blue textile kitchen apron with white stripes and wooden spoons home meal delivery. nndanko/iStock via Getty Images

Introduction:

I normally try to keep the ideas I post here to companies at least over $1 billion market cap. Every now and I think I come across a smaller idea that warrants my attention and a write. Blue Apron (APRN) is one of those ideas.

The Basics of Blue Apron:

For those of you who are not familiar with Blue Apron, it was the first mover in the home meal prep delivery business. I give kudos to founder Matt Salzberg for coming up with this business model and growing it to public company status. Unfortunately, his skills managing a public company left something to be desired as did some of the governance (including dual class structures and having his father on the board) that occurred under his watch first as CEO and then Chairman.

The stock fizzled almost immediately from the IPO as sales growth reversed and losses multiplied. The company’s fortunes deteriorated to the point where the company replaced its entire management team in short order including bringing in the current CEO Linda Findley who had previously been COO at Etsy (ETSY). Findley largely stemmed the cash bleed and stemmed sales even while relatively muted spending on marketing.

The company benefitted from the shelter in place/work from home dynamic of 2020. Some of those trends have reversed (a fact that some of the bears call out) but the trends are still better than 2019, which is a much fairer and more relevant comparison. The company has 350k subscribers, a number that bounced around mostly flat for the past eight quarters after years of losing customers.

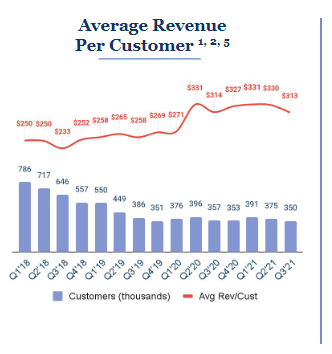

Average Revenue Per Customer

Blue Apron Average Revenue per customer by quarter Blue Apron Q3 presentation

I have seen bearish reports where people effectively say, “They went from 375k subscribers to 350k in one quarter! Covid is over and these guys are dead!”

I think that is very selective use of information to support a view. As you can see above, subscribers dipped a couple of quarter in the middle of 2020 only to bounce again. Moreover, orders per customer, while trending down a little from where they were in 2020 as people started going out again, are still higher than they were in 2019, which again is a fairer comparison year. Even more important, Average Order Value has marched steadily higher.

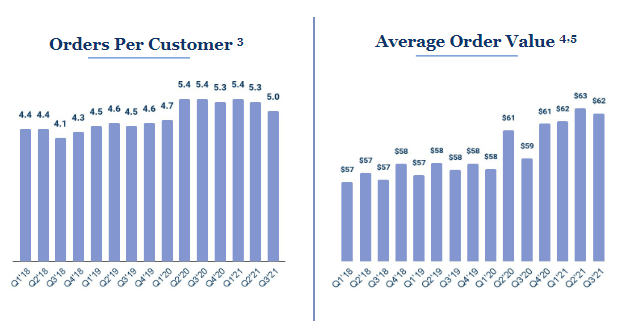

Order Per Customer and Average Order Value

Blue Apron Orders Per Customer and Average Order Value Company Q3 presentation

I think it is really hard to look at the above trends and say things are going in the wrong direction, especially versus 2019, pre-Covid and just as Findlay had taken over as CEO.

The Investment Thesis:

I think Findley has done a good job, but she has been hamstrung by lack of cash. I think it was also imperative to eliminate the dual class structure that gave the Salzbergs control of the company. The company solved both of those issues with an $78 million rights offering in the fall executed at $10/share versus the stock currently at $6.65 (at the time of this writing). Joe Sandberg backstopped the deal. He is the founder of Aspiration Financial a “green” fintech company that plants trees as people use the card rather than offer points back. It is going public via a merger with (IPVF) a SPAC, valuing the company at $2.3 billion. In December, APRN announced a co-branded credit card with Aspiration where users can earn credits toward APRN meals. I think access to Aspirations user base could be nice.

The right offering gave the company about $80 million of cash, over $2.50/share. This will allow to scale up its marketing. Another important part of the deal is it eliminated the company’s dual class structure and Matthew Salzberg and his father Barry left the board. Those actions dramatically improved the company’s governance and I hope the company’s performance as I don’t believe either Salzberg offered much to the company’s turnaround efforts.

With the rights offering the company was left with 31.6 million shares (not including warrants exercisable at $15, $18 and $20) and as I said around $80 million of net cash. At $6.65/share, that makes for about $150 million enterprise value. Given the company’s approximately $500 million of sales, it is trading at about .3x sales. Even after a selloff, HelloFresh (OTCPK:HLFFF) is trading at 1.6x sales. Granted, HelloFresh is a much larger company and generates considerable cash flow, still I think the valuation dispersion to be material particularly in light of the recent capital raise at a 50% premium to the current price, the improving underlying trends in APRN’s revenue profile and its low cash burn. Even if APRN traded at a 50% discount to HelloFresh on a multiple of revenue basis, that’s almost 200% appreciation from here.

Risks:

This company is still not profitable and still burns some cash. While I am hopeful that sales trends can improve from here, they might not. Also, the company’s gross margins could take a hit from elevated labor expenses and higher food costs. Perhaps they’ll be able to raise prices to offset those expenses, perhaps not. Lastly, this is a small stock. It traded over $6 million of volume today, but small stocks can have their issues, which is why I tend to not play them.

Conclusion:

At around $150 million enterprise value for a company with a decent amount of cash and $500 million of sales, I view this stock effectively as a call option albeit one without an expiry. Call options can have significant upside thanks to the leverage, but you have to be prepared for volatility and a higher than normal possibility of loss. I can see this stock go up 200% or more and down 50% or so. I like that risk/reward profile for the appropriate amount of a portfolio.

Be the first to comment