Elena Bionysheva-Abramova/iStock via Getty Images

Introduction

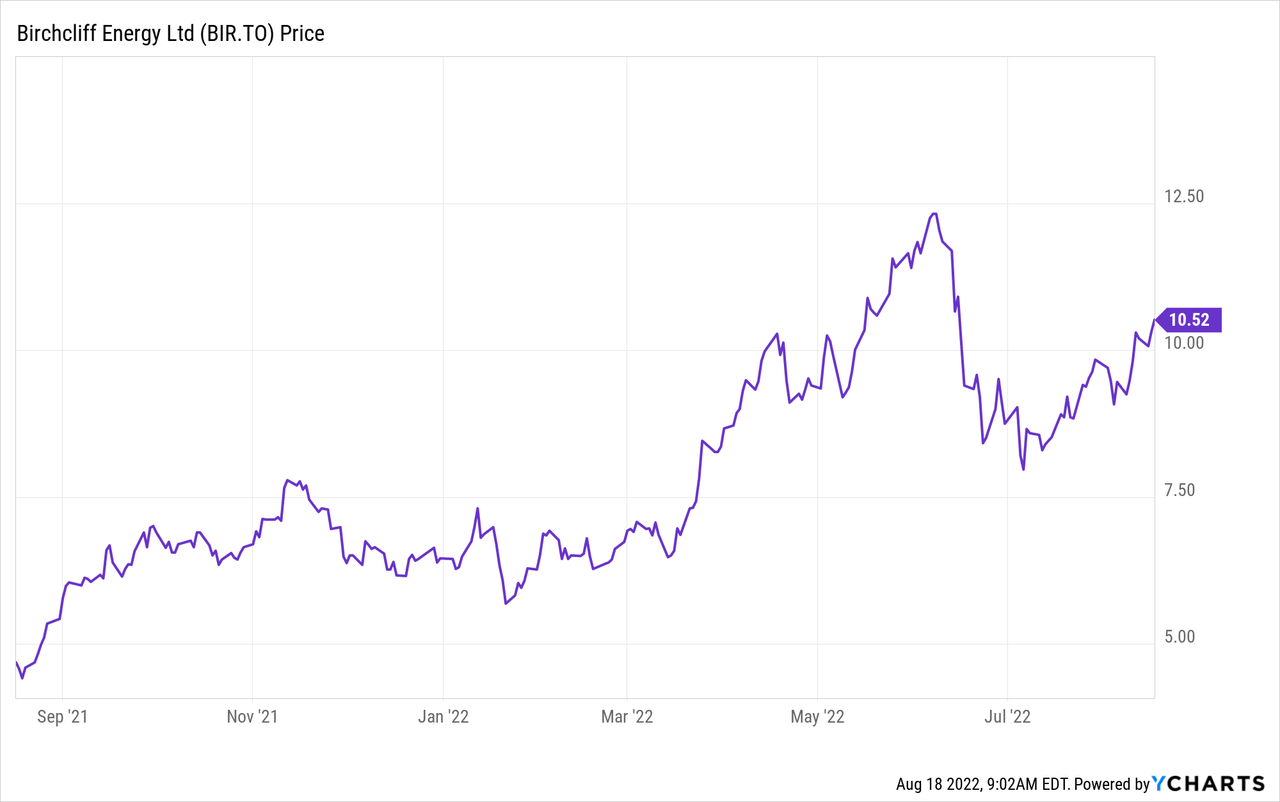

Birchcliff Energy (OTCPK:BIREF) (TSX:BIR:CA) is a Canadian natural gas producer and despite a stellar performance in the first half of this year, the company still appears to be flying under the radar. That’s unfortunate as its management team is taking all the right steps: the cash flow is used to rapidly reduce the net debt to zero while Birchcliff will also call all of its preferred shares. The real kicker will be the triple digit dividend boost from next year on.

