Andrew Burton/Getty Images News

Investment thesis

BlackRock (NYSE:BLK) should be able to benefit from several long-term growth drivers. Markets outside the U.S. have great catch-up potential in terms of capital market investments. Entire countries will need to overhaul their pension systems in the coming years and people need to protect their wealth from high inflation. This could create great business opportunities.

Investors benefit from the shareholder-friendly dividend policy and the well-diversified portfolio. The short-term noise of decreasing assets under management during market downturns should be ignored.

Motivation for this article

It was a challenging year so far for many companies and asset managers are no exception. Stock prices dropped significantly from their highs and people started talking about decreasing assets under management, reduced fees income, and net inflows/outflows. However, that’s just short-term noise and I am only interested in the long-term perspective of the business and that looks very promising.

There is no need for another introduction to BlackRock and its business model. You can find many excellent contributions on SA. In this article, I am discussing some potential key long-term growth drivers for BlackRock’s business.

Future growth drivers

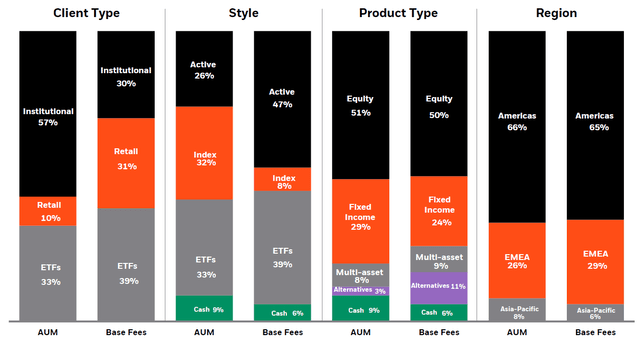

The company provides a nice business overview for investors in their earnings release supplement. When looking at BlackRock’s broadly diversified business across clients, products, and geographies, we should have a closer look at the region category.

The Americas are contributing 65% to the total base fees income, followed by EMEA with 29%, and Asia-Pacific with only 6%. Two-thirds of the money is made in the Americas. BlackRock and its products, especially the iShares ETFs, are well known in Europe, so why is that?

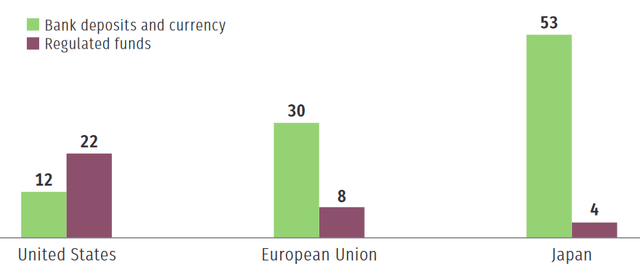

OK, one obvious reason is competition. However, the big differentiator between North America and Europe/Asia is the investment culture. The following image shows where households hold their wealth.

ICI – Investment Company Institute (Investment Company Fact Book, 60th edition)

Traditionally more bank-centric countries like Japan and parts of the European Union have a larger share of their wealth in bank deposits and currency. It’s the opposite for US households, where regulated funds are dominating. Why should that change in Europe and other parts of the world?

First of all, the pension system as we know it today in Germany will not be able to continue to exist in this form for much longer. Already now, many billions of euros of taxpayers’ money have to be subsidized every year. In the coming years, the largest birth cohorts in history (1964) will retire and their pensions will have to be paid. Politicians are slowly, admittedly very slowly, beginning to rethink the idea of a pension supported by the capital market. These considerations could result in major opportunities for BlackRock products in the long term.

Another argument for more investment in the equity markets is the persistently high inflation combined with low-interest rates in the eurozone. Unlike for the FED, the ECB’s scope for interest rate hikes is much more limited due to weaker member states of the common currency. To protect and preserve their wealth, people need to move away from bank deposits to prevent expropriation.

As I described in my first article about BlackRock, there is still a strong underlying shift towards passive investing. ETFs track major indexes like the S&P 500 or the MSCI World and are very cost efficient and offer excellent diversification. The share of passive investing is increasing every year.

Further arguments for BlackRock

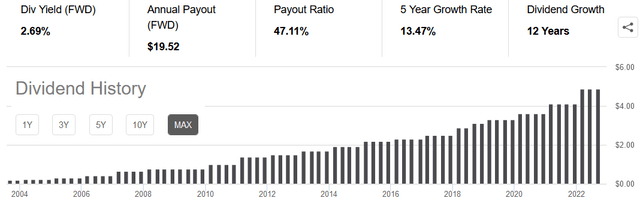

The dividend policy is another aspect to like BlackRock. Investors should never underestimate the psychological effect of a decent dividend yield in combination with inflation-beating increases during challenging market times.

An 18.2% increase in January is a strong signal of confidence for the market. Long-term investors can look back at a 5-year growth rate of 13.47% in combination with a low payout ratio. Today’s 2.69% yield offers an attractive entry point. Of course, it was even better a few weeks ago with around 3.3%.

Going back to the business overview from the beginning, product diversification is another strength of BlackRock. It’s not a pure play for actively managed funds or passive ETFs, instead, the company has a well-balanced product portfolio.

Risks to consider

We saw a couple of strong weeks and the market was able to recover. However, we don’t know what’s next. Investors need to be aware that fees income, net inflows, and assets under management can drop during market downturns. As I said at the beginning, that’s short-term noise and should be ignored by long-term investors. In fact, it’s a buy or get-in opportunity.

BlackRock is not the only player and the competition in the ETF/index business is strong. Vanguard offers attractive alternatives and consolidation took place when Amundi (OTCPK:AMDUF) acquired Lyxor. Pressure on fees is high.

Conclusion

BlackRock is a well-managed asset manager with an impressive track record. The company should be able to benefit from several long-term growth drivers. Markets outside the U.S. have great catch-up potential in terms of capital market investments. Entire countries will need to overhaul their pension systems in the coming years, and equity pensions or sovereign wealth funds could offer attractive business opportunities. In addition, people need to protect their wealth from high inflation and there are not many alternatives to stocks/passive investing.

Another strong argument for BlackRock is the shareholder-friendly dividend policy. Investors benefit from double-digit dividend increases and a modest payout ratio. The well-diversified portfolio is another strength of the asset manager.

The short-term noise of decreasing assets under management during market downturns should be ignored by long-term investors. It is a buying opportunity.

Be the first to comment