SeventyFour/iStock via Getty Images

Introduction

This market isn’t a lot of fun as the S&P 500 is down 23% year-to-date. We’re in an incredibly tricky market environment due to high inflation, supply chain issues, geopolitical tensions, an energy crisis, and a Federal Reserve that is hiking rates into economic weakness. The same goes for the Bank of England and soon (likely) the European Central Banks. In this environment, stocks are suffering as uncertainty is incredibly high. That’s bad for existing positions. However, I believe that times like these are necessary for long-term investors to add quality dividend (growth) stocks to their portfolios.

Extra Space Storage Inc. (NYSE:EXR) is one of these companies. The self-storage REIT is down 30% year-to-date, bringing its yield close to 4% as investors are selling everything that does well in a low-rate environment. The good news is that Extra Space Storage maintains a fortress balance sheet that will protect it against high rates in an environment that continues to support self-storage assets. I remain extremely bullish on a long-term basis, as the only thing that annoys me is the fact that I don’t have enough cash to make EXR a major position in my portfolio right now.

Let’s look at the details!

Weakness Brings Opportunities

I have followed the market daily since 2011 and I have to say that this market may be the trickiest I’ve witnessed – excluding the few weeks when nobody knew how bad COVID could get in early 2020. The economy is being pressured by a mix of related issues like high inflation, supply chain problems, labor shortages, energy issues, the war in Ukraine, Chinese lockdowns further hurting trade, a slowing economy, and to make it all worse, a Federal Reserve that isn’t supporting the economy, but aggressively hiking to combat inflation.

Add to this list that Europe is experiencing a massive energy crisis and what could be the start of a new euro crisis while the ECB hasn’t even hiked rates yet.

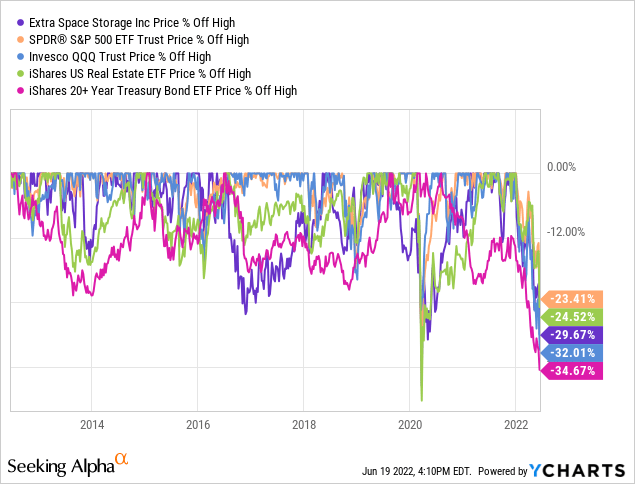

With that said, there really is no place to hide, at the moment, as the S&P 500 (SPY) is down close to 24% from its all-time high. Long-term government bonds as displayed by the iShares 20+ Year Treasury Bond ETF (TLT) are down 35%. Generally speaking, good REITs tend to outperform in tough times as rates (often) go down when markets fall, providing a basis for so-called “yield plays.” Right now, that’s not the case, causing the iShares U.S. Real Estate ETF (IYR) to fall by 25% as well. Extra Space Storage is down 30% from its all-time high.

I own EXR’s largest peer, Public Storage (PSA). I bought it back in 2020 when its yield was juicy. It became one of my most successful investments until it got hit as well, losing close to 30% since its peak.

The good thing is that this is nothing new. Recessions and sell-offs come and go and they will continue to do damage on a regular basis. That’s what you sign up for when making the decision to become a long-term investor in pretty much anything that comes with volatility and a cyclical pattern.

While I’m not having that much fun at the moment, I enjoy the opportunities the market gives us. After all, buying dividend growth stocks at good valuations (high-er yields) is a blessing when it comes to long-term investing.

For example, assuming 10% annual dividend growth on stock XYZ would turn a 2% yield into a 5.2% yield on cost in 10 years. If XYZ would yield 2.4%, that yield would turn into a 6.2% yield on cost. That’s a huge difference and it only gets bigger as time passes – everything else excluded.

