FOTOKITA/iStock via Getty Images

Investment Thesis – The Ad-Tier May Cause Its Short-Term Demise

Netflix (NASDAQ:NFLX) is reportedly eager to release its ad-supported tier by 1st November, ahead of its key rival, Disney (DIS), on 08 December 2022. However, given the massive rush since its announcement early this year, it is entirely possible that NFLX may stumble and fall at the start, given the odd choice of Microsoft (MSFT) as its (inexperienced) advertising partner. The combination of an elevated advertising fee of up to $80 in CPM rate, halved monthly subscription fee, and the minimal five minutes in ads per hour seems the rather unlikely recipe for success, given the massive deviation from industry standards of $20-$30 in CPM rate and up to twenty minutes of ads per hour.

The killing blow might also be delivered to its financial performance, since a new survey from Samba TV and Harris X highlighted that up to 45% of NFLX’s existing subscribers would consider switching to its ad-support tier. On one hand, given NFLX’s FQ2’22 total subscribers of 220.67M, the switch could mean a catastrophic switch of 99.3M users, indicating an upward cannibalization impact of $5.48B in the company’s annual revenues. On the other hand, the new tier may also attract new (and retired) cost-sensitive subscribers, with a speculative contribution of up to $5.5B in fees and advertising revenue from FY2023 onwards, while hitting an ambitious total of $8.5B by FY2027.

Whichever it is, many are waiting with bated breath, given the delicate balance between total subscriber growth and financial performance, significantly worsened by the pessimistic stock market through the next few quarters. The August CPI does not help matters as well, since the elevated inflation rate will continue to erode discretionary spending.

There is also the unlikely event that NFLX follows in DIS’ footsteps in raising its prices, with the latter introducing an ad-supported Disney+ at $7.99 monthly and an ad-free option at $10.99. That strategy may, unfortunately, backfire, leading to another massive user churn as experienced in FQ1’22. The simultaneous release of the ad-supported tiers by both streaming giants at the end of the year will also force constant comparisons between the two companies, possibly triggering another retracement if underperformance occurs.

Though NFLX notably wanted to take things slow, we are of the opinion that the launch of its ad-supporter tier will make or break the company’s stock by FQ4’22, with lesser chances of upward price revision through 2023 depending on the macroeconomics. Therefore, investors should be aware of the massive returns ahead, with the winner taking it all, assuming that all the stars are aligned. Otherwise, more likely another falling timber, crushing investors’ hopes and dreams during these difficult times, yet again.

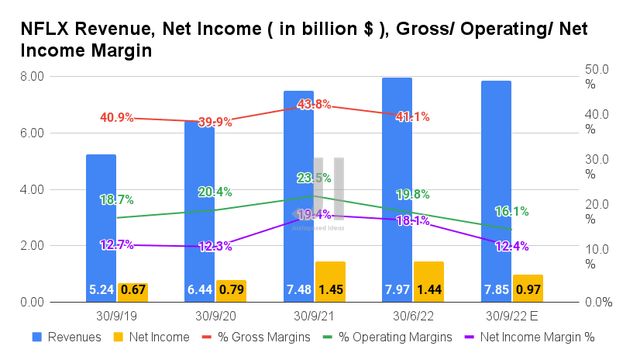

Mr. Market Has Effectively Downgraded NFLX’s FQ3’22 Performance

For the upcoming FQ3’22 earnings call, NFLX is expected to report revenues of $7.85B and operating margins of 16.1%, representing a notable QoQ decline of -1.5% and -3.7 percentage points, respectively. Otherwise, an increase of 4.94% though a decline of -7.4 percentage points YoY, respectively. These are probably attributed to the worsening macroeconomics triggering a temporary reduction in consumer discretionary spending and certain FX headwinds.

Naturally, NFLX’s profitability will also be affected, with net incomes of $0.97B and net income margins of 12.4% for the next quarter, indicating a massive decline of -32.63% and -5.7 percentage points QoQ, respectively. Otherwise, a YoY fall of -33.1% and -7 percentage points, respectively.

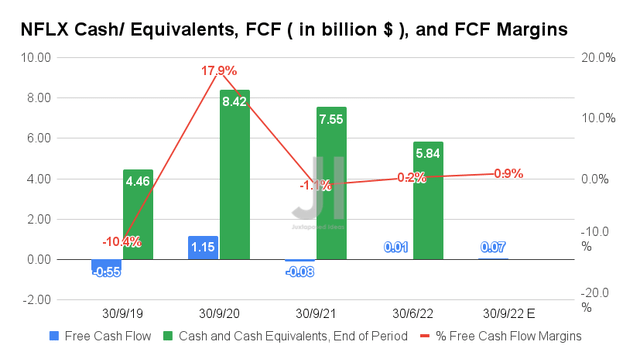

In the meantime, assuming a moderated expenditure, NFLX may report improved Free Cash Flow (FCF) generation of $70M and an FCF margin of 0.9% in FQ3’22, indicating an excellent increase QoQ and YoY indeed.

