AzmanL/E+ via Getty Images

The future is a hundred thousand threads, but the past is a fabric that can never be rewoven.”― Orson Scott Card

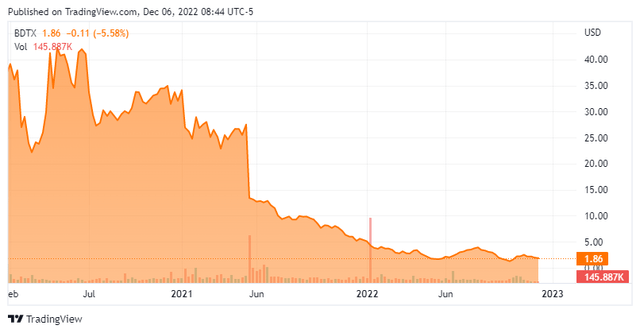

Today, we take a look a small developmental company whose stock is selling at a substantial discount to the net cash on the firm’s balance sheet. The shares have cratered due to the trial failure of its lead pipeline candidate, but the company has some earlier stage assets remaining. An analysis follows below.

Seeking Alpha

Company Overview:

Black Diamond Therapeutics, Inc. (NASDAQ:BDTX) is a Cambridge, Massachusetts based early clinical-stage biopharmaceutical concern focused on the development of precision therapies that target undrugged oncogene driver mutations in patients with genetically defined cancers. The company currently has one asset undergoing evaluation in a Phase 1 trial and one in preclinical studies. Black Diamond was founded in 2014 and went public in 2020, raising net proceeds of $212.4 million at $19 per share. Its stock currently trades for just under two bucks a share, translating to a market cap of approximately $70 million.

MAP Platform

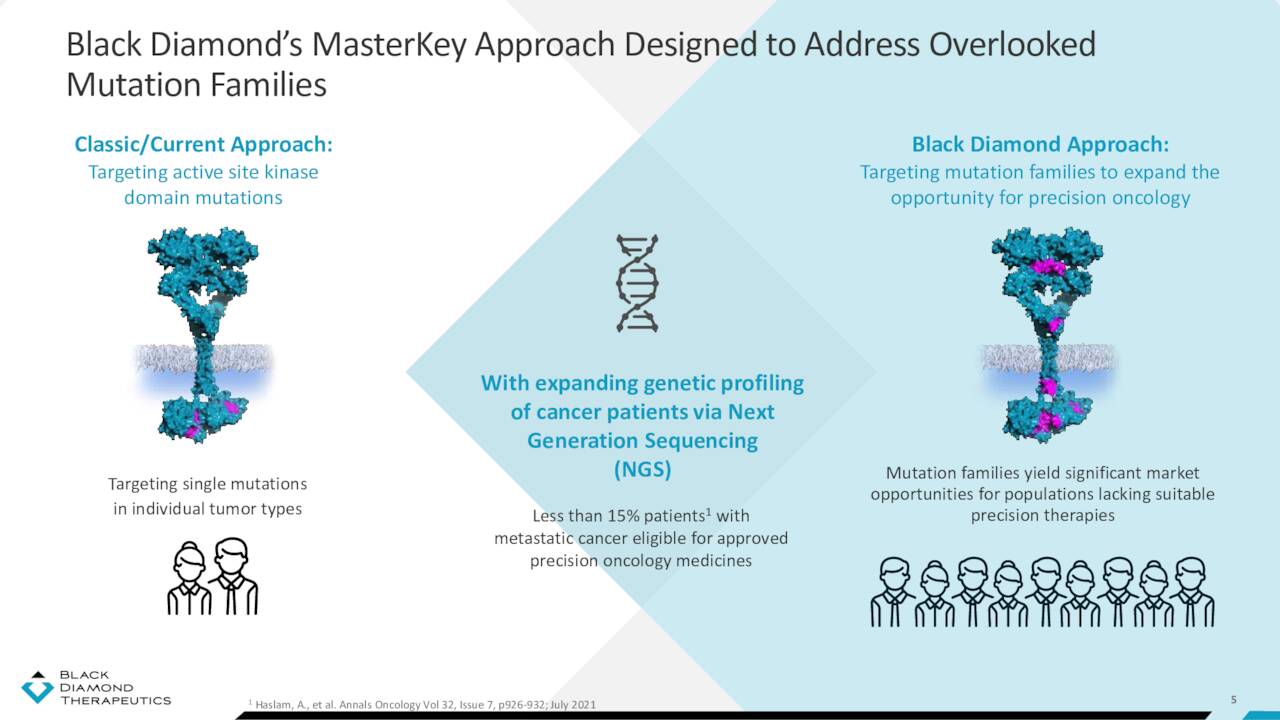

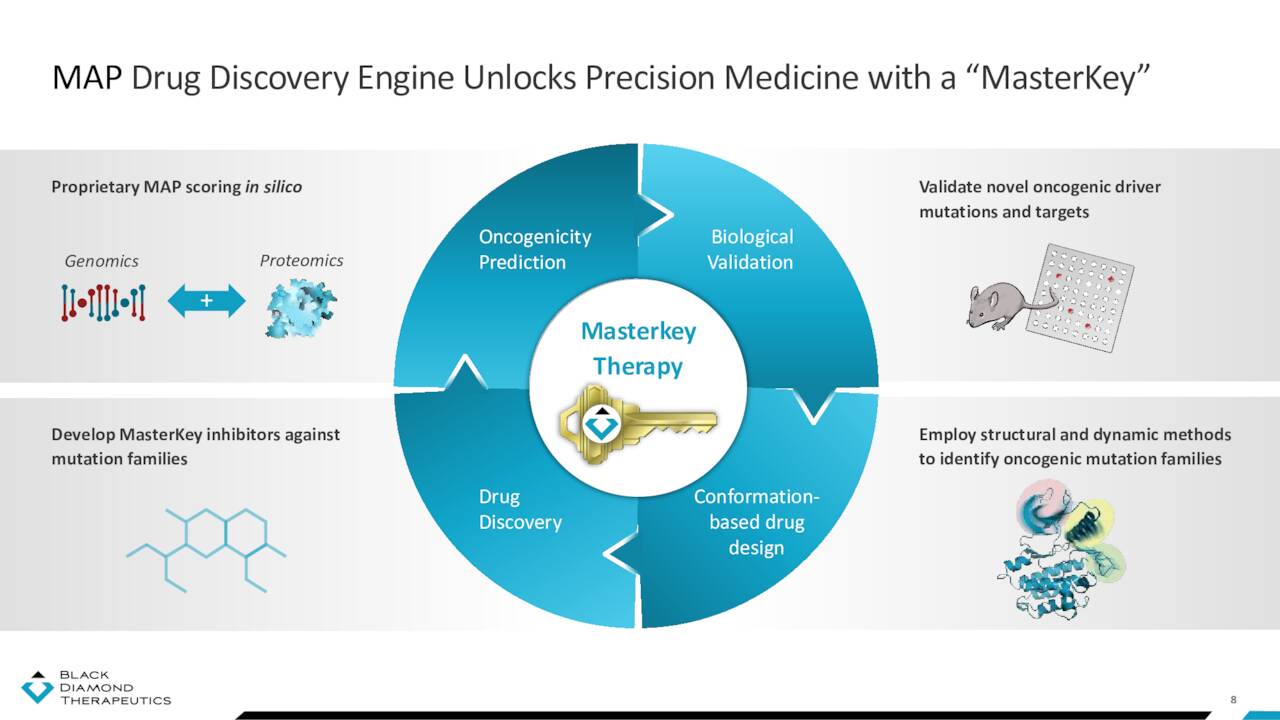

The company’s platform is designed to identify specific gene alterations that lead to cancer, aggregate these mutations into families that adopt a unified conformational state, and design therapies that target entire families of mutations, known as master key inhibitors.

May Company Presentation

Mutations that occur within the active site (i.e., the binding or adenosine triphosphate site) of an oncoprotein are relatively well-defined and often respond to existing therapeutics. However, other distal (allosteric or non-canonical) alterations sometimes act across large distances from the binding site to be oncogenic. These mutations typically do not respond to current medicines. Black Diamond’s discovery platform analyzes population-level genetic sequencing data to identify mutations that promote cancer across different tumor types. Once a mutation’s specific impact on a protein structure is known, it can be clustered with other similar-effecting mutations into ‘families’. The company then designs therapies that can inhibit multiple mutations in the same functional cluster, providing (in theory) a broad-based, master key solution to patients whose mutations would otherwise be too rare or unknown to be targeted by precision therapies. This Mutation-Allostery-Pharmacological (MAP) platform has spawned one clinical, one preclinical, and one failed program.

May Company Presentation

BDTX-189

Unfortunately, Black Diamond stumbled out of the gate, discontinuing its then lead program (BDTX-189) in April 2022. It was designed to inhibit allosteric ErbB mutations, which are overexpressed in non-small cell lung cancer (NSCLC) and invasive breast cancers (amongst other solid tumors) and are unresponsive to current epidermal growth factor receptor (EGFR) and human epidermal growth factor receptor 2 (HER2) kinase inhibitors. It was undergoing evaluation in a Phase 1/2 study but was terminated due to “a rapid evolution of the treatment landscape in NSCLC harboring either the EGFR or HER2 exon 20 insert mutations”. As a result of this pivot away from BDTX-189, Black Diamond announced it would lay off 30% of its workforce to preserve capital.

May Company Presentation

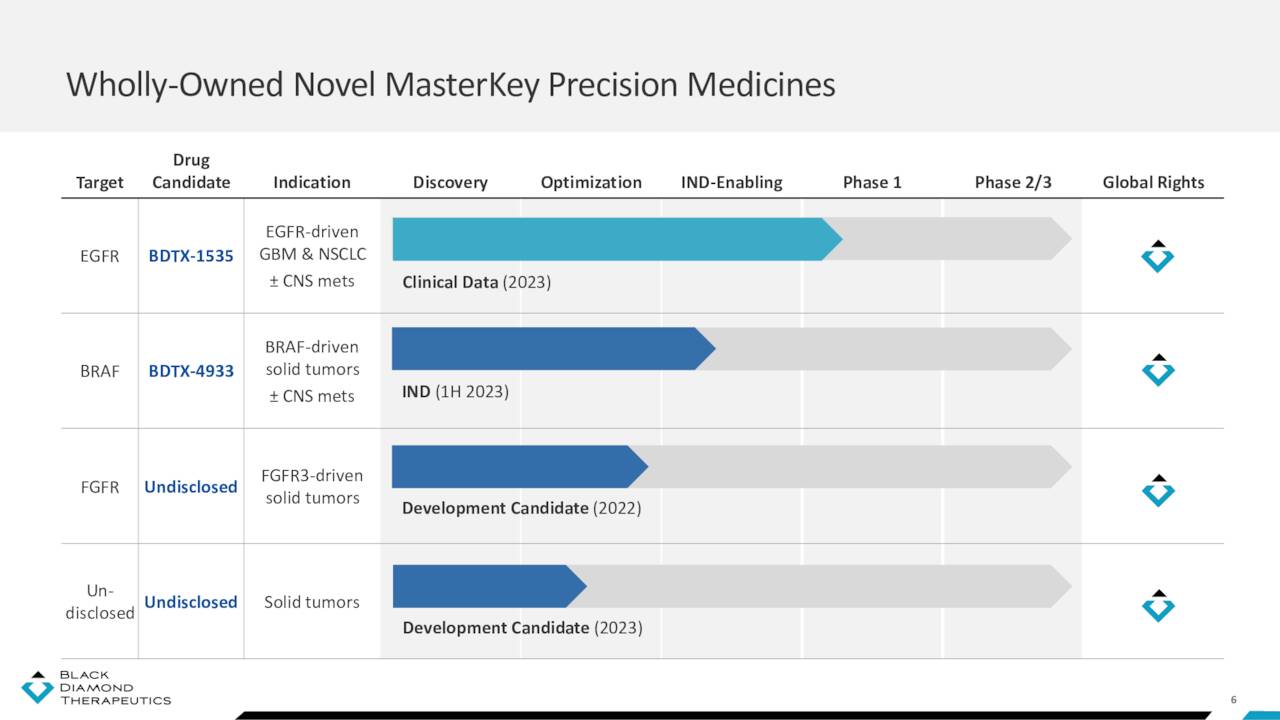

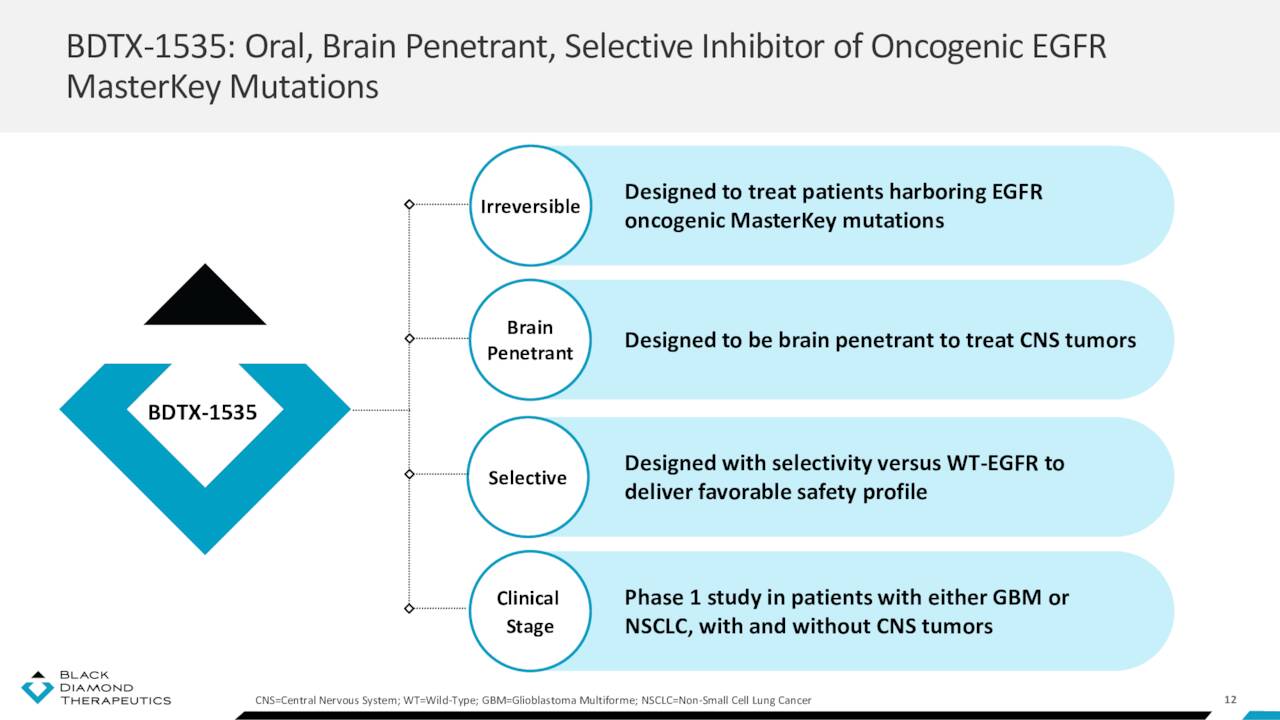

BDTX-1535

That setback left the company with one clinical-stage asset: BDTX-1535. It is an oral, brain-penetrant, irreversible inhibitor of EGRF alterations, including those present in glioblastoma and NSCLC. BDTX-1535 is also designed to be selective, only targeting EGFR mutations and not wild-type (non-mutated) EGFR. After demonstrating efficacy in murine models, Black Diamond initiated an open-label Phase 1 study in 1Q22 to assess the safety, tolerability, and preliminary antitumor activity of BDTX-1535 in patients with either recurrent glioblastoma or advanced/metastatic NSCLC harboring EGFR alterations, who have progressed on an approved EGFR inhibitor. Data from this study is expected in 2H23.

May Company Presentation

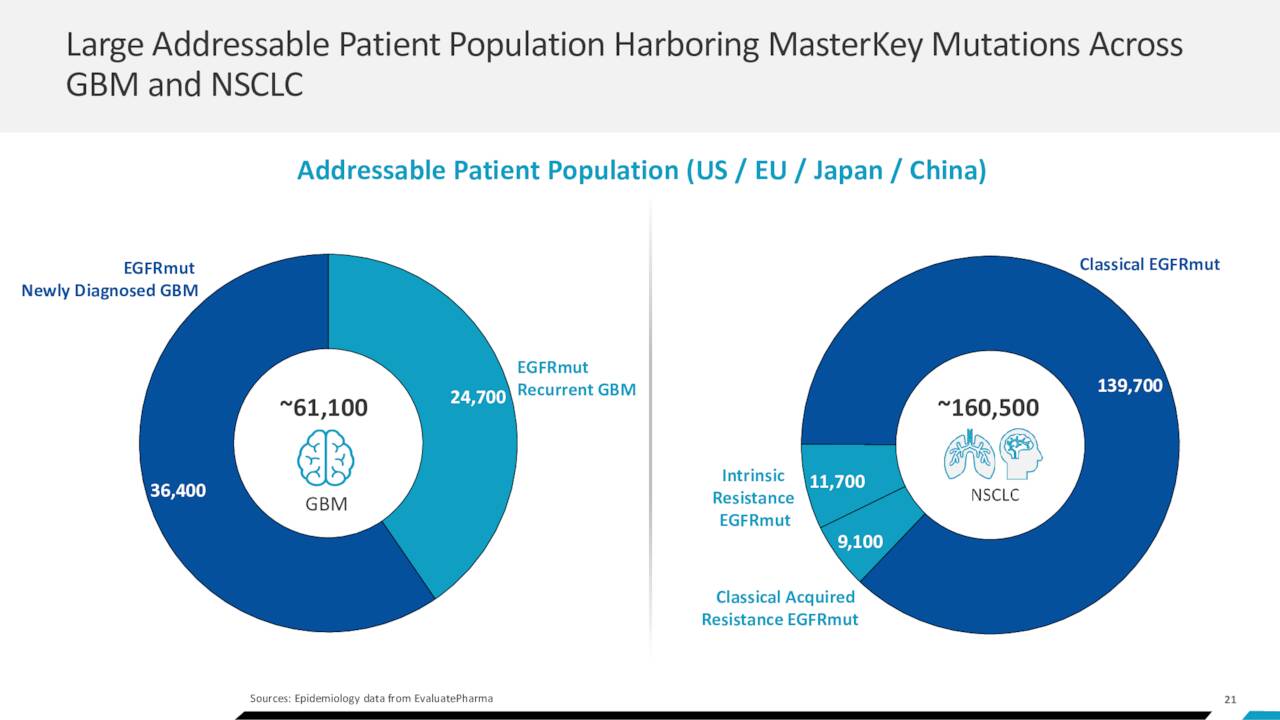

If BDTX-1535 is ultimately approved, the market is significant for these two indications. The glioblastoma population harboring an EGFR mutation across the U.S., EU, Japan, and China is estimated at 61,100, while patients afflicted with resistant EGFR mutation NSCLC across the same geographies number ~20,800. To date, attempts to target EGFR in glioblastoma have met with failure, the most recent of which was AbbVie’s (ABBV) antibody-drug conjugate depatuxizumab mafodotin, which was terminated due to lack of efficacy in 2019. Johnson & Johnson’s (JNJ) Rybrevant is approved for metastatic NSCLC with EGFR exon 20 insertion mutations, and Boehringer Ingelheim’s Gilotrif is approved as a first-line treatment for metastatic NSCLC with non-resistant EGFR mutations.

May Company Presentation

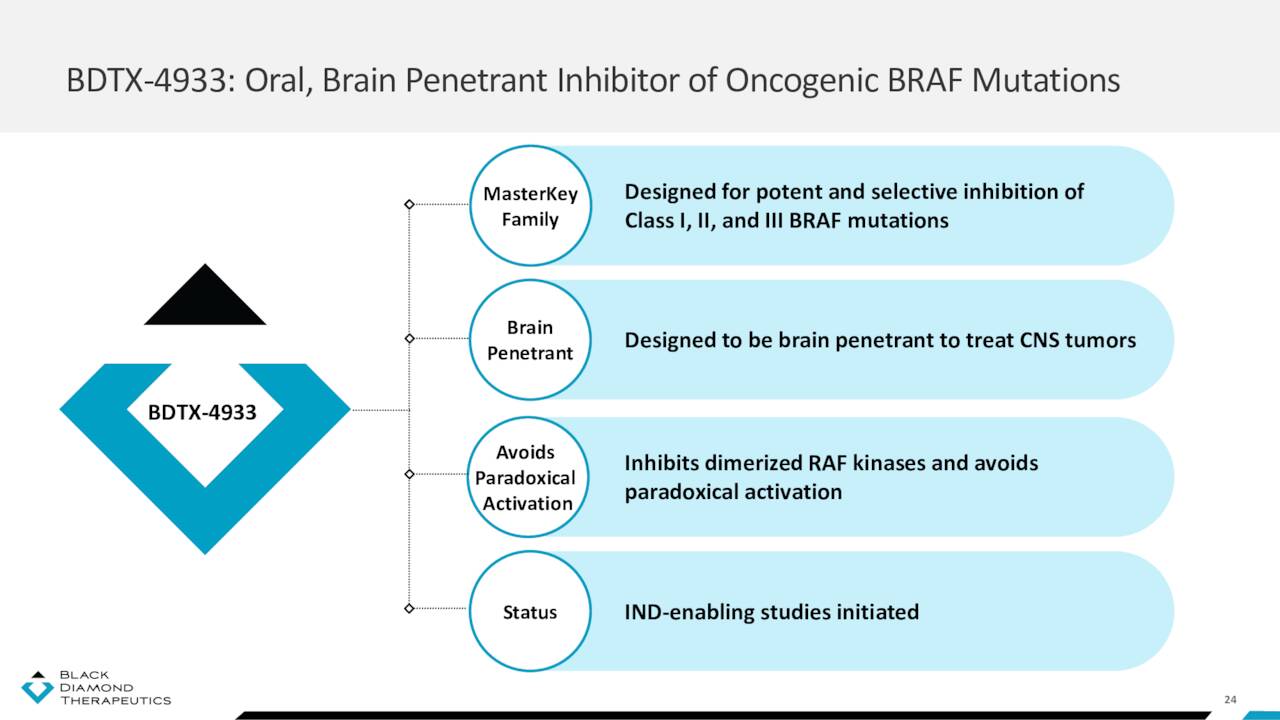

BDTX-4933

Black Diamond’s likely next entrant into the clinic is BDTX-4933, a brain-penetrant inhibitor of Class I, II, and III canonical and non-canonical BRAF mutations, which is currently undergoing IND enabling studies. So far, the program has demonstrated potential, significantly reducing tumor volume in mice across all three BRAF classes while avoiding paradoxical activation. Currently approved BRAF inhibitors (Pfizer’s (PFE) Braftovi; Roche’s (OTCQX:RHHBY) Zelboraf; and Novartis’ (NVS) Tafinlar) only address Class I mutations and can’t cross the blood-brain barrier, primarily treating colorectal cancer, melanoma, and NSCLC. Black Diamond anticipates filing an IND for BDTX-4933 in 1H23.

May Company Presentation

Balance Sheet & Analyst Commentary:

As of June 30, 2022, the company held unrestricted cash and investments of $144.2 million that, when giving effect to the job cuts announced in April 2022, should provide the company with a cash runway into 3Q24.

With its initial lead program already scrapped and only one other program in the clinic sans data, it is not surprising to see the Street lukewarm on Black Diamond. Of the three analysts offering commentary since the discontinuation of BDTX-189, Wedbush downgraded the stock from an outperform to a hold and lowered its price objective from $22 to $4; H.C. Wainwright also downgraded its investment recommendation from buy to hold with no price target; and Stifel Nicholas reiterated a hold and lowered its price forecast from $10 to $4. With a market cap below $100 million, there will likely be no additional commentary until data from BDTX-1535 is provided in 2H23.

That said, beneficial owner Biotech Growth N V aggressively accumulated Black Diamond stock in late October, adding 683,726 shares to increase its ownership interest to 15%.

Verdict:

The investors at Biotech Growth see a company trading at a ~50% discount to balance sheet cash (as of June 30, 2022) with potential to develop a single drug candidate that can target families of oncogenic mutations across various tumor types. Bears see no substantive clinical data to support the company’s approach to treating disease and will not be provided with any until 2H23. In the interim, Black Diamond will spend on advancing its assets through and into the clinic, justifying – at least to the bears – the discount to cash. All these dynamics make Black Diamond and ideal covered call candidate; however, liquidity in the options is too sparse. Black Diamond is too far away from commercialization to be considered for the model portfolio. a very small ‘watch item‘ position seems merited at this time for aggressive investors until the company advances its pipeline. For non-aggressive investors, the recommendation is to remain on the sidelines until further results come out in 2023. At which time, this is a name we will probably circle back on at that time.

People are like dice. We throw ourselves in the direction of our own choosing.”― Jean-Paul Sartre

Be the first to comment