tiero

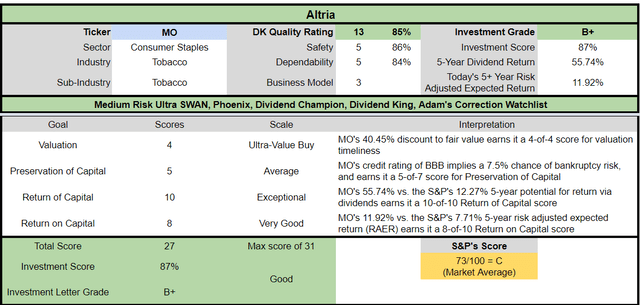

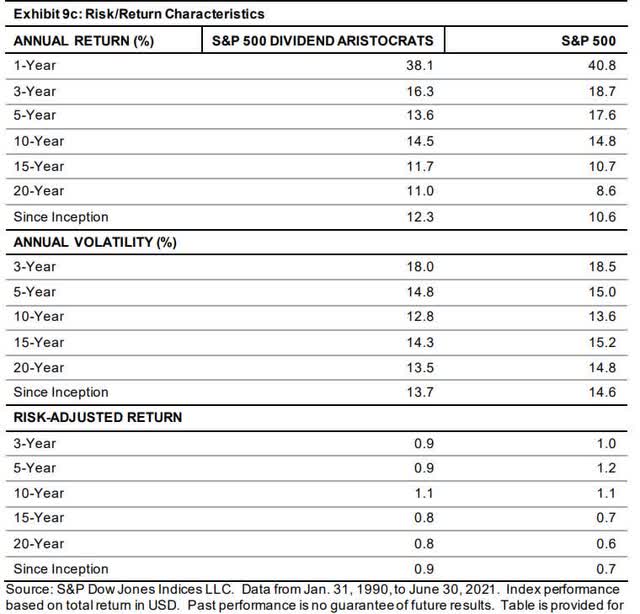

Dividend aristocrats are famous for beating the market over the long term and with lower volatility over time.

But the long term is 10+ years, and in the short term, crazy, terrifying, and potentially wonderfully profitable things will happen.

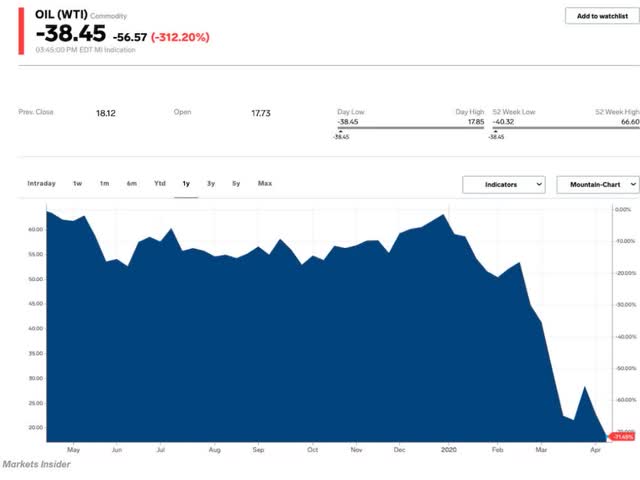

Things like oil trading at -$38 and offering income investors very safe 19% yields.

Things like the British Pound falling 10% in 2 days, and dragging world-beater blue-chip yields for British American Tobacco (BTI) up to 8%.

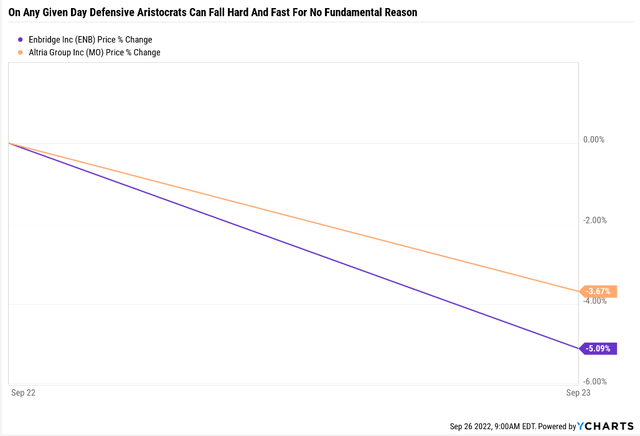

And sometimes high-yield aristocrats just fall off a cliff for no good reason at all.

