shapecharge/iStock via Getty Images

This article was first released to Systematic Income subscribers and free trials on Mar. 23

The recent period of sharply rising Treasury yields has clearly delineated those funds that are more resilient to rising rates from those that are more vulnerable. In this article, we highlight the Barings Global Short Duration High Yield Fund (NYSE:BGH) which trades at an 8.3% current yield and a 10.2% discount. The fund features a very low duration profile and has held up well year-to-date, outperforming most fixed-income funds.

BGH is a fund we have highlighted a few times as part of our focus on, what we call, cross-credit CEFs or funds that have relatively wide mandates to allocate across loans, corporate bonds, CLOs and other types of credit securities. As we discuss below, the fund has a number of margin-of-safety features which make it attractive. At the same time, its more cyclical / lower-quality profile does pose some risks, particularly for investors concerned about a recession in the near term. Although this is not our base case, the recent geopolitical tensions, rising energy prices and a flattening yield curve have increased its likelihood.

A Quick Look At The Fund

BGH is part of the broader Barings umbrella which manages close to $400bn of assets and is a subsidiary of MassMutual.

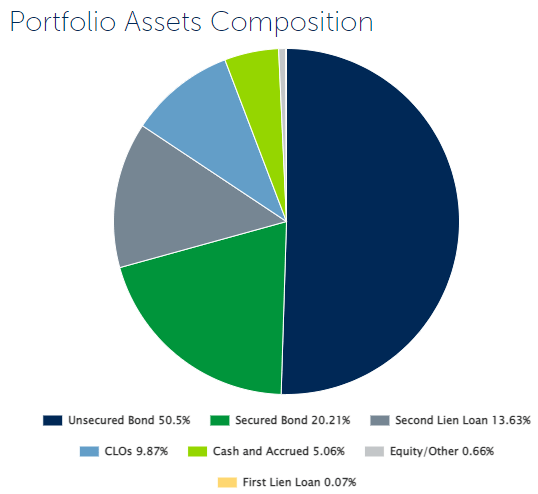

The fund’s asset allocation is split between bonds (both secured and unsecured) as well as floating-rate instruments such as loans and CLOs.

Barings

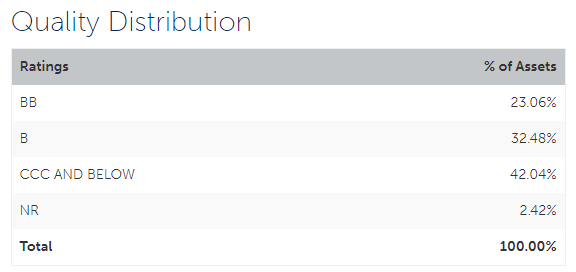

The fund’s quality allocation is on the lower side with three-quarters of the portfolio allocated to securities rated single-B and below.

Barings

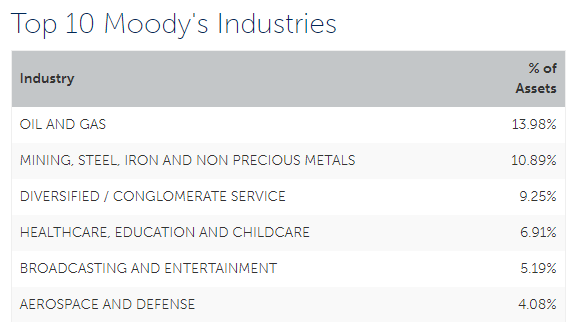

The fund has an unusual sector focus with a quarter of its holdings in energy and mining.

Barings

The fund’s duration is 2.2, which is on the low side in the credit space and is a function of three things: a significant allocation to floating-rate securities, a tilt to shorter-maturity bonds as well as a tilt to higher-coupon bonds (why coupon / yield level affects duration can be visualized here).

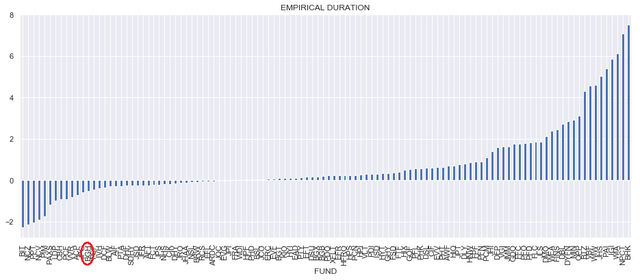

One thing we like to do is to also calculate a fund’s empirical duration, which measures the fund’s NAV actual sensitivity to interest rates over the past year. As many investors know, two funds with the same official duration can behave in very different ways during a period of interest rate rises. This has to do with the simple fact that 1) credit securities do not always move 1:1 with their duration and 2) there are other drivers of security performance than sensitivity to interest rates. Specifically, higher-yielding securities often exhibit a more muted sensitivity to interest rates than their profile may indicate. On this metric, BGH flags as having a very low empirical duration, in fact, a slightly negative one, meaning its NAV has tended to rally on average when interest rates rise.

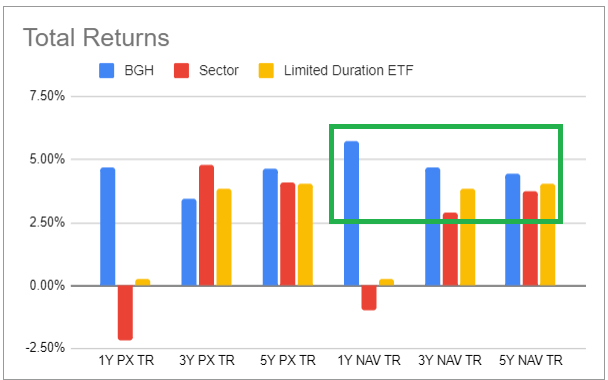

The fund has outperformed the Limited Duration CEF sector over various time horizons in total NAV terms. It has also outperformed the loan CEF sector and performed on par with the High Yield bond sector despite the sector’s longer-duration profile.

Systematic Income CEF Tool

Income Profile

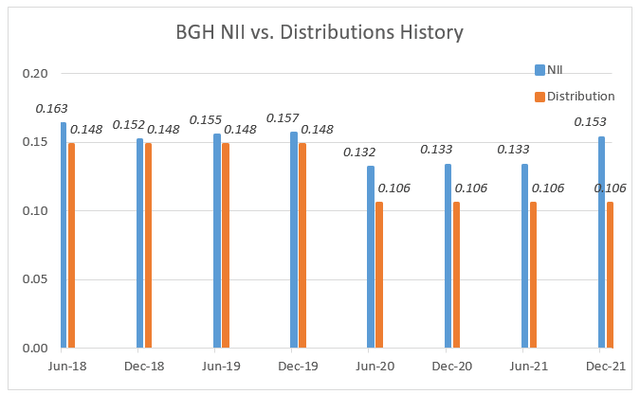

To get a sense of the fund’s income profile, let’s have a look at the following chart which shows both monthly NII per share (blue bars) as well as the fund’s distributions (orange bars).

The chart shows a few interesting things.

First, the fund’s most recent distribution coverage (as of the Dec-21 report) is comically high at 144%. For credit funds (i.e. covering sectors like High Yield, Loan and Limited Duration) coverage tends to run closer to 80-90%. The fund’s NAV net income investment or NII yield is 10.73% and 12% on price – both unusually high in the sector. Recall that while there are funds with double-digit distribution rates, their NII yields are typically significantly lower.

Second, the fund’s income profile dipped from a high of $0.163 (per month per share) in June-18 to a low of $0.132 two years later and has clawed mostly back to $0.153 as of Dec-21.

Third, the fund’s distribution was cut sharply by 30% in 2020 and has remained at the same level since then.

Let’s take a closer look at the fund internals to see what’s been driving these figures.

The fund’s unusually high NII yield level is a function of two key factors. First is the fund’s lower quality (judging by credit ratings) allocation as highlighted above which allows the fund to maintain holdings with higher yields relative to other funds. And two, the fund tends to tilt to high-coupon bonds. For example, the fund holds $2m of a 9.63% 2030 Ford bond. The bond was trading at a price of around $140 at year-end when the fund’s last shareholder report was filed which translates into a yield to maturity of around 3.5% (a figure which includes the -$40 pull-to-par or capital loss over 8 years); however, the bond’s yield as it shows up in the fund’s income statement is 6.9% (which is simply 9.63% / 140%).