Birchcliff has its primary listing in Canada where it’s trading with BIR as its ticker symbol. The average daily volume on the TSX is approximately 1.8 million shares making it the most liquid trading venue while it also offers options. I will use the Canadian Dollar as a base currency in this article.

The very strong natural gas price helps to retire debt and call preferred securities

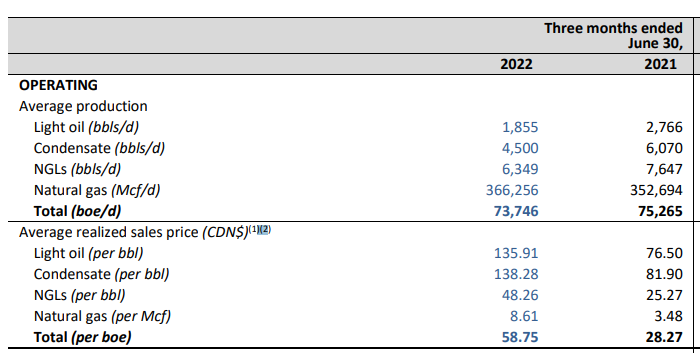

Birchcliff Energy produced almost 74,000 barrels of oil-equivalent in the second quarter with approximately 83% of the oil-equivalent production consisting of natural gas. While all fossil fuel prices were high during the quarter, Birchcliff made a killing thanks to the high realized prices for its natural gas. Thanks to its diverse delivery profile (it also sells its natural gas into the USA and isn’t just depending on the local Canadian AECO prices), it reported an average realized price of C$8.61 for its natural gas.

Birchcliff Energy Investor Relations

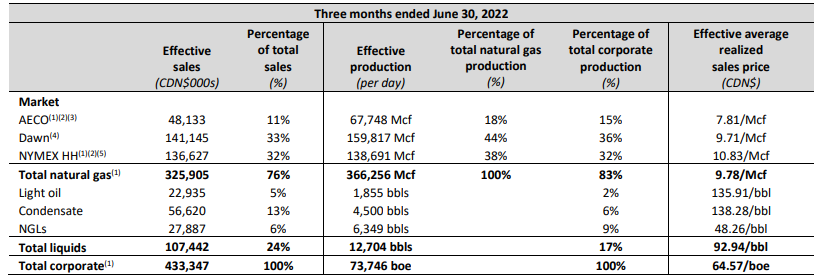

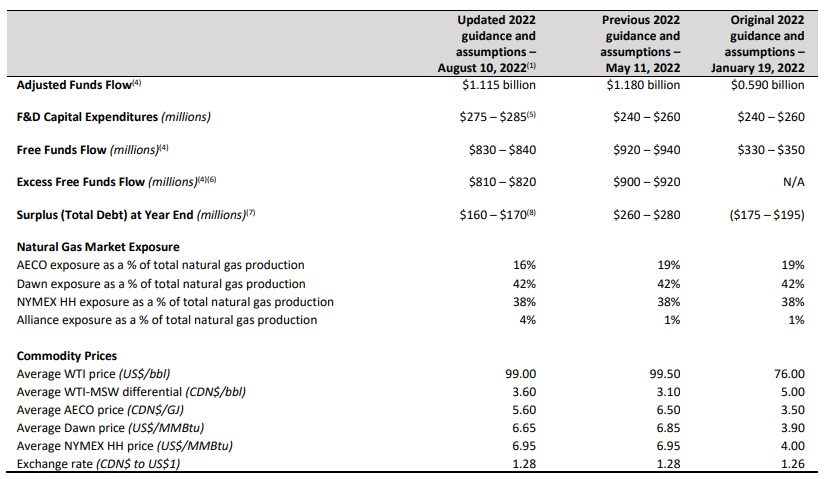

During the second quarter, only 18% of the natural gas production was sold under AECO-based contracts while the Dawn and Henry Hub contracts yielded higher average prices.