That’s what happened on Friday, September 23rd, when aristocrat Enbridge (ENB) fell 5% (7% intraday) and Altria (MO) fell 6% just one hour before the close.

I have a policy on ultra-yielding aristocrat bargains: when they fall 5+% in a day, I buy some, as long as their thesis remains intact.

So let me show you why I bought MO, ENB (and BTI) on Friday, September 23rd (BTI fell 8% at one point). More importantly, let me show you why you might want to consider adding to these attractive valued ultra-yielding dividend aristocrats and kings today before everyone else does.

Enbridge: The Defensive King Of Midstream Is Impervious To Oil Crashes

Further Reading

A comprehensive deep dive into ENB’s growth outlook, investment thesis, risk profile, valuation, and total return potential.

Tax Implications

- a Canadian corporation

- 1099 dividend form (no K1)

- 15% dividend tax withholding (only TAXABLE accounts)

- NO withholding in retirement accounts

- tax credit available in taxable accounts to fully recoup the withholding

Why ENB’s 5% Crash On Friday Made No Darn Sense

Oil was down as much as 6% on Friday so you might think it made sense for North America’s largest pipeline company would also go over a cliff.

Here’s why you’d be wrong.

(Source: Investor Day presentation)

ENB is an energy utility with the most utility-like business model in midstream. It has contracts as long as 50 years in duration that reserve its capacity and the world’s largest energy companies pay it even if they ship zero oil or gas.

In fact, ENB is the largest gas utility in Ontario, keeping Toronto warm and the lights on in the winter. What % of ENB’s revenue is directly exposed to oil prices? Just 2%.

Does it make sense for oil producers like Apache to fall 11% when oil falls 6%? Sure. ENB? No way in heck.

How low risk is ENB’s business model? Bond investors are willing to lend it money out to 2112, 90 years from now.

Literally, the “smart money” on Wall Street is betting that ENB will outlive not just you, but likely your children and maybe even your grandchildren.

So when this 7% yielding Ultra-SWAN (sleep well at night) dividend aristocrat falls 5% to 7% in a day of energy market carnage, I’m more than happy to “catch a falling ultra-yield blue-chip with conviction”.

Reasons To Potentially Buy Enbridge Today

| Metric | Enbridge |

| Quality | 91% 13/13 UltraSWAN (Sleep Well At Night) Global Aristocrat |

| Risk Rating | Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 69 |

| Quality Percentile | 86% |

| Dividend Growth Streak (Years) | 27 |

| Dividend Yield | 7.0% |

| Dividend Safety Score | 92% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.40% |

| S&P Credit Rating |

BBB+ Stable Outlook |

| 30-Year Bankruptcy Risk | 5.00% |

| Consensus LT Risk-Management Industry Percentile | 74% good |

| Fair Value | $49.83 |

| Current Price | $38.03 |

| Discount To Fair Value | 24% |

| DK Rating |

Potentially Strong Buy |

| P/Cash Flow | 8.6 |

| Growth Priced In | 0.2% |

| Historical PE Range | 9.5 to 13 |

| LT Growth Consensus/Management Guidance | 6.7% |

| 5-year consensus total return potential |

12% to 22% CAGR |

| Base Case 5-year consensus return potential |

14% CAGR (2X better than the S&P 500) |

| Consensus 12-month total return forecast | 24% |

| Fundamentally Justified 12-Month Return Potential | 38% |

| LT Consensus Total Return Potential | 13.7% |

| Inflation-Adjusted Consensus LT Return Potential | 11.5% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.96 |

| LT Risk-Adjusted Expected Return | 9.11% |

| LT Risk-And Inflation-Adjusted Return Potential | 6.89% |

| Conservative Years To Double | 10.45 |

(Source: Dividend Kings Zen Research Terminal)

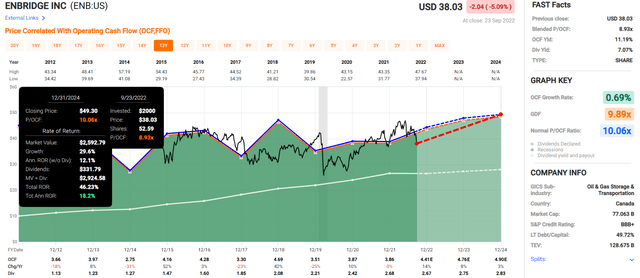

Enbridge 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If ENB grows as expected and returns to historical fair value by 2024, it could deliver Buffett-like 18% annual returns.

