David Tran/iStock Editorial via Getty Images

Elevator Pitch

I rate Adobe Inc.’s (NASDAQ:ADBE) shares as a Hold. I assessed ADBE’s financial performance for the third quarter of fiscal 2021 (YE November 30) in my previous September 30, 2021, update. I focus on the review of Adobe’s Q2 FY 2022 earnings and the evaluation of the company’s outlook in this article.

Adobe isn’t a Buy even though it reported above-expectations earnings for Q2 FY 2022. The company’s Q3 FY 2022 guidance was below the sell-side’s consensus financial projections. More negative surprises might be in store, as ADBE has maintained its full-year FY 2022 Net New Digital Media Annualized Recurring Revenue guidance despite expectations of an economic downturn. But ADBE isn’t a Sell as well, as the company’s long-term outlook with regards to top line and profit margin expansion is good. As such, I have kept my Hold rating for Adobe.

What Were Adobe’s Expected Earnings?

Prior to the company’s actual Q2 FY 2022 financial results announcement on June 16, 2022, after trading hours, the Wall Street analysts expected Adobe to generate a non-GAAP earnings per share of $3.31 in the most recent quarter. This would have implied a +9% YoY increase as compared to ADBE’s Q2 FY 2021 EPS of $3.03.

Did Adobe Beat Earnings?

Adobe’s actual EPS for Q2 FY 2022 was $3.35 as per the company’s second-quarter results press release. This meant that ADBE’s Q2 FY 2022 bottom line turned out to be +1.3% better than the sell-side’s consensus earnings projection and +11% higher on a YoY basis.

But the market’s reaction to ADBE’s Q2 earnings beat was relatively muted. Adobe’s stock price declined by -1% from $365.08 as of June 17, to $360.79 as of June 18. I analyze Adobe’s Q2 FY 2022 metrics and its future growth prospects in the subsequent sections of the current article to understand why the company’s shares didn’t rise despite delivering an earnings beat.

ADBE Stock Key Metrics

ADBE stock’s key Q2 FY 2022 metrics (not only EPS) were above investors’ expectations.

With respect to the company’s top line, Adobe’s total revenue expanded by +14% YoY from $3,835 million in the second quarter of fiscal 2021 to $4,386 million in the most recent quarter, and this was +1% ahead of the sell-side analysts’ financial estimates. In terms of performance by segment, the company’s Digital Media segment and Digital Experience segment saw their respective revenue grow by +15% YoY and +17% YoY, respectively. Revenue for both the Digital Media and Digital Experience business segments came in +1% higher than Wall Street’s consensus forecasts as per S&P Capital IQ.

When it comes to profitability, ADBE also surpassed the market’s expectations. Adobe’s operating profit margin in the second quarter of fiscal 2022 was 45.0%, which exceeded the market’s consensus operating margin estimate of 44.8% (source: S&P Capital IQ) by +20 basis points.

In addition, Adobe’s key operating metric for Q2 FY 2022 didn’t disappoint the market. ADBE achieved Net New Digital Media Annualized Recurring Revenue or ARR of $464 million in the recent quarter, which represented a +15% YoY increase in ARR and beat the analysts’ consensus forecast of $441 million by +5% as per S&P Capital IQ data.

In summary, ADBE’s EPS and other key metrics for the recent quarter were better than what the market had expected. However, Adobe’s share price performance post-results announcement wasn’t good, and this might be related to the company’s forward-looking guidance (rather than its historical results) which I touch on in the next section.

What To Expect After Earnings

Investors are expecting a lackluster Q3 FY 2022 for Adobe, notwithstanding the company’s above-expectations Q2 FY 2022 financial and operating performance.

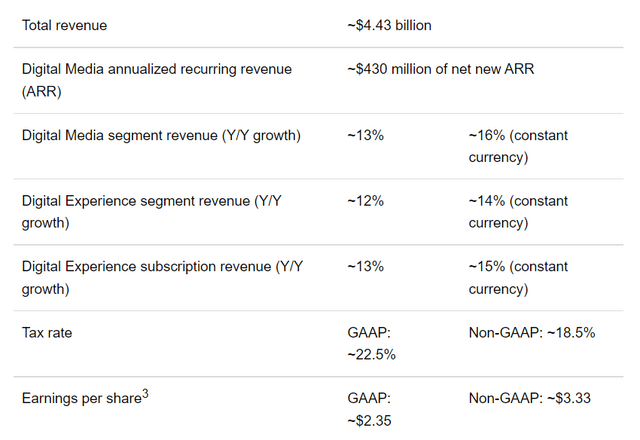

Adobe’s Q3 FY 2022 Management Guidance

ADBE’s Q2 FY 2022 Earning Press Release

As per the chart above, ADBE guided for the company to deliver top line of $4.43 billion and a non-GAAP EPS of $3.33 in the third quarter of fiscal 2022. Based on consensus financial forecasts obtained from S&P Capital IQ, the sell-side analysts had estimated Adobe’s revenue and bottom line for Q3 FY 2022 to be higher at $4.512 billion and $3.39, respectively.

Notably, ADBE’s $4.43 billion Q3 FY 2022 revenue guidance also meant that the company’s top line growth will slow from +14% YoY and +3% QoQ in Q2 FY 2022 to +13% YoY and +1% QoQ in the upcoming quarter. The company’s EPS guidance of $3.33 for Q3 FY 2022 also translates into a -0.6% QoQ contraction.

Separately, Adobe’s guided Net New Digital Media ARR of $430 million for the third quarter was +5% below the market’s consensus projection of $452 million.

In a nutshell, ADBE’s near-term outlook has disappointed investors, and this is the key reason driving the stock’s -1% price decline following its Q2 FY 2022 earnings release.

Is Adobe Stock Expected To Go Up?

Adobe’s stock price isn’t expected go up in the short term, as there could be room for further negative surprises going forward, particularly when it reports Q4 FY 2022 results.

At its Q2 FY 2022 earnings briefing on June 16, 2022, ADBE highlighted that “we reaffirm the $1.9 billion for Net New (Digital Media) ARR for the year (FY 2022).” This implies that Adobe will have to deliver a relatively high Net New Digital Media ARR of $588 million in the fourth quarter of fiscal 2022 (as compared to Q3 FY 2022 guidance of $430 million) to meet its full-year guidance of $1,900 million.

Adobe also noted at its second-quarter investor call that “everybody would have knowledge that it’s an uncertain macroeconomic environment.” But the company reiterated its “confidence in the underlying performance and the strength we see into the second half” on the belief that “every business continues to prioritize its digital investment.”

However, I am of the view that it is still inevitable that both corporations and consumers will cut spending (and have a negative impact on ADBE’s future performance), as the economy weakens and a recession eventually materializes.

In conclusion, I think it will be hard for Adobe’s stock price to go up in a meaningful way anytime soon, as the company’s Q3 FY 2022 guidance was below expectations and its Q4 FY 2022 performance might disappoint investors again.

Is Adobe A Good Investment Long-Term?

Adobe is a good investment candidate for the long term, if one considers its potential for revenue growth and margin expansion in the long run.

ADBE generated revenue of $15.8 billion in full-year FY 2021, and it revealed at its Q4 2021 earnings call on December 16, 2021, that it sees the company eventually delivering top line of $30 billion and $45 billion, respectively, in time to come. This doesn’t seem farfetched, as Adobe’s consensus FY 2024 revenue of $23.1 billion only represents 11% of its estimated 2024 Total Addressable Market or TAM of $205 billion (as disclosed at Q4 2021 results briefing). The sell-side analysts also see Adobe achieving sales of $28.3 billion in fiscal 2026, which will bring it very close to the key revenue milestone of $30 billion.

In other words, Adobe has the ability to double or triple its revenue going forward, riding on secular growth drivers such as digital transformation. I cited “the results of the Deloitte Digital Transformation Executive Survey 2021” in my prior article published on September 30, 2021, highlighting that “69% of respondents worldwide ‘planned to increase their financial commitments to digital transformation in response to the pandemic'”.

Separately, Adobe emphasized at the company’s Q4 2021 results briefing that “60s come after 50s” when “thinking about numbers on that scale”, when asked a question on whether ADBE’s operating profit margins are “capped in the mid-40s.” ADBE is alluding to the positive effects of operating leverage on its profitability, as the company scales up its revenue base further.

Apart from economies of scale, upselling is expected to be another key driver of ADBE’s long-term profitability improvement. At its fourth-quarter investor call, Adobe specifically mentioned “upselling” clients to “premium features, products, services.”

Is ADBE Stock A Buy, Sell, Or Hold?

ADBE stock stays as a Hold. Considering both short-term headwinds and long-term growth drivers, a Neutral view and a Hold rating for Adobe are appropriate.

Be the first to comment