gorodenkoff

Dementia and Alzheimer’s are diseases of old age with a high degree of prevalence in most developed countries. It is estimated that more than 10% of people over 65 in the United States have Alzheimer’s, about 6.5 million, a figure that is expected to double in the coming years. Dementia and Alzheimer’s are currently devastating neurogenerative diseases for which there are no approved treatments. One of the most common symptoms in the moderate and severe stages is attacks of agitation and aggressiveness, which represents a significant problem for family members and caregivers. In fact, it is estimated that up to 76% of Alzheimer’s sufferers have some type of aggressive behavior and agitation. Adding to this enormous problem is the fact that there are currently no approved treatments to treat agitation in this type of patient. Pharmacological therapies currently administered, off-label, are antipsychotic drugs, benzodiazepines, antidepressants, etc., all with significant risks for the elderly and doubtful effectiveness.

That is why many clinical trials currently seek to find effective drugs to treat this limiting condition of dementia and Alzheimer’s. The market for agitation in patients with Alzheimer’s and Dementia is huge, several billion dollars, hence the interest of pharmaceutical companies in finding an effective and safe treatment to prevent or control attacks of agitation and aggressiveness in this type of patient.

Given the special vulnerability of the typical profile of these elderly patients, it is not easy to find a drug that can reassure and that does not cause serious side effects.

Older people are especially sensitive and vulnerable to drugs, and they have many side effects that do not occur in young people and adults.

In fact, as I mentioned earlier, there are currently no approved medications to treat agitation in elderly patients with Dementia and/or Alzheimer’s.

Antipsychotics have a multitude of serious adverse effects on the elderly and all of them have a black box warning on the FDA label with special precautions for the elderly.

Among the side effects we can find:

Anticholinergic reactions, parkinsonian events, tardive dyskinesia, increased mortality rates, hypotension, cardiac conduction disorders, decreased bone mineral density, sedation, and cognitive slowing.

With benzodiazepines, significant adverse effects in the elderly include falls, cognitive impairment, sedation, and impairment of driving skills, all of which are particularly related to the long half-life of benzodiazepines.

Benzodiazepines can impair cognition, and mobility, in older people, as well as increase the risk of falls. A recent study also found an association between benzodiazepine use in older people and an increased risk of Alzheimer’s disease.

Long-term use of benzodiazepines should be discouraged because of the risk of dependence, which is a serious problem in the elderly. Unrecognized and untreated benzodiazepine dependence can lead to serious medical complications.

There is an urgent need for an effective drug to treat agitation in patients with dementia and Alzheimer’s that is also safe.

Not only for the patient’s well-being but also for their caregivers, relatives, etc., who have to face complicated situations due to the aggressive behavior typical of this type of neurological disease.

Several pharmaceutical companies are currently in different trials with candidate drugs that aim to fill this urgent need. It is a race to find the first drug, one that is effective and safe, and with a lucrative multi-billion dollar, market waiting.

In this article, I will compare some candidate drugs currently in different phases of clinical trials to treat agitation in patients with Dementia and Alzheimer’s. There are more drugs currently in clinical trials, but I consider the following to be the most advanced:

- Axsome’s AXS-05

- Brexpiprazole from Otsuka+Lundbeck

- IGC’s AD1

- BioXcel’s BXCL501

1) Axsome’s AXS-05

Pharmaceutical company Axsome Therapeutics (AXSM) focuses on drugs in the neuropsychiatry space, with its lead drug AXS-05.

AXS-05 is a fixed-dose combination of two approved drugs being developed for the treatment of agitation in people with Alzheimer’s disease. One component, dextromethorphan, is the active ingredient in several brands of cough syrup. Dextromethorphan is a weak antagonist of NMDA receptors, an agonist of sigma 1 receptors—molecular chaperones located in membranes of the endoplasmic reticulum—and inhibits serotonin and norepinephrine transporters, nicotinic acetylcholine receptors, and microglial activation. The other component is bupropion, a drug prescribed to treat depression and to help people stop smoking. Bupropion slows the metabolism of dextromethorphan and increases its plasma concentration.