Birchcliff Energy Investor Relations

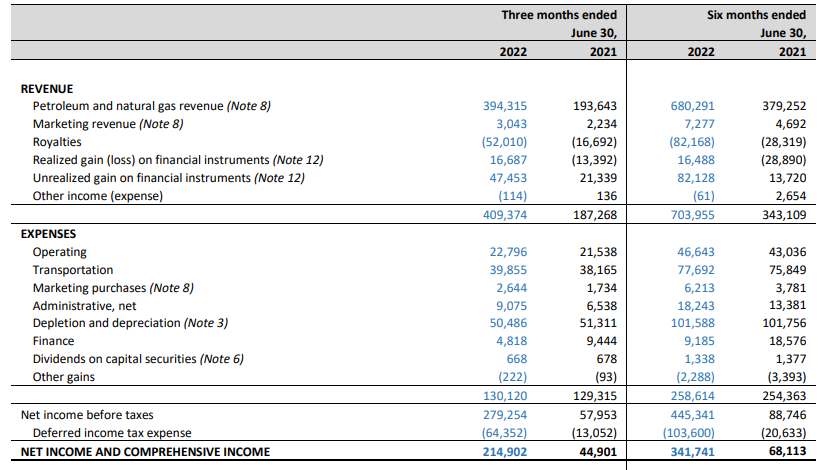

The very strong natural gas price resulted in a total revenue of C$394M and a total reported revenue of C$409M as Birchcliff also reported about C$64M in realized and unrealized gains on derivatives, which cancelled out the C$52M royalty payments. With a net income of C$215M and an EPS of C$0.81/share, the second quarter was absolutely excellent for Birchcliff.

Birchcliff Energy Investor Relations

Even if you’d remove the derivative gains from the equation, the EPS would still have exceeded C$0.60.

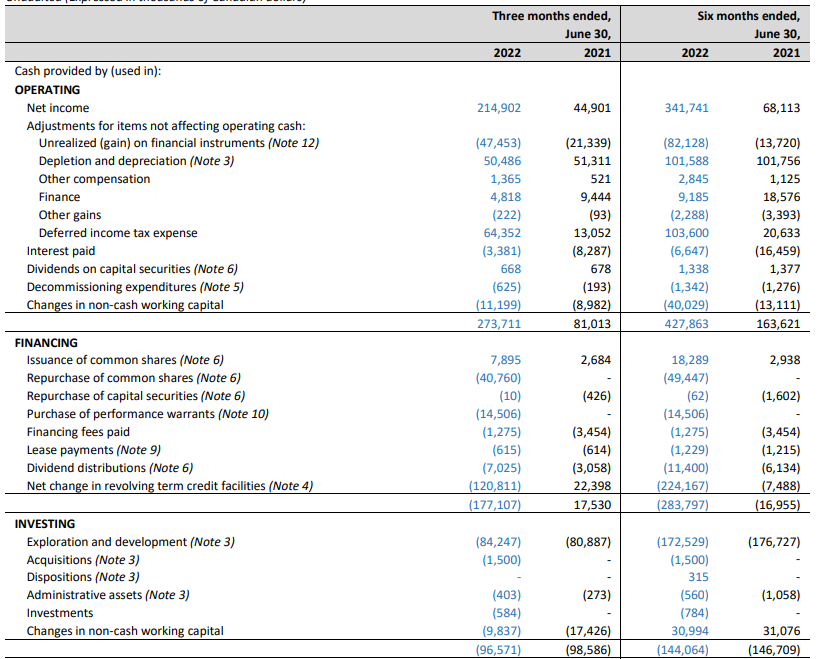

What really matters to Birchcliff is the free cash flow performance. The company reported an operating cash flow of C$274M but after adding back the working capital changes and deducting the C$64M in deferred taxes, the adjusted operating cash flow was approximately C$222M. The total capex was C$84M resulting in a free cash flow of almost C$140M for about C$0.53/share.

Birchcliff Energy Investor Relations

That’s lower than the reported net income due to the lack of derivatives gains and the fact Birchcliff has spent about C$84M on capital expenditures while its depreciation expenses are just over C$50M per quarter. These investments should allow Birchcliff to boost its production rate to 81,000-83,000 barrels of oil-equivalent during the final quarter of the year.