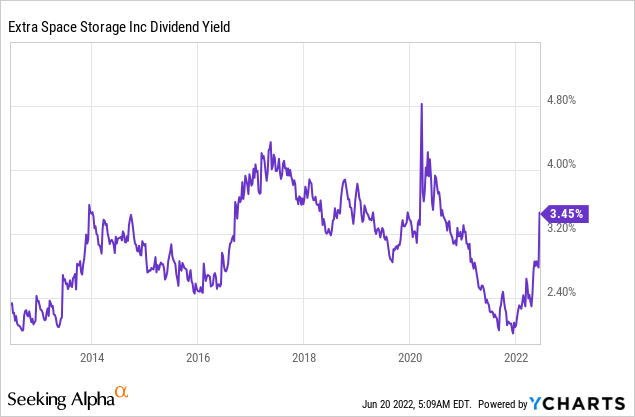

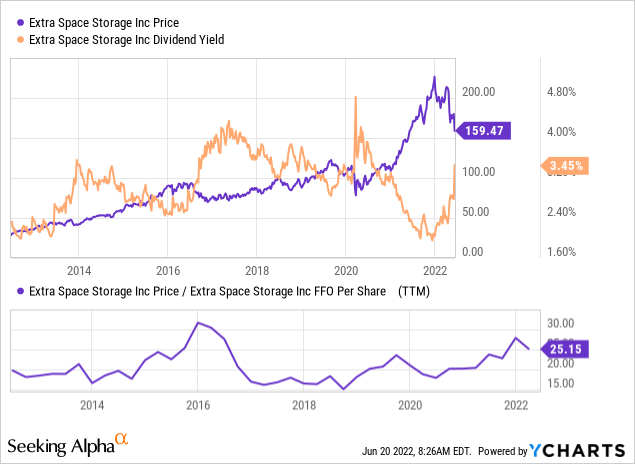

That’s why I’m so “happy” that EXR weakened a bit more. The stock is now yielding 3.8% (higher than the chart below suggests). This is one of the highest yields in its recent history and well in the range of “high-yield.”

The steep uptrend in high-quality REITs after the 2020 sell-off caused valuation to fall to truly disappointing levels. That’s over now, which is good news for new investors.

After all, EXR brings way more to the table than a decent yield.

EXR Stock Value

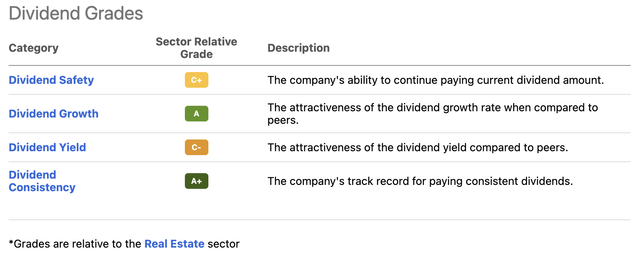

I believe that EXR has a terrific dividend scorecard – provided by Seeking Alpha – despite the fact that it includes a C+ and C-. The first C+ for dividend safety can be explained quite easily. EXR cannot cover investments in its business and dividends. This goes for every single REIT on my radar. This is resulting in elevated debt levels, causing the company to score somewhat poorly on dividend safety versus peers – but I will get to that later in greater detail.

The C- for its dividend yield can be explained more easily. The median real estate 4-year average yield is 4.5%. EXR cannot compete with that. A lot of REITs have high yields, which is the reason why a lot of investors are attracted to them. That’s perfectly fine, except that I like to go for dividend growth over a high yield.

In this case, EXR has both. A decent yield and satisfying dividend growth (grade A).

The best thing about EXR is that it operates in a high-growth industry that allows companies to hike rates, buy “bulk” properties, and benefit from secular trends like the need for storage as housing is increasingly more expensive.

The most recent Yardi Matrix National Self Storage Report supports the bull case as demand in the industry continues to support higher rates.

