JHVEPhoto

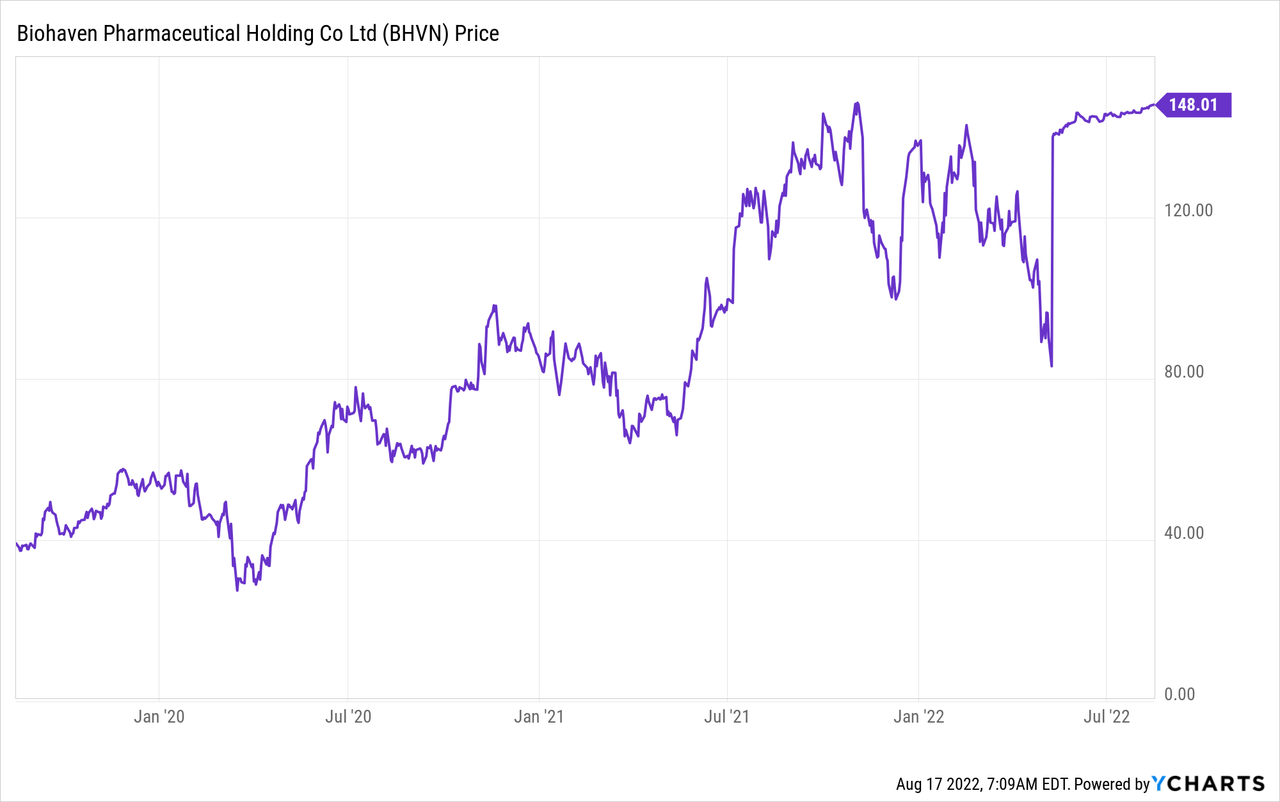

Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN) is being acquired by Pfizer Inc. (PFE). Pfizer is offering consideration of $148.50 in cash and 0.5 shares of “new-Biohaven” per share of Biohaven through a spin-out before the transaction’s consummation.

New-Biohaven keeps the name Biohaven, Vlad Coric as CEO, and other members of the Biohaven management team. New-Biohaven will be capitalized with $275M in cash. New-Biohaven will own royalties on any annual net sales of rimegepant and zavegepant in the U.S. in excess of $5.25B but subject to a cap. Finally, the spin-off will own a bunch of pipeline assets. The companies expect the transaction to close by early 2023 if things don’t get derailed too much by the spin-off process and/or regulators.

Currently, there is “only” around 0.33% upside to the cash closing price of this transaction.

But things look quite a bit better than that if we include the value of the spin-out. During the negotiations, investment bankers have come up with a valuation of $8.20. I’d argue $3.50 out of the $8.20 is very solid and there is a bit more uncertainty around further upside as it is based on the value of the royalties.

The Board of Directors recognized that the assets and royalty payment right to be transferred to SpinCo in the Spin-Off are valuable and that the Spin-Off provides the most attractive option for these assets, including with respect to the potential commercialization and future profitability of SpinCo’s product candidates. Each 0.5 share of SpinCo to be distributed to each holder of Company Shares was assumed to have a value of $8.20, reflecting $3.50 per share in cash based on a capitalization of $275 million plus $4.70 per share in risk-adjusted net present value of the royalty payment right based upon the revenue forecast set forth in the forecasts.

If we only include $3.50 worth of value, the upside here is around 2%. If we include the full $8.20, the upside here is more like 5.2%.

This merger is quite unlikely to break. Pfizer has a reputation to uphold. There aren’t regulatory or antitrust concerns that I’m aware of. Pfizer already owned 3% of Biohaven its shares before the acquisition. There was quite a bit of competition to acquire Biohaven. Initially, there were up to four interested parties, according to the preliminary proxy. Biohaven has been collaborating with Pfizer on rimegepant or NURTEC ODT. I’m inclined to believe that Biotech deals where the target and acquirer are actively collaborating are unlikely to fail.

If the deal fails, though, there’s going to be a lot of pain. On initial review and I penciled-in a break price around $80.

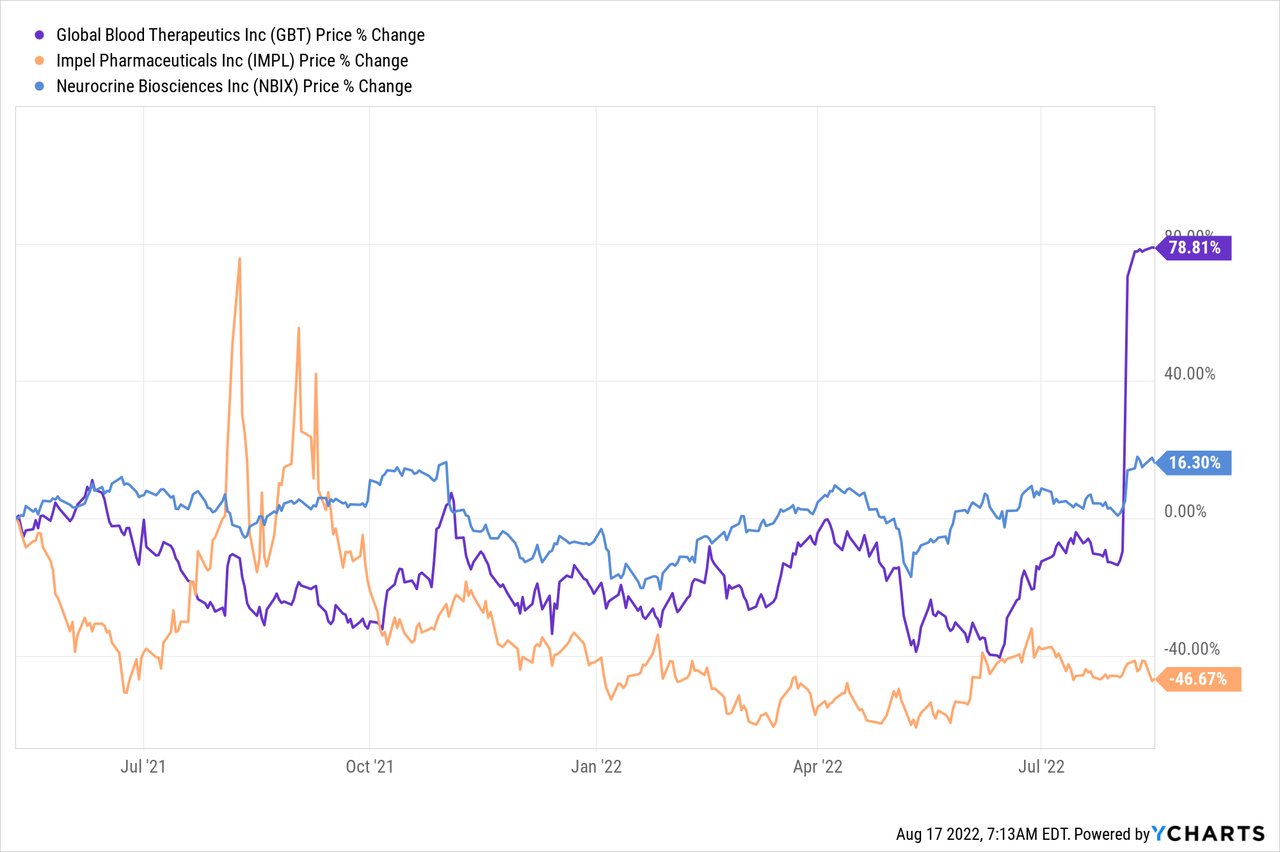

But I’m not sure the shares would drop to $80 given current information on its drug assets and interest by other companies. Bristol Myers (BMY) has a licensing agreement with the company. I also pulled up a few companies that investment banks figured to be connected or somehow similar. Global Blood Therapeutics got acquired by Pfizer in August.

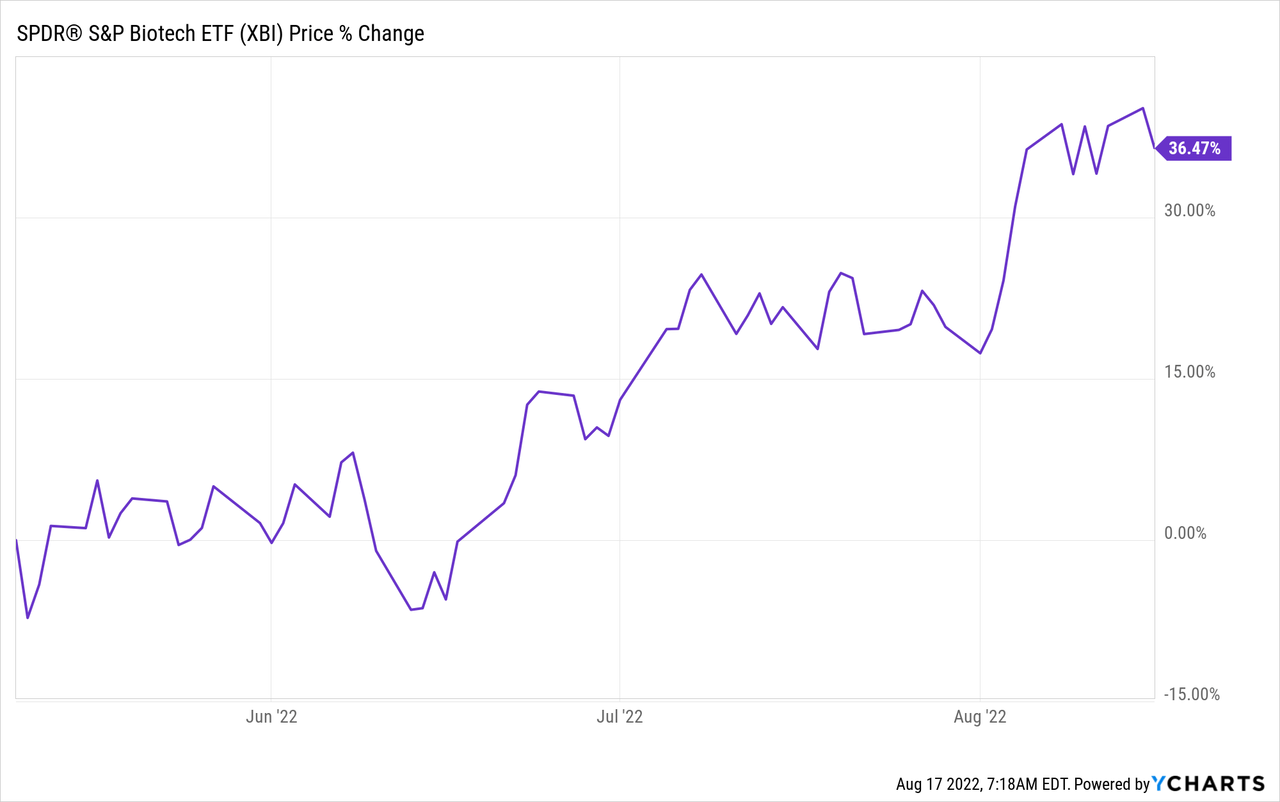

On a higher level, the S&P Biotech ETF (XBI) has traded up some 36% since the deal date.

Perhaps it is more realistic to view the downside as near $100, although I can’t be sure. Still, we’re looking at a downside of 32%, and if I’m wrong, 50% or over.

Although, it would have been better to pick this company up earlier. There was a good timely write-up here, I still think it is fairly interesting. I don’t think it is the best deal out there, but it is good enough for me to warrant some exposure. Although 0.33% is not that enticing, the spin-off value is quite interesting and likely discounted by some participants in the market. I also think the closing date (early 2023) is likely too conservative. I expect it to close before yearend. If that’s correct, the annualized spin-off adjusted return is somewhere in the 8% to 20% range. That’s very good, as I believe the risk of deal failure is very low in this particular case.

Be the first to comment