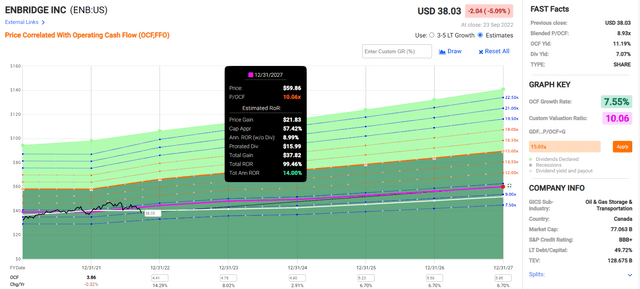

Enbridge 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If ENB grows as expected and returns to historical fair value by 2027, it could double, delivering 14% annual returns, or nearly 2X that of the S&P 500.

Now compare that to the S&P 500.

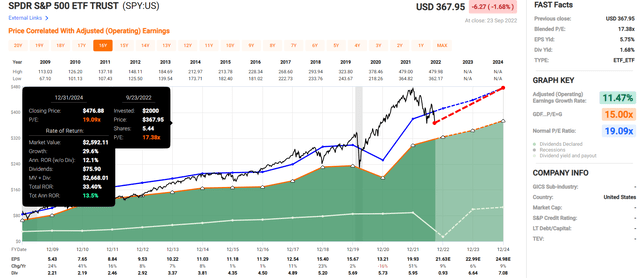

S&P 500 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Analysts expect a solid 13.5% annual return from the S&P 500 through 2024, though 8% earnings growth during next year’s recession is rather optimistic, to say the least.

- ENB has 33% more return potential than the S&P 500

S&P 500 2027 Consensus Total Return Potential

| Year | Upside Potential By End of That Year | Consensus CAGR Return Potential By End of That Year | Probability-Weighted Return (Annualized) |

Inflation And Risk-Adjusted Expected Returns |

| 2027 | 63.21% | 10.29% | 7.72% | 5.40% |

(Source: FAST Graphs, FactSet Research)

Over the next five years, analysts expect about 10% annual returns, the market’s historical return.

- ENB has nearly 2X the market’s return potential

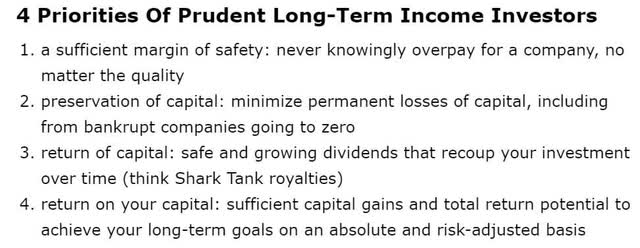

Enbridge Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

ENB is a potentially good ultra-yield global aristocrat option for anyone looking for supreme quality and comfortable with its risk profile.

- 24% discount vs. 8% market discount = 16% better valuation

- 7% very safe yield Vs. 1.8% S&P 500 (3.3X higher and safer yield)

- 35% better long-term annual return potential

- 50% better risk-adjusted expected return over the next five years

- 3.5X better 5-year consensus income

Altria: A Table Pounding Great Ultra-Yield Dividend King Buy

Further Reading

A comprehensive deep dive into ENB’s growth outlook, investment thesis, risk profile, valuation, and total return potential.

Why MO’s 6% Intraday Crash On Friday Made No Darn Sense

The best guess I had about why MO fell as much as 6% on Friday was that BTI fell as much as 8% on Friday.

But BTI fell because of the Pound implosion while MO is 100% US sales and actually benefits from a strong US dollar.

- its input costs fall

- and US inflation falls, making its customers richer and able to afford its semi-annual price increases more easily

Philip Morris facing pressure from hedge funds to raise offer for Swedish Match, CEO says — Bloomberg

In fact, the latest news about PM trying to buy Swedish Match is potentially good news for MO.

