Frederick Doerschem/iStock via Getty Images

My Thesis

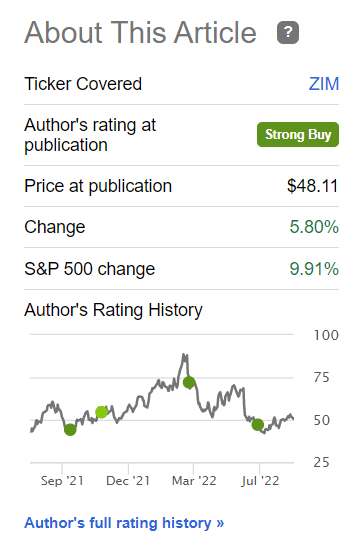

Last time, in my article on ZIM Integrated Shipping (NYSE:ZIM), I described the thesis that quotations have most likely bottomed out and should most likely push off to grow again because there were (and are) fundamental reasons for that. Now we see how that thesis has proven true, even if the stock was not more robust than the S&P 500:

Seeking Alpha, my previous article on ZIM

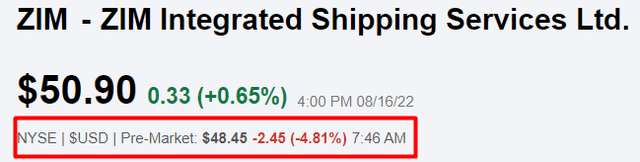

Today, however, we see that ZIM Integrated Shipping’s report turned out to be much worse than analysts had predicted – the trading algorithms apparently punished the stock heavily for this:

Seeking Alpha, ZIM’s main page, author’s notes

Nevertheless, I am getting bullish again and recommending buying this dip as soon as the markets open and the stock price drops even lower. I have a rationale for this.

Why I’m Bullish On ZIM

It just so happens that compared to its peers, ZIM reports quite late. Hapag-Lloyd reported Q2 2022 results less than a week ago (Aug. 11); Maersk released its numbers even earlier – on Aug. 3; Matson’s (MATX) results were announced on Aug. 1.

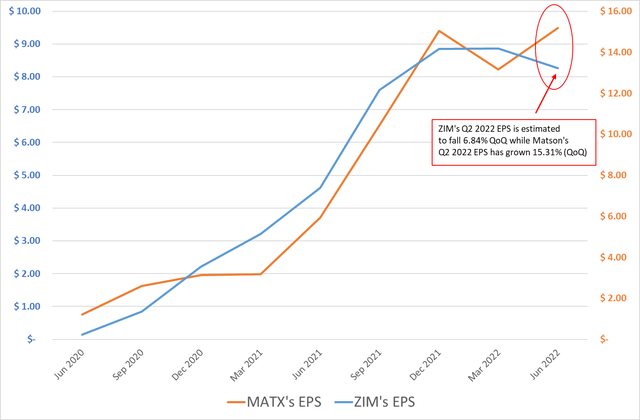

Analysts were estimating ZIM’s EPS at $13.22, down 6.84% from Q1 2022. However, using results from Matson, a direct competitor of the company, we see a discrepancy between those forecasts and the pattern that has existed for many quarters:

Seeking Alpha data (author’s charting)

I uploaded the growth metrics of the company’s top 3 competitors and found that ZIM’s Q2 2022 EPS consensus was expected to grow about 2 times weaker than its peers, according to analysts. At the same time, expected revenue growth was roughly in line with the median actual growth rates in the industry:

| Q2 YoY growth rates | Revenue | EBIT | EPS |

| Hapag-Lloyd | 91.91% | 197.09% | 194.91% |

| Moller-Maersk | 52.14% | 120.08% | 140.41% |

| Matson | 44.14% | 130.53% | 155.80% |

| Median | 52.14% | 130.53% | 155.80% |

| Average | 62.73% | 149.23% | 163.71% |

| ZIM (estimated before the Q2 release) | 55.23% | NA | 78.92% |

Source: Author’s calculations based on the company’s financial statements

That’s why I was surprised by the company’s results today – I thought that ZIM would at least not be much worse off compared to other representatives of the industry and beat analysts’ forecasts. But, unfortunately for investors, that did not happen.

