JHVEPhoto

This story was originally published for subscribers of Reading The Markets an SA Marketplace service, on July 22. It has been updated as of the afternoon of July 25.

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) shares have fallen sharply following disappointing results from Snap (SNAP) on July 21. Snap sent a shockwave through the social media and advertising-based stocks. But whether or not Alphabet has the same problems as SNAP will not be known until Alphabet reports results on Tuesday, July 26, after the close of trading.

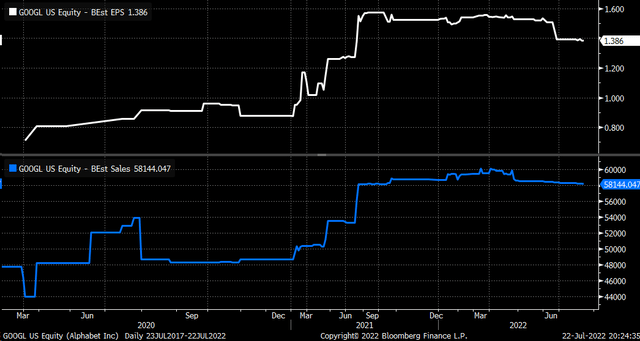

Analyst estimates that second quarter revenue grew 14% y/y to $58.14 billion, while earnings increased by 6% to $1.39 per share. Gross margins are forecast to have fallen sharply in the second quarter to 62.25% from 69.98% in the second quarter of 2021.

Google Cloud is forecast to see its revenue rise by 36.9% to $6.3 billion, while YouTube advertising revenue is estimated to have grown by 7.9% to $7.55 billion.

Investors follow a significant metric for Alphabet: Traffic Acquisition Costs (TAC). That’s estimated to have risen by 12.65% to $12.3 billion. Should the company report a higher than expected TAC number, it would be viewed negatively by the market.

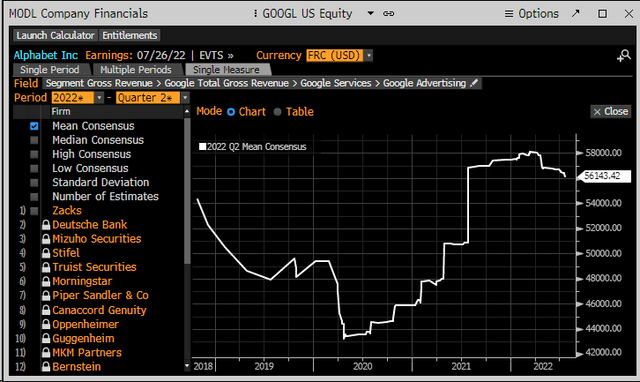

Analysts have adjusted their Google advertising revenue estimates down from $58.3 billion recently. Despite revenue estimates coming down, they’re still at the upper end of the range since the middle of 2021, indicating that analysts are not expecting a significant slowdown in Alphabet’s Ad business yet, setting a high bar for the company to beat.

Bloomberg

Overall revenue and earnings estimates have also not been adjusted by much. So if there are outside pressures from weakening ad sales, they have not been reflected in earnings or revenue estimates, which means Alphabet has to deliver this quarter and beat those elevated forecasts.

Bloomberg

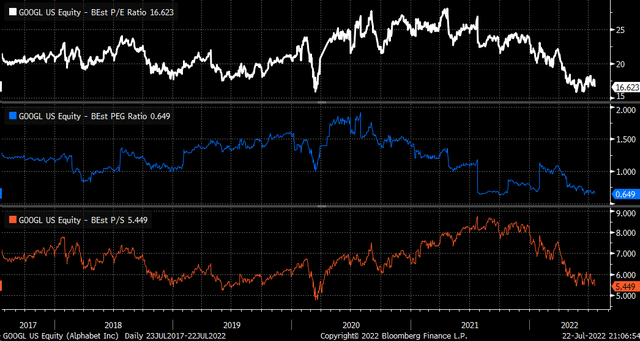

Is Google Stock Cheap Or Not?

Still, something seems off with the stock currently, as it has been very weak and appears to be very cheap, trading at just 16.6 times its next twelve months’ earnings estimates and trading at the very low end of its historical range. Even when adjusting for its expected long-term growth rate, the PEG ratio is just 0.70, well below 1, while the price to sales is around 5.5. Both are at the low end of their historical ranges and appear cheap.

This presents two options for investors: The stock is incredibly cheap, or the market fears that future earnings and revenue forecasts are too high and will need to be adjusted lower.

Bloomberg

Betting Shares Plunge

At least one trader thinks or fears the company will report disappointing results on Tuesday or believes that growth forecasts are too high. On July 22, the open interest for the September 16, $95 puts rose by around 13,752 contracts. The data shows the puts were bought at $1.19 per contract on the ASK. This implies that the stock is trading below $93.81 by expiration. It doesn’t sound like a big wager, but the trader paid a premium of about $1.6 million to create the bearish position, a sizable bet.

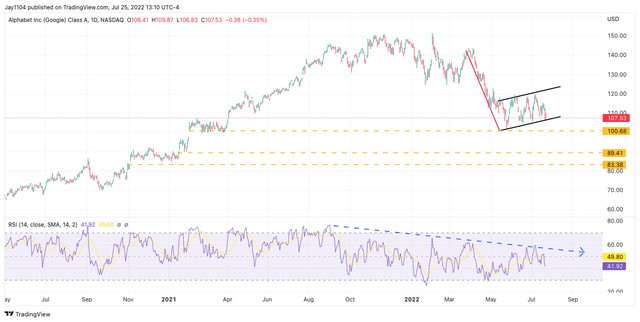

Weak Momentum In Alphabet Stock

The technical chart of Alphabet is very weak, with a long-term bearish trend in its relative strength index. Additionally, the shares have been consolidating sideways since the beginning of May, between $100 and $120. This sideways consolidation has formed after the stock suffered a significant decline. This creates what appears to be a technical pattern known as a bear flag that could result in the shares falling significantly. The support level that needs to be watched on a downward move would come at $100. If that price folds, it would open a path for the stock to fall to around $89.

Trading View

Alphabet has been a fantastic growth story over the past several years and has a bright future over the long term, given its dominant position in search and advertising and its growing dominance in streaming services. However, that doesn’t mean the company isn’t prone to having a rough patch occasionally. The stock may be entering one of those rough patches presently.

Join Reading The Markets Risk-Free With A Two-Week Trial!

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Be the first to comment