x, 4x, 6x, 14x and 2x, respectively. Sure, there may be more capital chasing deals now than back then, but there is also much more market capitalization to go after than back then, and with higher rates all that capital will demand higher returns so deals will be priced accordingly.

While I think concerns of rising rates and a lingering economic slowdown are misplaced as it relates to the Alts, I am also comforted by KKR’s strong balance sheet and predictable fee-related earnings. The company holds net cash and investments representing approximately 40% of its market capitalization. It also has significant visibility into its management fees for the next 5+ years, especially since its most significant flagship funds just completed their large capital raises within the last year. The combination of these items provides us with significant downside protection.

At the same time, I think KKR should be able to grow its distributable earnings (DE) per share meaningfully in the coming years. When we first bought KKR shares, it was earning less than $2 of DE per share. This year, DE is expected to exceed $4 per share. By 2026, I believe that KKR will earn more than $10 of DE per share and will trade for a higher multiple than it does today as investors get more comfortable with the Alts cycle risk.

Additionally, employees and management are highly incentivized to see KKR succeed. Insiders own a lot of stock. The compensation of the company’s investment team is heavily tied to fee and performance revenues. Lastly, the company’s recently appointed co-CEOs were each granted 7.5 million shares of KKR which fully vest when the stock reaches $136 per share (3x current levels). They each stand to make >$1 billion if they get the stock there by 2026. I think that they will.

To summarize, KKR is an extremely valuable franchise that benefits from secular tailwinds, has capable management, and generates solid earnings and cash flow. I have a tough time seeing how we lose here and can easily see us making multiples of our capital in this investment in the years to come.

Staying the Course

If one has a sound investment strategy, it is dangerous to change the strategy after a period of poor performance. In the words of Nassim Taleb, “if you must panic, panic early.” Panicking late turns temporary losses into permanent ones.

In the words of Howard Marks, “If you stand at a bus stop long enough, you’ll get a bus. But if you keep running from bus stop to bus stop, you may never get a bus.”

Of course, this doesn’t mean to stay the course and do nothing with one’s portfolio. Market drawdowns tend to be associated with periods where things are rapidly changing, making it more important than ever to underwrite and re-underwrite positions to ensure our portfolio is optimized for risk adjusted returns.

However, I believe that sticking to the broader strategy that works over long periods is less risky than trying to jump in and out of the market.

Outlook

The broader macro picture remains worrisome. High inflation is squeezing consumer wallets and corporate margins. Rising rates, the primary tool the Fed uses to combat inflation, continue to put downward pressure on asset values.

Despite this tightening of financial conditions, we have yet to see inflation moderate. The labor market remains strong, with 11 million open jobs in the US. The housing shortage continues to drive rents higher. Food and energy markets continue to be disrupted by the war in Ukraine.

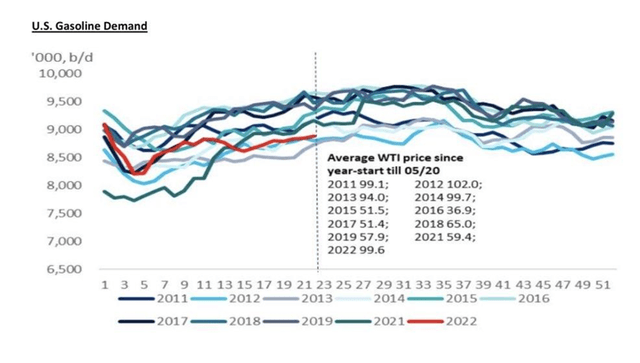

Of course, nothing is ever as good or as bad as it seems. Business conditions and consumer behavior aren’t static. Neither are the decisions of policymakers, employees, or management teams. High prices and high interest rates lead to demand destruction, which we are already starting to see in US gasoline demand.

Because of the dynamic nature of the economy, it is very hard to predict how things will play out. And because markets are forward looking and have already priced in a fair amount of pessimism, it is even harder to predict how stock prices will respond to the economic data as it changes.

To continue owning risk assets, however, investors must believe that the Fed governors have zero appetite to repeat the mistakes made by their predecessors in the early 70’s and will do whatever it takes to squash inflation, even if it means pushing the economy into a recession.

A recession may be bad for corporate earnings in the near term, but corporate earnings will eventually recover, and the lack of sustained inflation is the key ingredient needed to support longer-term multiples.

At the same time, the much more rapid deflation of bubble assets, such as meme stocks, high-flying story stocks and crypto, has been healthy in my opinion and has the potential to slow demand in a good way, while the job market remains in solid shape: a possible soft landing.

For the Fund, I will continue to try to own the best collection of businesses that can outgrow inflation in any environment, trading at reasonable valuations, with strong balance sheets and competent / aligned management. I am confident that this recipe will yield success with time.

As always, thank you for your continued support and confidence. Please reach out with any questions at yaron@1maincapital.com or 305-710-8509.

Sincerely,

Yaron Naymark

Monthly Performance Summary[2]

Footnotes

[1] Performance data is presented for the Fund’s Class A Interests, and is net of any accrued incentive allocation, management fees and other applicable expenses (as disclosed in the Fund’s Confidential Private Offering Memorandum), include the reinvestment of dividends, interest and capital gains, and assume an investment from inception. Returns for month-end and year to date 2022 are estimated, and un-audited. For investor specific returns, please refer to your capital statements. Due to the format of data available for the time periods indicated, net returns are difficult to calculate precisely. Please see the last page for important disclosure information.

[2] Performance Data is presented for the Fund’s Class A Interests, and are net of any accrued incentive allocation, management fees and other applicable expenses (as disclosed in the Fund’s Confidential Private Offering Memorandum), include the reinvestment of dividends, interest and capital gains, and assume an investment from inception. Returns for month-end and year to date 2022 are estimated, and un-audited. For investor specific returns, please refer to your capital statements. Due to the format of data available for the time periods indicated, net returns are difficult to calculate precisely. Please see the last page for important disclosure information.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment