yujie chen/iStock Editorial via Getty Images

Big Yellow Group Plc (OTCPK:BYLOF) is a veritable poster child for a great UK company. The company doesn’t operate in a particularly “fancy” industry but has seen major success in steadily rolling out its self-storage offering throughout the UK. Big Yellow’s success has been underpinned by a strong brand, a shrewd acquisition strategy, and a healthy, growing UK self-storage market. I am optimistic about the future of the self-storage market in the UK and I believe Big Yellow will have continued success in exploiting untapped opportunities.

Big Yellow and its market

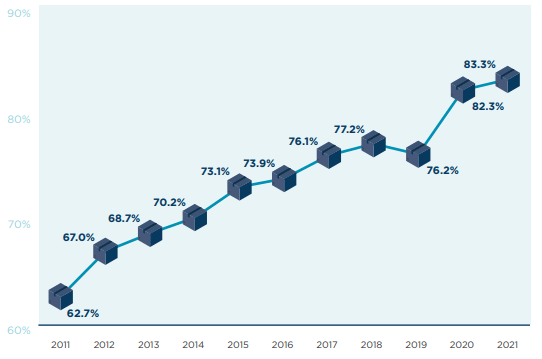

Big Yellow is the largest self-storage company in the United Kingdom, operating 78 sites. Its largest competitors are Lok’nStore and Safestore (OTCPK:SFSHF). The UK self-storage market is healthy and growing, in 2021 occupancy in current lettable space increased to 83.3% from 82.3% while the net rental rate per square foot increased 9%.

Occupancy rate on lettable area (SSA UK Industry Report )

A lot of the other key industry trends are in favor of larger operators like Big Yellow. Consolidation within the industry has continued as existing operators acquire new sites and deploy their capital. In the UK, a key challenge for new businesses entering the self-storage market is the lack of land, worsened by the fact there are already 2,050 self-storage stores. Therefore, finding new opportunities and having the necessary capital to take advantage of those opportunities is difficult for small-scale operators. Big Yellow has the capital and the expertise to pick up those sites and subsequently benefit from the demand in untapped areas.

Building its edge – doing the little things right

Self-storage is a very simple business and to be successful and gain an edge in the space on the operations side you have to do the simple things right. That means ensuring security and ease of bookings. The latter has grown in importance over time in the UK self-storage market. 86% of businesses now allow online bookings/reservations. Those who don’t are most likely local small-scale self-storage stores.

Big Yellow does the simple things right, stores are very secure and online booking is fast and easy. Each facility needs a very small team to operate (great benefit of self-storage) which means margins are strong.

When it comes to selling a commoditized, low-tech product – empty space – it would seem unlikely that brand-building would be an important factor in driving success. The simplistic nature of the offering would lend many to believe shrewd site location and streamlined operations would be what matters. That is true, but Big Yellow also realizes the importance of brand. According to a YouGov 2018 poll, Big Yellow’s unprompted brand awareness across the UK is seven times higher than the nearest competitor. Unsurprising, considering how much the enormous bright yellow building stands out in comparison to any of its high street counterparts

Due to this, Big Yellow has seen increasing demand for its pre-existing units across the UK. it also means that after a new store is built, occupancy is quickly filled and Big Yellow can fill units without having to plough loads of cash into marketing.

How the financials shape up

In Q1 of FY 22 (three months ended June), Big Yellow reported £45.5 million in revenue, up 24% YoY. The majority of this rise was driven by new store openings. On a like-for-like store basis revenue increased 9%. Purely looking at the stores which closed on a like-for-like basis – net rent per square foot increase by 12% to £32.35 offset slightly closing occupancy declining 2.7%. Big Yellow and the self-storage market demonstrated resilience throughout Q1, the comps were also tough because Q1 ’21 benefited from stronger housing demand in June.

The company continues to execute its diverse expansion strategy, acquiring an existing self-storage center in Aberdeen for £10 million and securing two new sites in Slough and London where the firm will pursue planning permission. Despite being the biggest self-storage company in the UK, Big Yellow is still finding an abundance of opportunities through untapped locations. Although the self-storage market has come a long way over the last ten years, it’s still largely fragmented with consolidation set to continue.

