piranka

Thesis

We recently wrote about the BlackRock Capital Allocation Trust (NYSE:BCAT) here. The CEF is a new offering from BlackRock and it represents a multi-asset closed end fund that was launched in September 2020. The fund has had a tough 2022, being down more than -24% year to date:

YTD Total Return (Seeking Alpha)

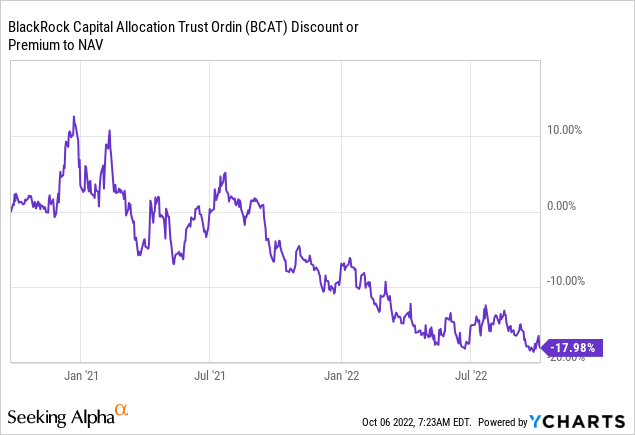

Just like any iteration of a fixed income / equity portfolio, the vehicle has experienced negative returns on both instruments given the significant rise in risk free rates. As the fund decreased in price, its discount to NAV widened:

We can see from the above graph that during the recent market rout in September when the S&P 500 re-tested the June bottom, BCAT reached a historic discount to NAV, close to 20%. That number is very, very significant because it basically says that investors are valuing the assets at only 80 cents on the dollar, when in fact the CEF does not contain very illiquid, hard to value securities. It is just the general malaise associated with the correlation between fixed income and equities this year:

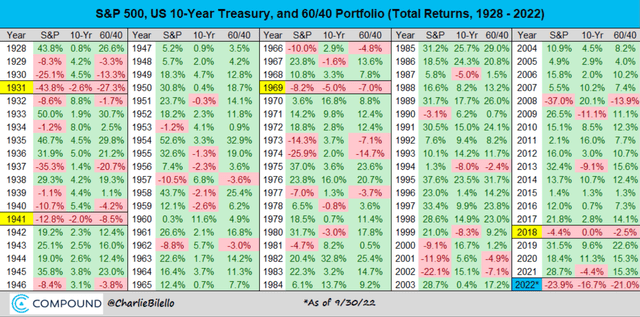

60/40 Portfolio Performance (Compound )

As we can see from the table above, courtesy of Compound Capital, 2022 is the second worst year on record for a 60/40 portfolio. We can see that historically negative equity returns have seen positive bond figures, as risk-off environments are associated with a decrease in yields. Not this year.

What can an asset manager do in this situation?

With its CEF trading at 20% discount to net asset value, an asset manager can basically pursue two paths:

1) Do nothing and allege markets are “mispriced”

2) Take action via share repurchases

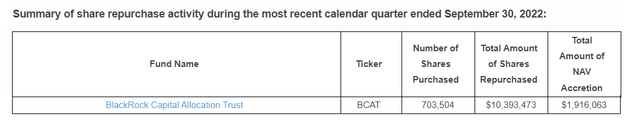

Share repurchases ultimately result in a positive for the fund, with the crystallization of the discount to NAV as an accretion. It fundamentally works like this: the manager purchases shares worth $80 in the market and then redeems the collateral for $100, thus realizing a net positive value for the fund in an amount of $20. And this is exactly what BlackRock has done in the quarter ending in September:

Share Repurchase Results (BlackRock)

We can see the fund generated a positive accretion of $1.9 million for the vehicle via this corporate action. This is a great outcome and speaks volumes regarding well run platforms.

If we take a step back we need to understand why BlackRock is doing this – as a large asset manager, perception is very important for BlackRock. Persistent discounts to NAV for CEFs signal investor discomfort with the asset manager, and ultimately result in business divestitures as we have seen with the Delaware Asset Management CEFs. To combat this the asset manager does not have many options. Among them are share repurchases, fund liquidations or mergers. BlackRock is actively choosing the share repurchase programs so that it supports its CEFs trading at discounts.

Furthermore the share repurchase program is structured in a flexible way, where the asset manager can choose points in time with the widest discounts:

The amount and timing of any repurchases under each Fund’s Repurchase Program will be determined either at the discretion of the Fund’s management or pursuant to predetermined parameters and instructions subject to market conditions. There is no assurance that any Fund will repurchase shares in any particular amounts. A Fund’s repurchase activity will be disclosed in its shareholder report for the relevant fiscal period. Any repurchases made under any Fund Repurchase Program will be made on a national security exchange at the prevailing market price, subject to exchange requirements and certain volume and timing limitations and other regulations under federal securities laws.

This flexibility is a great advantage, because it allows an active manager to go in the market precisely during those substantial dislocation periods (and we have seen plenty of those in 2022) and monetize very wide discounts to NAV.

While the ultimate impact to BCAT is moderate, we like this program and feel large, well run platforms expose this kind of behavior for CEF platforms, having maximum thresholds for discounts to NAV. We have seen that small platforms that do not manage this aspect for their funds ultimately close shop, as we have seen with the Delaware Management Company CEFs. As a retail investor in BCAT you do not need to do anything, but it should provide more comfort that you bought into a well run platform.

Conclusion

BCAT is a new multi-asset CEF from BlackRock. Due to the violent rise in rates this year the vehicle is down more than -24%, and has suffered as the historic negative correlation between equities and investment grade fixed income broke down. The vehicle is currently trading at historic discounts to NAV of almost -20%, due to the lack of a track record for the fund and the recent negative performance. BlackRock has tried to address this issue via share repurchases, which have a net result of generating positive accretive features for the fund via the crystallization of the discount. This is symptomatic of well run CEF platforms, which understand the need to proactively address very wide discounts to NAV. During the most recent quarter which ended in September, BCAT monetized a $1.9mm accretion to NAV via share repurchases. This corporate action feature does work, and it can provide long standing value for shareholders and the comfort of buying into a well run platform.

Be the first to comment