NoDerog/iStock Unreleased via Getty Images

Thesis

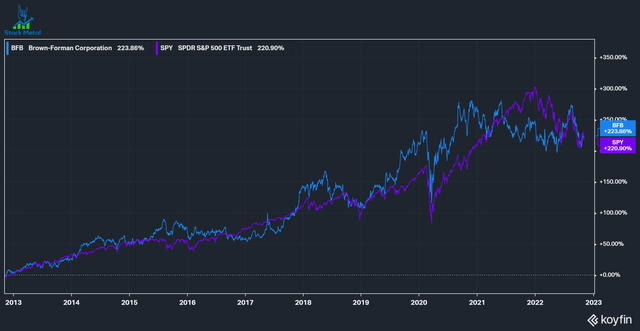

Brown-Forman Corporation (NYSE:BF.A, NYSE:BF.B) is a leading manufacturer and distributor of alcohol, predominantly whiskey and tequila. The company has matched the S&P 500 Index (SP500) for the last decade and has traded sideways for the previous two years. After an initial big hit from Covid, the company has recovered well. Let’s see if Brown-Forman could offer an attractive long-term buying opportunity.

Throughout this article, I’ll refer to Brown-Forman as BF.

Industry

BF has a portfolio of leading spirits, focusing on its iconic Jack Daniel’s brand and its tequila segment. The company expects its main categories to grow at a high-single-digits CAGR through 2025 (U.S. Whiskey 8%, Tequila 9%: Slide 54).

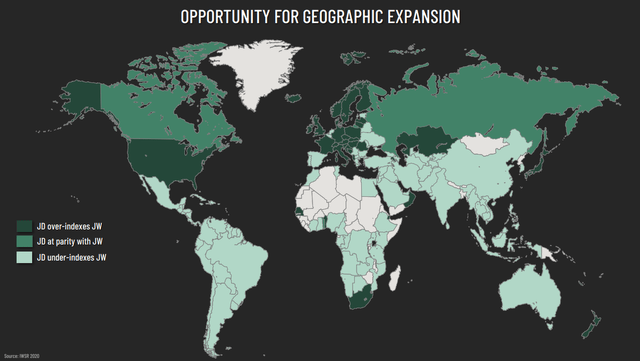

Although the company already derives 51% of its sales from international markets, they continue to see a big opportunity for global expansion. In the graphic below from their investor day (Slide 59), you can see a map with regions where Jack Daniel’s is the leader in dark green, regions on parity in light green, and regions where Diageo’s (DGE) Johnnie Walker is the dominant brand. We can see that JD dominates the U.S. and most of Europe, while most developing countries offer an opportunity to gain market leadership.

Geographic opportunity (BF Investor day)

Family owned

I like to invest in companies with so-called owner-operators (I go into more detail about why in this article) and companies with high insider ownership. Brown-Forman is a family business, with the Brown family owning around half of the company and a family member as the board’s chairman. Companies with high insider ownership tend to perform better, and I find it easier to hold these companies for the long term because you know that the people making the decisions have skin in the game and should think long-term.

Path forward

Brown-Forman has a few levers to pull to accelerate growth and take market share in the future:

Super Premium spirits

BF is looking to increase its market share in the so-called Super Premium segment, which is expected to grow to 16% of the overall spirits segment (Slide 85). Brown-Forman especially sees an opportunity in the European and Asian markets with its diversified portfolio of Premium brands.

RTD – Ready to drink

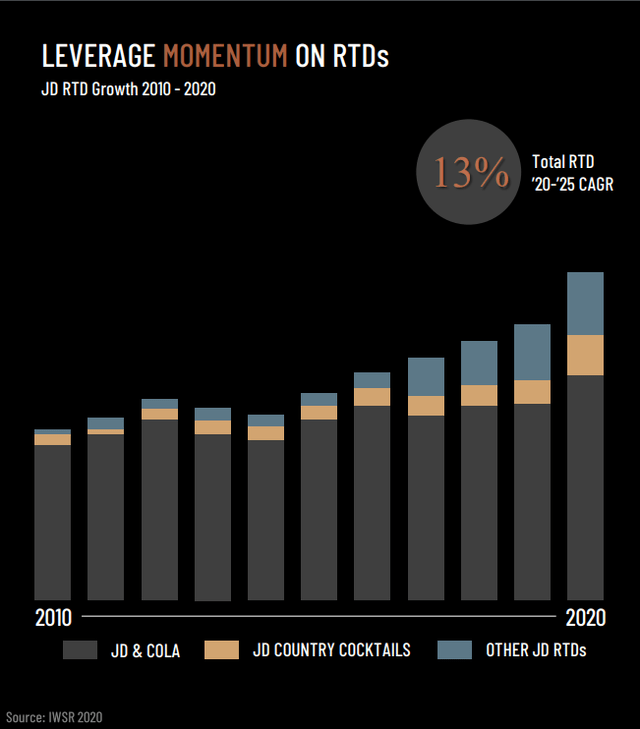

BF is looking to expand its Jack Daniel’s brand. It sees an opportunity with a 13% CAGR in the Ready to Drink segment (mostly canned drinks). JD Cola has been the largest part of this segment for a while, but its other RTDs keep growing much faster. RTD also targets another consumer group, and thus increases brand awareness for Jack Daniel’s.

