monsitj

Billionaire investor Leon Cooperman recently shared a gloomy outlook for the stock market (SPY)(VOO)(QQQ)(DIA), stating:

My cautious view is underpinned by the idea that I think the combination of Fed tightening, QT, strong dollar and the price of oil will create a recession in the second half of 2023…We’ve pulled forward demand because of very inappropriate fiscal monetary policies and ultimately a price is going to be paid…I think we are in store for a long period of low returns in the averages … and I’m looking to buy weakness, not strength. I believe the action is going to be in individual stocks, not in the averages.

In this article, we will elaborate on Mr. Cooperman’s perspective on the stock market, why stock picking is a better opportunity than investing in indexing right now, and then share some of our top picks in the current environment.

Leon Cooperman’s Outlook For SPY And Individual Stocks

Leon Cooperman believes that the combined forces of continued interest rate hikes by the Federal Reserve (which behave as gravity on equity valuations due to increasing discount rates), the Federal Reserve continuing to reduce the money supply by allowing its debt assets to mature and roll off its balance sheet, the strong value of the U.S. Dollar relative to other currencies (which makes U.S. goods and services more expensive and therefore less competitive abroad while also weighing on foreign earnings by U.S. based companies when translated into U.S. Dollars), and the elevated cost of energy (which drives up consumer and corporate costs, thereby eating into consumer buying power and corporate profits) will result in a recession next year.

As a result – when combined with the still not cheap cumulative valuation of SPY – he expects that the indexes may well be in for a lengthy period of low returns and that this is an environment where stock pickers can really shine as they can navigate the gyrations in the stock market and pick the winning sectors and businesses while avoiding – or even shorting – the losers. In contrast, those who blindly dollar cost average into index funds will simply watch their portfolio gyrate up and down on its way to nowhere, making such an investment quite weak in such a scenario.

Our Outlook For Indexes And Individual Stocks

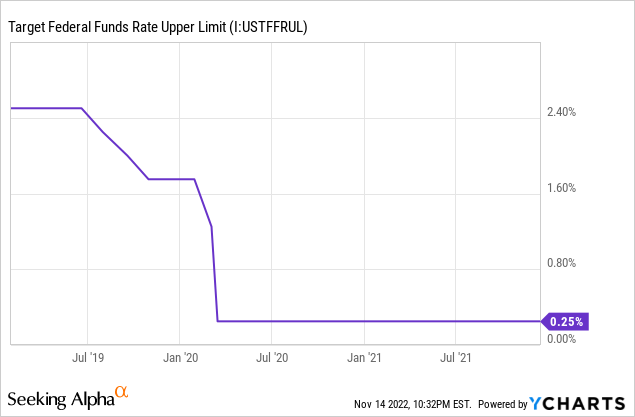

Our outlook is pretty similar overall to Mr. Cooperman’s in that we believe that the dramatic shift in the Federal Reserve’s monetary policy between 2022 and 2020 and early 2021 is likely enough in its own right to shock the economy into a downturn. The reason for this is simply that the Federal Reserve’s aggressive interest rate cuts in the wake of the COVID-19 outbreak sent a strong signal to entrepreneurs and consumers that the economy had lengthened its time preference, thereby incentivizing a consumption of capital by both businesses and consumers.

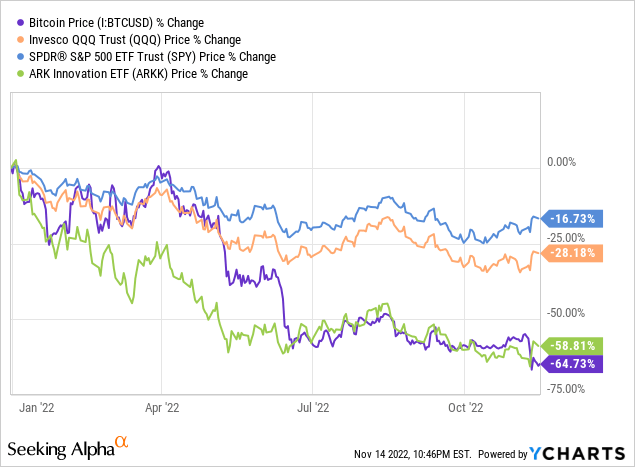

Borrowing was extremely cheap, encouraging investors and businesses to borrow a lot of money and to invest that money in ever riskier enterprises. As a result, we had a housing bubble that blew up to historical levels as the combination of stimulus checks and extremely low mortgage rates made the 30-year mortgage more affordable than ever. High growth, speculative technology stocks (ARKK) also boomed. So did highly speculative cryptocurrencies like Bitcoin (BTC-USD) and Ethereum (ETH-USD). Big tech giants like Amazon (AMZN), Meta (META), Alphabet (GOOG) (GOOGL), Netflix (NFLX), and Apple (AAPL) also saw their stocks rise as the COVID-19 lockdowns pushed people to spend even more time online and on their personal electronic devices. The semiconductor industry – led by giants like Nvidia (NVDA) and Broadcom (AVGO) – also boomed due to the explosion in data analytics and artificial intelligence applications.