AXS-05 has recently been approved by the FDA for the treatment of mayor Depressive Disorder (MDD) for patients who have not responded well to first-line antidepressant treatments. The market expects to see the first sales results of Avecity (trademark) in the large MDD market.

On the other hand, the company is testing this same drug for other indications (agitation in patients with Alzheimer’s and smoking cessation).

Regarding trials to treat agitation in patients with Alzheimer’s, the company presented at the end of 2020 the results of a phase III trial (Advanced-1) where the efficacy and tolerability of AXS-05 were evaluated in 366 patients with Alzheimer’s.

Advanced-I is a Phase 2/3, randomized, double-blind, controlled, 5-week study of AXS-05 in AD agitation. La administration consiste en dos dosis diarias de AXS-05 en forma de pastilla oral.

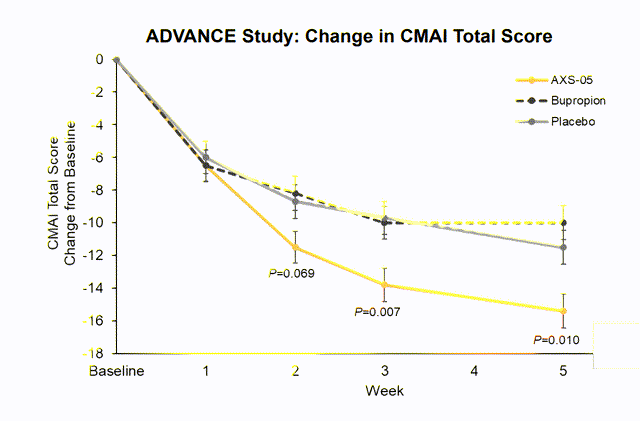

The primary endpoint was the change from baseline in the Cohen Mansfield Agitation Inventory (CMAI).

Axsome web

The primary endpoint, AXS-05 significantly relieved agitation, demonstrating a change from baseline in the CMAI total score of 15.4 compared to 11.5 for placebo (p = 0.010) and 10.0 for bupropion (p<0.001). These results represent a mean percentage reduction from the baseline of 48% for AXS-05 versus 38% for placebo.

The company has recently started another phase III trial (Advance-II) with the same design as the previous phase III trial (Advanced-I).

Strangely, the company wants to start another phase III trial, when they already have phase III results from the year 2020 (Advanced-I). I personally believe that the company intends to improve the efficacy results of Advanced I since the results obtained do not show much difference in the reduction of agitation between the AXS-05 arm (48%) and the placebo arm (38%), which implies a very weak efficiency.

As they commented in the past Q3 ER 2022, with Advanced-I “they intend to give greater robustness to the data previously obtained with Advanced-I”.

The company has been focusing more on the AXS-05 program for the MDD indication, which is where they expect to see the most revenue, and they are delaying the agitation program in Alzheimer’s patients.

Given how slowly Axsome is running trials, I don’t think they’ll report final trial data until 2024, so the hypothetical FDA approval would be no sooner than 2025.

As strong points of AXS-05 we can find:

-It is a drug that has already been approved by the FDA for another indication (MDD), so it already has a good position to be approved.

-Good safety demonstrated in trials. This issue is very important given the special vulnerability of the older adult patient.

Weak points:

-Very limited efficacy: Very little difference from placebo in reducing agitation

-High medical dose (two pills daily) for elderly patients who usually have a high consumption of medications. Possible negative interactions between drugs.

-Very slow in the trial process. I do not expect that until 2025 will be approved by the FDA.

2) Otsuka+Lundbeck´s Brexpiprazole

Otsuka Pharmaceuticals, a Japanese pharmaceutical company, is another in the race to find a drug to treat agitation in patients with dementia and Alzheimer’s.

It is currently testing the drug candidate Brexpiprazole together with the Danish pharmaceutical company Lundbeck.

Brexpiprazole was already approved by the FDA in 2015 as an atypical antipsychotic drug to treat schizophrenia and certain cases of depression and is marketed under the trade name Rexulti.

Both companies intend to market the drug by seeking approval for a second indication.

Last June, both companies announced the positive results of the phase III clinical trial of brexpiprazole in the treatment of agitation in patients with dementia of Alzheimer’s type (NCT03548584). The analysis concluded that there is a statistically significant difference (p=0.0026) in the mean change from baseline to week 12 in the Cohen-Mansfield Agitation Inventory (CMAI) total score between brexpiprazole and placebo.

Based on this result, Otsuka and Lundbeck are planning a regulatory filing with the FDA later in 2022.

The funny thing here is that no efficacy data are reported: “Full study results are not yet available.” Which is quite suspicious (Low efficiency?)

Additionally, on Rexulti’s label, the FDA warned in a boxed warning:

WARNING: INCREASED MORTALITY IN ELDERLY PATIENTS WITH DEMENTIA-RELATED PSYCHOSIS and SUICIDAL

THOUGHTS AND BEHAVIORS

See full prescribing information for a complete boxed warning.

• Elderly patients with dementia-related psychosis treated with antipsychotic drugs are at increased risk of death. REXULTI is not approved for the treatment of patients with dementia-related psychosis. (5.1)

- Antidepressants increased the risk of suicidal thoughts and behaviors in patients aged 24 years and younger. Monitor for clinical worsening and emergence of suicidal thoughts and behaviors. The safety and effectiveness of REXULTI have not been established in pediatric patients with MDD. (5.2, 8.4)”,

For all these reasons, the doubtful efficacy, and the serious safety warnings that Rexulti presents on the label regarding elderly patients, I have many doubts about the possible approval of the drug by the FDA.

The main strength is that it is the most advanced-stage drug that I have been able to find. If the application for approval is submitted at the end of this year 2022, it is likely that PDFA will be placed at the end of the next year 2023, so, if approved, it would be the first drug approved to treat agitation in patients with Dementia and Alzheimer’s.

In any case, even if it was finally approved, its weak efficacy and safety profile does not make it a great candidate to capture a large part of the market, despite the fact that it would be the first to go to market.

On the other hand, Avanir Pharmaceuticals (a subsidiary of Otsuka), is testing the candidate drug AVP-786, the deuterated form of dextromethorphan/quinidine (AVP-923), which is an approved treatment for the pseudobulbar effect3. Phase III trial data obtained in 2019 demonstrated mixed results:

“demonstrated a significant improvement on the primary endpoint on the Cohen-Mansfield Agitation Inventory for one of the two doses being evaluated; the other dose demonstrated numerical but not significant improvement on the SPCD analysis”

Since then, this candidate drug has been tested with no published results. The fact that the efficacy data has not been published, and that in one of the arms it was not even possible to obtain significant improvements, makes me doubt the real efficacy of AVP-923.

3) IGC´s AD1

India Globalization Capital (NYSE: IGC) is currently testing its candidate drug AD1 in phase II trials.

The purpose of this study is to evaluate the efficacy of an oral medication, IGC-AD1, which is a natural formulation based on THC (tetrahydrocannabinol), administered in microdoses, twice a day, on symptomatic agitation, in patients with dementia of mild to severe Alzheimer’s.

This drug candidate has the worst profile I see due to a multitude of weaknesses.

It’s still starting phase II trials, so it still has a long way to go in several years, in the unlikely event that it ever gets approved.

Its active ingredient is THC, which is a psychoactive of cannabinoids (a drug with known serious side effects). It’s similar to giving small doses of “marijuana” to the elderly to relax them.

I really don’t think it will pass the safety tests in the trials.

Also, the company. a very small capitalization ($22M), presented serious problems in its results last year 2021, which could lead to long-term viability problems.

4) BioXcel´s BXCL501

Finally, we come to BioXcel Therapeutics (NASDAQ: BTAI), which I have previous covered here at Seeking Alpha. BioXcel is a company that recently obtained approval for its lead drug BXCL501 to treat agitation in patients with schizophrenia and bipolar syndrome, and now is marketed under the IGALMI trademark.

BXCL501 is an investigational, proprietary, orally dissolving thin film formulation of dexmedetomidine, a selective alpha-2 adrenergic receptor agonist for the treatment of agitation associated with neuropsychiatric disorders.

It should be noted here that BXCL501, unlike the other drug candidates, is aimed at stopping acute agitation once they start to occur. That is, it is a drug that is only administered at the beginning of an attack of agitation.

BXCL501 is currently in two phases III trials (Tranquility II and Tranquility III) to treat agitation in patients with moderate and severe dementia and Alzheimer’s.

At the beginning of 2021 they presented results of phase II (Tranquility) with very promising results:

|

60 mcg (n=20) |

30 mcg (n=16) |

Placebo (n=14) |

||||

|

Reduction in PEC Total Score vs. Baseline |

-7.1 (P=0.0011) |

-5.4 (P=0.0813) |

-2.9 |

|||

|

Response Rate (% of Patients Achieving >40% Reduction in PEC Scores) |

70 |

% |

25 |

% |

7 % |

|

|

Reduction in PAS Total Score vs. Baseline |

-5.9 (P<0.0001) |

-3.9 (P=0.0961) |

-2.5 |

|||

|

Reduction in Mod-CMAI Total Score vs. Baseline* |

-14.0 (P<0.0001) |

-8.0 (P=0.0591) |

-3.2 |

|||

Source: BioXcel

As you can see here, we found a very good efficacy rate in terms of reduced agitation compared to the placebo at 120 minutes in the 30 mcg and 60 mcg groups. The efficacy of BXCL501 is tripled (30mcg) and quadrupled (60mcg) compared to the placebo group.

The study’s primary safety and tolerability endpoints were met, and no severe or serious adverse events were reported. Adverse events in the trial included hypotension (10%, 0%, and 0%, for 60 mcg, 30 mcg, and placebo, respectively), orthostatic hypotension (5%, 6.3%, and 0%, respectively), and dizziness (5 %, 6.3%, and 0%, respectively).

The company intends to report the results of the current phase III trials (Tranquility II and Tranquility III) next year 2023. I really hope that the results will be very good, due to the excellent data obtained in the previous phase II trial, and also that it has already been approved by the FDA to treat acute agitation in patients with schizophrenia and bipolar syndrome (IGALMI).

The efficacy of BXCL501 in calming patients with attacks of agitation has already been sufficiently demonstrated in several trials (Tranquility, Serenity). And security is also out of the question.

Another very positive element is that the company has divided the trials into two groups: Tranquility II (40mcg and 60mcg of BXCL501 for patients with moderate-grade Dementia and Alzheimer’s who can self-administer the drug), and Tranquility III (40mcg and 60mcg of BXCL501 for patients in severe phases of the disease who need help with their daily tasks). This may allow the FDA to introduce less restrictive labeling for the Tranquility II group (less serious patients who can self-medicate), and even allow it to be administered at home without the need for medical supervision.

It is intended that the results be reported throughout 2023, so the possible approval would be for 2024.

As we have already discussed, BXCL501 is only administered when the agitation attack occurs. This makes it possible to reduce the number of drugs consumed by the elderly patient, unlike the other candidate drugs, which are treatments with two daily doses. Therefore, only in very severe cases of agitation, with almost daily attacks, the use of daily drugs would be more convenient.

Because BXCL501 is used to stop attacks of agitation, how quickly the calming effect occurs is very important. In this sense, the efficacy of BXCL501 has been demonstrated just 20 minutes after oral administration. And the effects last a minimum of 24 hours.

Therefore, it can be clearly seen that BXCL501 seems to have an advantage, in terms of presenting the best efficacy and safety profile, compared to the rest of the candidate drugs in this race for the treatment of agitation in patients with Dementia and Alzheimer’s. In addition, because it is only administered when the agitation attack occurs, it considerably reduces the number of drugs that elderly patients must take, patients who usually take a multitude of drugs.

We will have to be very attentive to the next results of phase III (Tranquility II and Tranquility III) scheduled for the next year 2023 because if the promising results obtained so far are confirmed, I believe that BXCL501 is configured as the main drug candidate with potentially monopolizing most of the big market of agitation in Alzheimer’s and dementia patients.

The Market of the Agitation in patients with Dementia and Alzheimer’s in EE.UU.

As we have already mentioned, Dementia and Alzheimer’s have a high prevalence in most developed countries, and the number of patients is expected to double in the coming years.

As reported by BioXcel, an estimated 100 million attacks of agitation annually in the US are associated with Alzheimer’s disease. And this figure is expected to double in a few years.

Applying a drug cost per attack of around $100 (IGALMI costs $105 per film), we obtain an annual global potential market of $10B.

On the other hand, it is estimated that there are currently about 6.5 million Alzheimer’s patients in the United States. Of these, it is estimated that approximately 76% suffer from attacks of agitation. So assuming a monthly treatment cost of around $100, we get $5 billion.

Therefore, we can estimate the annual global market potential for agitation in Alzheimer’s patients in the US between $5 billion and $10 billion.

The huge revenue potential is at stake in this race for an effective and safe drug.

BioXcel Therapeutics: An Undervalued Biopharmaceutical With An Excellent Risk-Reward Profile

As I have already been commenting in some of my latest articles, BioXcel currently presents an excellent investment opportunity.

With a drug (IGALMI) recently approved to treat acute agitation in patients with schizophrenia and bipolar syndrome, and several phase III trials (Serenity III, Tranquility II, and Tranquility III) with results expected for the first half of the next year 2023, the potential for revaluation is enormous.

Last week the results of Q3 2022 were published. There was a big surprise in them: IGALMI’s first revenue originated in that Q3 ($137,000). Personally, (and Wall Street), did not expect any revenue until Q1 2023. This suggests that IGALMI is being very well received in the Hospital field and that a faster growth in income is foreseeable than what I had initially expected.

Best of all, IGALMI has the lowest revenue potential of the indications for which BXCL501 (Serenity III, Tranquility II, and Tranquility III) is currently being trialed.

Regarding the state of cash, its situation is very comfortable, as presented in the previous Q3ER:

Cash burn for the quarter was approximately $31.5 million, which is consistent with the first two quarters of 2022. As of September 30, 2022, cash and cash equivalents totaled approximately $232.3 million

With $232M and the current cash burn ratio, the company has enough cash to finance operations until at least 2024.

With a market capitalization of just $430 million approximately and the huge earning potential presented by its current pipeline, BioXcel has an excellent risk/reward profile.

Risks

As in any pharmaceutical company, BioXcel presents some risks that every investor should take into account:

-In current clinical trials, although with very good prospects, there is always some risk that the results will not be as expected.

-Igalmi’s sales, although they have started much earlier and better than expected, may slow down in coming quarters.

Conclusion

The huge revenue potential is at stake in this race for the best anti-agitation drug for dementia and Alzheimer’s patients. Currently, several pharmaceutical companies are testing candidates’ drugs and some of them are in the final stages of trials. It seems likely that Otsuka+Lundbeck’s brexpiprazole will be the first drug approved by the FDA (probably by 2023). However, due to the serious safety warnings that Rexulti (trade name for brexpiprazole approved in 2015 for schizophrenia and MDD) has on its FDA label if approved, is likely to impose serious restrictions on its use that will severely limit the revenue potential.

Axsome Pharmaceuticals is another competitor that with its candidate drug AXS-05 intends to capture part of the market. However, its efficacy seems to be very low, in fact, they are carrying out a second phase III trial to give “greater robustness to the results”. In case of approval, it would not arrive before 2025. Finally, the one with the best efficacy and safety profile, and therefore, the one that in my opinion has the best approval options and would monopolize most of the market is BioXcel’s BXCL501. It has demonstrated very high efficacy in reducing agitation in this type of patient, has acceptable safety, and does not require daily medication (only after the attack of agitation), making it my favorite drug.

We will have to be very attentive to the results of phase III that are expected for the next year 2023 in the two sections of phase III trials (Tranquility II and Tranquility III).

In this sense, and given the enormous revenue potential that BXCL501 (IGALMI+Dementia&Alzheimer, MDD) has, the low market capitalization of BioXcel (approximately $430 million), I believe that the company currently offers an excellent investment opportunity for the coming months and years.

Be the first to comment