A big part of the takeaway is quoted below (emphasis added):

With no let-up in demand for self storage as the traditional busy season starts, street rates ticked up in April. According to industry executives at the NYSSA investment forum this month, demand comes not only from traditional drivers such as migration and students, as households need space to store items while in transit between homes and apartments, but also from individuals who need storage to accommodate home offices and businesses that have been squeezed out of the tight industrial market. Plus, they said, existing customers are renewing at high rates and extending the length of stays. It all points to continued growth in rents and net operating income, which has increased upwards of 20% for some REITs over the past year, per recent earnings calls. “We’re encouraged by what we see through the month of April,” a Public Storage executive said during a recent call. “Clearly, we have momentum.”

Moreover, and with regard to inflation, the company believes that self-storage can deal with rising prices because leases can keep pace with rising prices while benefiting from a secular increase in demand.

On top of that, supply is expected to fall. Yardi forecasts that the amount of new supply delivered annually will gradually tighten to 2.5% of total stock in 2027. This would be a huge relief for an industry that has “always” been prone to aggressive new supply additions. After all, self-storage isn’t rocket science, and entry barriers are low.

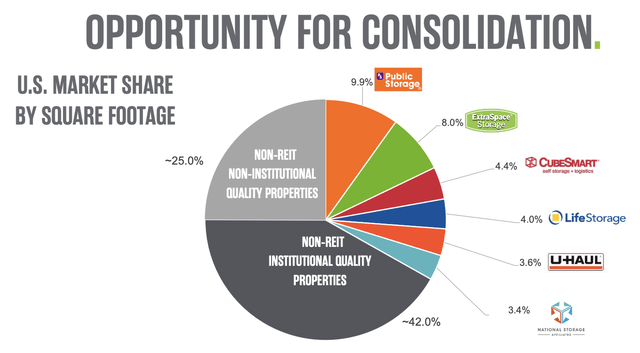

EXR owns/manages 2,130 properties with a market share of 8.0% in an industry that offers a lot of opportunities for consolidation. Roughly 995 properties are wholly-owned. 288 are part of joint ventures. 847 properties are managed. This opens up opportunities to generate additional (high margin) income and the possibility to acquire new assets from these JVs or managed property deals.

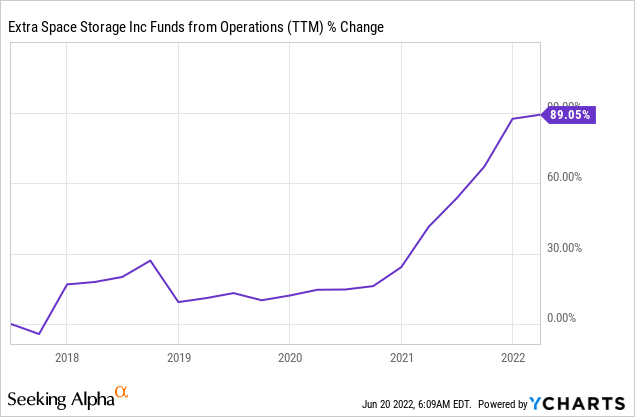

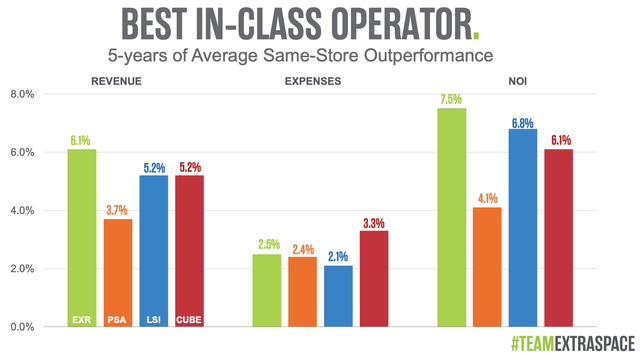

The best thing about EXR is that it manages its business so well. It has industry-leading margins and net operating income growth. Since 2011, the company has grown its core FFO (funds from operations) per share by 600%. The closest competitor CubeSmart (CUBE) comes in second with 300% growth.

Please be aware that “per share” data is extremely important. After all, like most REITs, EXR issues shares to fund operations. In 2017, it had 126 million common shares outstanding. In 2021, it ended with 133 million shares outstanding. That’s an increase of 5.6%. That’s OK, as GAAP funds from operations rose by almost 90% during the past five years.

