Nuthawut Somsuk/iStock via Getty Images

Introduction

It could be said that coal, both thermal and more importantly in this case, its steel-making metallurgical variant, have been the proverbial golden goose given the immense amount of cash now being generated from these once boring and overlooked assets. After eliminating their debt, it disappointingly seems that Alpha Metallurgical Resources, Inc. (NYSE:AMR) is wasting their golden goose on share buybacks as the threat of a recession looms on the horizon.

Detailed Analysis

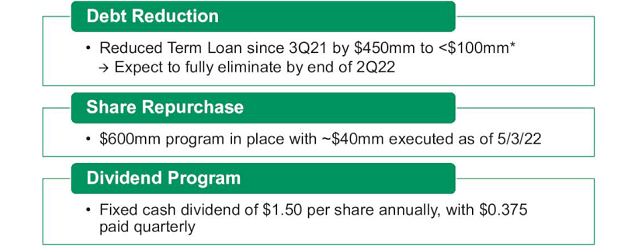

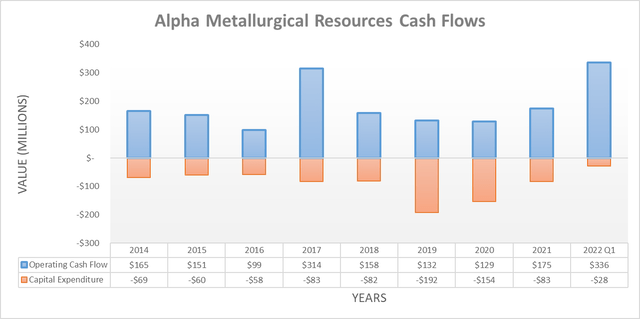

The cash windfall they have received is truly amazing, with the first quarter of 2022 (second quarter earnings are expected to be released on August 5) seeing operating cash flow of $336m. Apart from already eclipsing any annual result in their history, it was actually weighed down by a $124.2m working capital build, which if removed would have seen their underlying result approaching half-a-billion dollars. Even ignoring this aspect, their minimal capital expenditure of only $28m left $308m of free cash flow during the first quarter of 2022 alone, which annualized would equal circa $1.2b and thus an insane near 50% free cash flow yield on their current market capitalization of approximately $2.5b. This allowed them to repay a sizeable portion of debt, thereby leaving their net debt at only a minimal $91.9m and seeing management bring about a new era of shareholder returns, as the slide included below displays.

Alpha Metallurgical Resources First Quarter Of 2022 Results Presentation

It can be seen that aside from eliminating the remainder of their debt, which management planned to complete during the second quarter of 2022 and thus should be visible in their upcoming quarterly results, they have also launched a new shareholder returns policy. Whilst it includes a quarterly dividend of $0.375 per share, it ranks as a lower priority than their share buybacks and only offers a very low circa 1% yield against their current share price of $133.96. Following this announcement, an analyst asked whether additional dividends are forthcoming but disappointingly, there are no hints that such a move is likely, as per the commentary from management included below.

“Right now, our focus is purely on getting our debt repaid and executing on the $600 million share repurchase program.”

-Alpha Metallurgical Resources Q1 2022 Conference Call.

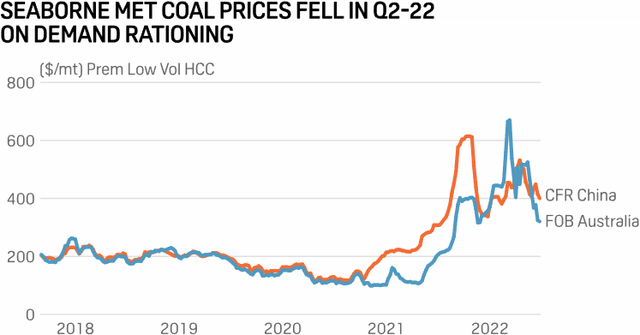

It seems quite unlikely to see significantly higher dividends anytime in the foreseeable future since their already announced $600m share buyback is already very large, relatively speaking and equals circa 24% of their current market capitalization. Although some investors may cheer, in my eyes, such a heavy focus on share buybacks is not ideal and tantamount to wasting their cash windfall from these booming coal prices. Whilst yes, their free cash flow yield is insanely high and thus it can easily be argued that their shares are cheap, there are still other aspects to consider. Firstly, this cash windfall is not something that can ever be realistically expected again given metallurgical coal prices have been so far above their historical norms, as the graph included below displays.

It can be seen that metallurgical coal prices peaked at north of $600 per mt during early 2022, which is a simply insane level few people would have ever thought possible and far above the usual $150 per mt to $200 per mt level seen throughout previous years. This means that the insane free cash flow they have enjoyed recently is not likely to ever be repeated, as this is not merely the equivalent of $100 per barrel oil prices, relatively speaking, which historically has occurred multiple times, this is more similar to seeing $200 per barrel or higher. Since it would not be realistic to expect their cash flow performance to continue anywhere near these levels well into the future nor necessarily be repeated occasionally, it makes the use of this windfall particularly important. Eliminating their net debt was a solid move, although their focus on share buybacks will almost certainly see them buying at the worst time, which leads to the second aspect to consider.

Their share price is obviously going to continue moving in tandem with metallurgical coal prices and thus by extension, as higher coal prices equal more free cash flow, it naturally would see more share buybacks and vice-a-versa. This disappointingly stands to always see their share buybacks weighted towards the upper end of the cycle, which means that they are going to be paying relatively higher prices. In my eyes, this is effectively wasting the cash windfall from higher coal prices since it goes against the old adage of “buy low, sell high.”

It should be remembered that their shares are almost certainly going to always seem cheap as they are a coal miner with volatile earnings. Realistically, they are never going to trade at the premiums often seen by high-growth technology companies or steady consumer staples companies and thus this is not a temporary bargain that management can exploit to create value for their shareholders. Once metallurgical coal prices inevitably slide lower, which is starting as we head into the third quarter of 2022, as per the S&P Global report whereby the graph included above was also sourced, they will be left with far less free cash flow, far less ability to conduct share buybacks and painfully for shareholders, a far lower share price.

Conclusion

Even though these once unfathomably high coal prices have boosted their corporate coffers like never before and eliminated their debt, it nevertheless remains disappointing that the remainder is being directed towards share buybacks. Due to their cyclical financial performance and share price, I remain very skeptical that these will create dollar-for-dollar value as they will likely overpay for their shares and thus in my eyes, effectively see them wasting their cash windfall. Due to the threat of a recession looming on the horizon that would likely prove toxic for metallurgical coal given that steel demand is heavily influenced by economic activity, I believe that a sell rating is appropriate. If they had elected for a shareholder returns policy that focuses on dividends, I would have instead assigned a hold rating.

Notes: Unless specified otherwise, all figures in this article were taken from Alpha Metallurgical Resources’ SEC filings, all calculated figures were performed by the author.

Be the first to comment