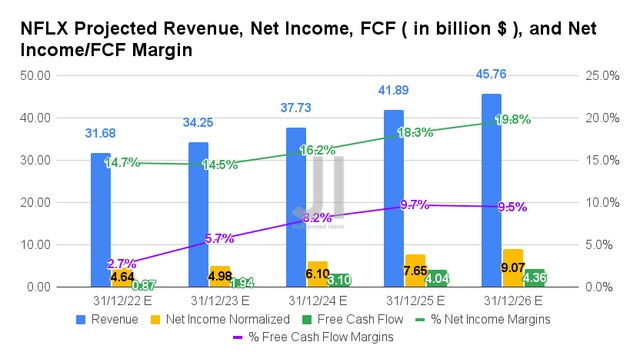

Over the next five years, NFLX is expected to report revenue and net income growth at a CAGR of 9.04% and 12.16%, respectively. It is evident that Mr. Market is rather optimistic about the company’s forward execution, given the improvement in its profitability, from net income/ FCF margins of 9.3%/-15.6% in FY2019, to 17.2%/-0.4% in FY2021, and finally settling at a stellar 9.5%/19.8% by FY2026. Nonetheless, we must also highlight that these numbers represent notable downgrades in estimates by -10.81% since our previous analyses in April and July 2022.

In the meantime, consensus estimates that NFLX will report revenues of $31.69B, net incomes of $4.64B, and FCF of $0.87B in FY2022, representing a YoY increase of 6.7%, -9.19%, and 659.19%, respectively. Though it remains to be seen how the ad-tier and advertising segment will perform in the short term, we may surmise that the company will start reaping massive benefits from FY2024 onwards, when the macroeconomics improves and consumer spending resumes. NFLX is expected to report impressive YoY growth in revenue and net incomes by 10.16% and 22.48% then, respectively, compared to 8.11% and 7.32% in FY2023. Impressive indeed.

In the meantime, we encourage you to read our previous article on NFLX, which would help you better understand its position and market opportunities.

- Netflix’s Nightmare Continues – Your Reminder To Unload Now

- Netflix Lost The Squid Game – Another Decline Expected In 3 Months

So, Is NFLX Stock A Buy, Sell, or Hold?

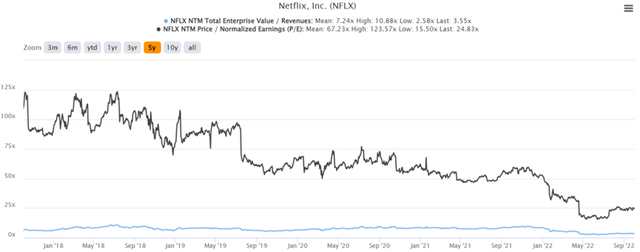

NFLX 5Y EV/Revenue and P/E Valuations

NFLX is currently trading at an EV/NTM Revenue of 3.55x and NTM P/E of 24.83x, lower than its 5Y mean of 7.24x and 67.23x, respectively. The stock is also trading at $239.04, down -65.89% from its 52 weeks high of $700.99, though at a premium of -49.91% from its 52 weeks low of $162.71. Nonetheless, given their price target of $239.29, it is evident that consensus estimates are cautious about NFLX’s prospects from current levels.

NFLX 5Y Stock Price

Assuming that the pessimistic FQ3’22 estimates came true, NFLX would have more downsides from current levels, potentially breaking its previous June lows. The S&P 500 Index had already done so, with a -25.25% plunge on 30 September 2022, indicating peak market pessimism and fear levels. Even though the latter had also recovered by 2.59% at the time of writing, one day’s price action may not reflect the true state of the market, which has been admitted bearish since the start of the year.

However, all hope is not lost, since the September CPI released in early October may provide the potential catalyst for the stock market’s recovery, due to the Fed’s projected terminal rate of 4.6% by 2023. This potentially indicates a 75 basis point hike in November, with January 2023 moderating with a 50 basis point hike. Therefore, we may speculatively assume that most of the pessimism is already baked in, barring an earnings miss in FQ3’22 and financial losses in FQ4’22. We shall see.

In the meantime, we prefer to rate NFLX stock as a Hold for now, since the stock is also trading above its 50 and 100-day moving averages. Patience for now, since we will likely see better entry points after its earnings call.

Be the first to comment