Kubrak78

Black Hills Corporation (NYSE:BKH) is a South Dakota-headquartered holding company with an eight-state service area shown below and 1.3 million natural gas and electric utility customers.

blackhillscorp.com

In the map above, natural gas service areas are orange and electricity service areas are dark gray.

Be aware that Seeking Alpha’s quant model ranks Black Hills as underperforming due to insufficient capex growth and a lower-than-average levered free cash flow margin. However, BKH capex growth and regional growth—particularly in Colorado—appear stronger than anticipated by SA quants.

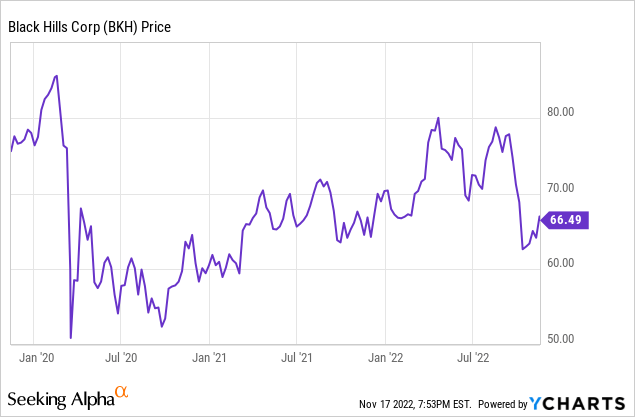

Black Hills, like all utilities, is indeed exposed to higher interest rates because of its debt costs. This is readily seen by its stock price drop, and only partial recovery, since late August when the Fed started raising interest rates.

I continue to rate Black Hills as “a buy,” although investors should appreciate that all utility holding companies are subject to inflation and interest rate risks because of their high debt levels and large fixed infrastructure base.

The company has ample access to inland natural gas (for heating and for electricity generation) and to coal for meeting baseload electrical demand.

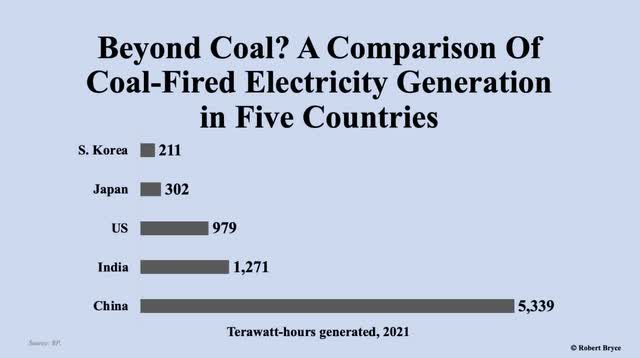

Indeed, the past year’s gas (and oil) shortage as Russian supplies are dislocated/redirected has pointed up the importance of coal supplies. While the US has been shutting down coal plants, Germany, for example, is now using far more coal than last year. And China has never stopped using coal. This graph from energy expert Robert Bryce is illustrative of that.

Robert Bryce

Third Quarter 2022 Results and Guidance

In the third quarter of 2022, Black Hills’ net income was $35.0 million, or $0.54/share compared to $44.1 million, or $0.70/share for 3Q21. Nine months’ net income was $185.9 million, or $2.86/share compared to $165.6 million or $2.63/share for the same period in 2020.

The company affirmed full-year 2022 earnings per share guidance to $3.95-$4.15 and projects 2023 EPS at $4.00-$4.20. Black Hills increased its dividend 5% and increased its 2022-2026 capital investment by $250 million to a total of $3.5 billion. It expects 5-7% long-term earnings growth.

Operations

Black Hills Corporation is headquartered in Rapid City, South Dakota. Its 1.3 million customers divide as: 1,094,000 natural gas customers and 218,000 electric customers.

Operationally, it has two business segments: Gas utilities and electric utilities. Last year it added both power generation and mining operations into the electric utilities segment.

The company’s natural gas operations are mostly residential and commercial—which vary greatly with weather—and a small slice of industrial demand. Thus, its natural gas segment sees its largest revenues in the fourth and first quarters when weather is the coldest and heating demand the greatest.

Wyoming Electric and South Dakota Electric set new peak load records in 3Q22 driven by larger customer load in both regions. As I noted last year, nationally, electricity demand growth is expected from a) growing electrification, especially EVs, b) marijuana farming, c) data centers (some Microsoft (MSFT) data centers run on BKH electricity), and d) Bitcoin mining. Although Bitcoin mining has sharply spiked electricity consumption with many queuing up for power, according to Dan Pickering of Pickering Energy Partners, Bitcoin mining is expected to be weaker now at current prices and the implosion of digital currency company FTX.

In its 3Q22 report, the company highlighted the approval of its Ready Wyoming 260-mile transmission expansion project, which will start construction next year and will enable growth in southeast Wyoming. The company progressed on rate reviews for Arkansas, the Rocky Mountain Natural Gas pipeline in Colorado, and Wyoming Electric.