This dynamic is one we have discussed ad nauseum which is why we like to make a distinction between CEF distribution rates, NII yields and portfolio yields. Unfortunately, getting a hold of portfolio yields is notoriously difficult and requires a few tricks; however, it provides a much cleaner representation of a fund’s sustainable ability to generate value. Many investors who rely only on distribution rates or who think they are going “above and beyond” by also considering NII yields are surprised when total returns of credit funds fail to measure up to these numbers.

This doesn’t mean that funds with high NII yields and negative pull-to-par are not investable. It just means that investors ought to be aware that a fund like BGH with an NAV NII yield of 10.7% is generating sustainable value closer to a 7-8% figure.

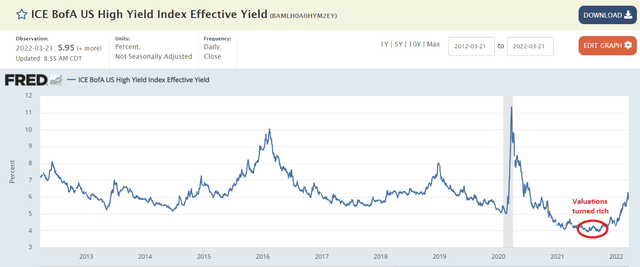

Let’s turn to the fund’s NII dip in 2020. What explains that is the fact that the fund deleveraged, cutting its borrowings by 40%. Since then it scaled its borrowings by 45% although they remain a bit lower than the pre-COVID level. The fund dropped its borrowings in the second half of 2021 by about 12% (moving its leverage from 30 to 27.5%) which, in retrospect, was a good move. Credit valuations were obviously expensive so a dialing down of exposure is a sign of decent discipline by the fund’s managers and has helped preserve NAV in the recent backup in yields.

An important question is how the recent rise in short-term rates and an expected Fed hiking trajectory will impact the fund’s income. The short answer here is it won’t matter a whole lot. This is because the fund maintains roughly the same amount of floating-rate securities as it does floating-rate liabilities.

Valuations

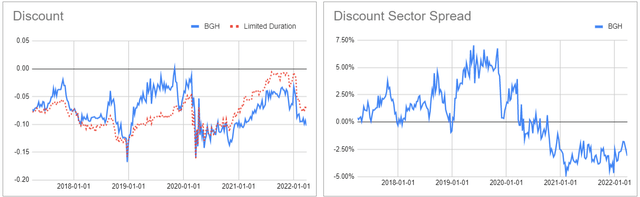

The fund continues to trade at a wider discount to the Limited Duration sector – the current differential of about 2.5% is near a 5-year high, i.e. the fund remains cheap relative to its sector.

We get a similar picture if we compare the fund to the Loan and High Yield Bond sectors as well with the discount differential on the order of 5%, i.e. BGH is trading 5% cheaper relative to these sectors despite similar historic total NAV returns.

Takeaways

BGH has a number of obvious risks that are important to keep in mind. First, its lower-quality / more cyclical allocation makes it more vulnerable in a “typical” recession where we would expect a sharp increase in the number of corporate defaults. A stagflationary environment might work out OK for the fund given its focus on energy and commodities, particularly if these sectors continue to benefit from rising prices as they have over the last year.

Secondly, even absent a recession, the fund’s lower-quality profile could drive another deleveraging during a period of excessive volatility. It should be noted, however, that deleveraging is not something that can be avoided even by funds with higher-quality holdings (such as Nuveen preferreds funds that hold securities issued by investment-grade entities) or those that are perceived as “best-in-class” such as PIMCO funds. A recent discretionary drop in the fund’s borrowings, relatively modest leverage and outperformance this year does show that the fund’s managers aren’t swinging for the fences and are mindful of the fund’s elevated risk level.

At the same time, BGH offers a number of attractive features to investors. Its lower-quality allocation can be an asset in a barbell portfolio where a smaller part of an income portfolio has to be dedicated to higher-risk assets and a larger portfolio can be dedicated to higher-quality or dry-powder assets.

Separately, the fund’s low duration and wide scope to generate alpha are attractive as are its high level of distribution coverage and wide discount, providing a double of margin of safety for investors.

Be the first to comment