helen89/iStock Editorial via Getty Images

Intro

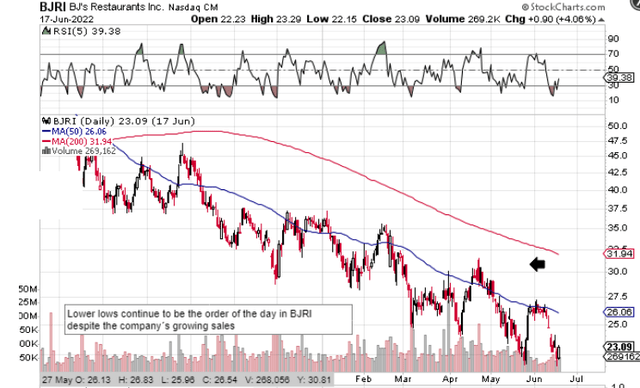

BJ’s Restaurants, Inc. (NASDAQ:BJRI) announced record top-line numbers in its first-quarter earnings report which were announced in April of this year. As we can see from the chart below, however, shares did not move on the news and in fact, topped out once the numbers were released. This may have surprised some investors as the company had to deal with the ramifications of the Omnicron variant in the first quarter. Furthermore, strong sequential top-line growth is expected in Q2 ($326+ million) which if met would be a 13%+ increase over the same period of 12 months prior. The market though continues to remain uninterested with shares down well over 25% since those record first-quarter numbers were released.

BJRI Technical Chart (Stockcharts.com)

The prime reason behind the market’s lack of interest is BJ’s profitability metrics which remain under pressure. Although management announced a $1.5 million net profit in Q1, this bottom-line number was aided by a hefty $10.2 million income tax benefit in the quarter. Suffice it to say, high inflation has been affecting the income statement in a big way and the market will need to see signs of this trend reversing before shares bottom out here over the near term.

Inflation Ramifications

Rising sales normally alleviate this problem but not when inflation persists on the costs side aggressively. Management now has the dilemma of trying to extract as many costs out of the system as possible while keeping the highest standards in the company’s establishments in place (Concerning services & food). The CEO laid out a comprehensive plan concerning strategic initiatives surrounding forward-looking growth but the restaurant chain may find itself behind the eight ball concerning these initiatives for the following reason.

If we look at BJ’s income statement over the past four quarters, we can see that combined revenue totaled $1.162 billion & cost of goods sold amounted to $1.029 billion during this time period. This gives us a gross profit of $133 million which in turn equates to a trailing twelve-month gross margin of 11.45%. Despite the company’s growing sales, BJ’s trailing 12-month gross margin actually comes in higher than the 9.7% number the company reported in its fiscal first quarter this year.

Gross margin trends are crucial in times of high inflation especially in the restaurant industry because it literally tells you the difference between the price of the finished plate on the menu versus the cost of the ingredients and the materials used to present the plate. So for example, for every $1 BJ’s generates in sales at present, it makes approximately $0.11 in gross profit. Put another way, BJ’s cost of goods sold for every $1 of top-line sales currently comes in at $0.89.

Gross Margin Problem

Now let’s take a worst-case scenario and say that inflation runs at approximately 10% over the next 12 months. Management has already taken steps to combat the rise in costs by increasing menu prices (With another one pending) on the front end (sales) but it is the cost side that is the real problem for BJ’s for the following reason. At an annual inflation clip of 10%, BJ’s cost of goods sold will increase from $0.89 for every $1 of sales to an equivalent $0.98. This is a $0.09 difference which is really substantial as one moves down the income statement.

Now how can these costs be siphoned out of the system is the next logical question. Going on current trends, this is going to remain very difficult due to sustained food cost inflation, high labor costs, and the need to spend aggressively in order to find the growth the company is looking for. BJ’s catch-22 is that it needs to spend more (in a high inflation environment where costs are growing) in order to grow the company. The risk with going down this avenue is whether customers will continue to flock to establishments if management needs to continue to increase prices on the front-end to pay for this spending. Suffice it to say, BJ’s growth issues come back to its poor gross margin metric which trails the industry average by quite some distance. If this key profitability metric was substantially higher, the restaurant chain would not feel the same effects of the high inflation gripping western economies at this moment in time.

Conclusion

Therefore, to sum up, BJ’s needs inflation to come down sharply to ensure higher costs do not affect the company’s operations in a significant way. This will ensure the restaurant chain can keep on providing guests the maximum value possible where experience and quality remain at the forefront. We look forward to continued coverage.

Be the first to comment