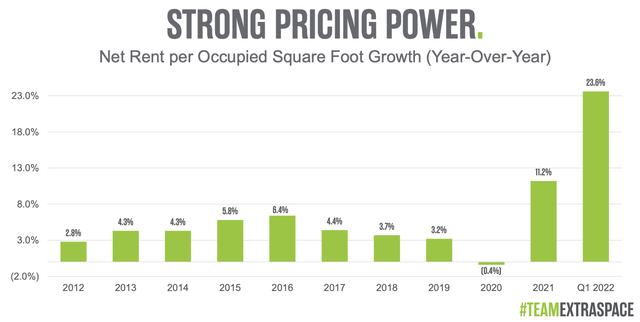

In 1Q22 alone, the company achieved 34.0% core FFO growth as it benefits from a 95.3% occupancy rate, close to 45 average monthly rentals per store (almost an all-time high), and low discounts (just 3% of total rental revenues) suggesting strong pricing power – as well as 23.6% growth in net rent.

These numbers aren’t sustainable, but right now, it’s a reaction to high demand and strong growth in rents and home prices. Prior to the pandemic, rent growth hovered between 3-6% most of the time.

Additionally, one may wonder if these rent increases hurt demand. The company commented on that in its 1Q22 call:

So I won’t say we’re not seeing pushback from the rental rates we’re sending out. Our vacate activity in response to rate increases is probably double what it normally is, but demand is so strong and our ability to backfill those tenants is consistent across the country, that it hasn’t affected us in terms of results, in terms of performance.

As a matter of fact, the average length of a tenant stay is now longer than 24 months for 47.6% of EXR customers – a new all-time high. More than 66% of tenants stay longer than 12 months – also an all-time high.

So far, this proves that the company does indeed have pricing power and it confirms my suspicion that self-storage is benefiting from a strong secular growth trend. This was confirmed by the aforementioned Yardi report as well.

So, what does this mean for your dividends?

It’s good news.

EXR Dividend & Outperformance

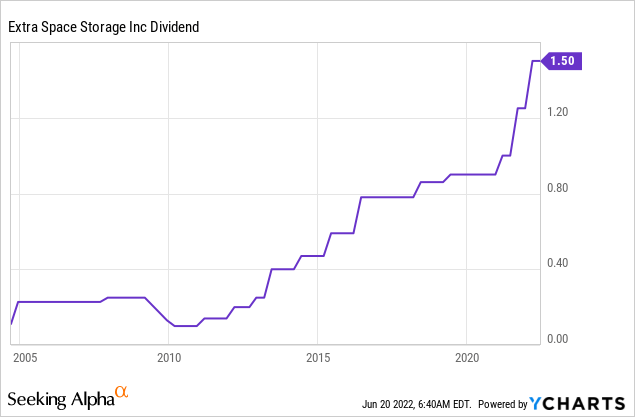

The last time the company cut its dividend was during the Great Financial Crisis. since, then, it has been a one-way street. While dividend growth isn’t very consistent, the company boosts payout whenever it sees an opportunity to do so. Between 2012 and 2022, the dividend gradually rose from $0.20 per share to $1.50.

These are the most recent hikes:

- February 2022: 20%

- August 2021: 25%

- February 2021: 11%

- May 2019: 4.7%

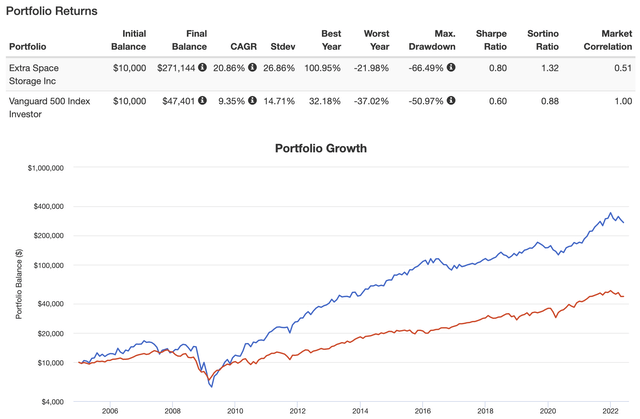

I cannot promise anything, but investors are in a good spot to benefit from long-term dividend growth leading to outperformance. The long-term total return (including dividends) is impressive. Since 2004, EXR has returned 20.9% per year, which includes the Great Financial Crisis drawdown of 66.5%. The S&P 500 has returned 9.4%, which isn’t bad either. The standard deviation is somewhat elevated at 26.9%, but that’s OK as the strong performance makes up for it. After all, the Sharpe ratio (volatility adjusted return) is at 0.80, beating the S&P 500 by 0.20.