Despite this negative news, I believe that investors should pay attention to the company’s guidance, which seems quite conservative compared to other peers. The most important example is that ZIM reiterated its earlier full-year 2022 guidance for adjusted EBITDA of $7.8 billion to $8.2 billion and adjusted EBIT of $6.3 billion to $6.7 billion. At the same time, its larger and less operationally flexible peers have increased their respective forecast values by about 1/3:

| New guidance vs. the previous one | Moller-Maersk | Hapag-Lloyd | ZIM |

| EBITDA | 23.33% | 33.26% | unchanged |

| EBIT | 29.17% | 37.04% | unchanged |

Source: Author’s calculations

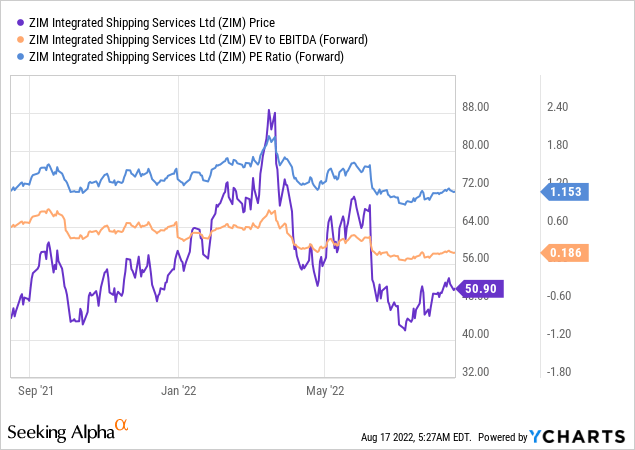

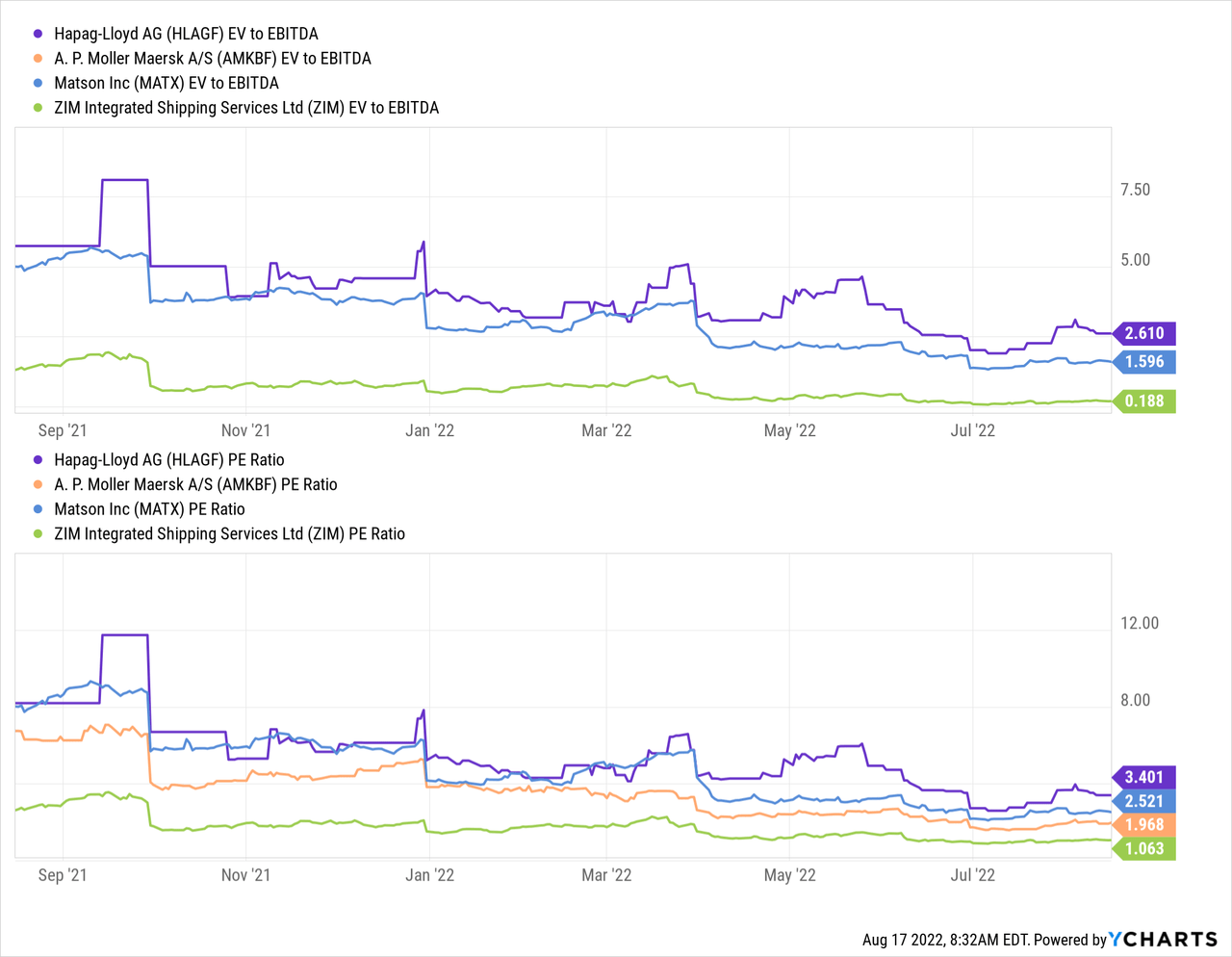

In my opinion, the decline in the Drewry Composite World Container Index, which has been ongoing since mid-September 2021, will indeed make ZIM less money than last year. However, this seems to be fully priced in when we look at the company’s forward multiples:

For the full year of 2022, the company is going to generate more EBITDA than its entire enterprise value (forward EBITDA’s mid-range of $8 billion vs. $5.59 billion EV). Operating profit (in the middle of the forecast range) is alone ~6% above the company’s current market value, as reported by Seeking Alpha.

All this is due to the unhealthy valuation of ZIM, which is cheaper than the rest of the industry in almost all key metrics.

After today’s upcoming drop in quotes, the multiples you see above will be even lower – this will make the already cheap ZIM even cheaper.

Such low valuation multiples could theoretically indicate a value trap in a cyclical industry. But if that were the case, management would not raise the dividend payout from 20% to 30%:

Commencing with the dividend for the second quarter of 2022, ZIM intends to distribute a dividend to its shareholders on a quarterly basis at a rate of ~30% of the net quarterly income (up from 20% of net income) of each of the first three fiscal quarters of the year. It further expects that the cumulative annual dividend amount to be distributed by the company (including the interim dividends paid on account of the first three fiscal quarters of the year) will total 30-50% of its annual net income.

Source: SA News

Net cash generated from operating activities was $1.71 billion for the second quarter of 2022 (+44.92% YoY) – this is not how a value trap company operates, in my humble opinion.

A quarterly dividend of $4.75/share will be paid on September 8 (for shareholders of record on August 29; ex-div August 26). So I see the strong overreaction to the report as a good opportunity to buy a quality stock with a double-digit yield.

I am also hesitant to believe in a major weakening of demand in the shipping service – in any case, in addition to the modest forward-looking statements of ZIM’s management, we also have guidance from other industry representatives. These are much more optimistic about the future – an indirect confirmation of my view that demand remains strong and that the piece of the market ZIM owns will continue to generate large amounts of cash for the company.

Bottom Line

Of course, my thesis has its risks. The most important of these is the final reversal of the shipping bull cycle, which will be the result of a recession, of which there has been increasing talk lately.

Moreover, my thesis is largely based on a cross-sectional analysis that is not directly related to the company – I am talking about how the good guidance of ZIM’s competitors may affect the company’s forward earnings, which may not be entirely accurate. However, I do this intentionally to prove that ZIM management’s forecasts are too modest.

However, if the overreaction today causes the stock to fall back to its local support level, I believe that the upcoming dividend payment will allow ZIM to recover this decline within a few days. With luck, we might even see a breakout of the multi-day downtrend line:

TrendSpider Software, ZIM, author’s notes

Author’s note: Special thanks to fellow SA contributor Danil Sereda (see our association in my bio description) for running the TrendSpider software to obtain the above information.

The next logical target for ZIM is to test levels that are 15-25% above the current price – this is the medium-term upside I see. Please share your opinion in the comments if you have a different price target in mind.

Final note: Hey, on September 27, we’ll be launching a marketplace service at Seeking Alpha called Beyond the Wall Investing, where we will be tracking and analyzing the latest bank reports to identify hidden opportunities early! All early subscribers will receive a special lifetime legacy price offer. So follow and stay tuned!

Be the first to comment