SWInsider

Freeport-McMoRan (NYSE:FCX) is in a sweet spot with the copper market. The mining firm still beat estimates despite copper and other metal prices falling. The “strikingly tight” physical copper market is a positive catalyst that should send FCX stock higher from here. More importantly, the company curtailed supply during the quarter. Its delay in increasing development will likely strengthen future results.

After FCX rallied by around 6% after its third-quarter report, what are the upside prospects from here?

Freeport-McMoRan Q3 Earnings Results

In the third quarter, Freeport-McMoRan posted revenue of $5 billion, down by 17.8% Y/Y. It sold 1.1 billion pounds of copper, 480,000 ounces of gold, and 17 million pounds of molybdenum. With an operating cash flow of $0.8 billion in Q3, the company bought back $1.1 billion worth of senior notes. As a result, it ended the quarter with a consolidated debt of $10.7 billion. Its net debt is only $1.3 billion when excluding net debt for its Indonesia smelter projects.

Importantly, Freeport-McMoRan has the flexibility to act on the $3.2 billion available in its $5.0 billion stock buyback program. It held cash and cash equivalents of $8.6 billion. Management has the flexibility to increase project developments or buy back stock. Its action depends on the price of copper. This excellent balance increases the attractiveness of FCX stock.

Chief Executive Officer Richard Adkerson said that the company has strong long-term fundamentals. It should navigate through the current global market uncertainties. Chances are high that fearful investors will panic and sell the stock in the coming months. History tends to repeat itself. In April and in June, the stock entered a downtrend. This created a bottom in the stock at around $25 by mid-July.

Opportunity

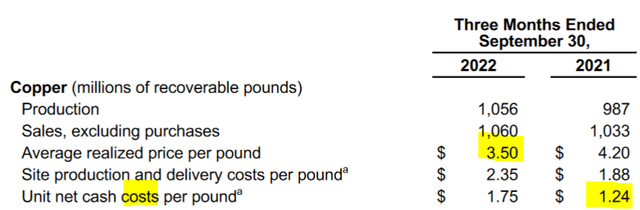

Freeport-McMoRan might report growing profitably when input costs from energy and inflation peak and metal prices strengthen. Copper is the miner’s biggest revenue generator. As shown below, the average realized price per pound fell last year while net cash costs rose.

Copper has multiple demand catalysts ahead. Clean energy efforts will increase demand for decarbonization technologies. This helps copper demand.

In the third quarter, copper settlement prices fell. Weak Chinese economic data and worries about the global economy hurt prices. In addition, Europe sustained an energy crisis as the U.S. central bank embarked on an aggressive interest rate hike policy.

After peaking at $4.87 per pound in March 2022 on the London Metal Exchange, the copper settlement price fell to $3.47 per pound on October 19, 2022. Freeport-McMoRan’s customers have sustained demand for copper. The company believes that demand might double in 15 years, driven by global decarbonization efforts.

Catalysts

Freeport-McMoRan has three underground mines in the Grasberg minerals district. It achieved 100% of the projected annualized production of ~ 1.6 billion pounds of copper and 1.6 million ounces of gold in late 2021. In the second half of 2023, it will complete its installation of additional milling facilities. This raises its milling capacity to around 240,000 metric tons of ore per day. The sustained output levels are a positive catalyst for investors.

At its Indonesia smelter, Freeport-McMoRan will construct another domestic smelting capacity. Capacity will likely top 2 million metric tons of concentrate annually by the end of 2023.

In 2024, the company will complete its greenfield smelter in Gresik, Indonesia. Capacity should reach around 1.7 million metric tons of copper concentrate a year. The project will cost $3.0 billion.

Risks

Input costs such as energy and commodity-related consumables previously correlated to copper prices. Might this time be different? The company noted in its press release that this correlation broke down in 2022. Copper prices fell when many commodity-related consumable prices rose. Investors need to watch for better labor market conditions and easing supply chain constraints. That will lower operating costs and increase production efficiency.

FCX Stock Grade

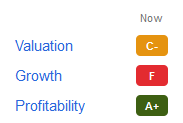

Freeport-McMoRan has mixed stock grades. It has strong profitability, fair valuation, and weak growth.

SA Premium

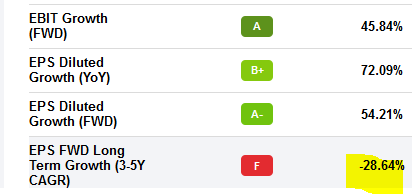

Digging into the growth grade, the stock scores between A and B+ on nearly every line item. Its negative long-term forward growth is negative, compared to the sector median of 8.96%.

SA Premium

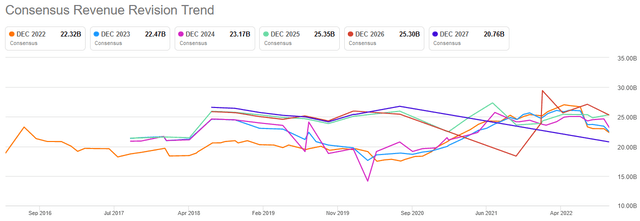

Analysts revised revenue expectations lower:

The stock is likely already pricing in the company’s downside revenue targets. I think it’s positively adjusted for the discount after the earnings report posted on October 20. This increases the company’s attractiveness for investors. Should copper prices strengthen, investors who want exposure to the mining industry will buy FCX stock in response.

Be the first to comment