The very strong natural gas price also has a negative result for my personal portfolio. I own preferred shares in Birchcliff and although I have been very happy collecting the 8% preferred dividend yield, the fat lady is almost singing. Exactly because Birchcliff’s financial health is improving so fast, it is now in an excellent position to retire all preferred shares and they will be called in October.

There are about 3.5 million preferred shares outstanding, so calling them all will cost Birchcliff less than C$90M and it will save the company almost C$7M in preferred dividends on an annual basis. This will add approximately C$0.025 per share to the net income attributable to the common shareholders.

Birchcliff has pledged to boost its dividend by 900% next year

Birchcliff has an obsession with repaying its debt as fast as it can. During the second quarter it spent another C$121M on repaying debt, bringing the YTD total to almost a quarter of a billion Canadian Dollars. As of the end of the first semester, Birchcliff’s net debt had dropped to just C$276M and in its updated guidance (see below), it anticipates ending the year with a net cash position (although Birchcliff’s definition also includes working capital elements).

Birchcliff Energy Investor Relations

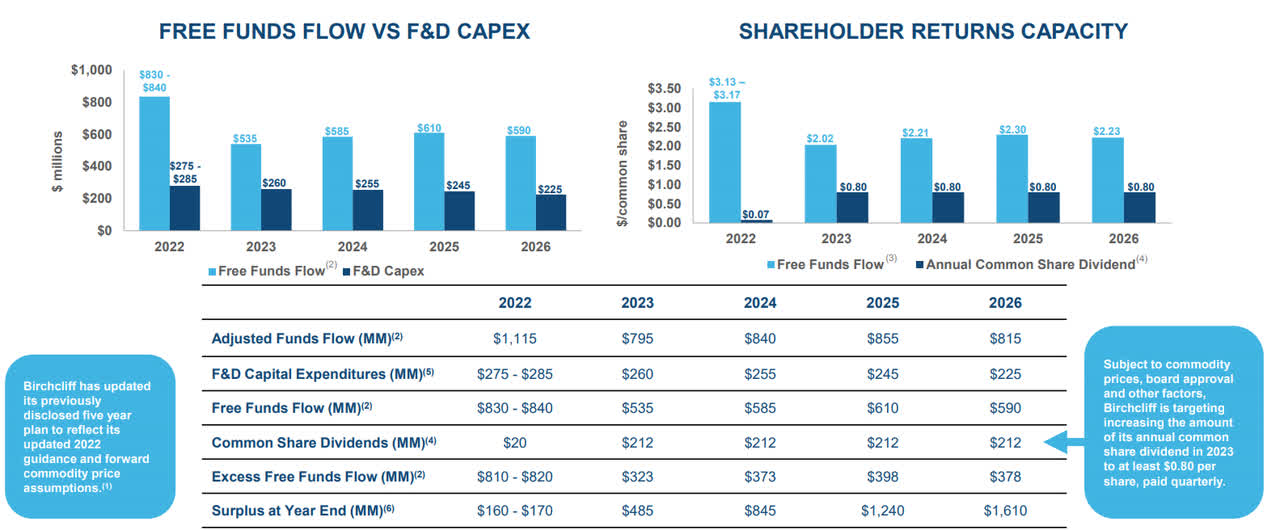

While most oil and gas companies have already substantially hiked their dividends, Birchcliff’s yield is now less than 1% per year, exactly because its main focus is on reducing the net debt as fast as possible and buying back shares (common and preferred equity). However, from next year on, the company is planning to increase the annual dividend from C$20M to C$212M. That’s more than a ten-fold increase.

Birchcliff Energy Investor Relations

Divided over the current share count of 265M shares, this implies the annual dividend will be hiked to C$0.80 per share which will catapult the dividend yield to just under 8% based on the current share price. And perhaps even more important, in its five-year guidance, the company uses the words ‘at least’ when it is looking forward to the dividend payments from 2023 on. Reading between the lines, there seems to be a good potential for higher dividends if the natural gas price remains strong.