I expect this outperformance to continue.

With that said, let’s address one of the reasons why REITs are in a tough place: rates.

Extra Space Storage Balance Sheet

One of the reasons why REITs are so weak is because rates are rising. Higher rates mean more stress on balance sheets.

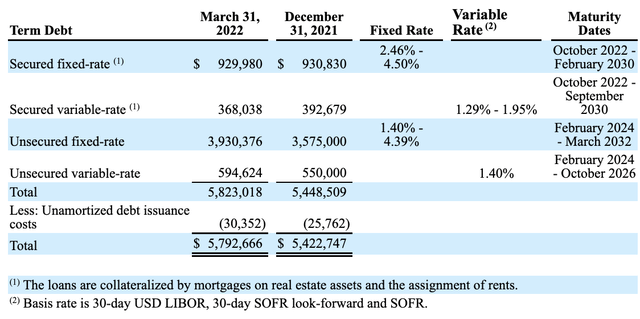

EXR’s balance sheet is rated BBB Stable by S&P Global and Baa2 Stable by Moody’s. As of June 2022, the company’s weighted average interest rate is 2.8%. Its interest coverage ratio is at an all-time high of 7.9x. It was less than 5.5x prior to the pandemic – which wasn’t a bad number either. The fixed charge ratio is at 6.8x, which includes how well a company can cover interest payments, leasing obligations, and related.

Almost more important, net debt has fallen to just 4.5x EBITDA. Prior to the pandemic, this number was close to 6.0x.

It also helps that a lot of debt is fixed debt with maturities starting in 2024, which gives the company time until rates fall again – I don’t think rates will remain this high.

As of March 31, 2022, the company had $5.8 billion in term debt. $3.9 billion of this was fixed with rates between 1.4% and 4.4% and no maturities before February 2024.

Extra Space Storage (1Q22 10-Q)

Moreover, the company’s rates on its revolving credit lines are attractive as well. its biggest credit line (Credit Line 2), has a $1.25 billion capacity. The interest rate is LIBOR +0.85%, which resulted in a 1.3% rate as of March 31, 2022.

So, what about the valuation?

EXR Stock Valuation

In 2022, EXR expects to achieve a core FFO result of $8.05-$8.30. Using the company’s $160 stock price, we’re dealing with a 19.3x-19.9x multiple. This valuation is attractive, as it gives us a margin of safety as well in case the company runs into demand problems. The same goes for the dividend yield of 3.8% (not 3.5% as the chart below shows), which is making this dividend growth investment way more attractive.

Takeaway

The market is causing frustration. Most stocks these days are experiencing steep drawdowns while economic growth is extremely fragile. Business expectations are falling, inflation remains high, supply chains are still damaged, and the Fed is expected to remain aggressively hawkish unlike prior cycles when it quickly turned dovish when the market experienced similar economic and market developments.

While I don’t know when or where the market will bottom, I’ve been adding to existing investments and added three new companies to my portfolio. I like the risk/reward and Extra Space Storage is one of my favorites at current prices.

The company is selling off along the broader market as it does not benefit from lower rates this time. However, it has a stellar balance sheet, a business model benefiting from secular growth, and management’s ability to generate value in a competitive space.

Dividend growth is accelerating and the current dividend yield is now close to 4%, making it a great long-term dividend growth.

The best way to deal with this from a new investor’s point of view is to break up an initial investment, i.e., buy 25% now and add gradually over time. If the stock drops further, investors can average down. If the stock suddenly takes off, investors have a foot in the door.

The only reason why I have no exposure yet is that I invested a lot in other areas. I do have plans to add EXR to my PSA position.

(Dis)agree? Let me know in the comments!

Be the first to comment