Kevin Frayer/Getty Images News

Investment thesis

Baidu (NASDAQ:BIDU) has been lacking in catalysts for the longest time and I think that this could be the time to invest in the company. Baidu has several growth drivers it can pull in the future to drive a re-rating in the multiples of the stock. First, it can leverage its leadership position in the autonomous and intelligent driving market in China and start to commercialise its self-driving technology capabilities, thus gaining a first-mover advantage. Second, Baidu’s artificial intelligence (“AI”) cloud business looks set to gain new industry applications from across industry verticals and maintain its leadership position as it continues to innovate and become a material growth driver for Baidu in the future.

Baidu AI Cloud

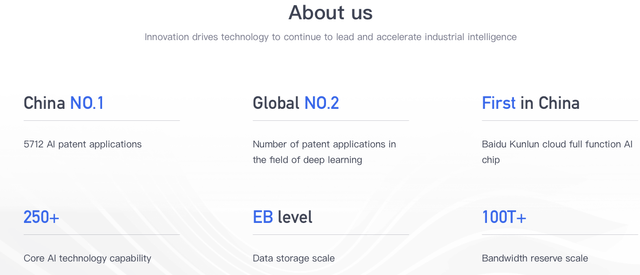

The company continues to be growing its AI cloud customer base and improve on the number of industry applications. Baidu’s AI cloud has been ranked number 1 in China for 2021 by IDC. As can be seen below, Baidu’s AI cloud is the leading player in China with the most number of AI patent applications, innovations and even the first Baidu Kunlun cloud AI chip in China.

Baidu AI Cloud (Baidu website)

Baidu’s AI cloud has demonstrated its value add in different industries like automobiles, energy, transportations, for example. The offering has enabled companies to achieve an intelligent upgrade and accelerate their digital transportation journey.

Baidu’s AI cloud business grew by 45% year on year in 1Q22, compared to the industry average of 21% growth year on year, as per IDC. This stronger growth was backed by its Platform as a Service revenues as well as its Infrastructure as a Service revenues, both of which help to bring together an integrated, one stop solution for customers. As a result, this has led to its Platform as a Service revenues growing by 120% year on year in 2021, and as I will illustrate later, its strong growth in multiple industry verticals like auto, energy and smart transportation. For its AI IaaS offering, has been receiving strong interest from industry verticals like biocomputing and intelligent driving.

Baidu’s AI cloud is gaining traction with multiple industry verticals, further cementing the strong leadership position Baidu has in the AI cloud space in China.

For Baidu’s AI cloud, one of the segments is the ACE smart transportation, which has contracted with 41 cities as of 1Q22. Baidu uses the acronym ACE which stands for “Autonomous Driving, Connected Road, Efficient Mobility”. As a result, Baidu’s AI cloud does have a first mover advantage in intelligent driving as the approval of Baidu’s AI cloud by local governments in China further brings weight to the innovation that Baidu has done on this front.

Also, another industry vertical that has shown increasing interest and adoption of Baidu AI cloud is the automobile segment, with the Baidu AI cloud revenues from these clients growing almost 290% year on year in 2021 as Baidu has collaborations with 10 out of the top 15 Chinese automakers like SAIC. Baidu is also collaborating with 5 of the top 10 Chinese electric vehicle companies like Nio (NIO) and Li Auto (LI). According to the company at the Baidu World event, the use of AI cloud based solutions for the car designing as well as the research and development efforts led to 15% reduction in costs on average.

Lastly, in the energy industry vertical, Baidu AI cloud revenue from the industry vertical grew by 130% year on year as these energy companies look to accelerate their digital transportation. For example, Baidu has worked with State Grid to build an automated inspection solution as well as an AI platform to reduce the need for manual inspection by 60% and to increase the accuracy of power transmission by 95%.

Baidu launched the PaddlePaddle platform, which is an open source deep learning platform that helps to lower some of the barriers to commercialise AI technology. The platform currently has more than 4.7 million developers around the world with more than 560,000 AI models having been built through the platform, which has served more than 180,000 companies. PaddlePaddle is also China’s largest deep learning framework platform, and the third largest in the world.

In conclusion, I think that Baidu’s AI cloud business is in its early stages of growth as China looks towards digital transformation in the next decade to improve productivity and innovation. Baidu AI cloud is at the forefront in terms of market share and innovation and looks set to benefit from this new wave of demand for its AI cloud offerings.

Apollo Go

Baidu was the earliest company in China to envision a future with driverless cars as it invested heavily into autonomous driving technology. As a result, Baidu’s Apollo has industry leading autonomous technology in China and the most mature autonomous driving solutions in China. It has more than 32 million kilometres in testing milage and is already in commercial service providing autonomous driving services in multiple cities in China, some without any safety personnel in the car. Apollo Go operates a fleet containing 300 vehicles nationwide as of July 2022.

Baidu recently revealed its sixth generation of its autonomous driving robotaxi, the Apollo RT6. The newest version is expected to bring cost savings as it will cost almost half as much as the previous version, with a total cost of RMB 250,000.

With the completion of more than 1 million orders in more than 10 cities in China where Apollo Go robotaxi is operating in by July 2022, the company is on the right track to becoming one of the largest autonomous robotaxi platform and service provider in the world. In addition, the company has done tests in 30 cities with 32 million km of L4 autonomous driving mileage.

As evidence of its first-mover advantage and leadership in the robotaxi space, Baidu was the first-ever company to receive fully driverless robotaxi licence in China. The licenses were awarded in two cities, Wuhan and Chongqing.