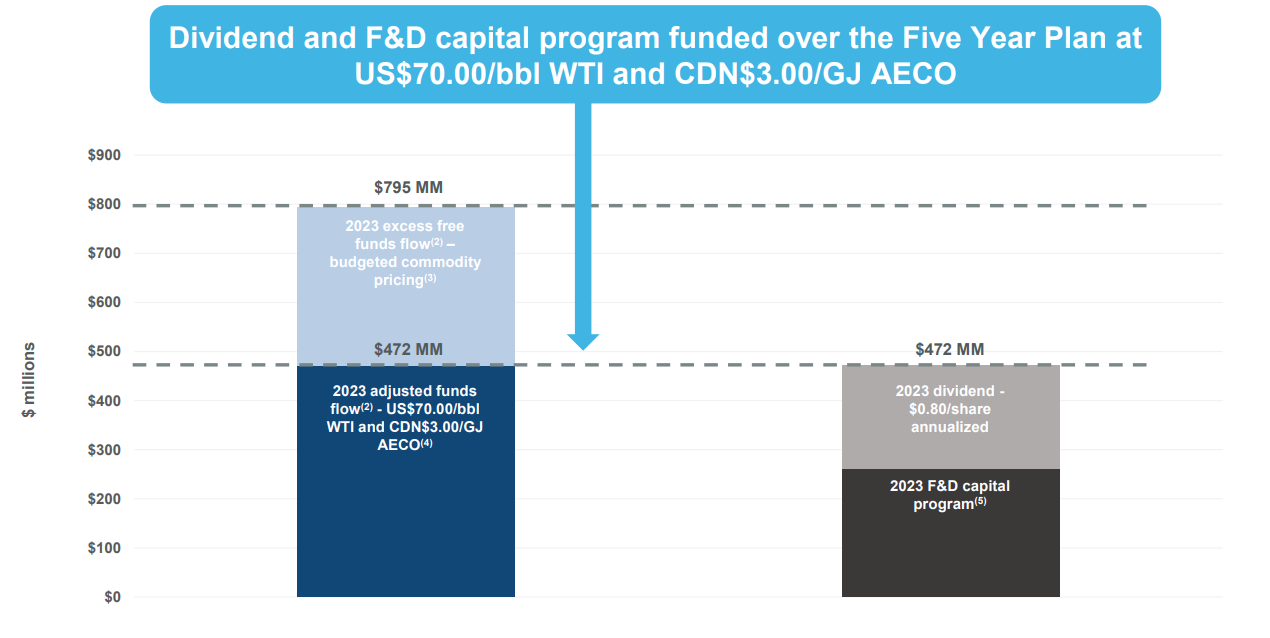

The focus is also on the sustainability of the dividend. And Birchcliff has disclosed that as long as the oil price remains at US$70 WTI and the natural gas price trades at C$3 (which is about 1/3 rd of the realized natural gas price in Q2), the dividend and capex program will be fully covered by the cash flows.

Birchcliff Energy Investor Relations

The C$795M in free cash flow is based on US$85.5 WTI, C$4.60 AECO and US$5.35-5.40 Dawn and Henry Hub natural gas prices which is also not unreasonable.

Investment thesis

My preferred shares will be called in a few weeks and perhaps I should start consider establishing a long position in the common shares as the yield will be equal although I liked the cumulative dividend on the preferred shares which offered payment protection during downturns.

I am considering writing put options with an expiry date in October which will allow me to use the incoming cash from the preferred share call to fund the purchase of the common shares should the written put options end up in the money. I will likely write put options on several strike prices to optimize pricing and size as for instance the P11 with a premium of approximately C$1.25 has a higher likelihood of ending up in the money than for instance the P10 (C$0.75 premium) or a P9 (C$0.40 premium).

Be the first to comment