Erdark/E+ via Getty Images

Blue Apron Holdings (NYSE:APRN) is recognized as one of the pioneers in direct-to-consumer meal kit delivery. While the service saw a boost in popularity during the early stages of the pandemic, the setup now is a more challenging operating environment amid broader macro headwinds. The combination of intense competition and rising costs, while customers are being squeezed by high inflation, has made the goal of reaching profitability elusive as a fundamental weakness.

Indeed, Blue Apron just reported its latest quarterly result with declining sales, poor performance metrics, and some liquidity concerns as management pulled guidance. Shares are off more than 80% over the past year in what has escalated into an apparently sinking ship. Our call here is to expect the volatility to continue with no quick turnaround in sight. In our view, the brand has lost momentum and risks remain tilted to the downside.

APRN Earnings Recap

Q3 revenue of $109.7 million declined by -11.7% year-over-year. Within that figure, a large $10 million order from an enterprise customer last year skewed the result lower. Nevertheless, the takeaway here is that key indicators have moved in the wrong direction.

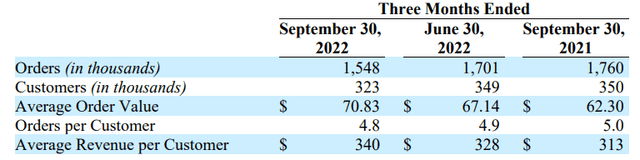

Total customers in Q3 at 323k fell by -8% y/y from 350k in Q3 2021. The number of total orders at 1.55 million also dropped sharply from 1.76 million just from the recent Q2. Customers are making fewer orders on the platform at 4.8, down from levels above 5.0 last year.

On the other hand, Blue Apron has attempted to mitigate some of those losses with higher pricing, which has also been used to deal with rising costs. The average order value reached $70.83 compared to $67.14 in Q2. The average revenue per customer also climbed by 3.6% to $340.

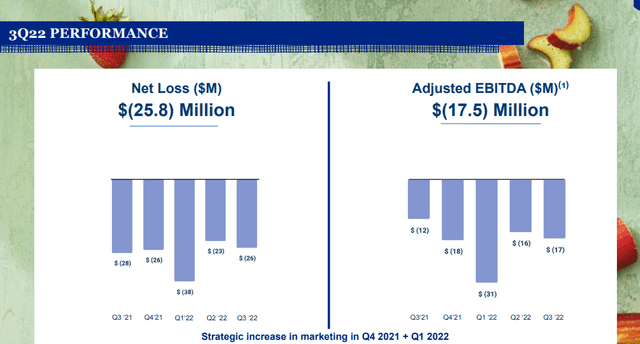

The appearance is that the core and most loyal group of core customers is increasing their activity while Blue Apron is struggling to find new first-timers or more casual diners. The result here is that the adjusted EBITDA loss of -$17.5 million widened from -$16 million in Q2 and even -$12 million in Q3 2021. Over the past year, Blue Apron has generated a net loss of more than -$112 million.

One positive update is the news that Blue Apron is now available on Amazon.com (AMZN) online stores without a subscription. The understanding is that the sales channel would feature a lower margin given the wholesale approach specifically targeting more casual one-time buyers. The hope is the visibility will help reach a new demographic and potential lifelong customers although it remains to be seen how much growth this relationship can generate.

With an outlook for recurring losses in the foreseeable future, negative cash flows are set to continue. In Q3, APRN faced a cash bleed of -$22.7 million against a balance sheet cash position of only $31 million. The focus of management is to stabilize cash flows through cost-cutting initiatives.

On this point, the company raised $14.1 million after the quarter ended in October through an at-the-market offering. Securing larger longer-term financing has been an issue. Back in September, Blue Apron entered a private placement agreement with Joseph Sanberg, an early investor in the company and director at RJB Partners LLC. The deal was expected to raise $57 million although Blue Apron has not received the funds with some controversy regarding the circumstance.

The update is that a separate pledge agreement was entered with Mr. Sanberg to transfer security interest in certain private companies affiliated with RJB Partners as an alternative to the payment. While the implied value of the investments is more than the owed amount, it doesn’t address the near-term cash needs. This type of corporate imbroglio has added to liquidity concerns and explains some of the recent volatility in the stock.