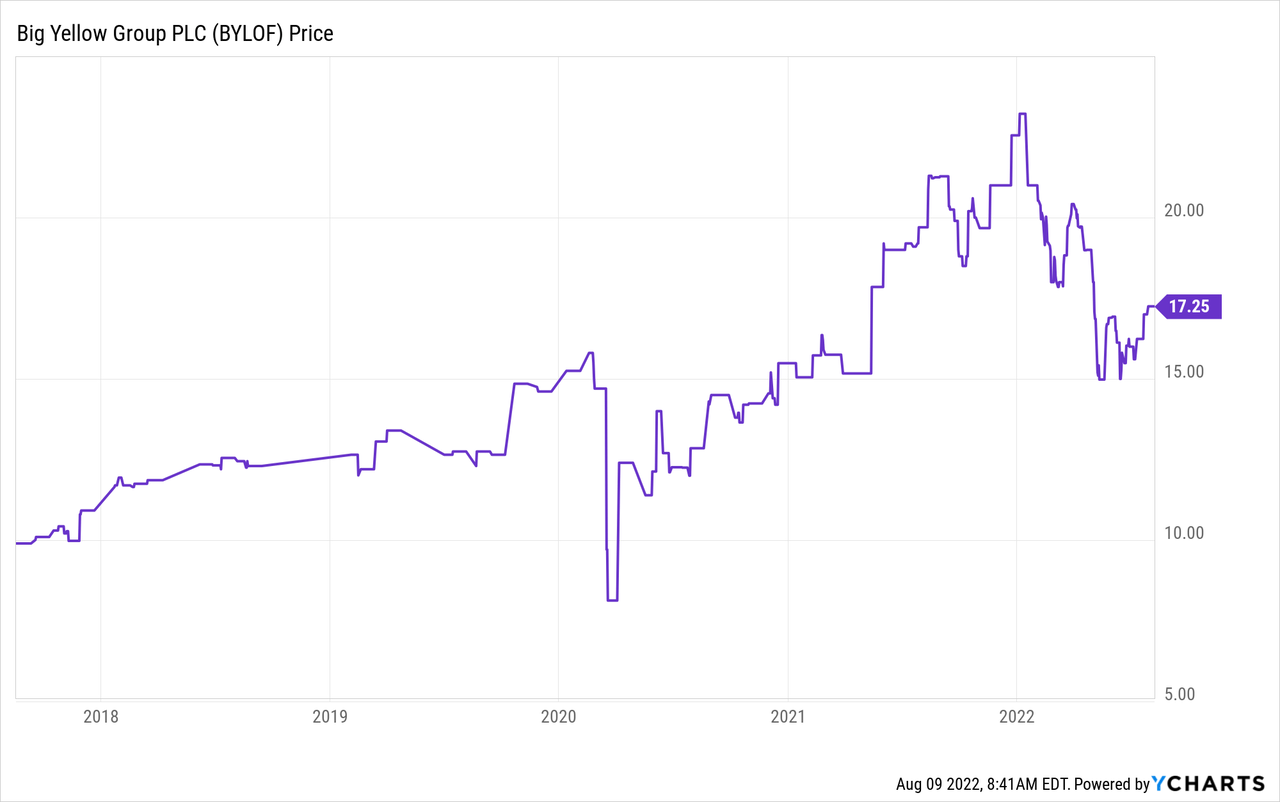

Valuation

Following the 21% pullback this year, Big Yellow trades on a Fwd P/E of 24.8, considering net income is only expected to be 20% higher by the end of FY24 this is expensive. Though on a relative basis this is similar to Lok’nStore which also trades on a Fwd P/E of 20 with net income expected to remain level over the next few years. Below I have tabled some other key metrics (compiled using Refinitiv estimates)

| Price/Book | Premium to NAV | Price to cash flow | Fwd EV/EBITDA | |

| Big Yellow | 1,15 | 11.5% | 24,2 | 25.44 |

| Lokn’Store | 1.72 | 19.2% | N/A | 22.85 |

| Safestore | 1.46 | 46% | 63.7 | 22.45 |

I believe that Big Yellow’s price/book discount to peers is unwarranted, particularly when considering the success the firm has had over the last few years and the fact it’s an industry leader. Despite Lok’nStore’s smaller size the company isn’t expected to grow any faster than Big Yellow over the last few years. Big Yellow also has the benefit of greater resilience due to its large client base and bigger brand that gives the firm a better chance of coming through a difficult period more unscathed then smaller counterparts. Big Yellow is more similar to larger competitor Safestore which trades at a premium on both price/book and premium to NAV then Big Yellow.

The Bottom Line

Big Yellow is the market leader in one the UK’s most resilient and best performing market. Big Yellow’s offering is simple, but its expertise and locations are largely unmatched in the self-storage market. With the UK self-storage market continuing to condense and Big Yellow trading at a book discount to peers, I am bullish on the company.

Be the first to comment