jeffbergen/E+ via Getty Images

After the bell on Tuesday, we received fiscal second quarter results from BlackBerry (NYSE:BB). The company has been in turnaround mode for nearly a decade under CEO John Chen, and the stock has significantly underperformed the overall market. The Q2 report showed many similar trends to those periods in the past, where headline numbers seemed good but drilling down showed another step back for the company.

For the three months ending in August, revenues came in at $168 million. This number was flat sequentially and down $7 million from the year ago period. Investors will likely be happy that the company beat street revenue estimates by just over $2 million, but again this was due to reduced expectations. Going into the Q1 earnings report about three months ago, analysts were looking for almost $171 million in Q2, so this was another beat that was primarily driven by lowered estimates.

Cybersecurity revenues came in at $111 million, down $2 million sequentially and $9 million below the year ago figure. The IoT segment saw revenues stay flat sequentially at $51 million, but this was nice growth as expected from $40 million in Q2 of fiscal 2022. Licensing revenues ticked up to $6 million, but remain well off prior year levels as the company tries to sell a good chunk of patents, a process that is not going smoothly.

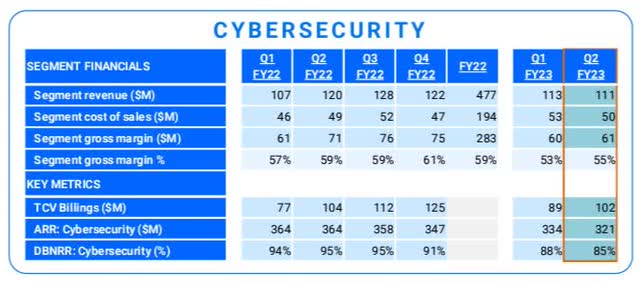

The problem for BlackBerry is that the important numbers just aren’t showing any major signs of progress. The graphic below shows key numbers for the Cybersecurity segment, the company’s largest revenue area. Here, there were meaningful declines in total revenue and gross margin dollars (and its corresponding percentage) over their prior year counterparts. Then, total billings also declined year over year, and annual recurring revenues fell yet again, with the dollar based net retention rate percentage dipping too.

Cybersecurity Key Figures (BlackBerry Q2 Presentation)

Management says that ARR here should return to growth early in the next fiscal year, but we’ve heard plenty of comments about revenue growth returns from management for years that haven’t come true. Also, this current guidance implies at least two more quarters where ARR will decline, so even if we get some growth early next year, we might be even lower overall a year from now. I’m also curious as to why management decided not to include an ARR figure for the IoT segment in this quarterly report.

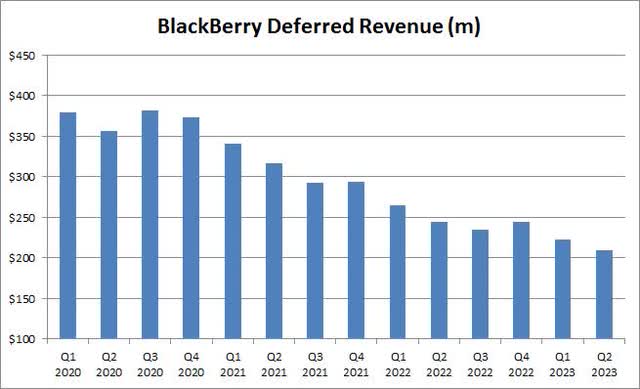

When we put all of these numbers together, it paints a bleak picture for the near term future, even though the back half of the year is expected to show some overall revenue improvement. In analyzing prior quarterly reports, I’ve discussed how deferred revenue continues to drop, which doesn’t inspire confidence in top line trends moving forward. Well, as the chart below shows, total deferred revenue lost another $13 million sequentially, and is down $35 million in the past 12 months.

End of Quarter Deferred Revenue (Company Earnings Reports)

I’m sure that investors will also focus on the company’s Q2 bottom line beat, but again, this number doesn’t tell the whole story. BlackBerry usually beats here, especially as it takes out many key continuous expenses like stock based compensation. This quarter, management even included a $6 million gain on the sale of property, plant, and equipment in its adjusted results to make them look better. Overall, the company’s true operating loss worsened sequentially, and the company burned through $26 million in cash.

In the after-hours session, BlackBerry shares traded down more than 3%, again falling below $5 and getting close to their 52-week low. The average price target on the street going into this report was $6.14, but that’s down from $8 roughly a year ago. Over the past year, shares have lost more than half of their value, nearly double that of the Invesco QQQ ETF (QQQ). If we go back to the day that John Chen took over the company in 2013, BlackBerry shares are down about 20%, while the QQQ ETF is up 220%.

In the end, this was another lost quarter for BlackBerry. Yet again, revenues beat only because the street lowered its estimates, while the adjusted bottom line practically always beats due to numerous adjustments. More importantly, key metrics such as Cybersecurity ARR and deferred revenue continued to decline, reducing near term hopes for significant top line improvement. BlackBerry shares have continued to underperform over time, and results like this don’t inspire too much confidence.

Be the first to comment