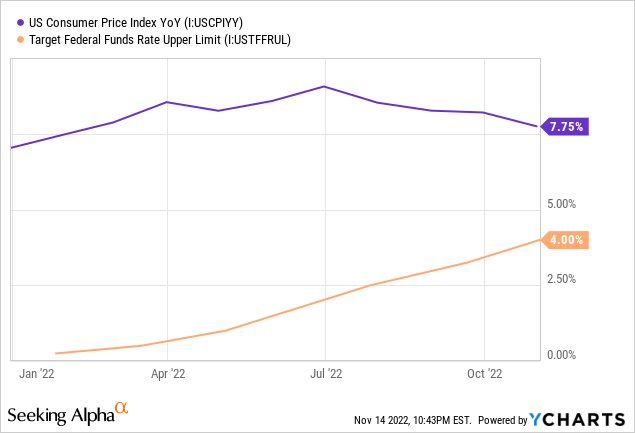

However, after nearly two years of heavy capital allocation based on the “cheap money forever” signal from the Federal Reserve (with the initial warning signs of inflation being flippantly dismissed by the Fed and the Biden administration as being merely “transitory”), it quickly became clear that inflation was becoming a massive problem and that the Federal Reserve had grossly misdirected the economy and the allocation of trillions of dollars in capital. As a result, it was forced to do a sudden and dramatic pivot in a panicked effort to head off inflation. Nevertheless, inflation remains near four-decade highs:

The stock market has had a pretty miserable year as a result, especially high growth tech and Bitcoin:

Now, the predictions for a recession in the coming months (we may well already be in the early innings of one now, actually) have grown increasingly urgent and have become increasingly accepted as the expected outcome. On top of that, several major tech companies are slashing jobs and other expenses in anticipation of a significant slowdown in the economy. The housing market has also entered a major downturn due to soaring mortgage rates, and Zillow (Z)(ZG) projects that housing prices will decline meaningfully over the next year or two.

While we agree that the outlook for the economy is not great, we are heartened by signs that inflation appears to have peaked and may even be beginning to decline gradually. What this means is that – especially as the economic slowdown becomes more apparent and the unemployment rate begins to increase – the Federal Reserve will soon have the flexibility (if not the mandate) to begin easing its foot off of the tightening pedal. As a result, instead of raising interest rates aggressively and shrinking its balance sheet, the Federal Reserve will pause these actions and possibly may even reverse them if the recession proves to be particularly severe.

What does this mean for markets? Well, it means that in general, the recession-resistant stocks that suffer from rising interest rates (such as utilities (XLU) and triple net lease REITs like Realty Income (O)) will probably outperform over the next year or two while the stocks that benefit from a booming economy as well as from rising interest rates (such as BDCs (BIZD) for example) will likely underperform.

Meanwhile, declining economic growth on the whole should cause indexes to generate meager return. In addition to the downward earnings revisions that we anticipate in the wake of the oncoming recession, we also do not see the markets as being particularly attractively valued at the moment even if economic conditions were better. Based on a compilation of market valuation models, the S&P 500 is currently 0.6 standard deviations above the stock market’s long-term fair value trend. This means that the overall stock market is not necessarily significantly overvalued, but it is definitely not on sale either, especially when taking into account the macroeconomic and geopolitical headwinds and risks right now.

Investor Takeaway

With the stock market indexes relatively unattractively priced, where are investors supposed to find value? Well, as we stated, companies that are more recession-resistant and benefit from lower interest rates will likely outperform moving forward as we expect the Fed to probably pivot away from raising interest rates sometime in 2023 and a recession to hit the economy in the very near future. Some of our top picks that fit this description include:

- Essential Properties Realty Trust (EPRT) is a triple net lease REIT that is down significantly year-to-date and combines an attractive current dividend yield with robust growth momentum. As a result, once the Federal Reserve pivots on interest rates, we expect this REIT to shoot higher by providing investors an attractive combination of multiple expansion, current income, and robust per share growth. Meanwhile, its underlying business generates a stable cash flow stream that should hold up very well during an economic downturn. You can read our recent exclusive interview with the company here, and you can read our investment thesis here.

- ATCO (OTCPK:ACLLF) is a higher growth infrastructure business consisting primarily of its core Canadian Utilities (OTCPK:CDUAF) business along with high growth structures and logistics and ports businesses. ACLLF recently reported strong Q3 FY2022 results. The company generated adjusted earnings per share of $0.76 in the third quarter of 2022, indicating robust 26.7% year-over-year growth. ACLLF continues to be a very steady sleep well at night investment that continues to pay out very reliably growing and attractive dividends, underpinned by a per-share growth rate that is far above the dividend growth rate at the moment. ACLLF’s core utilities business as well as its ancillary growth businesses seem to be firing on all cylinders at the moment. You can read our full investment thesis here, and you can read our recent exclusive interview with ACLLF here

While index investing has been on a great run, the period ahead appears to be one where volatility will be increasingly frequent while total returns for the indexes will likely be muted. As a result, picking individual stocks where pockets of value exist in sectors where the macro factors serve as tailwinds will likely drive outperformance moving forward. At High Yield Investor, we are focused on identifying and investing in those pockets that are poised to benefit most from an upcoming Federal Reserve pivot, while also sheltering the underlying business model from the impending recession.

Be the first to comment