PM has said it has no plans to raise its bid for Swedish Match, but hedge funds that own that company are trying to force it to. If the deal falls apart, then MO’s risk profile gets slightly less risky because PM would be more reliant on MO’s licensing deal for iQOS for its US distribution.

What else happened on Friday? Oil fell as much as 6%. That means lower gasoline prices which is a perennial cause of concern from some analysts anytime the price at the pump climbs too high.

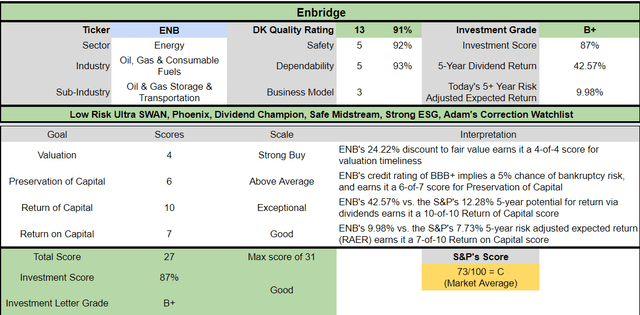

What about fundamental risk? Did that increase significantly?

(Source: FactSet Research Terminal)

Yes, according to the bond market on Friday, the fundamental risk increased by 3% to 5.6%, but to default risks still consistent with its BBB-stable credit rating.

- 4.76% 30-year default risk is actually consistent with BBB+ credit ratings

- 1-year default risk just 0.3611%

There was no reason for MO to soar to a very safe 9% yield and 8.3 PE (8.0X cash-adjusted PE).

Reasons To Potentially Buy Altria Today

| Metric | Altria |

| Quality | 85% 13/13 UltraSWAN (Sleep Well At Night) Dividend King |

| Risk Rating | Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 155 |

| Quality Percentile | 69% |

| Dividend Growth Streak (Years) | 53 |

| Dividend Yield | 9.0% |

| Dividend Safety Score | 86% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.70% |

| S&P Credit Rating |

BBB Stable Outlook |

| 30-Year Bankruptcy Risk | 7.5% |

| Consensus LT Risk-Management Industry Percentile | 56% Average |

| Fair Value | $69.98 |

| Current Price | $41.76 |

| Discount To Fair Value | 40% |

| DK Rating |

Potentially Ultra Value Buy |

| PE | 8.3 |

| Cash-Adjusted PE | 8.0 |

| Growth Priced In | -1.0% |

| Historical PE Range | 14 to 16 |

| LT Growth Consensus/Management Guidance | 4.7% |

| 5-year consensus total return potential |

16% to 20% CAGR |

| Base Case 5-year consensus return potential |

17% CAGR (2X better than the S&P 500) |

| Consensus 12-month total return forecast | 26% |

| Fundamentally Justified 12-Month Return Potential | 76% |

| LT Consensus Total Return Potential | 13.7% |

| Inflation-Adjusted Consensus LT Return Potential | 11.5% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.96 |

| LT Risk-Adjusted Expected Return | 8.87% |

| LT Risk-And Inflation-Adjusted Return Potential | 6.65% |

| Conservative Years To Double | 10.83 |

(Source: Dividend Kings Zen Research Terminal)

MO is trading at an anti-bubble 8X cash-adjusted earnings pricing in -1% growth for a company that’s growing almost 5% and hasn’t had a negative year of EPS growth since 2003 (-2%).

