alvarez

When it comes to investing, the amount of time that it takes to generate a desirable return can vary significantly from prospect to prospect. Sometimes, the desired return doesn’t come at all. One instance in which investors would have benefited in a rather quick period of time involves Ethan Allen Interiors (NYSE:ETD), an enterprise that is focused on the production and sale of interior design products like home furnishings and accents, case goods, and other related offerings. Recently, shares of the business have been on the rise, driven by robust financial performance on both the top and bottom lines. What’s really great is that, given this performance, shares still seem to offer some nice upside potential moving forward. This leads me to keep the ‘buy’ rating I had on the stock previously, reflecting my belief that shares should continue to outperform the broader market for the foreseeable future.

Robust results

On September 13th of this year, I wrote a bullish article on Ethan Allen Interiors wherein I talked about the company’s exceptionally strong performance, noting particularly that its cash flows were impressive. On top of this, I found that shares of the company were cheap on both an absolute basis and relative to similar firms. All of this, combined, led me to feel comfortable with my prior ‘buy’ rating, leading me to keep it as a ‘buy’. That came despite the fact that shares of the company had fallen only 1.2% compared to the 13.5% decline the S&P 500 saw from the time I had written about the firm back in November of last year. Since then, the company has continued to outperform the market. While the S&P 500 is up by only 0.2%, shares of the enterprise have generated a return for investors of 22.6%.

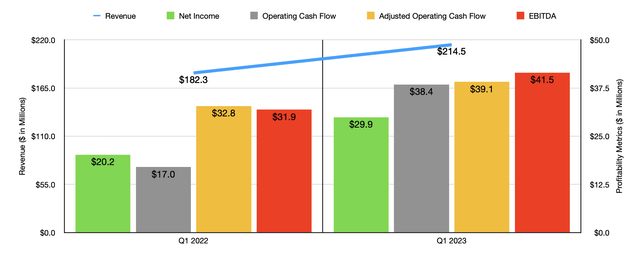

Author – SEC EDGAR Data

This return disparity is no fluke. Instead, it has been driven by robust financial performance achieved by the firm. To see what I mean, I would like to point to its results for the first quarter of the 2023 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the business. During that quarter, sales came in at $214.5 million. That’s 17.7% higher than the $182.3 million generated the same time one year earlier. This increase in revenue came from strength across the board. For instance, the company benefited from a 4.8% rise in revenue associated with its wholesale operations. This was due to higher contract sales and an increase in intersegment sales to the company’s design centers. The design center improvement came even in spite of the fact that the number of locations the company has an operation fell from 301 in the first quarter of 2022 to 294 the same time this year.

Meanwhile, retail net sales for the company jumped by 18.5%. This surge was driven by a 19.8% increase in revenue from the US and came in spite of the fact that Canadian design center revenue dropped by 25.8%. According to management, the firm benefited from high backlog that resulted in higher deliveries. Price increases enacted by the company and management’s ability to keep production steady, all led to robust sales. It appears as though revenue would have been higher had it not been for the fact that temporary disruptions in the Canadian retail side of the business occurred because of the timing in delivery of certain goods. To be clear, management does not guarantee that any of these trends will continue. They did offer a cautionary note in their quarterly report, even going so far as to say that while current demand for their offerings is strong, that economic conditions have contributed to the softening of consumer interest and home furnishings in recent months.

On the bottom line, the picture has been great as well. Net income in the latest quarter came in at $29.9 million. That’s 48% higher than the $20.2 million generated the same time last year. The big driver here for the company came from Gross profit climbing from $109.2 million to $129.6 million. This came largely as a result of increased revenue. But the company also did benefit from a modest increase in its gross profit margin from 59.9% to 60.4%. This, in turn, came from a favorable change in product mix, higher premier home delivery revenue, an increase in average ticket sales and higher clearance sale margins, and other related factors. This is really impressive in and of itself when you consider the impact that inflationary pressures have had on many other similar companies in recent months. Instead of seeing margins increase, many of them have seen them compressed. Naturally, other profitability metrics have followed suit. Operating cash flow went from $17 million to $38.4 million. If we adjust for changes in working capital, it would have risen from $32.8 million to $39.1 million. Meanwhile, EBITDA for the company also improved, climbing from $31.9 million to $41.5 million.

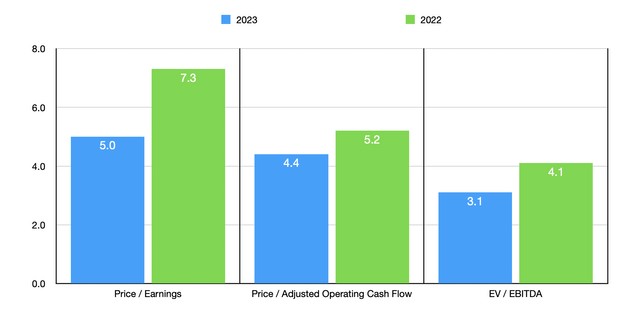

Author – SEC EDGAR Data

Management has not offered any detailed guidance for the current fiscal year. But if we annualize results experienced in the first quarter so far, we would anticipate net income of $152.9 million, adjusted operating cash flow of $172.1 million, and EBITDA of $196.3 million. This would result in the company trading at a forward price-to-earnings multiple of 5.0, a forward price to adjusted operating cash flow multiple of 4.4, and a forward EV to EBITDA multiple of 3.1. Truthfully, and especially without guidance, it is too early to assume that the year will go that smoothly. This is especially true in light of current economic concerns. Because of this, investors would be wise to price the company based on data from 2022 instead. That would result in these multiples coming in at 7.3, 5.2, and 4.1, respectively. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 2.8 to a high of 62.5. Using the price to operating cash flow approach, the range was from 1.4 to 23. And when it comes to the EV to EBITDA approach, the range was from 2 to 16.8. In all three cases, only one of the five was cheaper than Ethan Allen Interiors.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Ethan Allen Interiors | 7.3 | 5.2 | 4.1 |

| The Lovesac Company (LOVE) | 9.3 | 23.0 | 7.8 |

| Bassett Furniture Industries (BSET) | 2.8 | 13.1 | 2.0 |

| Hooker Furnishings (HOFT) | 61.5 | 10.5 | 16.4 |

| Flexsteel Industries (FLXS) | 62.5 | 1.4 | 16.8 |

| Tempur Sealy International (TPX) | 11.0 | 14.2 | 8.9 |

Takeaway

Based on all the data provided, I do believe that Ethan Allen Interiors remains a solid prospect for investors to consider. Given that even management has provided some warning that the future might not be as bright as the past has been, investors should obviously be very cautious. But given how strong the fundamentals of the company are and when considering just how cheap the stock is, both on an absolute basis and relative to similar firms, I do think it still warrants a solid ‘buy’ rating at this time.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment