ktsimage

Civilization is a hopeless race to discover remedies for the evils it produces.”― Rousseau

Today, we take an in-depth look at a biotech concern that comes up from time to time on comments from Seeking Alpha followers and has been in the news recently. A full analysis follows below.

Company Overview

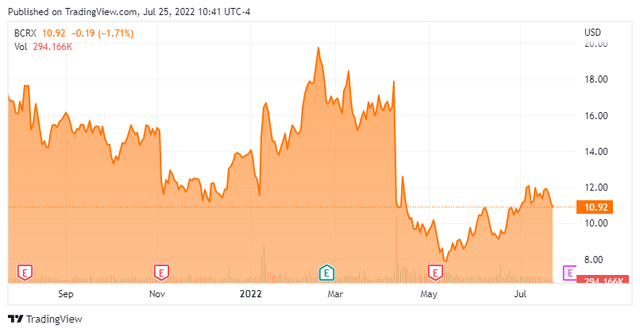

BioCryst Pharmaceuticals, Inc. (NASDAQ:BCRX) is a Durham, North Carolina based biopharma concern focused on the development of therapies for rare diseases where enzymes factor prominently in their pathology. The company has two approved therapies and three product candidates, although its prospects revolve around two assets: approved Orladeyo for the treatment of hereditary angioedema [HAE] and clinical program BCX9930, which is targeting several complement-mediated diseases. BioCryst was formed in 1986 and went public in 1994, raising net proceeds of $15.2 million at $6 a share. The stock trades for around $11.00 a share, equating to a market cap approaching $2.1 billion.

Products

Orladeyo. The preponderance of the company’s sales are generated from Orladeyo (berotralstat), an oral, once-daily plasma kallikrein inhibitor for the prevention of HAE attacks in patients 12 years and older. HAE is a severely debilitating rare genetic condition characterized by swelling in multiple locations such as the hand, feet, intestines, face, and airway from excess fluid trapped inside the body’s tissues. The potentially fatal condition’s prevalence is approximately 1 in 50,000. Plasma kallikrein is responsible for the production of bradykinin, which mediates acute swelling attacks in HAE patients. Although there are eight other approved HAE therapies, all of them require either subcutaneous self-administration or intravenous injection, providing oral Orladeyo with a significant advantage. However, it should be noted that KalVista (KALV) has two oral kallikrein inhibitors in Phase 2 and Phase 3 trials for HAE.

June Company Presentation

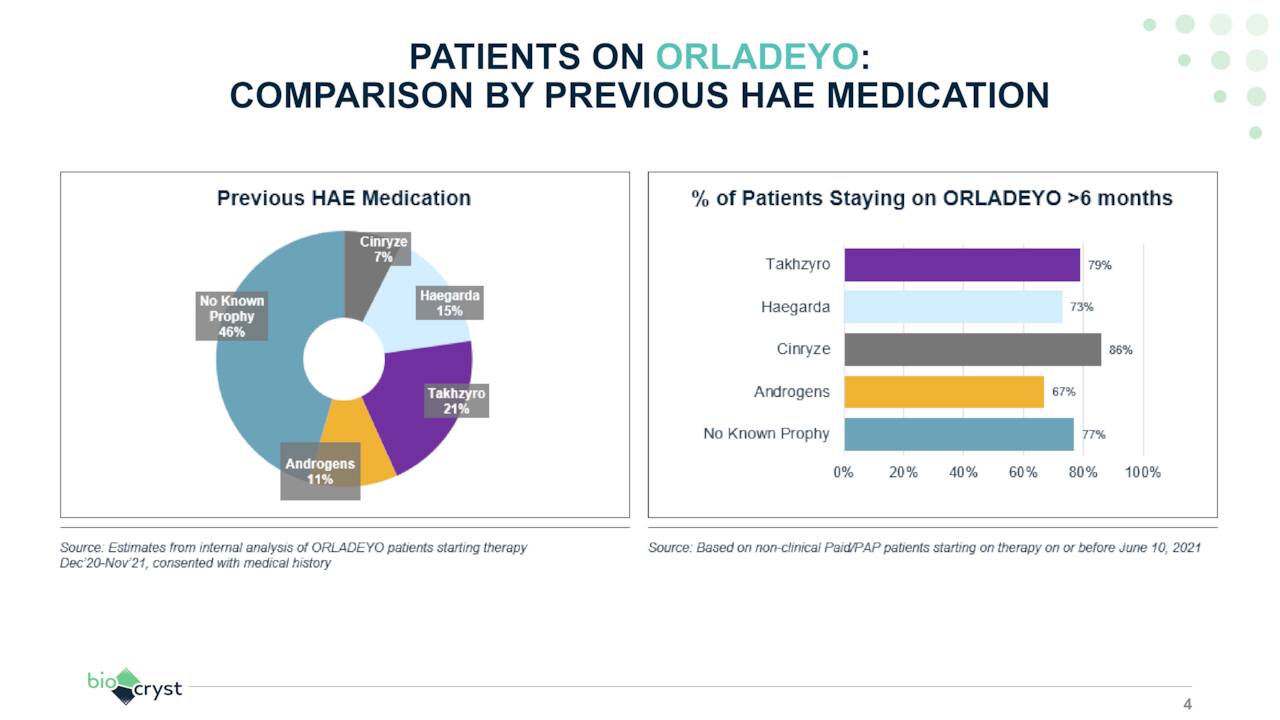

Approved in the U.S. in December 2020, Orladeyo accounted for FY21 revenue of $121.9 million – 89% of the company’s FY21 product sales – and is expected to generate no less than $250 million in FY22, with peak global sales expected to reach $1 billion. It is also approved for sale in the EU, UK, Japan, and the UAE.

Peramivir. The balance of its product revenue is produced by its peramivir injection, which received FDA approval in 2014 for the treatment of acute uncomplicated influenza in patients who have been symptomatic for no more than two days. Sold to the U.S. Department of Health and Human Services under the brand name RAPIVAB and internationally under several brand names, worldwide FY21 peramivir sales tallied $14.5 million, or 11% of total.

Pipeline

BCX9930. Although the Orladeyo launch is off to a solid start, most of the excitement concerning BioCryst has involved its twice-daily, oral Factor D inhibitor BCX9930, which is undergoing clinical assessment for complement-mediated diseases. For those unaware, the complement system is part of the body’s immune system and is responsible for aiding in the elimination of microbes and damaged cells through three pathways. Comprised of proteins produced by the liver, overactivation of the complement system can cause severe immune and inflammatory disorders. Factor D is an essential enzyme in arguably the most important of the three pathways of the complement system – the alternative pathway – and as such has been chosen as an initial target.

June Company Presentation

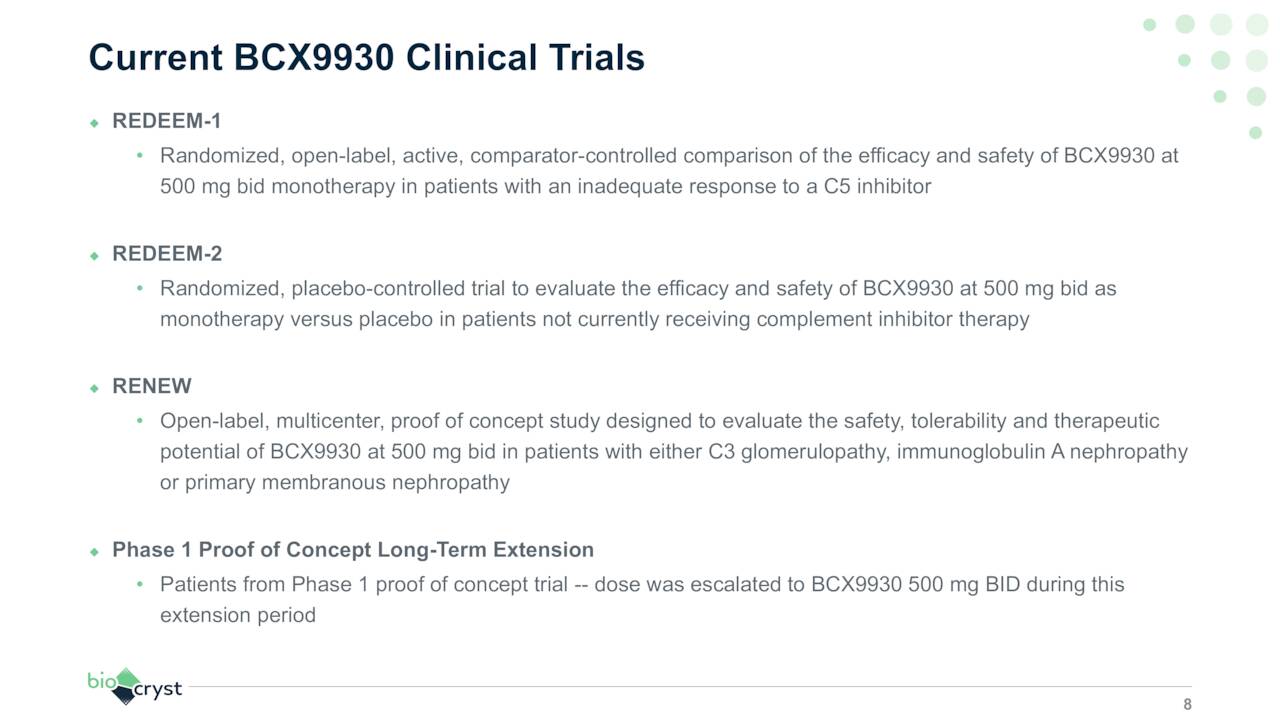

BCX9930, which has been advertised by BioCryst’s management as a pipeline unto itself, was being investigated as a monotherapy in a pivotal randomized, placebo-controlled study (REDEEM-2) for patients with paroxysmal nocturnal hemoglobinuria (PNH), a disease characterized by the destruction of red blood cells by the complement system, not currently on complement inhibitor therapy. Primary endpoint is change from baseline in hemoglobin at week 12. REDEEM-2 enrolled its first patient in November 2021. This was followed in January 2022 with first patient enrollment in another pivotal trial (REDEEM-1) that is assessing BCX9930 in PNH patients who had an inadequate response to a C5 inhibitor. The primary endpoint is also change from baseline in hemoglobin, assessed at week 12 through week 24.

BioCryst also entered BCX9930 into a proof-of concept trial [RENEW], evaluating it in the treatment of three renal complement-mediated diseases (C3 glomerulopathy, immunoglobulin A nephropathy (IgAN), and primary membranous nephropathy), with the first patient enrolling in February 2022. The primary endpoint of RENEW for each of the three parallel cohorts is percent change from baseline in 24-hour urine protein-to-creatinine ratio at week 24.

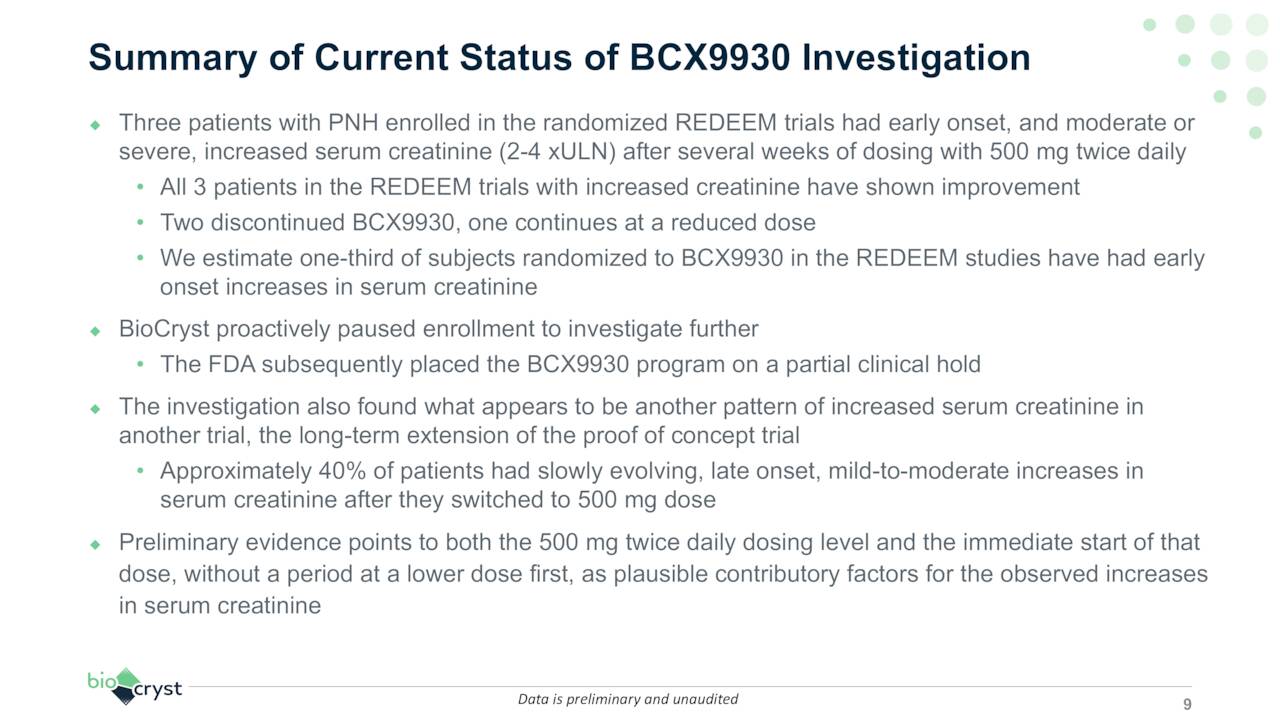

All three studies were slated to be readout in 2H23. However, on April 8, 2022, BioCryst announced a voluntary halt to enrollment in all three trials due to elevated serum creatinine levels in three patients in the REDEEM trials. Elevated serum creatinine levels are indicative of kidney dysfunction and/or injury. Subsequent to the voluntary enrollment stoppage, the FDA stepped in and placed the BCX9930 program on partial clinical hold. Management believes the culprits are the 500 mg twice daily dosing and the immediate start of patients on that dosage without titration.

June Company Presentation

It appears as if a 400 mg dosage will be proposed to regulators as remediation but it is anyone’s guess as to whether BioCryst can fully resume these trials, putting it further behind AstraZeneca’s (AZN) two oral Factor D inhibitors, which are in Phase 3 (PNH) and Phase 2 trials (lupus nephritis and IgAN). All three patients in question have demonstrated improvement, but two have discontinued the study. Although no newcomers are being enrolled, those already enrolled will continue to receive therapy. A decision from regulators regarding trial resumption is expected by the end of 3Q22. First news of the halt pummeled shares of BCRX, losing 38% of their value at $11.12.

BCX9250. Beyond BCX9930, BioCryst owns BCX9250, an activin receptor-like kinase-2 (ALK-2) inhibitor that is undergoing evaluation for the treatment of fibrodysplasia ossificans progressiva (FOP), a dreadful ultra-rare disease characterized by irregular bone formation outside the normal skeleton – in muscles, tendons, and soft tissue – resulting in deformation and early mortality. FOP afflicts one in two million worldwide and has no FDA-approved therapies. However, French pharma Ipsen filed (and subsequently withdrew) an NDA for its retinoic acid receptor gamma agonist palovarotene and has an ALK-2 inhibitor in Phase 2 development. To date, BCX9250 has completed a Phase 1 trial in healthy subjects with next steps to be determined.

Balance Sheet & Analyst Commentary

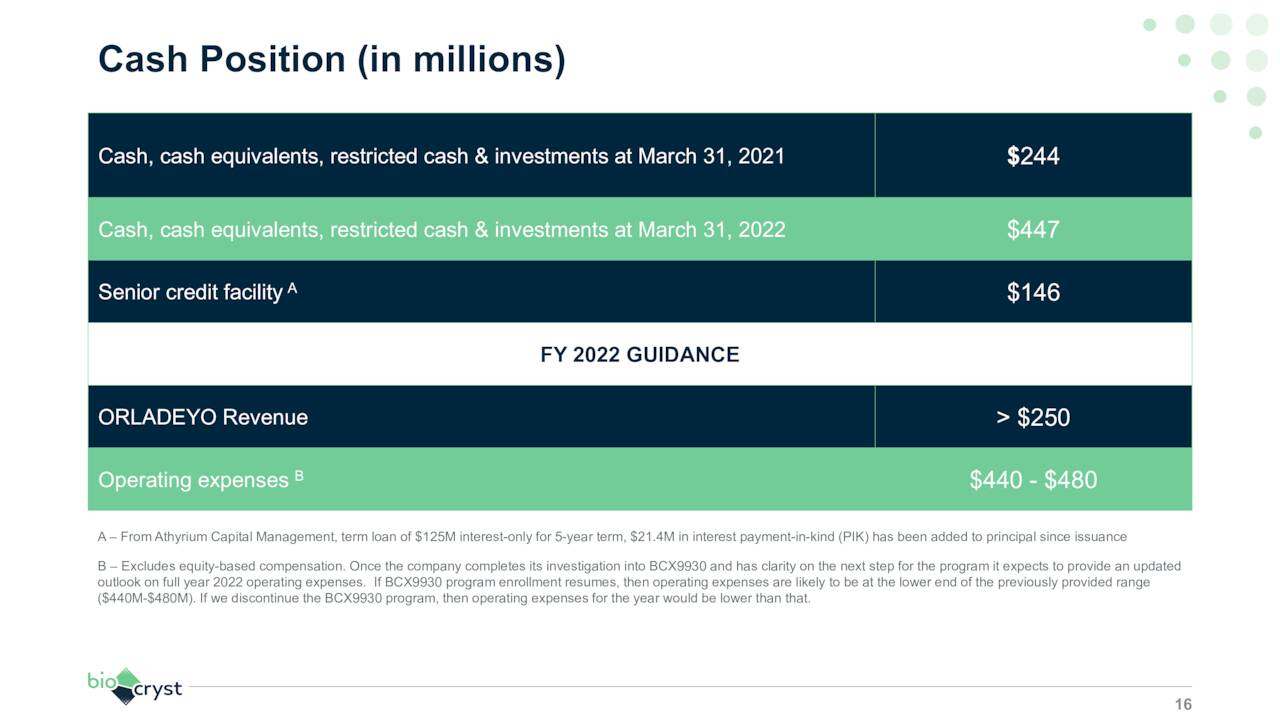

Although the company held cash and investments of $443.5 million as of March 31, 2022, management projected operating expenses of $460 million in FY22, placing even greater pressure on Orladeyo to perform to expectations. It will be a race to see if BioCryst doesn’t have to tap the equity markets for more financing. To shore up its balance sheet, the company raised $350 million in November 2021 by selling additional royalty streams on Orladeyo and on its now uncertain Factor D franchise to Royalty Pharma and Canadian pension plan OMERS, as well as 3.85 million shares of BCRX to Royalty Pharma. The bottom line: royalty payments will ramp to 17% on the first $350 million generated on Orladeyo sales in the U.S. as well as certain EU markets and 10.5% on the next $200 million in sales by 4Q23. The company has debt of $146.4 million and $75 million available on an existing credit facility.

June Company Presentation

After the trial stoppages, only two Street analysts (Barclays (BCS) and Bank of America (BAC)) downgraded BioCryst stock, although lower price targets were nearly universal. Two buys and four outperform ratings slightly outweigh the four hold recommendations. They see FY23 sales (almost all Orladeyo) at $370 million, which indicates some skepticism on management’s claim that Orladeyo will attain blockbuster status. Several insiders have sold nearly $6 million worth of stock in aggregate so far here in 2022 with no insider purchases.

Verdict

If BioCryst could strip away all the noise and be simply become a one-drug concern – peddling only Orladeyo – it can be reasoned that franchise is worth more than the $2.05 billion market cap currently bestowed on the entire company. If peak sales reach $800 million and the market assigns a three times peak sales multiple to account for royalty payments and the fact that it has no pipeline or R&D effort, BioCryst would be worth $2.4 billion.

However, with the company continuing to bleed cash while an FDA decision/directive regarding BCX9930 is still three months away, one of two outcomes will occur. The regulators could permit the trials to resume under a modified (twice-daily 400 mg) protocol, which will set the company up for additional dilution – either through an equity sale or additional royalty considerations on future Orladeyo sales; thus, diluting the top line – sometime in 1H23. If there is no regulatory pathway forward with BCX9930, BioCryst will have flushed ~$300 million down the drain and be back to the drawing board with an FOP therapy that hasn’t been tested on an actual patient and will (in all likelihood) not have first-mover advantage, if approved. Thus, the short interest of nearly 19% in its stock.

As such, with neither outcome that appealing shares of BCRX are likely to be rangebound – even with the high short interest – around the $10 to $12 area until some clarity is provided in September. Therefore, I have no current investment recommendation around this name now, but will likely circle back on it when more clarity is provided.

There’s no such thing as civilization. The word just means the art of living in cities.”― Roger Zelazny

Be the first to comment