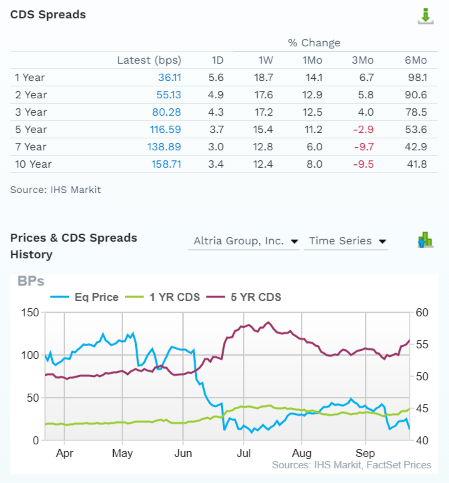

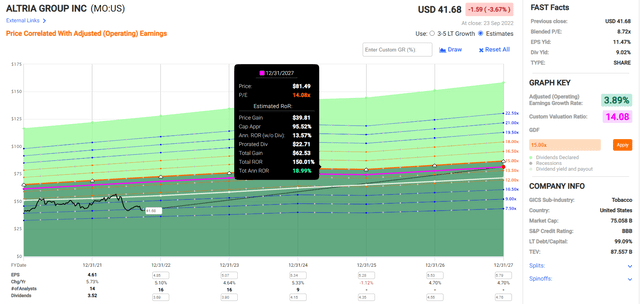

Altria 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If MO grows as expected (it almost always does) and returns to historical fair value by 2024, it could double and deliver Buffett-like 36% annual returns.

- 3X better return potential than the S&P 500

Altria 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If Mo grows as expected through 2027 and returns to historical market-determined fair value (14X earnings), it could deliver 150% total returns or Buffett-like 19% annual returns.

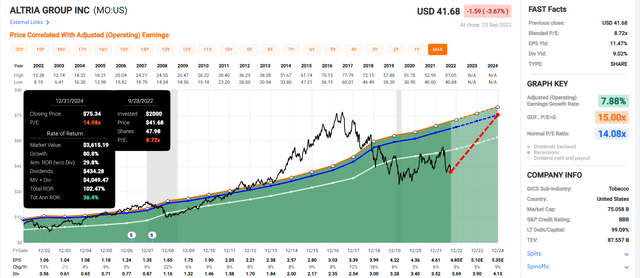

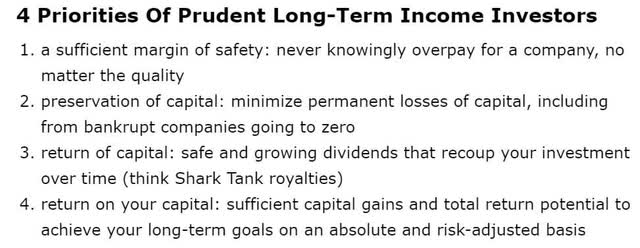

Altria Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

MO is a potentially good ultra-yield Ultra SWAN dividend king option for anyone looking for supreme quality and comfortable with its risk profile.

- 40% discount vs. 8% market discount = 32% better valuation

- 9.0% very safe yield Vs. 1.8% S&P 500 (5X higher and safer yield)

- 35% better long-term annual return potential

- 2X better risk-adjusted expected return over the next five years

- 5X better 5-year consensus income

Bottom Line: I’m Buying These 2 Ultra-Yield Aristocrats, And So Should You

The 4% rule has long been the default strategy for many retirees. This says you can safely withdraw 4% of your retirement portfolio each year, adjusted for inflation, and not run out of money for at least 30 years.

In years like this, that 4% withdrawal rate makes a lot of investors nervous, both because of high inflation and a crashing stock market.

But do you know what can help you sleep well at night during turbulent times like these? Ultra-yield aristocrats like ENB and MO, which yield very safe 7% and 9% yields, respectively.

These are the kinds of world-beater blue-chips that can help you build a 6.5% yielding portfolio that potentially doesn’t have to sell a single share when the market is making new lows.

When you can live entirely off of very safe and steadily growing dividends, that’s true financial freedom.

When stock prices are irrelevant, and only fundamentals matter to your standard of living, the world always makes sense. In a year when treasury yields are flying or falling like crypto and currencies like the Yen and British Pound are acting like emerging market stocks, this kind of peace of mind is truly priceless.

Ultra-yield Ultra SWAN aristocrats like ENB and MO are not immune to short-term market craziness. But their fundamentals are, and that’s all that matters.

And that’s why, on crazy days when aristocrats like these crash 5+% for no good reason, I’m more than happy to back up the truck a bit and buy more.

Might they fall more? Sure. But when you combine life-changing yield with world-class quality and safety, that’s the kind of blue-chip falling knife I’ve happy to catch…with conviction.

No company is right for everyone of course. Still, suppose you are comfortable with ENB and MO’s risk profiles. In that case, I can say with 80% confidence that long-term investors won’t regret adding more of either name to their diversified and prudently risk-managed portfolios.

Be the first to comment