Segment Results

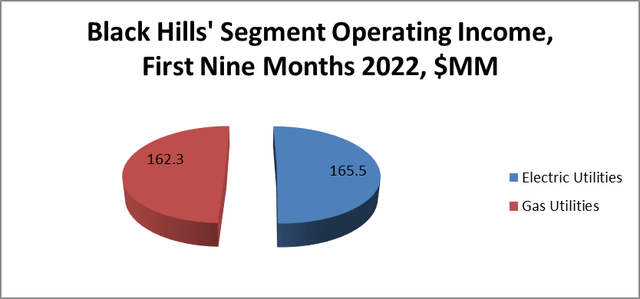

The graph below shows nine-months’ operating income by segment.

blackhillscorp.com and Starks Energy Economics, LLC

The YTD operating income for gas utilities is similar to that for electric utilities. Two caveats: On one hand, Black Hills has five times as many natural gas customers as electric customers, so per-customer income from electricity is much higher than from natural gas. On the other hand, 4Q22 operating income for natural gas will be very high due to heating season.

Natural Gas and Electric Utilities

Black Hills has 46,400 miles of natural gas lines—most of them gas distribution lines – six natural gas storage sites, and about 50,000 horsepower of compression.

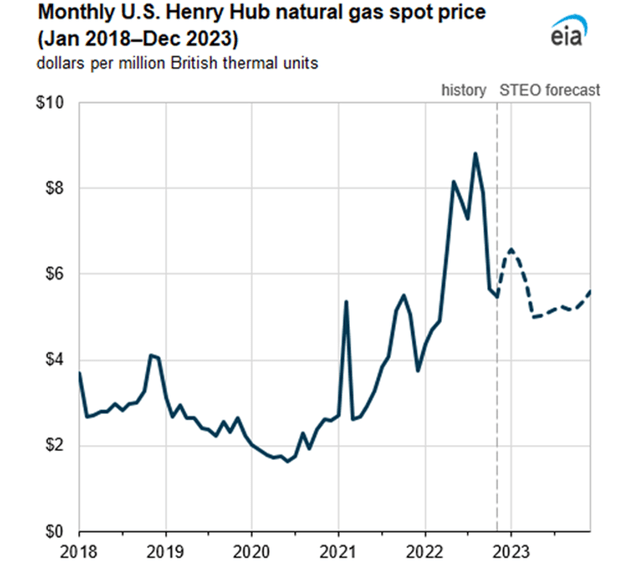

Although Russia’s war with Ukraine and consequent cutoff of exports to Europe has vastly increased global gas prices, the US forward curve is dropping. While the Energy Information Administration expects winter gas prices to be high, they then will likely drop seasonally. This is shown below.

EIA

The company has ready access to natural gas from the Rockies, North Dakota (oil-associated gas), and Appalachia via pipelines as production exceeds 100 BCF/D (now at 100.8 BCF/D compared to 95.7 BCF/D last year), the vast Freeport LNG export terminal remains offline, and new LNG export terminals are not due to come on until late 2023 at the soonest.

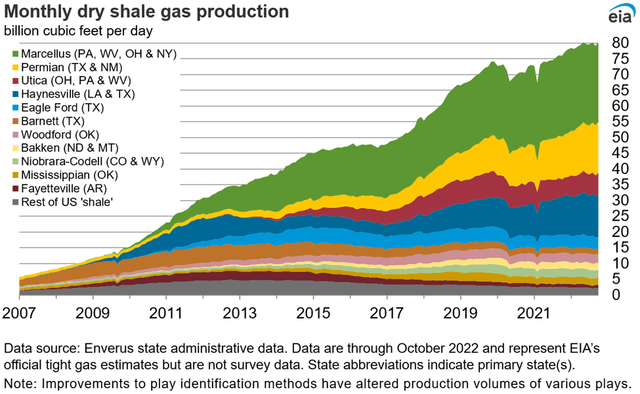

Working gas in storage is well within the five-year minimum-maximum range. Shale gas production continues to expand.

EIA

Black Hills owns and operates 1.5 gigawatts of generation capacity and 8900 miles of electrical lines.

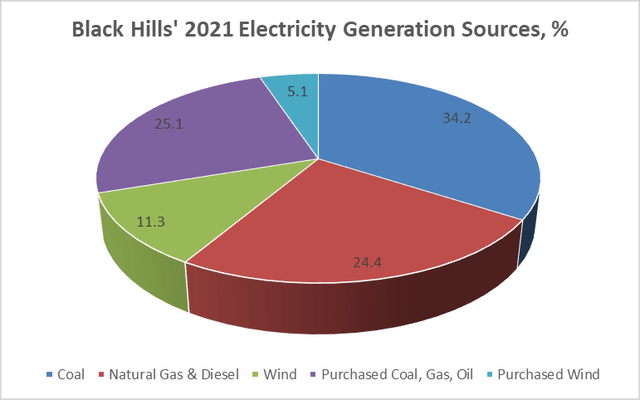

In 2021, Black Hills’ electric utilities bought 30% of the electricity they delivered.