JD RTD Growth (BF Investor Day)

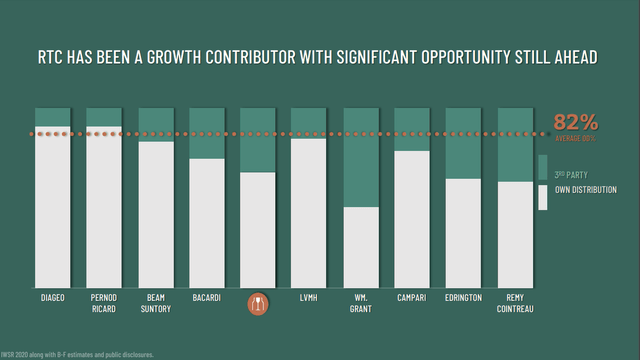

Direct to consumer still below the average

Direct to Consumer or Route to Consumer (RTC), as BF calls it, is an opportunity for incremental margin expansion. Brown-Forman here is well below the average of 82%-owned distribution. The company operates many owned subsidiaries that do distribution, but still does around 38% of its sales through 3rd party distributors.

D2C as a growth opportunity (BF Investor Day)

Comparison

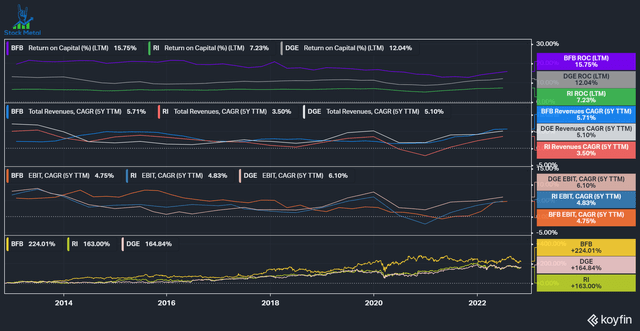

Let’s compare BF (in this case, BF.B) to two of its peers: Diageo and Pernod Ricard (OTCPK:PDRDF, OTCPK:PRNDY): We can see that BF has consistently generated higher Returns on Capital than its peers, but also that ROC is trending downwards over time. The company generates Returns on Capital well above its Cost of Capital around 8%. Even though both peers have lower ROC, they also both earn excess returns compared to their cost of capital, and thus generate value for shareholders.

We can also see that revenues and operating profits (EBIT) grew around 5% annually for all three companies, much below their shareholder returns of 12% annually (BF) and 10% ((PDRDF, DGE)).

BF Comparison to peers (Koyfin)

Valuation and conclusion

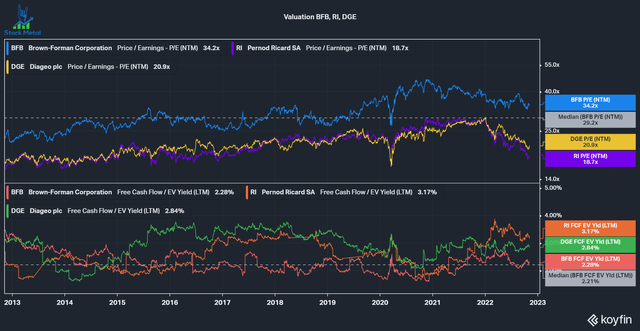

Over the long term, companies generally return similar amounts to their growth in cash flows plus cash flow yields. Brown-Forman experienced a gradual multiple expansion over the last decades and currently trades well above its peers at a 34x P/E and a 2.28% FCF (free cash flow) yield. The company aims to grow revenues by mid-single-digits, according to its 10K, and margins are already mature at 32% EBIT margin.

I’m having a hard time thinking of a scenario where Brown-Forman meaningfully outperforms the S&P 500 from here, given the growth management expects and its high valuation, both in absolute and relative terms. For slow-growing businesses, I’d want to have at least a Free Cash Flow yield above the 10-year Treasury, which is currently at 4.17%. Brown-Forman is a high-quality business that I’ll happily keep on my watchlist, but I’d need to see a meaningful correction in share price and FCF yield before considering investing.

Our long term net sales ambition for achieving mid-single-digit growth is based on an expectation of continued growth in the U.S.

Brown-Foreman FY22 10K

Be the first to comment