The total proportion of driverless ride hailing for the company has thus reached around 24% as of end June, after the company received the necessary approvals for driverless operations at the end of April.

ASD (Apollo Self-Driving)

As part of Baidu’s Apollo auto solutions, both Apollo Self Driving (“ASD”) and Duer OS continue to gain traction with automakers in China as these auto OEMs increasingly recognise and commit to autonomous vehicles. As of the second quarter of 2022, Baidu announced that its total backlog for ASD is around RMB 10 billion. Baidu expects ASD will continue to grow quickly from now till 2025 due to its wide range of product features like smart map, smart cabin and intelligent driving pilot.

For the smart cabin, there have been more than 160 vehicle models that are in collaboration with Baidu’s DuerOS. In addition, there have been more than 3 million shipments as of the second quarter of 2022, up from 1.8 million in the prior year, making it the number 1 player by market share. The company expects to roll out more AI applications that can enable an even smarter cabin.

For the smart pilot offering, management is confident about the commercialisation of its smart pilot solutions, with many automakers installing Baidu’s intelligent driving pilot in their new car models. For example, there were 5 models that installed Baidu’s intelligent driving pilot, with 11 more models expected in 2022. BYD (OTCPK:BYDDF) is one good example of an automaker installing Baidu’s intelligent driving pilot to develop self-driving electric vehicles. Management expects that the Apollo self driving smart pilot deployments to grow at 100% CAGR from 2022 to 2026.

Lastly, China is a good market for Baidu to be rolling out its autonomous technology given that China is at least 2 years ahead of the international markets in the adoption of smart cars and Chinese consumers are also more willing to pay more for these new intelligent driving features than the United States.

All in all, I think that Baidu’s intelligent and self-driving unit is starting to reap the benefits of its investments into autonomous driving technology many years ago. I am of the view that given the Chinese market’s more positive response towards intelligent driving features and the increasing demand and receptiveness to autonomous driving, Baidu will be a clear winner in the robotaxi and autonomous driving space as it has the first-mover advantage and the superior autonomous technology relative to peers.

Jidu, Baidu’s self-driving EV

Baidu set up a joint venture with automaker Zhejiang Geely Holdings called Jidu Auto, with Baidu owning 53% of the joint venture. Both companies invested $400 million into the joint venture for the development and production of Jidu’s first robot car. Jidu introduced the concept of its first self-driving electric vehicle in June 2022 and is looking to mass produce the car in 2023. There are also plans to utilise Baidu’s autonomous driving technologies for the vehicle.

As an update, Baidu’s management sees that its initial timeline could be met, as it expects its first mass market model, the ROBO-1, to finish its development phase and Jidu will be taking orders in late 2022 for delivery to commence in 2023. Management also shared that the ROBO-1 will also be equipped with Baidu’s most advanced intelligent driving software, ANP 3.0.

Baidu’s recent quarter and core business

In its second quarter results, there was a strong beat on earnings in Baidu’s core business while revenues were large as per market expectations. There was evidence of gross margins improving sustainably that could help Baidu’s core earnings growth go back to the positive territory. Furthermore, there was a recovery in the ads year on year trend in August. Lastly, Baidu had an above industry average growth in its cloud revenue of 31% year on year growth when peers were growing between -6% and 10%

I think that this second quarter results do show Baidu’s management’s solid execution abilities to turnaround Baidu’s core earnings growth to positive by improving margins across its ad business and AI cloud business, as well as cost reduction in areas like sales and marketing, and general and administrative expenses.

I expect further upside to come after 2H22 when we start to see more contributions from ASD orders as well as deliveries for Jidu in 2023.

Valuation

I use a sum of the parts model to value Baidu given the different business segments it has. I assume a 4x multiple on 2023F sales for the Baidu AI cloud business, and I use a DCF model for the Apollo and intelligent vehicle business. I apply a holding company discount of 30% and value its investments at fair value based on their most recent market capitalisations.

My 1-year target price for Baidu is $209, representing 76% upside from current levels. This target price implies 2023F P/E of 24x. As such, I think that the risk reward perspective for Baidu is skewed to the positive.

Risks

Macroeconomic environment

If the macroeconomic environment were to deteriorate, this will undoubtedly affect advertising spend and thus affect Baidu’s growth and earnings recovery.

Delay in progress of launch of EV and autonomous driving milestones

Any delays in the progress of the launch of Jidu and any problems with ramping up production and deliveries for its EV could lead to a drop in its share price. Furthermore, there are many milestones to be achieved with its autonomous driving business. As a result, any problems or delay in the timeline for the autonomous driving business could also lead to a drop in its share price.

Conclusion

Baidu has multiple long-term growth drivers that can drive a re-rating to its multiples. First, there is the AI cloud business that is expected to grow rapidly in the next few years as China looks toward digital transformation. Furthermore, Baidu’s AI cloud offering brings the best technology in the industry and takes up the number 1 market share in China. Second, Baidu’s autonomous driving arm, Apollo, looks set to commercialise its best-in-class autonomous technology as it rolls out robotaxi services in China, and in some cities, without any safety staff. Furthermore, the company has many other ways to monetise its autonomous driving technology by providing automakers with self-driving capabilities and selling intelligent car features. Third, Baidu has its own EV unit which will be delivering its first vehicles next year. My 1-year target price for Baidu is $209, representing 76% upside from current levels. I think that this target price is conservative given the huge upside that we will likely see as Baidu commercialises on its autonomous driving technology and as the AI cloud business grows more materially in the future.

Be the first to comment