Electricity generating sources comprised coal, natural gas (with oil backup), wind, purchased wind, and purchased coal and natural gas-fueled generation.

blackhillscorp.com and Starks Energy Economics, LLC

State Regulators

As a utility holding company, Black Hills does not have direct competitors. However, it has oversight from and reporting responsibilities to public utility commissions in every state in which it operates. In rate cases it answers to and is subject to input from a wide variety of customer-stakeholders. The company also is subject to normal market pressures for its fuel sources and changes in demand for its gas delivery and electricity production.

Governance

At Nov. 1, 2022, Institutional Shareholder Services ranked Black Hills’ overall governance as 2, with sub-scores of audit (2), board (2), shareholder rights (5), and compensation (2).

Insiders own a small 0.61% of the stock. On October 31, 2022, 6.3% of the floated stock was shorted.

Black Hills’ beta is 0.50: like most utilities its stock does not fluctuate as sharply as the overall market.

In October 2022, the company’s CFO, Richard Kinzley, announced his retirement for mid-year 2023. Per succession planning, BKH’s controller and treasurer, Kimberly Nooney, has been appointed CFO effective April 1, 2023.

As of June 29, 2022, most of Black Hills’ stock was held by institutions, some of which represent index fund investments that match the overall market. The top three institutional holders are Blackrock with 16.7%, Vanguard with 10.5%, and State Street with 10.0%.

BlackRock, Vanguard, and State Street just re-upped as signatories to the Net Zero Asset Managers Initiative, a group that, as of Nov. 9, 2022, manages $66 trillion in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve netzero alignment by 2050 or sooner.

Recently BlackRock, which alone manages assets worth $8 trillion, was downgraded to neutral by UBS due in part to pushback Blackrock has received from US state treasurers against (and for) the company’s net zero advocacy.

Financial and Stock Highlights

Black Hills’ market capitalization is $4.3 billion at a Nov. 17, 2022, stock closing price of $66.50 per share.

The 52-week price range is $59.08-$80.95 per share, so its most recent closing price is 82% of the 52-week high. The closing price is at 89% of the company’s one-year target price of $74.43/share.

Black Hills’ trailing twelve months EPS is $3.97, for a current price-to-earnings ratio of 17.0.The company projects 2022 and 2023 EPS at $4.09/share and $4.19/share, respectively for a forward ratio range of 16.3-15.9.

Return on assets is 3.0% and return on equity is 9.3%.

At Sept. 30, 2022, Black Hills had $6.34 billion in liabilities, including $4.13 billion of long-term debt and $9.32 billion in assets resulting in a liability-to-asset ratio of 68%.

Assets include non-current regulatory assets of $416 million, most of which ($393 million) are related cost recovery for 2021 Winter Storm Uri. Black Hills has received all approvals necessary to recover these incremental costs.

The company’s rate base is $4.8 billion: 57% natural gas and 43% electric.

Black Hills’ dividend of $2.50/share yields 3.8%.

Overall, the company’s mean analyst rating is a 2.4 or between “buy” and “hold” from the eight analysts who follow it.

Notes on Valuation

The company’s enterprise value (EV) is $8.98 billion and its EV/EBITDA ratio is 13.0, above the preferred ratio of 10 or less that suggests a discount.

Book value per share of $44.36 is about two-thirds of its market price, indicating positive market sentiment.

Positive and Negative Risks

Black Hills’ natural gas revenues are almost entirely weather-dependent.

More concerning is the anti-hydrocarbon bias — with coal a particular target – in both the current administration and among many bankers.

Potential investors should consider their expectations of regional economic growth (especially Wyoming, Colorado, Nebraska, South Dakota, and Iowa), state regulatory environments, regional population growth, and natural gas prices as factors most likely to affect the company.

While it’s a possibility that the Bitcoin mining business growth will slow, that’s true for many utilities. Data centers’ use of electricity and organic population growth are positive factors.

Inflation remains the most significant risk. Yields of other investments (bonds, Treasuries) will likely continue to rise to compete for investors, operating costs may increase without a corresponding ability to recover them through the regulatory mechanism, and financing costs for the debt-heavy utility sector could increase. At a liability-to-asset ratio of 68%, Black Hills is more exposed to interest rate changes than companies in non-utility sectors.

Recommendations for Black Hills Corporation

Black Hills may interest investors who want a moderate dividend of 3.8% in a lower-beta stock with a very good governance rating.

While investors should not ignore the SA quant warnings, the risk of rising interest rates, and a possible decline in what had heretofore been a big demand spike from Bitcoin mining, Black Hills’ stock price reflects these factors.

Less appreciated is its very affordable coal supply, Colorado population growth, data center electric use growth, natural gas access for both direct residential/commercial heating as well as electricity generation, and full regulatory approval of recovery of nearly $400 million in 2021 Winter Storm Uri incremental costs.

Black Hills targets regular 5-7%/year EPS growth and has achieved significant dividend growth.

I recommend Black Hills to utility investors looking for stable returns.

blackhillscorp.com

Be the first to comment