In this case, management specifically cited that uncertainty as part of the reasoning for withdrawing full-year guidance. Previously the company was targeting revenue growth for 2022 between 7% and 13%. With the poor Q3 trends, it’s clear that level would not have been realistic.

Due to the uncertainty of the anticipated funds from Mr. Sanberg’s affiliates, Blue Apron is withdrawing its previously announced revenue growth target of 7% to 13% for full year 2022. The company remains focused on achieving Adjusted EBITDA profitability in the future and will evaluate providing updated targets once the company has more certainty on its liquidity position.

What’s Next for APRN?

The high-level question when looking at Blue Apron is whether meal-kit subscriptions are more than a fad and if the company will be able to reclaim positive growth. Our take is that the food plan service represents an important market opportunity but is a relative niche, and generally a poor business with limited profits. A big concern here is the competitive landscape that has evolved with many emerging players over the past decade.

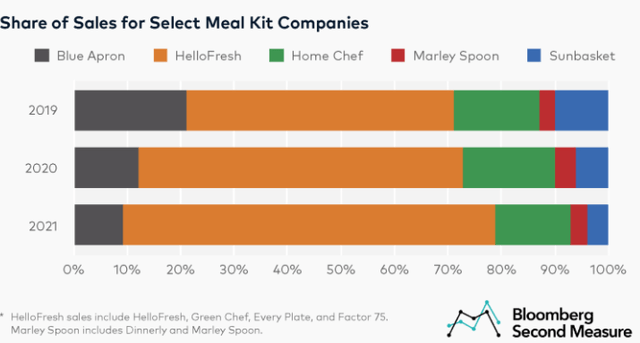

According to Bloomberg, Blue Apron lost market share in the meal kit segment from above 20% back in 2019, declining to under 10% by 2021. Even as total sales for meal kits in the United States have increased over the period, Blue Apron has not kept up while HelloFresh SE (OTCPK:HLFFF) which is the largest in the U.S., consolidating its lead to nearly 70% of the market.

It appears that consumers have made their choice of preferred service with HelloFresh successfully leveraging its logistics to scale and capture the demand. Data shows HelloFresh has higher retention of the subscription with customers making more regular orders. Notably, HelloFresh has also struggled with profitability and weaker-than-expected growth in the past year.

It becomes a harder road for Blue Apron to reclaim lost customers that are now with a different provider including several smaller players. The point here is to say that we are skeptical that any new growth initiatives or refreshed menus would be enough to move the needle in Blue Apron’s growth outlook.

All this is in the context of the company’s urgent push to cut costs and stabilize cash flow which can translate into decreased marketing efforts and slower new customer acquisitions. The spread just to reach breakeven adjusted EBITDA remains aspirational in the current circumstance. Putting it all together, further dilutive equity issuances and capital raises should limit any upside in the stock price.

APRN Stock Price Forecast

The meal kit and curated food plan market have proven to be very difficult to navigate for the companies. For Blue Apron, a deeper restructuring and realignment may be necessary for the group to continue in its present form.

In terms of valuation, APRN has a market cap of around $70 million or $100 million on an enterprise basis. With declining sales and negative earnings, the company is only worth the hope of a long-term turnaround. The profile here of a nano-cap stock makes APRN highly speculative with significant risks. With shares down more than 60% just over the last month, expect extreme swings in the stock price in both directions. Still, It’s not worth attempting to pick a bottom on this one in our opinion.

The bearish case from here the company continues to lose customers while performance indicators like order per customer break down further. The challenge here is finding a new wave of growth at a level that can shift financial margins sustainably higher.

On the upside, it will be important for Blue Apron to prove it has a proverbial “second act” with a resurgence of growth. Monitoring points over the next few quarters include the number of orders per customer and total orders. For investors underwater in the stock, the best-case scenario at this point would be a potential acquisition, although nothing has been reported, and we few such a deal as unlikely given the poor sales trends.

Be the first to comment